Comprehensive Ethereum Price Prediction: A Deep Dive Into Future Trends

Table of Contents

H2: Technological Advancements Shaping Ethereum's Future

Ethereum's future price is inextricably linked to its ongoing technological development. Several key advancements promise to significantly impact its scalability, security, and overall utility.

H3: Ethereum 2.0 and its Impact

The much-anticipated Ethereum 2.0 upgrade marks a paradigm shift from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism. This transition promises several crucial improvements:

- Increased Transaction Speed: PoS is expected to drastically reduce transaction confirmation times, leading to a smoother user experience.

- Reduced Energy Consumption: PoS is significantly more energy-efficient than PoW, addressing environmental concerns and potentially attracting more environmentally conscious investors.

- Enhanced Security: The PoS mechanism is theoretically more resistant to 51% attacks, strengthening the network's overall security.

- Potential for Wider Adoption: Improved scalability and efficiency pave the way for wider adoption by businesses and institutions, potentially driving up demand and price.

H3: Layer-2 Scaling Solutions

Ethereum's inherent scalability limitations have been addressed by the emergence of Layer-2 scaling solutions like Optimism, Arbitrum, and Polygon. These solutions process transactions off-chain, significantly reducing congestion and transaction fees on the main Ethereum network.

- Reduced Gas Fees: Layer-2 solutions dramatically decrease transaction costs, making Ethereum more accessible to a broader range of users.

- Faster Transaction Times: Transactions are processed much faster on Layer-2, improving the overall user experience and attracting more developers and users.

- Increased User Experience: Lower fees and faster transactions create a more user-friendly environment, boosting adoption and potentially driving price increases.

- Positive Impact on Price: The combined effect of increased scalability and reduced costs should positively influence Ethereum's price.

H3: Development Activity and DeFi Growth

The thriving ecosystem of decentralized finance (DeFi) applications built on Ethereum is a key driver of its value. Continued development activity fuels innovation and attracts investment.

- Number of Active Developers: A high number of active developers indicates a vibrant and growing ecosystem, suggesting future innovation and potential price appreciation.

- New DeFi Projects Launched: The continuous launch of innovative DeFi projects expands the utility of Ethereum and attracts more users and capital.

- Total Value Locked (TVL) in DeFi Protocols: A high TVL reflects the significant amount of capital locked in DeFi protocols on Ethereum, indicating confidence and potential for future growth.

- Correlation between Development and Price: Historical data shows a strong correlation between development activity and Ethereum's price, suggesting that continued development will likely support price growth.

H2: Macroeconomic Factors Influencing Ethereum's Price

While technological advancements are crucial, macroeconomic conditions also play a significant role in shaping Ethereum's price.

H3: Regulatory Landscape and Government Policies

Government regulations globally significantly impact the cryptocurrency market. Uncertainty surrounding regulations can cause price volatility.

- Specific Regulations (e.g., SEC rulings): Clear and favorable regulations could boost institutional investment and increase demand, driving up the price. Conversely, restrictive regulations could suppress price growth.

- Potential for Increased Adoption or Suppression: Government policies can either encourage or hinder the adoption of cryptocurrencies, directly impacting Ethereum's price.

- Uncertainty and its Effect on Price Volatility: Regulatory uncertainty often leads to increased price volatility as investors react to news and speculation.

H3: Bitcoin's Price Correlation

Bitcoin's price often influences the price of other cryptocurrencies, including Ethereum. However, the correlation is not always perfect.

- Correlation Coefficient: While historically correlated, the correlation coefficient between Bitcoin and Ethereum has fluctuated, suggesting potential for decoupling.

- Potential for Decoupling: As Ethereum's utility and adoption grow, it may become less reliant on Bitcoin's price movements.

- Bitcoin's Influence as the Dominant Cryptocurrency: Bitcoin's dominance still significantly impacts overall market sentiment, which can indirectly influence Ethereum's price.

H3: Global Economic Conditions

Global economic factors significantly impact investor behavior and risk appetite.

