Core Group Strategy: Re-evaluating Walleye Credit In Commodities

Table of Contents

Understanding the Current Walleye Credit Landscape

Defining Walleye Credit

Walleye Credit, in the context of commodity trading, refers to a system of credit extended based on the projected future value of a specific commodity, often incorporating risk assessments related to factors such as harvest yields, storage costs and market demand. This credit mechanism allows traders to secure financing or extend credit to buyers before the commodity is physically delivered or its final value realized.

- Calculation: Walleye Credit is typically calculated based on a complex algorithm incorporating historical price data, projected supply and demand, and other relevant market indicators.

- Limitations: The accuracy of the credit calculation depends heavily on the reliability of the predictive model and the stability of the market. Unexpected events can significantly impact the final value of the commodity and potentially lead to credit defaults.

- Regulatory Aspects: While the specifics depend on the jurisdiction and the commodity type, Walleye Credit transactions are typically subject to relevant financial regulations and reporting requirements to mitigate fraud and ensure transparency.

Identifying Risks and Opportunities

Navigating the Walleye Credit landscape demands a thorough understanding of both inherent risks and potential rewards.

- Potential Market Risks:

- Significant price fluctuations in the underlying commodity.

- Credit defaults by borrowers due to unforeseen market downturns.

- Changes in regulations impacting the viability of Walleye Credit transactions.

- Counterparty risk associated with the reliability and financial stability of trading partners.

- Opportunities for Leveraging Walleye Credit:

- Hedging strategies to mitigate price risk in commodity holdings.

- Arbitrage opportunities arising from price discrepancies across different markets.

- Enhanced access to capital and liquidity for commodity trading operations.

Developing a Robust Core Group Strategy

Defining Your Core Group

Establishing a high-performing Core Group is paramount to successful Walleye Credit management. The core group comprises individuals or entities with diverse expertise and financial resources.

- Ideal Core Group Member Characteristics:

- Deep understanding of commodity markets and Walleye Credit mechanics.

- Strong financial stability and risk management capabilities.

- Established track record of successful commodity trading.

- High risk tolerance aligned with the strategic goals.

- Selection and Vetting Process: A rigorous due diligence process is crucial. This includes assessing financial statements, verifying experience, and analyzing past performance to ensure the reliability and suitability of each core group member.

Establishing Clear Goals and Metrics

Clearly defined goals and Key Performance Indicators (KPIs) are essential for measuring the effectiveness of your Core Group Strategy and ensuring accountability.

- Relevant KPIs:

- Return on Investment (ROI) from Walleye Credit transactions.

- Risk-adjusted return to assess the efficiency of risk management.

- Credit default rate as a measure of risk exposure.

- Transaction volume and velocity.

Implementing Risk Mitigation Strategies

Proactive risk mitigation is vital for protecting against potential losses associated with Walleye Credit.

- Risk Mitigation Techniques:

- Diversification across multiple commodities and trading partners.

- Implementation of hedging strategies to offset price volatility.

- Conducting regular stress testing to assess the resilience of the portfolio under adverse market conditions.

- Establishing robust credit approval and monitoring processes.

Re-evaluating and Optimizing Walleye Credit Strategies

Regular Portfolio Review

Continuous monitoring and evaluation are indispensable to maintaining a successful Walleye Credit portfolio.

- Frequency and Methods: Regular portfolio reviews (e.g., monthly, quarterly) should involve analyzing performance data, assessing market trends, and identifying areas for improvement.

- Market Adjustments: Based on market conditions and performance data, adjustments to the Core Group Strategy and individual transactions might be necessary to maintain optimal performance.

