Canadian Dollar Weakness: A Deeper Dive Into Recent Currency Movements

Table of Contents

Impact of Interest Rate Differentials on CAD Weakness

The divergence in monetary policies between the Bank of Canada (BoC) and the US Federal Reserve (Fed) is a primary driver of Canadian dollar weakness.

Bank of Canada Policy and US Federal Reserve Actions

The Fed's aggressive interest rate hikes to combat inflation have created a significant interest rate differential with the BoC. Higher interest rates in the US make US dollar-denominated assets more attractive to international investors, leading to increased demand for the USD and consequently, a weaker CAD.

- Recent Rate Hikes: The Fed has implemented several substantial interest rate increases in the past year, while the BoC, while also raising rates, has done so at a more measured pace.

- Impact on Bond Yields: Higher US interest rates result in higher bond yields, making US Treasury bonds more appealing to investors seeking safe havens. This increased demand further strengthens the USD.

- Attractiveness of US Investments: The higher returns offered by US investments draw capital away from Canada, weakening the Canadian dollar.

Investor Sentiment and Capital Flows

Investor sentiment plays a crucial role in capital flows and, consequently, CAD strength. Negative sentiment can trigger capital flight, leading to a weaker Canadian dollar.

- Global Recession Fears: Concerns about a global recession often lead investors to seek safety in the US dollar, a traditional safe-haven currency, putting downward pressure on the CAD.

- Domestic Economic Data: Disappointing Canadian economic data, such as lower-than-expected GDP growth or rising unemployment, can also negatively impact investor confidence and weaken the CAD.

Commodity Price Fluctuations and their Effect on the Canadian Dollar

Canada's economy is heavily reliant on commodity exports, making the Canadian dollar highly sensitive to commodity price fluctuations.

Oil Prices and the CAD

Oil prices have a strong correlation with the Canadian dollar. Lower oil prices directly impact Canada's export revenue and negatively affect the CAD.

- Key Oil Benchmarks: The West Texas Intermediate (WTI) and Brent crude oil prices are key indicators influencing the CAD. Decreases in these benchmarks often lead to CAD weakness.

- Factors Influencing Oil Prices: Global demand, OPEC+ production policies, and geopolitical events are all significant factors impacting oil prices and, consequently, the CAD.

- Correlation with CAD Charts: Analyzing historical data clearly demonstrates a strong positive correlation between oil prices and the CAD.

Other Commodity Prices and their Influence

Fluctuations in prices of other Canadian exports, such as lumber and various metals, also contribute to CAD volatility.

- Relative Importance: While oil is dominant, other commodities like lumber, potash, and metals contribute significantly to Canada's export revenue and indirectly influence the CAD.

- Recent Price Movements: Recent declines in the prices of some key commodities have added to the downward pressure on the Canadian dollar.

Geopolitical Factors and their Influence on CAD Weakness

Global uncertainty and geopolitical events significantly influence investor behaviour and currency values.

Global Uncertainty and Safe-Haven Currencies

During periods of global uncertainty, investors often flock to safe-haven currencies, like the US dollar, reducing demand for riskier assets like the CAD.

- Geopolitical Tensions: Geopolitical tensions, such as wars or international disputes, can create uncertainty and strengthen the USD at the expense of the CAD.

- Impact on Investor Sentiment: Increased uncertainty leads to risk aversion, driving capital towards safer assets and weakening the CAD.

US-Canada Relations and Trade

The strong economic relationship between the US and Canada influences the CAD. Trade disputes or policy changes can significantly impact the currency.

- Trade Agreements: The USMCA (United States-Mexico-Canada Agreement) is a crucial element influencing trade and the overall economic relationship. Any changes or uncertainties regarding this agreement can impact the CAD.

- Potential Trade Disputes: Potential trade disputes or disagreements between the two countries can create uncertainty and lead to CAD weakness.

Conclusion

Canadian dollar weakness is a multifaceted issue stemming from the interplay of interest rate differentials, commodity price fluctuations, and geopolitical events. Understanding these factors is crucial for businesses and investors. The divergence in monetary policy between the US and Canada, lower commodity prices (especially oil), and global uncertainty all contribute to a weaker CAD.

Key Takeaways: The recent weakness in the Canadian dollar reflects a complex interplay of economic and geopolitical factors. Businesses need to carefully manage currency risk, while investors should monitor these factors closely to make informed decisions.

Call to Action: Understanding the complexities of Canadian dollar weakness is vital for making informed financial decisions. Stay updated on market trends and consult with financial experts to navigate the current climate and effectively manage your exposure to CAD fluctuations.

