Commodities Teams: Focusing Core Groups & Walleye Credit Cuts

Table of Contents

Focusing on Core Groups within Commodities Teams

Building a high-performing commodities team starts with identifying and nurturing its core strengths. This involves a multi-faceted approach encompassing identifying core competencies, streamlining team structure, and investing in continuous development.

Identifying Core Competencies

Determining the key strengths and expertise within your team is paramount. A clear understanding of individual and collective capabilities allows for strategic allocation of resources and responsibilities.

- Analyze past performance data: Scrutinize historical trading records to pinpoint top-performing traders and their areas of specialization (e.g., energy derivatives, precious metals, agricultural commodities). This data-driven approach provides objective insights into individual strengths.

- Conduct skill assessments: Implement regular skill assessments to identify both strengths and weaknesses within the team. This could involve written tests, practical exercises, or simulations of real-world trading scenarios. Identifying skill gaps allows for targeted training and development.

- Leverage personality profiling: Understanding team dynamics is crucial for effective collaboration. Personality profiling tools can help identify communication styles, conflict resolution approaches, and potential team synergy challenges. This allows for optimized team structures and conflict management strategies.

Streamlining Team Structure

A well-structured commodities team operates efficiently and minimizes redundancies. Restructuring can significantly improve productivity and focus.

- Reduce redundancies: Identify and eliminate overlapping roles to streamline operations and optimize resource allocation. Consolidating similar functions improves efficiency and reduces unnecessary costs.

- Delegate tasks based on expertise: Assign tasks based on individual strengths and expertise. This ensures that each team member works within their area of competence, maximizing productivity and minimizing errors.

- Implement clear communication channels: Establish clear and efficient communication channels and reporting structures. This ensures timely information flow and reduces misunderstandings, crucial for effective decision-making in fast-paced trading environments.

Investing in Core Group Development

Continuous training and upskilling are essential for sustained success in the dynamic world of commodities trading.

- Professional development opportunities: Provide access to professional development programs, including workshops, conferences, and online courses, to keep your team at the forefront of industry trends and best practices.

- Mentorship programs: Foster knowledge transfer and experience sharing through mentorship programs. Pairing experienced traders with newer members accelerates learning and improves team cohesion.

- Performance-based incentives: Implement a performance-based incentive structure to motivate and reward top performers. This can include bonuses, profit-sharing, or other forms of recognition that directly reward success.

The Impact of Walleye Credit Cuts on Commodities Teams

Walleye credit, a crucial element in commodities financing, significantly impacts trading strategies and risk management. Understanding its role and adapting to changes is paramount for successful navigation of market fluctuations.

Understanding Walleye Credit

Walleye credit, in the context of commodities trading, refers to the lines of credit extended to trading firms to facilitate their activities. Its availability directly affects a team's ability to engage in larger trades and manage risk effectively.

- Mechanics of walleye credit: Walleye credit is typically secured through a combination of collateral (like inventory or other assets) and creditworthiness assessments. It allows firms to finance trading positions and manage their cash flow effectively.

- Sources of walleye credit: Typical sources include banks specializing in commodities financing, specialized commodity trading houses, and other financial institutions. The terms and conditions vary greatly depending on the lender and the borrower's creditworthiness.

- Implications of reduced availability: Reduced walleye credit availability forces commodities teams to adjust their strategies, potentially limiting trading activity and increasing risk.

Adapting Trading Strategies to Credit Constraints

Credit constraints necessitate a strategic shift in trading approaches to mitigate risk and ensure continued profitability.

- Reduce position sizes: To minimize risk exposure, reduce the size of trading positions. This limits potential losses in case of adverse market movements.

- Focus on shorter-term strategies: Shift from long-term strategies to shorter-term trading approaches to minimize exposure to market fluctuations and reduce financing needs.

- Explore alternative financing options: Investigate alternative financing sources like factoring, invoice financing, or hedging strategies to reduce reliance on traditional walleye credit lines.

Mitigating Risks Associated with Credit Cuts

Robust risk management strategies are crucial in addressing the challenges posed by walleye credit cuts.