- Investor Sentiment: During periods of economic uncertainty, investors may move towards safer assets, potentially reducing investment in cryptocurrencies like Ethereum.

- Risk-on/Risk-off Behavior: In times of economic growth, investors are more likely to take on risk, potentially driving up Ethereum's price.

- Safe-haven Asset Status of Cryptocurrencies (or lack thereof): The perception of cryptocurrencies as a safe haven asset can influence investment flows, affecting Ethereum's price.

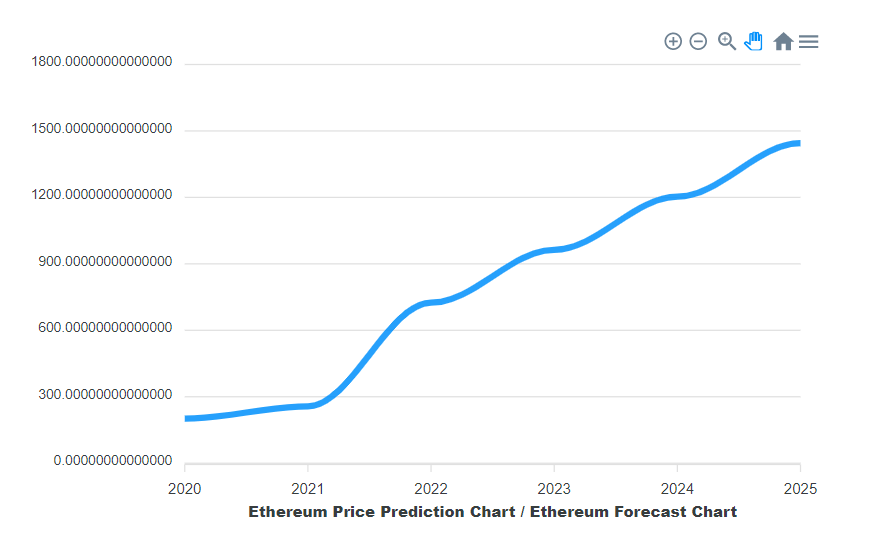

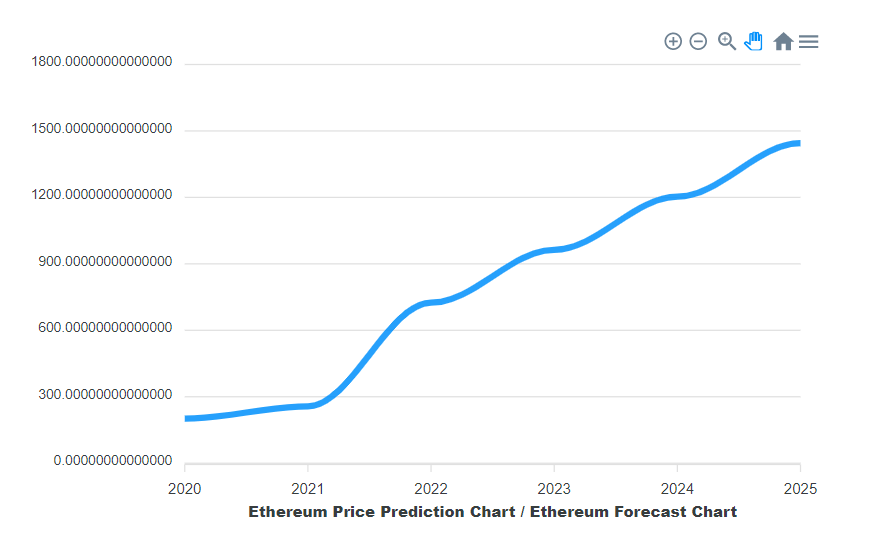

H2: Analyzing Historical Price Trends and Predicting Future Movement

Understanding past price movements is crucial for predicting future trends. We must analyze several factors.

H3: Past Performance and Price Cycles

Examining Ethereum's historical price data reveals cyclical patterns, including bull and bear markets.

