Coping With Income Inequality In A Marriage: A Creative's Guide

Table of Contents

Open and Honest Communication: The Foundation of Financial Stability

Open and honest communication is the bedrock of any successful marriage, especially when dealing with the complexities of income inequality. Talking about money can be uncomfortable, but it's crucial for building trust and finding solutions that work for both partners. Avoiding these conversations only allows resentment and misunderstandings to fester.

Talking About Money Without Fighting

Establishing a safe space for open dialogue is paramount. Avoid accusatory language and instead, focus on collaborative problem-solving. Here's how:

- Schedule regular "financial check-in" meetings: Dedicate specific time, perhaps weekly or monthly, to discuss finances without distractions.

- Actively listen to each other's concerns and perspectives: Emphasize understanding each other's feelings and viewpoints, even if you don't agree.

- Use "I" statements to express feelings without assigning blame: For example, instead of saying "You never contribute enough," try "I feel stressed about our finances, and I'd like to explore ways we can better manage our money together."

Defining Financial Goals Together

Creating shared financial goals fosters a sense of unity and purpose, helping both partners feel invested in the process. This shared vision can significantly alleviate the stress associated with financial inequality.

- Short-term goals: These might include paying off high-interest debt, saving for a much-needed vacation, or building an emergency fund.

- Long-term goals: Focus on bigger-picture objectives such as buying a house, funding your children's education, or planning for retirement.

- Align goals with individual values and aspirations: Ensure that your shared goals reflect both partners' values and personal aspirations.

Creative Budgeting and Financial Management Strategies

Traditional 50/50 budgeting may not be suitable for couples facing income inequality. Explore alternative methods that acknowledge and address the financial disparity fairly.

The "Fair Share" Approach

The "fair share" approach involves contributing a percentage of income based on individual earnings. This method acknowledges the differences in earning potential while promoting a sense of shared responsibility.

- Calculate a percentage contribution based on income disparity: Determine a percentage contribution that feels fair to both partners, considering the income difference.

- Establish a joint account for shared expenses and individual accounts for personal spending: This allows for transparency regarding shared expenses while respecting individual spending habits.

- Regularly review and adjust the contribution percentages as needed: Financial situations change, so regular reviews ensure the budget remains equitable and effective.

Utilizing Financial Tools and Resources

Leverage technology and professional expertise to manage finances more efficiently. Numerous resources are available to simplify the process and provide valuable insights.

- Explore budgeting apps like Mint or YNAB (You Need A Budget): These apps help track spending, create budgets, and monitor progress towards financial goals.

- Use online calculators to project savings goals and retirement plans: These tools offer valuable insights into long-term financial planning and can help visualize progress.

- Consider consulting a financial advisor to create a personalized financial plan: A financial advisor can provide expert guidance tailored to your specific circumstances and goals.

Addressing Emotional and Psychological Impacts of Income Inequality

Income inequality in a marriage can have significant emotional and psychological consequences. Openly acknowledging and addressing these feelings is crucial for maintaining a healthy relationship.

Acknowledging Feelings of Resentment and Guilt

Financial disparities can lead to feelings of resentment, guilt, inadequacy, or even power imbalances. Creating a safe space to express these emotions is essential.

- Create a safe space to express vulnerability and emotions: Encourage open and honest communication without judgment or criticism.

- Seek professional help from a therapist or counselor if needed: A therapist can provide guidance and support in navigating these complex emotions.

- Focus on mutual support and understanding: Emphasize teamwork and mutual respect, focusing on each other's contributions and emotional needs.

Maintaining Individual Identities and Contributions

Recognize and value both partners' contributions, regardless of financial input. Many non-monetary contributions, such as childcare, household management, or emotional support, are invaluable.

- Create a list of all contributions (monetary and non-monetary): This helps visualize the full scope of each partner's contributions to the household.

- Have a discussion about the value and importance of each contribution: Acknowledging and appreciating all contributions fosters a sense of equality and partnership.

- Reframe the conversation to emphasize teamwork and shared responsibility: Focus on the collaborative effort involved in maintaining the household and achieving shared goals.

Conclusion

Coping with income inequality in a marriage requires open communication, creative financial planning, and a deep understanding of the emotional aspects involved. By implementing these strategies, couples can build a stronger, more financially secure, and emotionally fulfilling relationship. Don't let financial disparities define your marriage; proactively address the issue and embrace creative solutions for a harmonious future. Remember, open communication is key to successfully navigating income inequality in your marriage, fostering a stronger and more resilient partnership. Start addressing income inequality in your marriage today by implementing these strategies and building a secure financial future together.

