Cenovus CEO Rules Out MEG Bid, Emphasizing Organic Growth Strategy

Table of Contents

Cenovus's Rationale for Rejecting the MEG Bid

Cenovus's decision to forgo the MEG acquisition wasn't arbitrary; it stemmed from a careful consideration of financial implications and strategic alignment, ultimately leading to a renewed focus on organic growth.

Financial Considerations

A comprehensive financial analysis revealed several key factors that weighed against the MEG acquisition. The projected merger cost, including acquisition valuation and integration expenses, was deemed excessive relative to the anticipated synergies. Moreover, the acquisition posed a significant risk of diluting Cenovus shareholder value. Concerns surrounding increased debt levels post-acquisition further solidified the decision against the merger.

- High acquisition cost relative to projected synergies: The potential benefits of the merger didn't justify the significant financial outlay required.

- Potential dilution of Cenovus shareholder value: The acquisition was projected to negatively impact the return on investment for existing shareholders.

- Concerns about debt levels post-acquisition: Taking on substantial debt to finance the merger would have increased Cenovus's financial risk. Keywords: financial analysis, merger cost, acquisition valuation, return on investment, shareholder value.

Strategic Alignment

Beyond the financial aspects, the proposed acquisition lacked strategic alignment with Cenovus's long-term goals. The companies' operational focus and geographic footprints differed significantly, presenting substantial integration challenges and raising concerns about potential operational inefficiencies. The lack of significant strategic synergies further weakened the case for the merger.

- Differences in operational focus and geographic footprint: Integrating MEG's operations with Cenovus's existing infrastructure would have been complex and costly.

- Potential integration challenges and costs: Significant resources and time would have been required to successfully integrate the two companies.

- Lack of significant strategic synergies: The merger wouldn't have generated substantial improvements in efficiency or market position. Keywords: strategic fit, synergies, operational efficiency, long-term strategy, corporate goals.

Focus on Organic Growth

Cenovus is now firmly committed to an organic growth strategy, emphasizing internal investments and operational improvements to fuel future expansion. This approach offers several advantages, including greater control over expansion and reduced financial risk. This strategy includes targeted investments in existing oil sands projects, exploration and development of new oil and gas resources, and ongoing efforts to enhance operational efficiency and reduce costs.

- Investments in existing oil sands projects: Optimizing existing assets to maximize production and profitability.

- Exploration and development of new oil and gas resources: Expanding Cenovus's resource base through strategic exploration activities.

- Efficiency improvements and cost reductions: Streamlining operations to enhance profitability and competitiveness. Keywords: organic growth strategy, capital allocation, exploration and production, operational improvements, production increase.

Implications of Cenovus's Decision on the Energy Sector

Cenovus's decision to prioritize organic growth over a large-scale acquisition sends a ripple effect through the energy market. It suggests a potential shift away from the large mergers and acquisitions that have characterized the sector in recent years. This could lead to increased competition as companies focus on internal growth and operational improvements. Furthermore, the decision impacts the valuation of similar energy companies, potentially influencing future M&A activity.

- Potential shift away from large-scale mergers in the energy sector: Other companies might re-evaluate their own M&A strategies.

- Increased focus on organic growth strategies among competitors: Organic growth may become the preferred method of expansion for many energy firms.

- Impact on the valuation of similar energy companies: The market may reassess the value of companies based on their organic growth potential. Keywords: energy market, M&A activity, industry trends, competitive landscape, market share.

Conclusion: Cenovus's Commitment to Organic Growth – A Strategic Shift in the Energy Landscape

Cenovus Energy's rejection of the MEG Energy bid and its embrace of an organic growth strategy represents a significant recalibration in its corporate direction. This strategic shift, driven by financial prudence and a focus on long-term strategic alignment, positions Cenovus for sustainable and controlled expansion. The decision’s impact extends beyond Cenovus, potentially reshaping the competitive dynamics and M&A activity within the broader energy sector. By prioritizing organic growth, Cenovus aims to create substantial long-term value for its shareholders and establish itself as a leader in sustainable energy development.