- Historical Charts: Analyzing historical price charts helps identify potential support and resistance levels.

- Price Cycles: Understanding past price cycles can offer insights into potential future cycles and price targets.

- Bull and Bear Markets: Recognizing bull and bear market patterns helps gauge potential future price swings.

- Identifying Potential Support and Resistance Levels: These levels can indicate potential price reversal points.

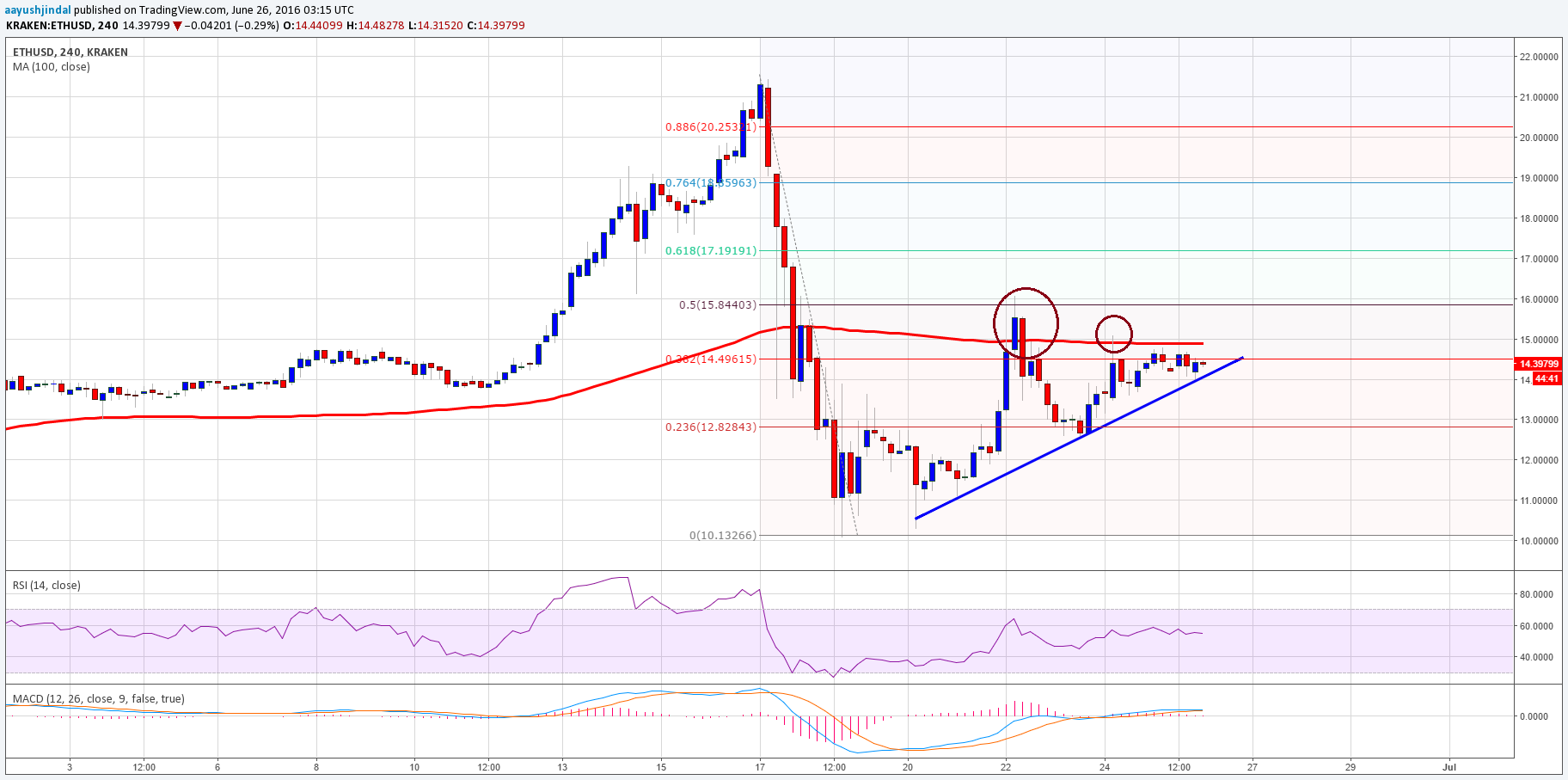

H3: Technical Analysis and Chart Patterns

Technical analysis employs various indicators and chart patterns to forecast price movements.