Featured Posts

-

Saints Mock Draft Finding Kamaras Successor In The Top 10 Picks

Apr 25, 2025

Saints Mock Draft Finding Kamaras Successor In The Top 10 Picks

Apr 25, 2025 -

Sadie Sinks Age Implications For Mcu Casting And Spider Man 4

Apr 25, 2025

Sadie Sinks Age Implications For Mcu Casting And Spider Man 4

Apr 25, 2025 -

Uk Eurovision Act Makes Unexpected Statement Points Arent The Priority

Apr 25, 2025

Uk Eurovision Act Makes Unexpected Statement Points Arent The Priority

Apr 25, 2025 -

Predicting The Eurovision 2025 Winner Top Contenders

Apr 25, 2025

Predicting The Eurovision 2025 Winner Top Contenders

Apr 25, 2025 -

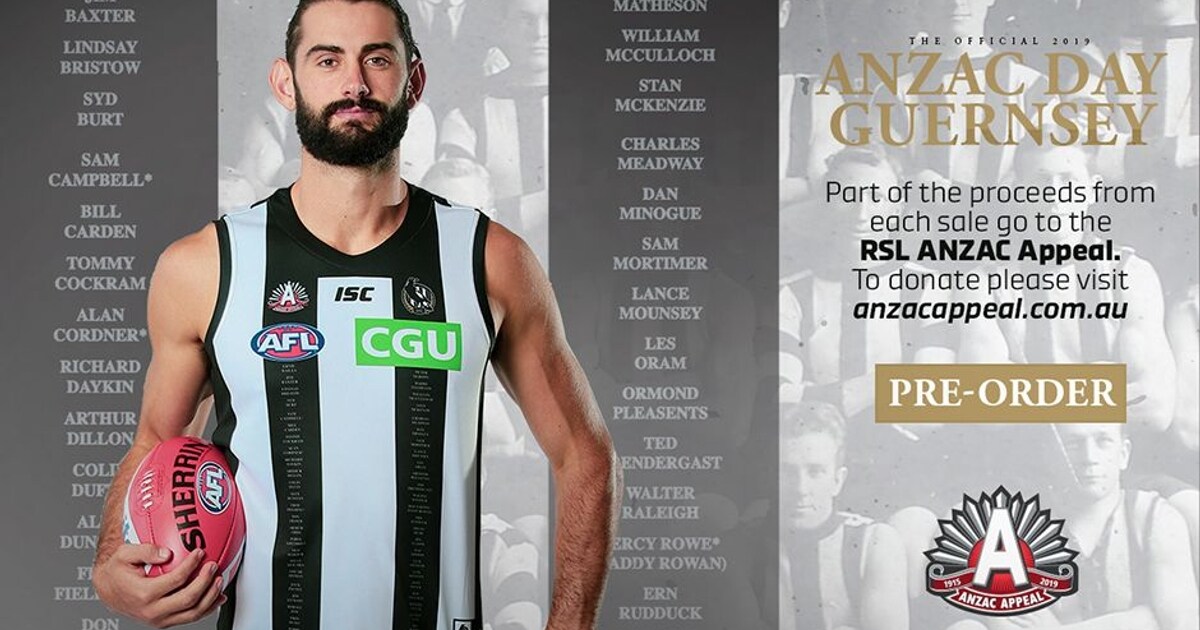

New 2025 Anzac Day Guernsey Design Unveiled

Apr 25, 2025

New 2025 Anzac Day Guernsey Design Unveiled

Apr 25, 2025

Latest Posts

-

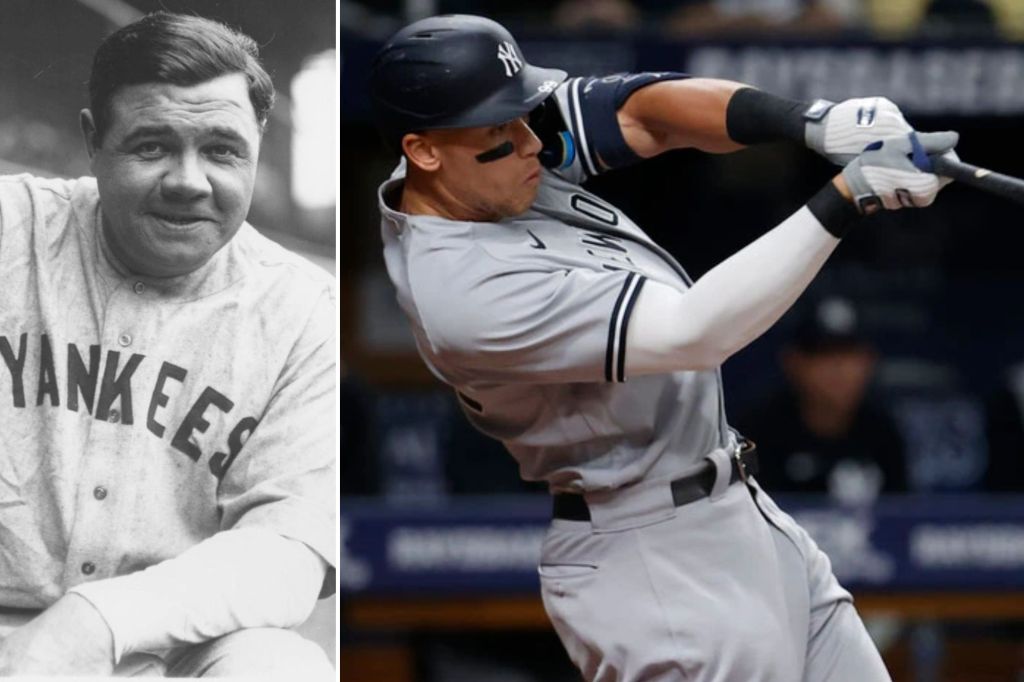

Babe Ruth And Aaron Judge A Yankees Record Tying Feat

Apr 28, 2025

Babe Ruth And Aaron Judge A Yankees Record Tying Feat

Apr 28, 2025 -

Aaron Judges Historic Home Run Matching Babe Ruths Yankees Mark

Apr 28, 2025

Aaron Judges Historic Home Run Matching Babe Ruths Yankees Mark

Apr 28, 2025 -

Yankees Star Aaron Judge Matches Babe Ruths Impressive Record

Apr 28, 2025

Yankees Star Aaron Judge Matches Babe Ruths Impressive Record

Apr 28, 2025 -

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025 -

Yankees Star Aaron Judge Hints At 2025 With Unique Push Up Celebration

Apr 28, 2025

Yankees Star Aaron Judge Hints At 2025 With Unique Push Up Celebration

Apr 28, 2025