Adapting to Market Changes

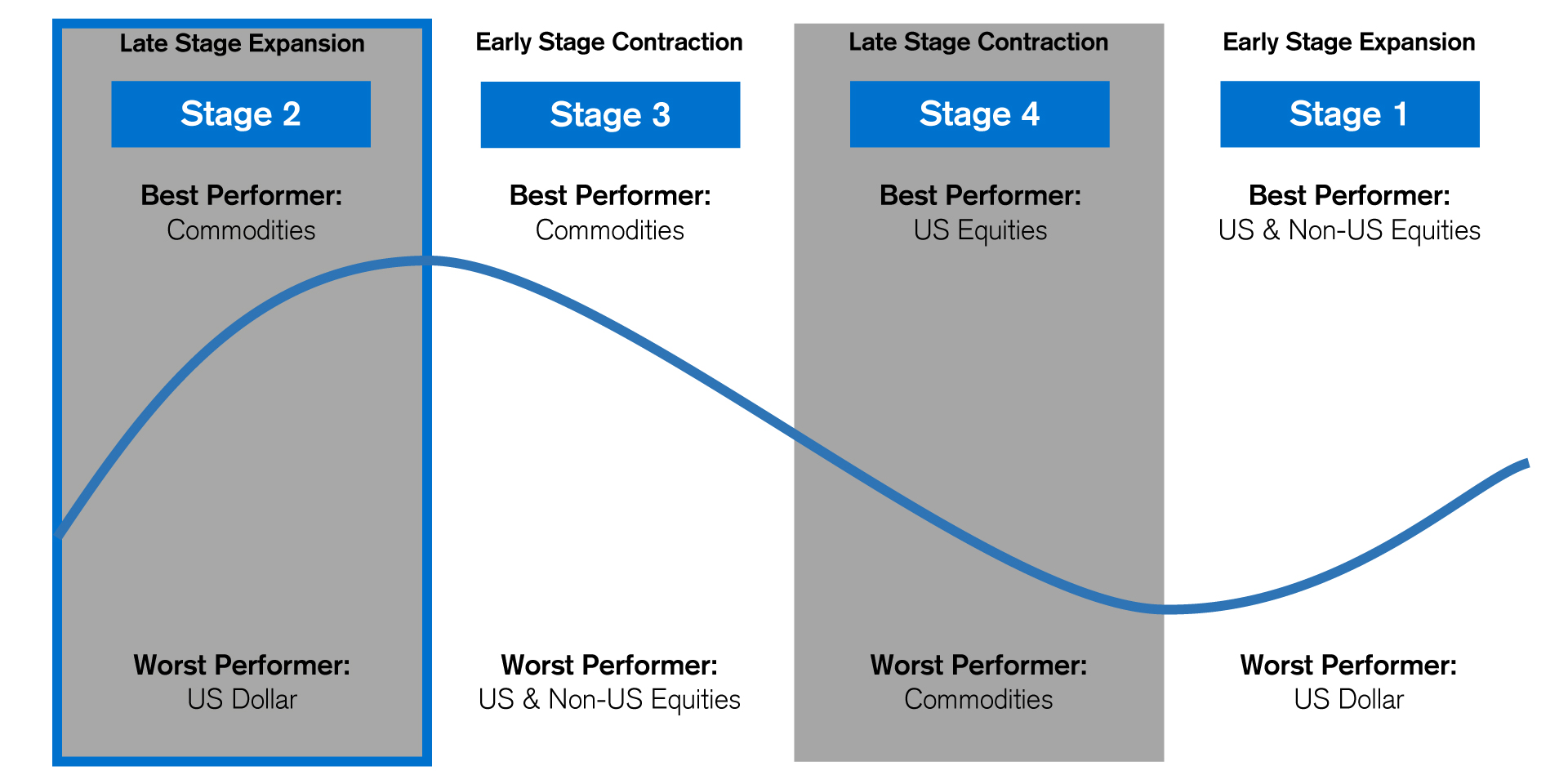

The commodities market is dynamic. A successful Core Group Strategy must adapt to evolving market landscapes.

- Potential Market Shifts:

- Significant price volatility driven by supply chain disruptions or geopolitical events.

- Changes in regulations influencing the feasibility of Walleye Credit transactions.

- Technological advancements impacting trading practices.

- Adaptation Strategies: Proactive monitoring of market trends, flexible investment strategies, and continual skill development are crucial for adapting to market changes.

Leveraging Data Analytics

Advanced data analytics can provide critical insights for enhancing Walleye Credit management.

- Data Analytics Techniques:

- Predictive modeling to forecast future commodity prices and assess credit risk.

- Risk assessment tools to identify potential vulnerabilities in the portfolio.

- Sentiment analysis to gauge market sentiment and identify potential trading opportunities.

Maximize Your Walleye Credit Potential with a Strong Core Group Strategy

Implementing a robust Core Group Strategy is paramount for optimizing Walleye Credit management. This involves a careful selection of core group members, the establishment of clear goals and KPIs, and the proactive implementation of risk mitigation strategies. Regularly re-evaluating and adapting your strategy in response to market changes and leveraging data analytics are crucial for maximizing returns and mitigating risk. To further enhance your understanding and successfully implement a tailored Core Group Strategy for your Walleye Credit operations, consider seeking expert consultation from commodity trading specialists. Don't let market volatility hinder your success; proactively develop a strong Core Group Strategy to unlock the full potential of your Walleye Credit investments.

Featured Posts

-

O Romskih Muzikantih V Prekmurju

May 13, 2025

O Romskih Muzikantih V Prekmurju

May 13, 2025 -

Olympus Has Fallen Vs White House Down A Comparative Analysis

May 13, 2025

Olympus Has Fallen Vs White House Down A Comparative Analysis

May 13, 2025 -

Steven Gerrard Leading Contender For Southampton Manager

May 13, 2025

Steven Gerrard Leading Contender For Southampton Manager

May 13, 2025 -

The Value Of Middle Management Improving Company Performance And Employee Satisfaction

May 13, 2025

The Value Of Middle Management Improving Company Performance And Employee Satisfaction

May 13, 2025 -

Uk And Australias Double Standard Sanctions On Myanmar Junta But Ignoring The Opposition

May 13, 2025

Uk And Australias Double Standard Sanctions On Myanmar Junta But Ignoring The Opposition

May 13, 2025

Latest Posts

-

Captain America Brave New World Box Office Performance Compared To Other Mcu Films

May 14, 2025

Captain America Brave New World Box Office Performance Compared To Other Mcu Films

May 14, 2025 -

Low Box Office Returns For Captain America Brave New World An Mcu Analysis

May 14, 2025

Low Box Office Returns For Captain America Brave New World An Mcu Analysis

May 14, 2025 -

Captain America Brave New World Underperforms At The Box Office

May 14, 2025

Captain America Brave New World Underperforms At The Box Office

May 14, 2025 -

Captain America 4 Box Office Among Mcus Lowest Grossing Films

May 14, 2025

Captain America 4 Box Office Among Mcus Lowest Grossing Films

May 14, 2025 -

14 Major Walmart Great Value Brand Recalls A Comprehensive List

May 14, 2025

14 Major Walmart Great Value Brand Recalls A Comprehensive List

May 14, 2025