China Slowdown Impacts Nvidia, But Forecast Remains Positive

Table of Contents

The Impact of China's Economic Slowdown on Nvidia's Revenue

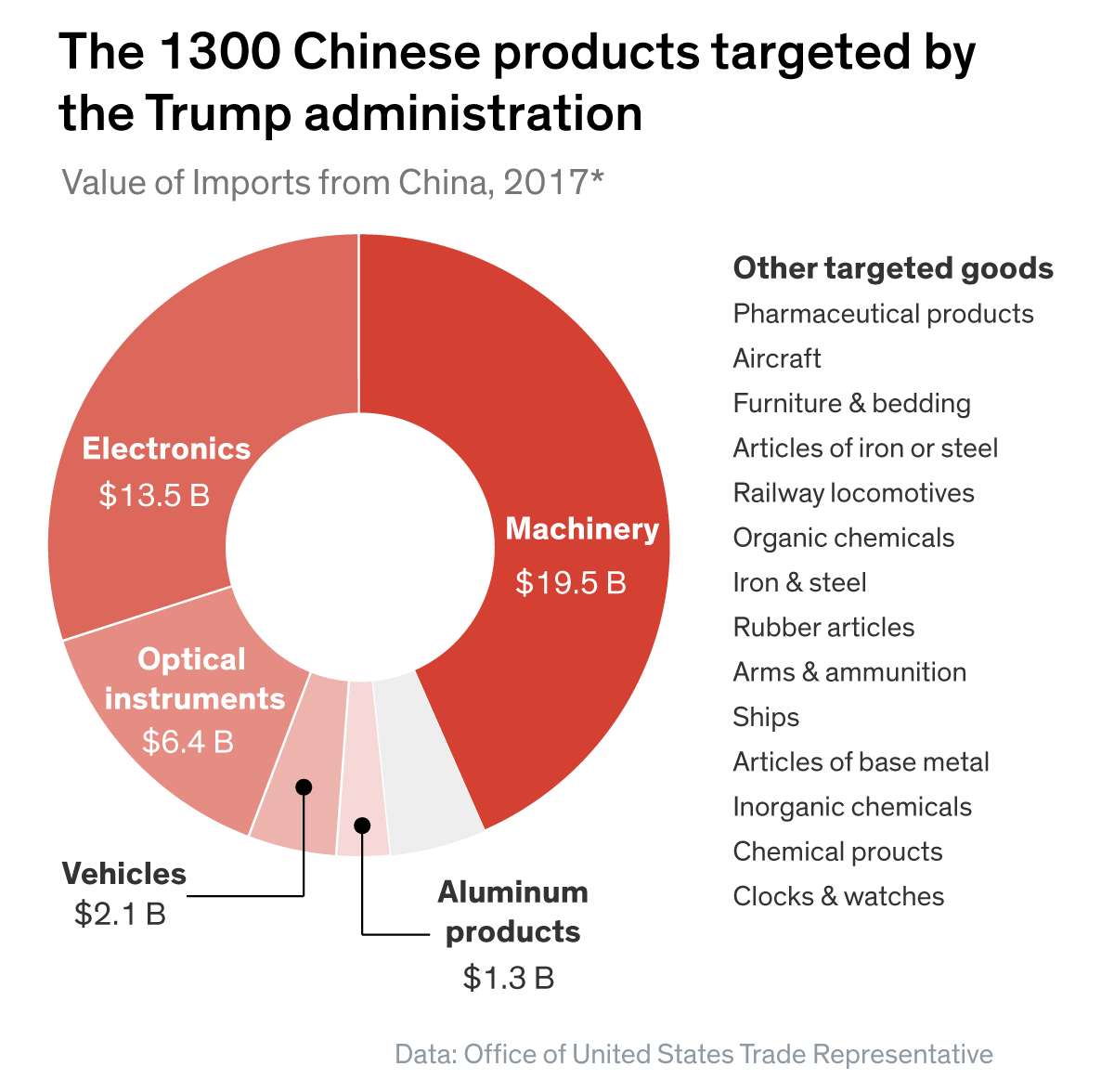

China represents a significant market for Nvidia, particularly in the data center and gaming sectors. The current economic uncertainty has undeniably affected Nvidia's revenue, primarily through reduced demand for its products. This impact manifests in several key areas:

- Decreased Gaming GPU Sales: Reduced consumer spending in China has directly translated into lower sales of Nvidia's gaming GPUs. The once-booming Chinese gaming market is experiencing a contraction, impacting Nvidia's market share and overall revenue.

- Lower Data Center Demand: Chinese cloud providers, major consumers of Nvidia's high-performance computing (HPC) solutions, are scaling back investments due to the economic slowdown. This decreased demand for data center GPUs significantly impacts Nvidia's revenue from this crucial sector.

- Potential Impact on Nvidia's Overall China Market Share: The combination of reduced gaming and data center demand threatens Nvidia's market share in China, a considerable concern given the size and potential of this market. This necessitates a strategic reassessment of Nvidia's approach to the Chinese market. The uncertainty surrounding the economic climate adds further complexity to the situation.