Featured Posts

-

Nyt Mini Crossword Answers March 13 Solve The Puzzle With Expert Tips

May 19, 2025

Nyt Mini Crossword Answers March 13 Solve The Puzzle With Expert Tips

May 19, 2025 -

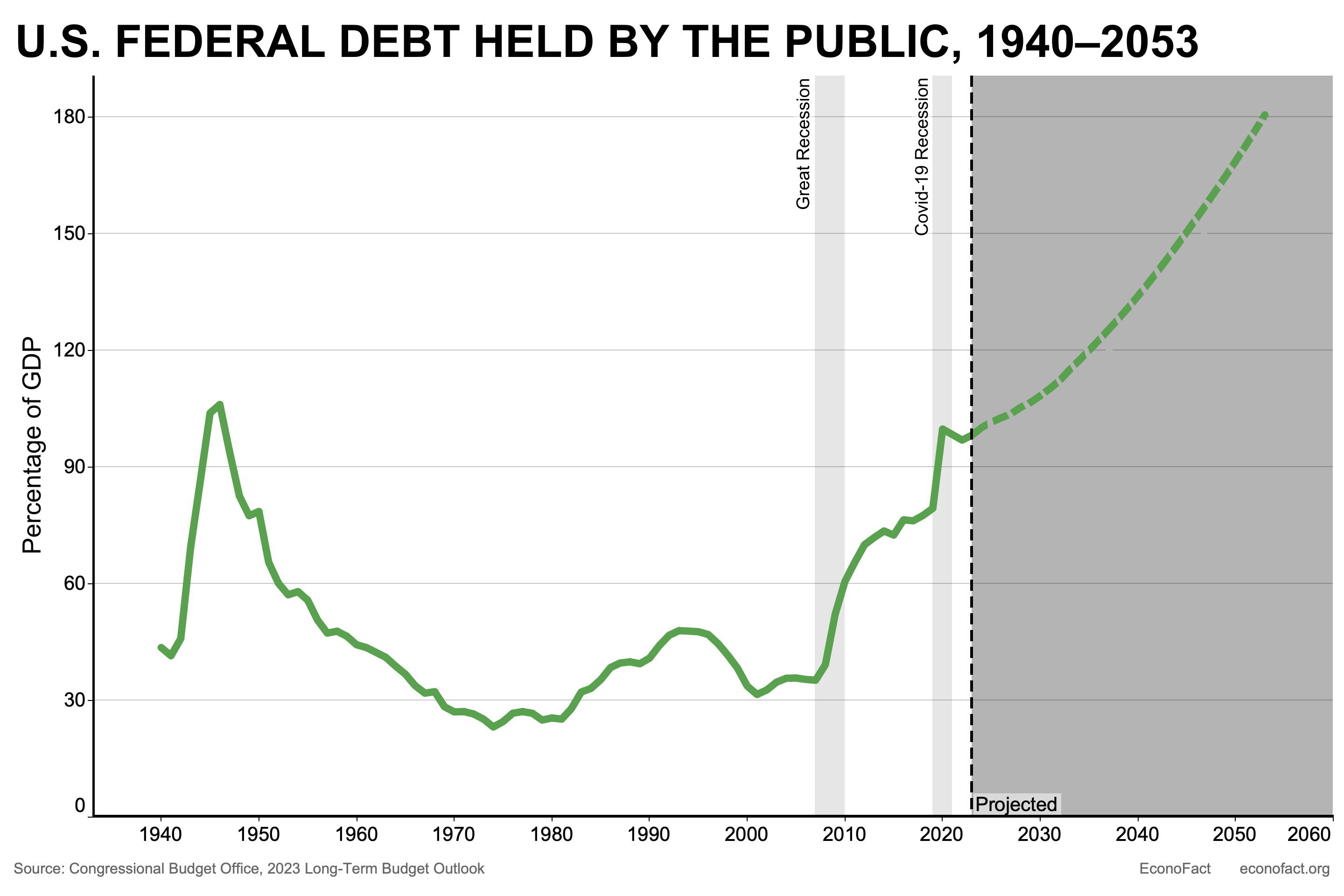

Rising Federal Debt How It Impacts Mortgage Borrowers

May 19, 2025

Rising Federal Debt How It Impacts Mortgage Borrowers

May 19, 2025 -

Mairon Santos Ufc 313 Knockout Bid 50 000 Diaper Fund Incentive

May 19, 2025

Mairon Santos Ufc 313 Knockout Bid 50 000 Diaper Fund Incentive

May 19, 2025 -

Ufc 313 Live Results Pereira Vs Ankalaev Gaethjes Return

May 19, 2025

Ufc 313 Live Results Pereira Vs Ankalaev Gaethjes Return

May 19, 2025 -

Arusero Alfonso Arus Analiza La Participacion De Melody En Eurovision 2025

May 19, 2025

Arusero Alfonso Arus Analiza La Participacion De Melody En Eurovision 2025

May 19, 2025

