Buffett's Apple Investment: What We Can Learn About Successful Stock Picking

Table of Contents

Understanding Buffett's Investment Philosophy

Buffett's investment success is built upon a foundation of value investing principles, clearly demonstrated in his Apple investment.

H3: Value Investing Principles:

Buffett's approach emphasizes:

- Long-term investment: He doesn't chase short-term gains but rather invests in companies he believes will thrive for years to come. His Apple investment is a prime example of this long-term vision.

- Intrinsic value assessment: Before investing, Buffett meticulously assesses a company's intrinsic value—its true worth based on its assets, earnings, and future potential—and aims to buy it below that value. He likely saw Apple's intrinsic value significantly underestimated by the market before making his initial investment.

- Understanding the business model: He dives deep into understanding how a company makes money, its competitive advantages, and its potential for growth. His grasp of Apple's ecosystem and its loyal customer base played a key role in his decision.

- Margin of safety: Buffett always builds in a margin of safety, buying assets at a price significantly below his estimated intrinsic value to cushion against potential risks and market volatility. This approach reduced the risk associated with his massive Apple investment.

H3: Beyond the Numbers: Qualitative Factors:

Numbers are important, but Buffett also prioritizes qualitative factors:

- Strong management team: A capable and trustworthy management team is crucial for long-term success. Apple's leadership undoubtedly impressed Buffett.

- Competitive advantage (moat): Buffett looks for companies with a strong competitive advantage, or "moat," that protects them from competitors. Apple's brand loyalty, robust ecosystem, and innovative products create a significant moat.

- Brand recognition: A strong brand is an invaluable asset, and Apple's global brand recognition significantly contributed to Buffett's confidence in its long-term prospects.

- Future market trends: Buffett considers future market trends and how they might impact a company's growth. He recognized Apple's position in the rapidly growing technology sector.

Analyzing the Apple Investment: A Case Study

Berkshire Hathaway's Apple investment serves as a compelling case study in successful stock picking.

H3: The Initial Investment and Subsequent Growth:

Berkshire Hathaway started acquiring Apple shares in 2016. The initial investment size was substantial and strategically increased over time, reflecting Buffett's growing confidence in the company. The investment resulted in exponential returns, significantly boosting Berkshire Hathaway's portfolio value. (Include a chart or graph here showing Apple's stock price and Berkshire Hathaway's investment timeline.)

H3: The Role of Long-Term Vision:

Buffett's Apple investment highlights the importance of a long-term perspective. While short-term market fluctuations may cause temporary dips, his buy-and-hold strategy allowed him to capitalize on Apple's long-term growth. A short-term investor might have sold their shares during market downturns, missing out on the substantial gains.

Key Takeaways and Practical Applications for Stock Picking

Buffett's Apple investment offers valuable lessons for investors of all levels.

H3: Identifying Undervalued Companies:

To apply Buffett's approach:

- Thorough due diligence: Conduct extensive research, examining the company's financials, business model, and competitive landscape.

- Financial statement analysis: Master the art of analyzing financial statements to understand a company's profitability, cash flow, and debt levels.

- Understanding industry dynamics: Analyze the industry the company operates in, identifying growth opportunities and potential risks.

- Assessing competitive landscape: Evaluate the company's competitive position and its ability to maintain a sustainable advantage.

H3: Developing a Long-Term Investment Strategy:

Long-term investing requires patience and discipline:

- Avoiding emotional decision-making: Don't let market volatility dictate your investment decisions. Stick to your research and long-term plan.

- Focusing on fundamental analysis: Prioritize fundamental analysis over short-term market trends.

- Resisting market volatility: Market fluctuations are inevitable; stay focused on the long-term potential of your investments.

Conclusion

Buffett's Apple investment epitomizes the power of value investing, emphasizing the importance of understanding a company's intrinsic value, its qualitative strengths, and the significance of long-term vision. By combining thorough due diligence with a patient and informed approach, you can significantly enhance your stock picking strategy. By understanding the principles behind Buffett's Apple investment, you can refine your own stock picking strategy and unlock the potential for significant long-term gains. Start your journey towards successful investing by applying the lessons learned from Buffett's Apple Investment today!