The overall effect is a noticeable dent in Nvidia's revenue from the Chinese market, representing a significant piece of Nvidia revenue. This necessitates a deeper analysis of Nvidia's diversification strategy and its ability to mitigate these headwinds.

Diversification and Resilience: Nvidia's Strengths in a Challenging Market

Despite the challenges presented by the China slowdown, Nvidia's diversification strategy and its leading position in the burgeoning AI market provide significant resilience. The company's success isn't solely dependent on the Chinese market; instead, it leverages a global presence and technological leadership:

- Strong Presence in Key Global Markets: Nvidia maintains a strong presence in the US and Europe, which lessens the dependence on the Chinese market. These established markets provide a buffer against economic fluctuations in any single region.

- Dominance in the AI Chip Market: The explosive growth of artificial intelligence (AI) is a game-changer for Nvidia. The demand for Nvidia's GPUs, crucial for training and running AI models (particularly generative AI and large language models), is soaring globally. This demand more than compensates for the decline in other sectors.

- Continuous Innovation and Product Development: Nvidia's commitment to research and development ensures it remains at the forefront of technological advancements. This continuous innovation sustains its competitive edge and attracts new customers, further solidifying its position in the AI market.

This diversified approach and focus on the high-growth AI sector form a robust defense against the headwinds created by the China slowdown, promoting long-term growth.

Analyzing Nvidia's Positive Forecast Despite the Headwinds

Despite the challenges in the Chinese market, Nvidia's forecast remains positive, a testament to the strength of its AI business and its global reach. This positive outlook is underpinned by several key factors:

- High Demand for AI Chips: The surge in demand for Nvidia's AI chips, especially for applications like generative AI and large language models, significantly outweighs the decline in other sectors. This robust demand is the primary driver of the positive forecast.

- Positive Outlook for Long-Term AI Market Growth: The AI market is predicted to experience exponential growth in the coming years. Nvidia's early and substantial investment in this sector positions it to capitalize on this massive expansion.

- Strategic Investments in R&D: Continued investment in research and development further enhances Nvidia's competitive advantage and allows it to anticipate and adapt to future market demands.

Recent financial reports and expert opinions support this positive outlook, confirming that the growth in the AI sector more than compensates for the temporary slowdown experienced in the Chinese market. Nvidia's stock price largely reflects this positive sentiment, indicating investor confidence in the company's long-term prospects.

Conclusion: China Slowdown and Nvidia's Future

In conclusion, while China's economic slowdown undeniably impacts Nvidia's revenue to some extent, particularly affecting Nvidia revenue streams from the gaming and data center sectors, the company's strong position in the rapidly expanding AI market and its diversified business model ensure a positive overall forecast. While monitoring the situation in China remains crucial, the long-term outlook for Nvidia remains bright, driven by the unstoppable growth of AI. Stay informed about the Nvidia stock forecast and the impact of China's slowdown on the tech industry by following [link to relevant resource]. Continue to monitor the Nvidia China market to understand future developments and their implications for the company.

Featured Posts

-

Canadas Economic Response 8 Data Points Showing The Impact Of Trumps Trade War

May 30, 2025

Canadas Economic Response 8 Data Points Showing The Impact Of Trumps Trade War

May 30, 2025 -

Broadcoms V Mware Deal At And T Details The Extreme Cost Implications

May 30, 2025

Broadcoms V Mware Deal At And T Details The Extreme Cost Implications

May 30, 2025 -

Domaci Stavby Slavnostni Vyhlaseni Vitezu Stavba Roku

May 30, 2025

Domaci Stavby Slavnostni Vyhlaseni Vitezu Stavba Roku

May 30, 2025 -

Blagoveschenskaya Tserkov V Kyonigsberge Istoriya Operatsiya I Karpov

May 30, 2025

Blagoveschenskaya Tserkov V Kyonigsberge Istoriya Operatsiya I Karpov

May 30, 2025 -

Como Obtener Tu Reembolso Por La Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025

Como Obtener Tu Reembolso Por La Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025

Latest Posts

-

Emergency Response Disrupted Cleveland Fire Station Closed Due To Leaks

May 31, 2025

Emergency Response Disrupted Cleveland Fire Station Closed Due To Leaks

May 31, 2025 -

Showers Expected On Election Day In Northeast Ohio

May 31, 2025

Showers Expected On Election Day In Northeast Ohio

May 31, 2025 -

Cleveland Fire Station Temporary Closure Following Water Damage Incident

May 31, 2025

Cleveland Fire Station Temporary Closure Following Water Damage Incident

May 31, 2025 -

Water Leaks Force Temporary Closure Of Cleveland Fire Station

May 31, 2025

Water Leaks Force Temporary Closure Of Cleveland Fire Station

May 31, 2025 -

Election Day Forecast Northeast Ohio To See Showers

May 31, 2025

Election Day Forecast Northeast Ohio To See Showers

May 31, 2025