Stay informed about Cenovus Energy's strategic shift toward organic growth and the future of the energy landscape. Follow Cenovus's progress as they implement their new organic growth strategy, paving the way for a future focused on sustainable energy development.

Featured Posts

-

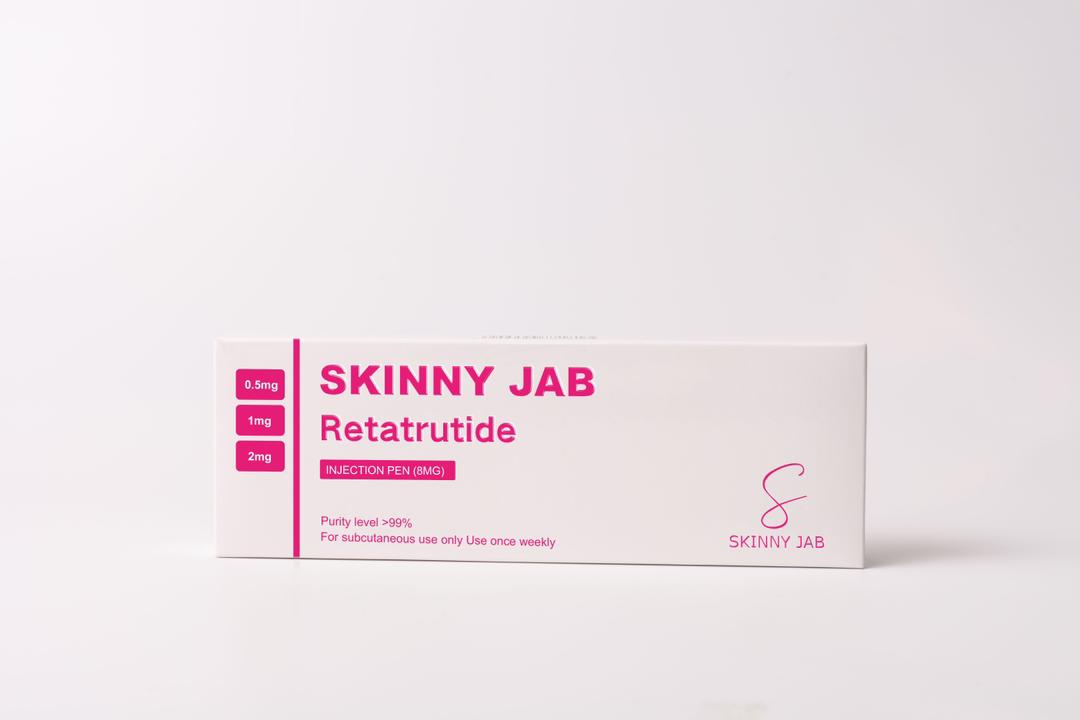

Top Streaming And Tv Shows The Skinny Jab Revolution Black 47 And Roosters

May 26, 2025

Top Streaming And Tv Shows The Skinny Jab Revolution Black 47 And Roosters

May 26, 2025 -

Georgia Murder Case Man Arrested After 19 Year Flight With Nanny

May 26, 2025

Georgia Murder Case Man Arrested After 19 Year Flight With Nanny

May 26, 2025 -

Sinners Louisianas Next Big Horror Hit

May 26, 2025

Sinners Louisianas Next Big Horror Hit

May 26, 2025 -

Running Shoe Review Hoka Cielo X1 2 0 Lightweight And Responsive

May 26, 2025

Running Shoe Review Hoka Cielo X1 2 0 Lightweight And Responsive

May 26, 2025 -

North Myrtle Beach Excessive Water Use A Public Safety Risk

May 26, 2025

North Myrtle Beach Excessive Water Use A Public Safety Risk

May 26, 2025