Featured Posts

-

Runway Rogue Convicted Fraudster Defies Justice

May 06, 2025

Runway Rogue Convicted Fraudster Defies Justice

May 06, 2025 -

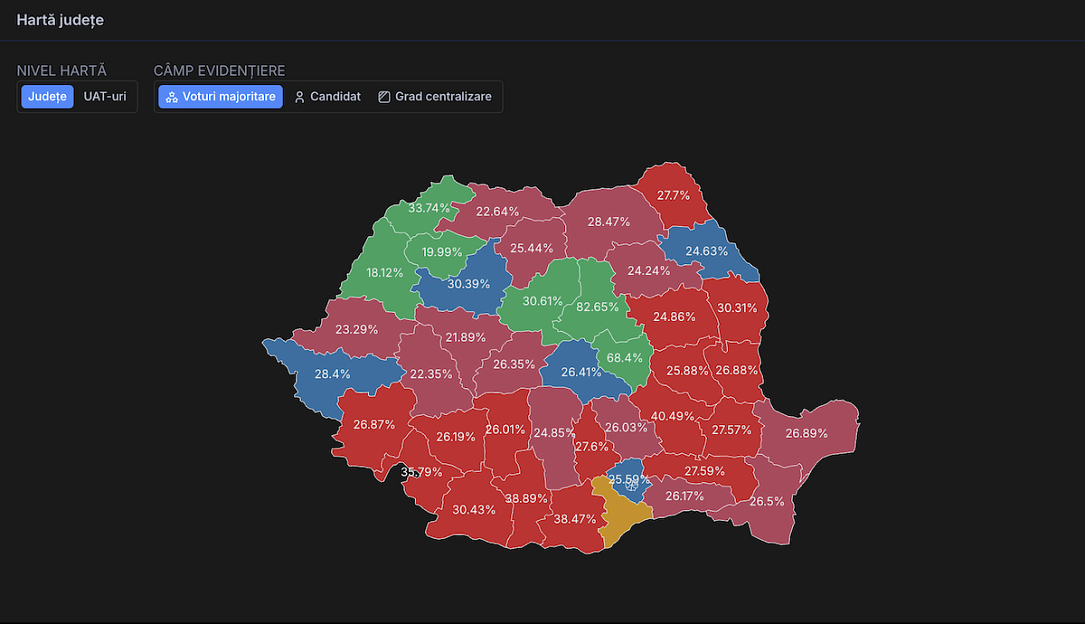

Romania Votes Key Issues In The Presidential Runoff Election

May 06, 2025

Romania Votes Key Issues In The Presidential Runoff Election

May 06, 2025 -

Kevin Costners Post Divorce Pursuit Of Demi Moore What We Know

May 06, 2025

Kevin Costners Post Divorce Pursuit Of Demi Moore What We Know

May 06, 2025 -

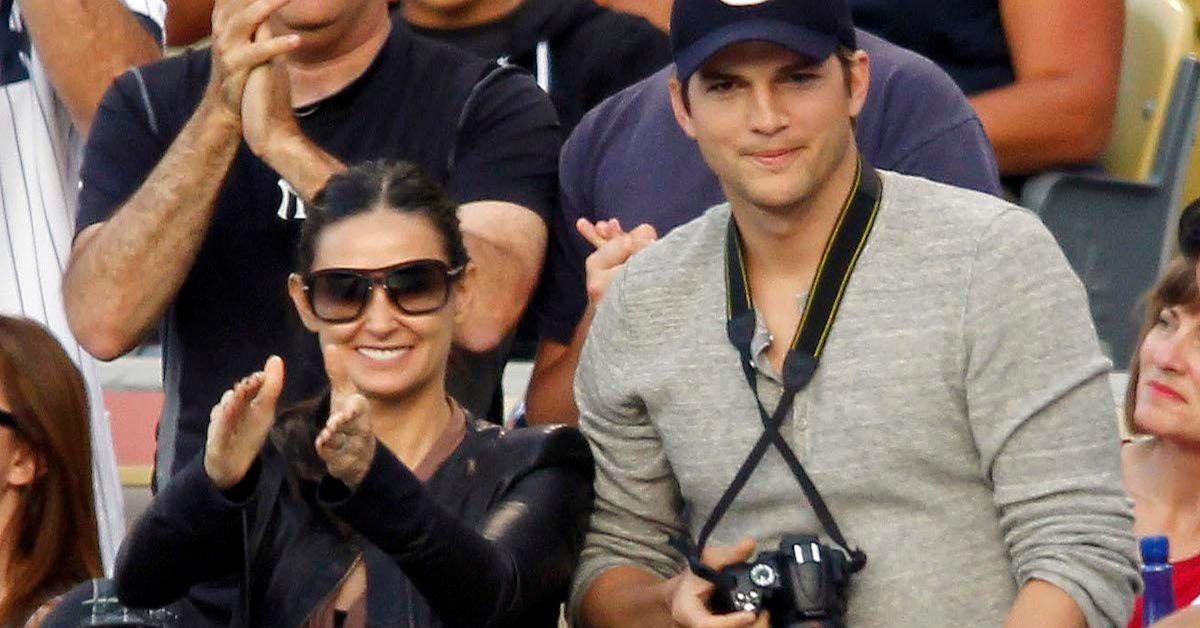

Demi Moores Daughters Cryptic Ashton Kutcher Comment And Instant Regret

May 06, 2025

Demi Moores Daughters Cryptic Ashton Kutcher Comment And Instant Regret

May 06, 2025 -

Met Gala 2024 Chris Appleton On Kim Kardashians Hair

May 06, 2025

Met Gala 2024 Chris Appleton On Kim Kardashians Hair

May 06, 2025