- Strengthen risk management processes: Enhance risk management systems to proactively identify and mitigate potential losses stemming from credit constraints. This involves regular portfolio reviews, stress testing, and scenario planning.

- Diversify trading strategies: Diversify trading activities across different commodities and markets to reduce reliance on specific sectors and minimize the impact of credit constraints on any one area.

- Implement robust stress testing: Conduct thorough stress testing to assess the impact of various credit scenarios on the team's portfolio. This provides a realistic assessment of the potential impact of credit constraints on overall profitability.

Conclusion

Successfully managing commodities teams requires a strategic approach that incorporates both internal optimization and external market considerations. Focusing on core groups, by identifying key strengths, streamlining structures, and investing in development, allows for increased efficiency and profitability. Simultaneously, understanding and adapting to changes in market conditions, such as walleye credit cuts, is critical for effective risk management. By proactively addressing these challenges, commodities teams can navigate market volatility and achieve sustainable success. Learn more about optimizing your commodities teams and developing robust risk management strategies today!

Featured Posts

-

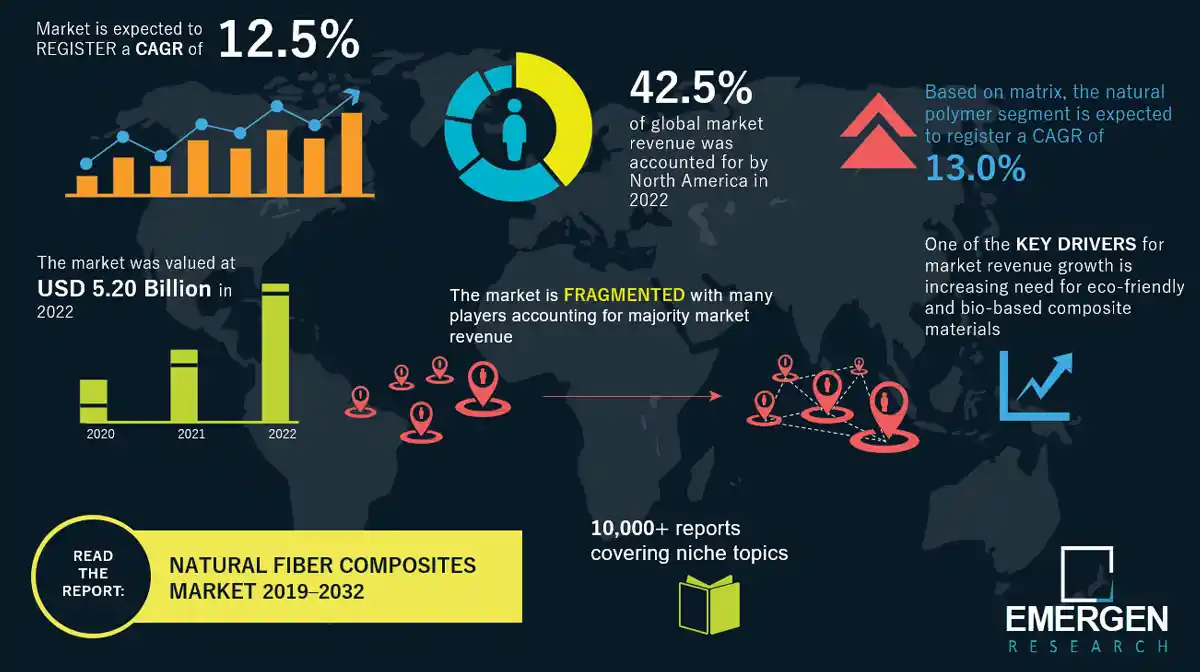

Global Natural Fiber Composites Market Research Report 2029 Forecast

May 13, 2025

Global Natural Fiber Composites Market Research Report 2029 Forecast

May 13, 2025 -

Evaluating Andrew Chafins Impact On The 2024 Texas Rangers Season

May 13, 2025

Evaluating Andrew Chafins Impact On The 2024 Texas Rangers Season

May 13, 2025 -

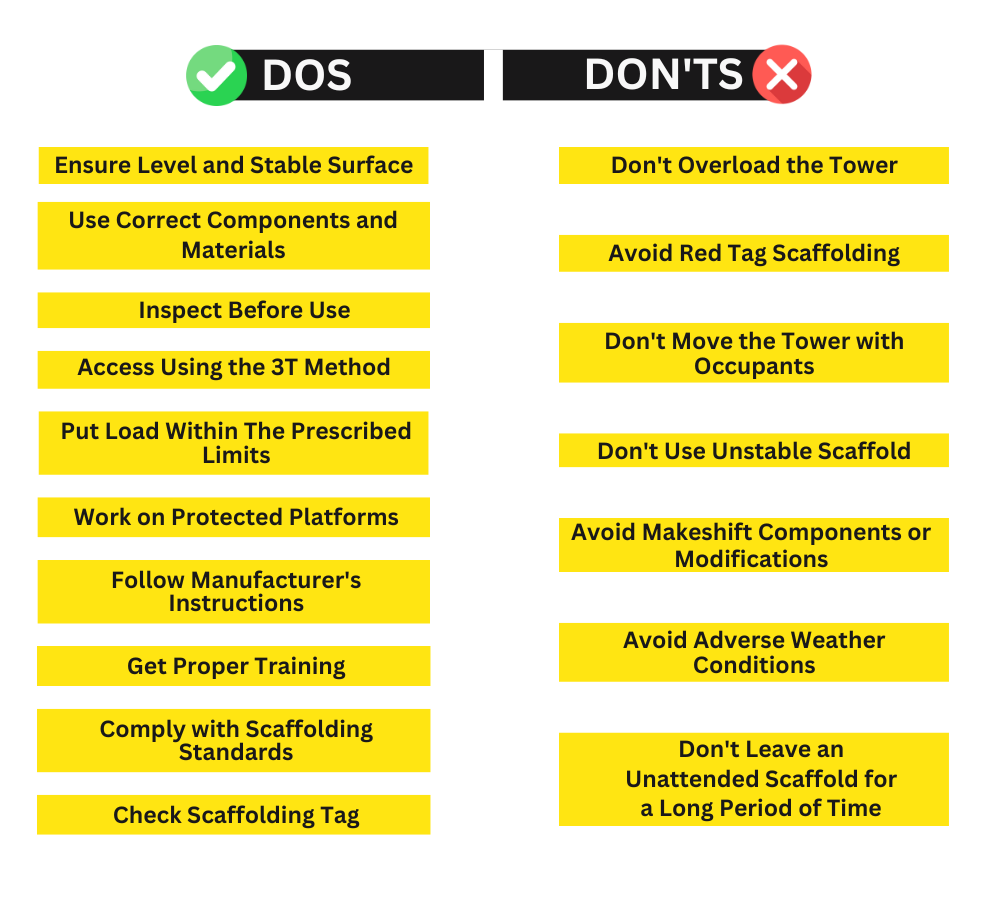

5 Key Dos And Don Ts Succeeding In The Private Credit Job Market

May 13, 2025

5 Key Dos And Don Ts Succeeding In The Private Credit Job Market

May 13, 2025 -

Animal Wonders A Journey Through Diverse Species

May 13, 2025

