Closure Of Emerging Markets Fund Leads To Point72 Trader Exits

Table of Contents

The Closure of Point72's Emerging Markets Fund

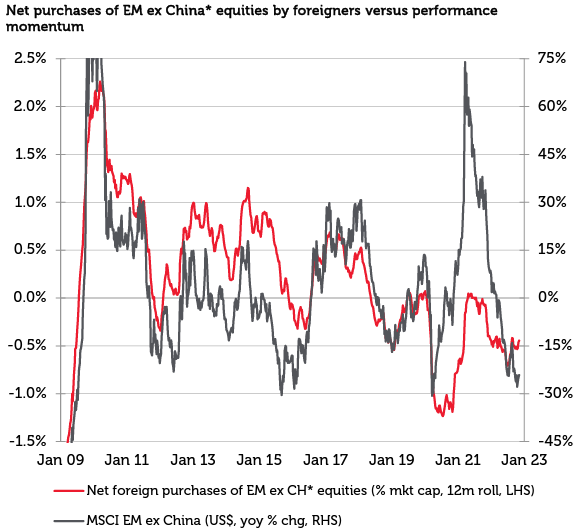

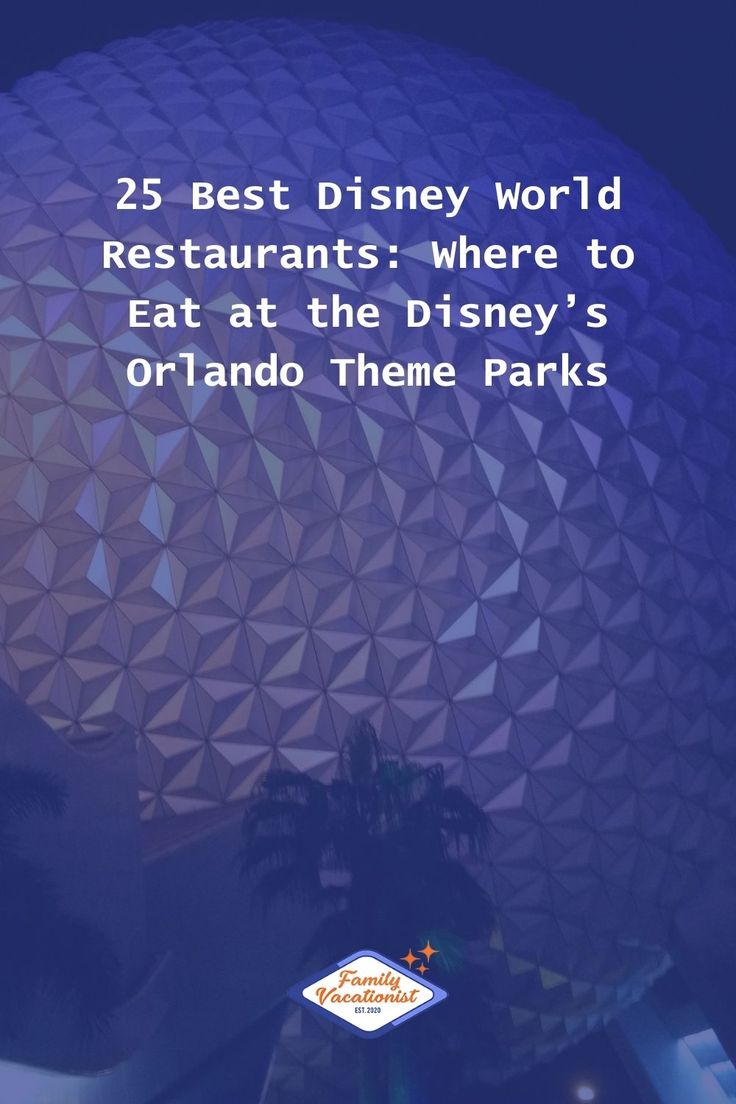

The closure of Point72's emerging markets fund marks a significant shift in the firm's investment strategy. While the exact reasons remain somewhat opaque, several factors likely contributed to this decision. The fund's underperformance relative to benchmarks, coupled with increasingly challenging market conditions in several emerging economies, likely played a major role. This strategic realignment reflects a broader trend within the asset management industry, where firms are carefully evaluating their exposure to riskier asset classes.

- Specific reasons for fund closure: Reported underperformance against benchmarks, volatile emerging market conditions, and a strategic shift toward other investment areas.

