Canadian Dollar Overvalued: Economists Urge Swift Action

Table of Contents

Signs of an Overvalued Canadian Dollar

Several factors contribute to the widely held perception that the Canadian dollar is currently overvalued. Analyzing the CAD exchange rate against historical averages and purchasing power parity reveals a significant divergence. The strength of the US dollar, a major trading partner for Canada, also plays a crucial role. Furthermore, interest rate differentials between Canada and other major economies impact the attractiveness of the CAD to foreign investors.

Here are some key indicators pointing towards an overvalued Canadian dollar:

- CAD/USD Exchange Rate: The current CAD/USD exchange rate significantly deviates from its historical average and its predicted value based on purchasing power parity (PPP). This discrepancy suggests an overvaluation. Analyzing long-term CAD exchange rate charts reveals this significant divergence.

- Trade Deficits: Canada is experiencing a widening trade deficit, indicating that imports are exceeding exports. This persistent imbalance can put downward pressure on the CAD value in the long term, however, the current high value suggests the deficit isn't acting as a natural correction.

- Inflation Rates: Canada's inflation rate, while high, is comparable to many other major economies. However, the relative strength of the CAD compared to these economies suggests a potential overvaluation, as import costs are lower, hindering the normal inflationary pressures.

- Current Account Deficits: A persistent current account deficit, reflecting a net outflow of capital, further contributes to concerns about the Canadian dollar's valuation.

Economic Consequences of an Overvalued CAD

An overvalued Canadian dollar has significant negative repercussions for the Canadian economy. Its impact is far-reaching, affecting various sectors and potentially jeopardizing long-term economic stability.

The key consequences include:

- Reduced Competitiveness of Canadian Exports: An overvalued CAD makes Canadian exports more expensive in international markets, harming industries like manufacturing, agriculture, and resource extraction. This reduces export volumes and profitability, affecting employment and economic growth.

- Increased Imports: Conversely, imports become cheaper, leading to a greater reliance on foreign goods and widening the trade deficit further impacting the Canadian dollar valuation.

- Negative Impact on Economic Growth and Job Creation: The combined effects of reduced exports and increased imports translate to slower economic growth and potential job losses across various sectors. This creates a vicious cycle, further impacting the currency value.

- Potential for Deflationary Pressures: While inflation is currently high, an overvalued CAD could lead to deflationary pressures if the reduced demand for exports and the increased availability of cheaper imports suppress prices.

Economists' Calls for Action and Proposed Solutions

Leading economists are sounding the alarm, urging swift action to address the potential crisis stemming from the Canadian dollar overvalued issue. They propose various solutions, encompassing monetary and fiscal policies, as well as long-term strategic initiatives.

Their recommended actions include:

- Bank of Canada Intervention: The Bank of Canada could adjust interest rates or implement quantitative easing to influence the CAD exchange rate and manage inflation. These monetary policy tools are crucial to address the issue.

- Governmental Fiscal Policies: The government could implement fiscal policies to boost domestic demand and reduce reliance on exports, thereby lessening the impact of the overvalued currency.

- Economic Diversification: Reducing Canada's reliance on commodity exports through strategic investments in other sectors is a long-term solution to enhance economic resilience and reduce vulnerability to fluctuations in commodity prices.

- Long-term Strategic Planning: Implementing a comprehensive long-term economic strategy that promotes sustainable growth and diversification is crucial for mitigating the risks associated with an overvalued currency.

Potential Risks of Inaction

The potential long-term consequences of inaction are severe. Failure to address the Canadian dollar overvalued situation could result in:

- Prolonged Economic Stagnation: Continued overvaluation could stifle economic growth for an extended period, leading to a prolonged period of slow or no growth.

- Increased Unemployment: Reduced export competitiveness and decreased economic activity will inevitably lead to job losses across multiple sectors.

- Further Decline in International Competitiveness: Without intervention, Canada's competitiveness in the global marketplace will continue to deteriorate, making it harder to attract foreign investment and compete effectively.

- Financial Instability: An extended period of economic stagnation could lead to financial instability, increasing the risks to the overall economic health of the nation.

Addressing the Overvalued Canadian Dollar – A Call to Action

The Canadian dollar's overvaluation poses a significant threat to the Canadian economy. Economists are urging swift and decisive action to mitigate the negative consequences. The potential for an economic crisis is real and demands immediate attention. The risks of inaction are substantial, potentially leading to prolonged economic stagnation, increased unemployment, and a further decline in international competitiveness. We must act now.

It's crucial for Canadians to stay informed about the evolving situation, engage with policymakers, and promote a robust discussion on effective strategies to manage the Canadian dollar's value. Monitor the CAD exchange rate, advocate for responsible economic policies, and support initiatives that promote the long-term stability of the Canadian economy. Let's work together to address the overvalued Canadian dollar and secure a prosperous future.

Featured Posts

-

Los Angeles Showdown Angels Outlast Dodgers

May 08, 2025

Los Angeles Showdown Angels Outlast Dodgers

May 08, 2025 -

How Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025

How Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025 -

Diego Luna On Andor Season 2 A Departure From Disneys Star Wars Formula

May 08, 2025

Diego Luna On Andor Season 2 A Departure From Disneys Star Wars Formula

May 08, 2025 -

India Pakistan Conflict Unprecedented Strikes Across The Border

May 08, 2025

India Pakistan Conflict Unprecedented Strikes Across The Border

May 08, 2025 -

Kripto Para Mirasi Yakinlariniza Dijital Varliklarinizi Nasil Devredebilirsiniz

May 08, 2025

Kripto Para Mirasi Yakinlariniza Dijital Varliklarinizi Nasil Devredebilirsiniz

May 08, 2025

Latest Posts

-

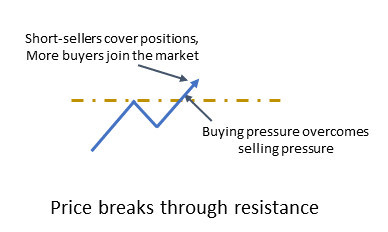

Is 2 000 The Next Stop For Ethereums Price Breaking Through Resistance

May 08, 2025

Is 2 000 The Next Stop For Ethereums Price Breaking Through Resistance

May 08, 2025 -

Saving Private Ryans Rival Realistic Wwii Movies Recommended By Military Experts

May 08, 2025

Saving Private Ryans Rival Realistic Wwii Movies Recommended By Military Experts

May 08, 2025 -

Ethereums Price Action Conquering Resistance Aiming For 2 000

May 08, 2025

Ethereums Price Action Conquering Resistance Aiming For 2 000

May 08, 2025 -

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Films

May 08, 2025

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Films

May 08, 2025 -

Ethereum Price Breaks Through Resistance Could 2 000 Be In Sight

May 08, 2025

Ethereum Price Breaks Through Resistance Could 2 000 Be In Sight

May 08, 2025