- Moving Averages: Moving averages help smooth out price fluctuations and identify trends.

- RSI, MACD: These indicators measure momentum and potential overbought or oversold conditions.

- Candlestick Patterns: Recognizing candlestick patterns can offer insights into potential price reversals or breakouts.

- Potential Future Price Targets Based on Technical Analysis: Technical analysis can provide potential price targets, but these are not guaranteed.

H3: On-Chain Metrics and Market Sentiment

On-chain metrics, like transaction volume and active addresses, provide insights into network activity and investor sentiment.

- Correlation between On-Chain Data and Price Movements: Higher transaction volume and active addresses generally suggest increased network activity and potentially higher prices.

- Social Media Sentiment: Analyzing social media sentiment can offer insights into overall market sentiment towards Ethereum.

- News Events Affecting Market Sentiment: Significant news events can dramatically impact market sentiment and Ethereum's price.

3. Conclusion

Predicting the Ethereum price prediction accurately is challenging, as it depends on a complex interplay of technological advancements, macroeconomic factors, and market sentiment. While Ethereum 2.0, Layer-2 solutions, and continued DeFi growth offer significant potential for long-term price appreciation, regulatory uncertainty and global economic conditions introduce considerable risk. Our analysis suggests a cautiously optimistic outlook for the long term, but short-term price movements will likely remain volatile. It's crucial to remember that any Ethereum price prediction is inherently speculative. Conduct your own thorough research before making any investment decisions regarding Ethereum price prediction. Remember to diversify your investment portfolio and understand the risks involved in cryptocurrency investment.

Featured Posts

-

See Counting Crows Live This Summer In Downtown Indianapolis

May 08, 2025

See Counting Crows Live This Summer In Downtown Indianapolis

May 08, 2025 -

Son Dakika Bakan Simsek Kripto Para Birimlerine Iliskin Riskleri Vurguladi

May 08, 2025

Son Dakika Bakan Simsek Kripto Para Birimlerine Iliskin Riskleri Vurguladi

May 08, 2025 -

Rogue Channels Cyclops In Latest X Men Comic

May 08, 2025

Rogue Channels Cyclops In Latest X Men Comic

May 08, 2025 -

Ethereums Price Above Support But Will It Fall To 1 500 Analysis

May 08, 2025

Ethereums Price Above Support But Will It Fall To 1 500 Analysis

May 08, 2025 -

Inter Milan Contract Expirations Four Key Players Out In 2026

May 08, 2025

Inter Milan Contract Expirations Four Key Players Out In 2026

May 08, 2025

Latest Posts

-

James Gunns Superman 5 Minute Krypto Preview Released

May 08, 2025

James Gunns Superman 5 Minute Krypto Preview Released

May 08, 2025 -

New Superman Minecraft Preview 5 Minutes From A Thailand Theater

May 08, 2025

New Superman Minecraft Preview 5 Minutes From A Thailand Theater

May 08, 2025 -

Lidls Plus App Consumer Organisation Launches Legal Action

May 08, 2025

Lidls Plus App Consumer Organisation Launches Legal Action

May 08, 2025 -

5 Minute Superman Minecraft Preview From Thailand Theater

May 08, 2025

5 Minute Superman Minecraft Preview From Thailand Theater

May 08, 2025 -

Lawsuit Filed Against Lidl Consumer Organisation Challenges Plus App Functionality

May 08, 2025

Lawsuit Filed Against Lidl Consumer Organisation Challenges Plus App Functionality

May 08, 2025