- Timeline of events: The closure announcement followed a period of several quarters of underperformance, suggesting a deliberate and considered decision rather than a knee-jerk reaction. Specific dates regarding the timeline may emerge in subsequent disclosures.

- Financial performance of the fund before closure: While precise figures are usually confidential, reports suggest a consistent underperformance, triggering the eventual closure decision.

- Impact on Point72's overall portfolio: The closure represents a relatively small percentage of Point72's overall portfolio, minimizing the overall impact on the firm's overall financial health. However, it signals a shift in their strategic allocation of capital.

Key Trader Exits and Their Significance

Following the closure of the emerging markets fund, several experienced portfolio managers and traders have left Point72. These departures represent a significant loss of expertise and institutional knowledge. The reasons behind these exits are likely multifaceted, but industry speculation points to a combination of factors: reduced career progression opportunities within a smaller emerging markets team, potentially lower compensation expectations post-fund closure, or simply a desire to pursue opportunities at firms with more robust emerging market strategies.

- Names and positions of departing traders: While Point72 may not publicly disclose all names, reports suggest senior portfolio managers and analysts specializing in specific emerging markets regions were among those who left.

- Their experience and contributions to Point72: These individuals possessed extensive experience in navigating the complexities of emerging markets, contributing significantly to Point72's previous success in this area.

- Potential reasons for their departures: Limited career growth, compensation adjustments, and a shift in the firm's overall strategic focus are some of the contributing factors.

- The impact of their departures on Point72’s capabilities: The loss of this talent pool will undoubtedly impact Point72's ability to rapidly re-enter the emerging markets space if and when conditions become more favorable.

Market Implications of the Point72 Developments

The closure of Point72's emerging markets fund and the subsequent departures of key traders have significant implications for both investor confidence and the overall hedge fund landscape. The events may cause some investors to reassess their exposure to emerging markets, at least in the short term. However, opportunities may also exist for other hedge funds to recruit top talent and potentially capitalize on shifts in the investment strategies.

- Impact on investor sentiment towards emerging markets: This development could trigger cautious sentiment, influencing other investors' strategies and potentially causing some short-term market volatility.

- Potential shifts in investment strategies within the industry: Other firms may use this as an opportunity to adjust their own strategies, seeking to fill any gaps left by Point72's retreat.

- Opportunities for other firms to acquire talented traders: The departure of experienced professionals creates an opportunity for competitor firms to bolster their own emerging markets capabilities.

- Analysis of similar events in the past: Analyzing comparable events from the past helps determine the long-term consequences for Point72, the emerging markets sector, and the broader investment environment.

Conclusion

The closure of Point72's emerging markets fund and the ensuing trader exits represent a significant development in the hedge fund world. While the immediate impact may be felt primarily within the firm, the broader implications for investor confidence and the emerging markets investment landscape cannot be ignored. Understanding these developments is crucial for investors and industry professionals alike. The events highlight the inherent risks and volatility associated with emerging markets investment and the importance of regularly reassessing investment strategies. Stay informed about future developments in the Point72 emerging markets fund and other key changes in the hedge fund world by subscribing to our newsletter today!

Featured Posts

-

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 26, 2025

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Standee Unveiled At Cinema Con

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Standee Unveiled At Cinema Con

Apr 26, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 26, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 26, 2025 -

Resumption Of Construction On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Resumption Of Construction On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

Discover 7 Exciting New Orlando Restaurants Beyond Disney World

Apr 26, 2025

Discover 7 Exciting New Orlando Restaurants Beyond Disney World

Apr 26, 2025

Latest Posts

-

Paolini Y Pegula Fin De Su Participacion En El Wta 1000 De Dubai

Apr 27, 2025

Paolini Y Pegula Fin De Su Participacion En El Wta 1000 De Dubai

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai 2024 Paolini Y Pegula Fuera Del Wta 1000

Apr 27, 2025

Dubai 2024 Paolini Y Pegula Fuera Del Wta 1000

Apr 27, 2025 -

Government Appoints Vaccine Skeptic To Lead Immunization And Autism Study

Apr 27, 2025

Government Appoints Vaccine Skeptic To Lead Immunization And Autism Study

Apr 27, 2025 -

Wta 1000 Dubai Caida Inesperada De Paolini Y Pegula

Apr 27, 2025

Wta 1000 Dubai Caida Inesperada De Paolini Y Pegula

Apr 27, 2025