Animal Wonders A Journey Through Diverse Species

May 13, 2025 -

A Tul Magas Gazsik Di Caprio Peldaja Es A Filmipar Valsaga

May 13, 2025

A Tul Magas Gazsik Di Caprio Peldaja Es A Filmipar Valsaga

May 13, 2025

Latest Posts

-

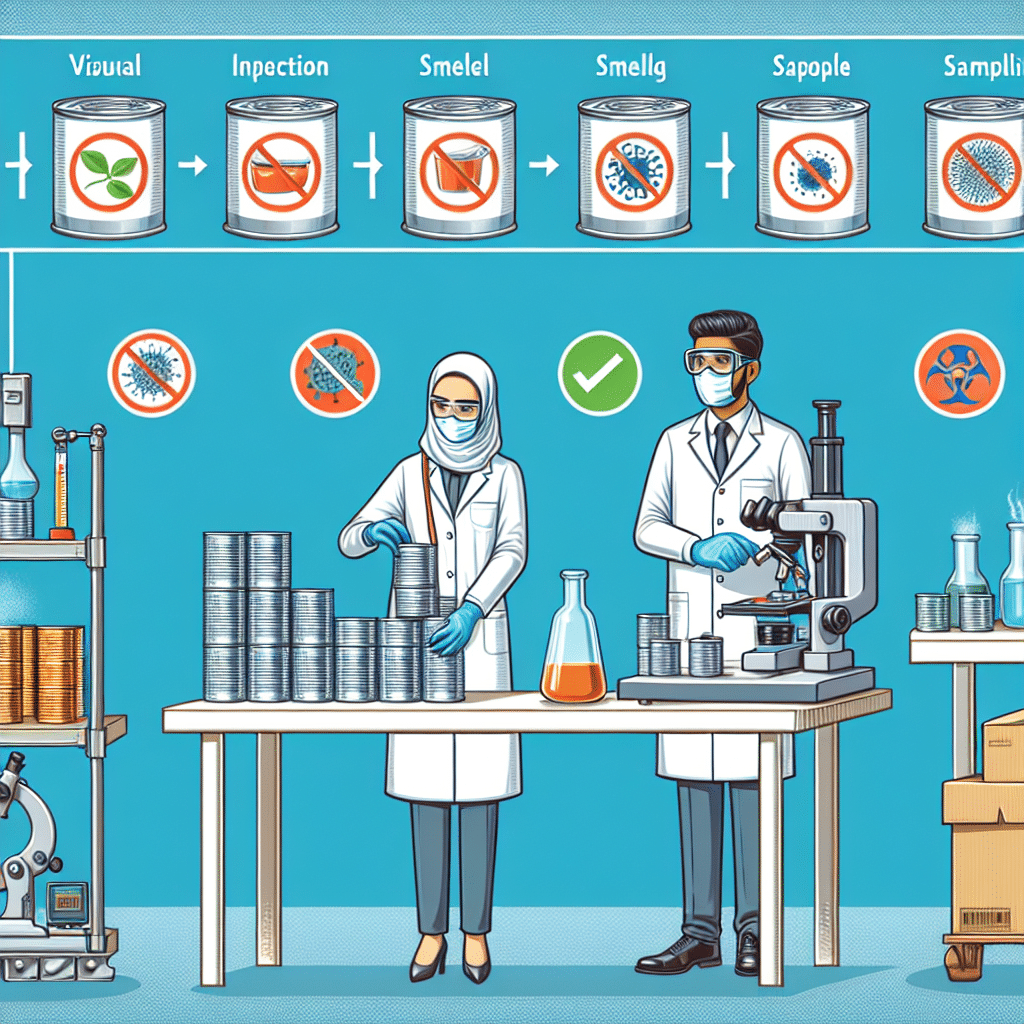

Wegmans Braised Beef Recall What To Do If You Bought It

May 14, 2025

Wegmans Braised Beef Recall What To Do If You Bought It

May 14, 2025 -

Walmart Canned Bean Recall A Comprehensive Overview

May 14, 2025

Walmart Canned Bean Recall A Comprehensive Overview

May 14, 2025 -

Safety Alert Walmart Recalls Orvs Oysters And Electric Scooters Nationwide

May 14, 2025

Safety Alert Walmart Recalls Orvs Oysters And Electric Scooters Nationwide

May 14, 2025 -

Understanding The Fda Recall Walmart Canned Beans

May 14, 2025

Understanding The Fda Recall Walmart Canned Beans

May 14, 2025 -

Walmart Recall Expands New Concerns Over Orvs Oysters And Electric Scooters

May 14, 2025

Walmart Recall Expands New Concerns Over Orvs Oysters And Electric Scooters

May 14, 2025