Latest Posts

-

Erling Haaland Buys R44 Crore Bugatti Tourbillon Supercar

May 19, 2025

Erling Haaland Buys R44 Crore Bugatti Tourbillon Supercar

May 19, 2025 -

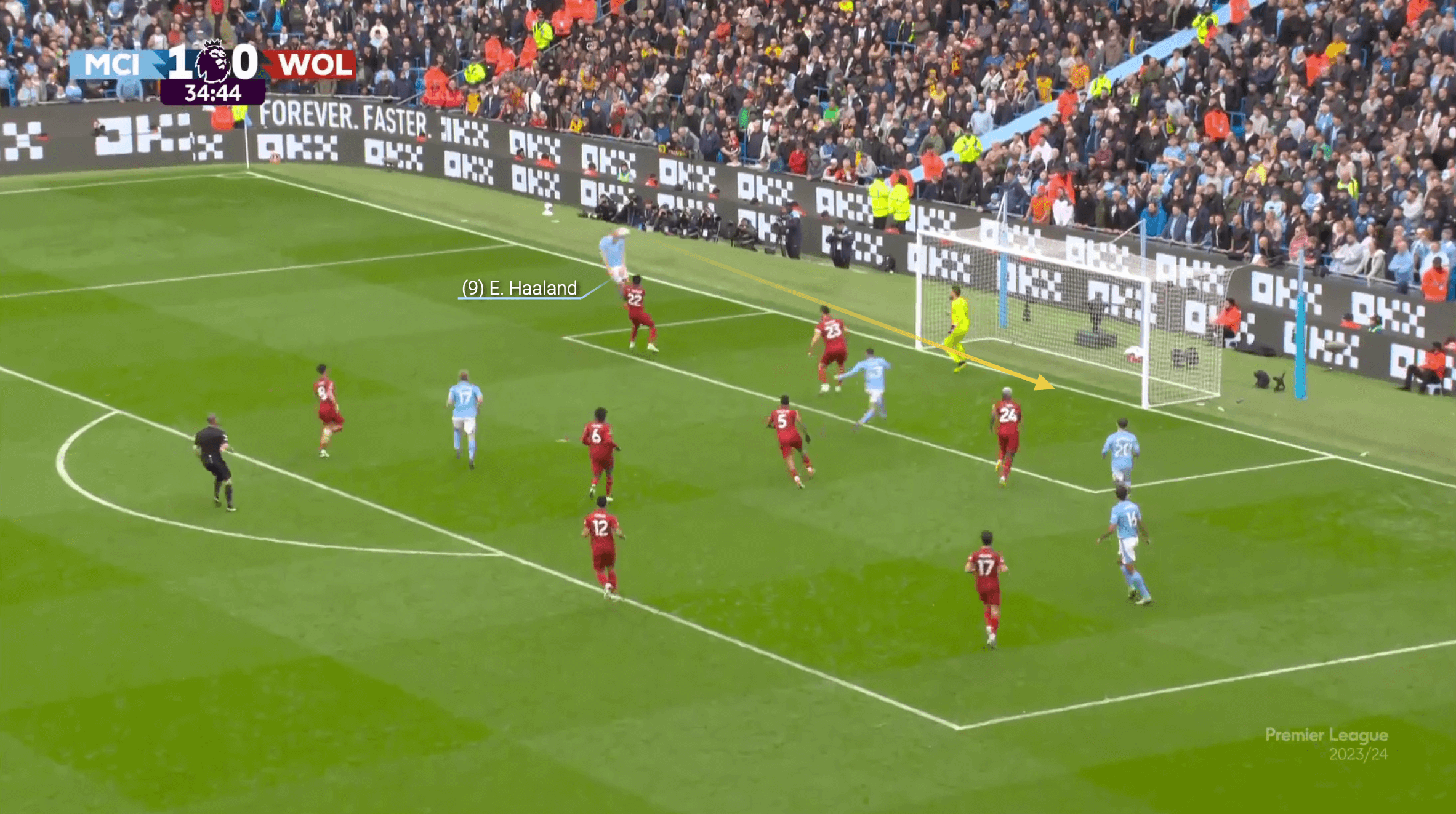

Fastest To 100 Haalands Electrifying Epl Goal Involvement Record

May 19, 2025

Fastest To 100 Haalands Electrifying Epl Goal Involvement Record

May 19, 2025 -

R44 Crore Bugatti Erling Haalands New Supercar

May 19, 2025

R44 Crore Bugatti Erling Haalands New Supercar

May 19, 2025 -

Real Madrid To Make Bold Moves After Mbappes Underwhelming Arsenal Match

May 19, 2025

Real Madrid To Make Bold Moves After Mbappes Underwhelming Arsenal Match

May 19, 2025 -

Haaland Reaches 100 Epl Goal Involvements Faster Than Any Player Before Him

May 19, 2025

Haaland Reaches 100 Epl Goal Involvements Faster Than Any Player Before Him

May 19, 2025