CoreWeave (CRWV): Jim Cramer's Assessment And The Future Of AI Computing

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV): A Deep Dive

While a definitive, publicly available statement from Jim Cramer specifically endorsing or condemning CoreWeave (CRWV) stock might be hard to pinpoint, analyzing his general commentary on the AI sector and similar companies provides valuable context. Cramer, known for his appearances on CNBC's "Mad Money," often emphasizes the importance of investing in disruptive technologies. His pronouncements are closely followed by individual investors and institutional players alike, impacting the market perception and the price of the mentioned stocks.

- Analyzing Cramer's broader AI commentary: By examining Cramer's past commentary on the AI market and related companies, we can infer his likely perspective on CoreWeave (CRWV)'s potential. Does he generally favor companies in the cloud computing or GPU computing space? This would offer clues on his potential attitude towards CRWV.

- Market sentiment and timing: Cramer's comments are rarely made in a vacuum. The overall market sentiment, the prevailing economic climate, and the specific performance of CoreWeave (CRWV) stock around the time of any potential commentary need careful consideration. Was he bullish overall on the market at the time? Or was there a sense of caution? This provides crucial context.

- Absence of evidence is not evidence of absence: The lack of a direct, on-air mention of CoreWeave (CRWV) on "Mad Money" doesn't negate its potential. The sheer volume of companies Cramer discusses makes it understandable that some significant players might not receive direct, individual attention.

CoreWeave (CRWV)'s Business Model and Competitive Advantages in AI Computing

CoreWeave (CRWV) distinguishes itself by providing specialized cloud infrastructure optimized for the demanding computational needs of AI workloads. Unlike general-purpose cloud providers, CoreWeave focuses intently on the unique requirements of artificial intelligence, offering significant advantages:

- Specialized Hardware: CoreWeave leverages high-performance GPUs, specifically designed for machine learning and deep learning tasks, providing significantly faster training times for AI models compared to general-purpose CPUs.

- Software Optimization: The company's platform is meticulously designed for seamless integration with popular AI frameworks like TensorFlow and PyTorch, enabling developers to deploy and manage their AI applications efficiently. This also boosts machine learning as a service capabilities.

- Scalability and Flexibility: CoreWeave's infrastructure allows businesses to scale their AI operations easily, adapting to fluctuating demands and ensuring optimal resource utilization. This is a vital aspect for the fluctuating needs of generative AI infrastructure.

- Target Market: CoreWeave (CRWV) serves a wide range of clients, including research institutions, startups, and large enterprises involved in developing and deploying cutting-edge AI applications across numerous industries.

Market Analysis: Growth Potential and Challenges for CoreWeave (CRWV)

The AI computing market is experiencing explosive growth, projected to reach hundreds of billions of dollars in the coming years. CoreWeave (CRWV) is well-positioned to capitalize on this expansion, however, challenges exist:

- Market Share and Expansion: While CoreWeave is gaining traction, it still faces competition from established giants like AWS, Google Cloud, and Azure. Its success will depend on its ability to differentiate itself and secure a significant market share in this highly competitive landscape.

- Competitive Landscape: The intense competition requires CoreWeave to continually innovate and improve its services to maintain its competitive edge. This includes the development of novel AI infrastructure and the offering of competitive pricing strategies within the cloud computing market.

- Financial Performance: Analyzing CoreWeave's financial reports—revenue growth, customer acquisition costs, and profitability—is crucial for assessing its long-term sustainability and investment potential. Positive growth in these key metrics points towards a healthy trajectory.

- Regulatory Hurdles: The rapidly evolving regulatory landscape surrounding AI could pose challenges for CoreWeave. Keeping abreast of and complying with new rules and regulations is vital for maintaining a strong and ethical business.

Future Outlook: CoreWeave (CRWV) and the Long-Term Implications for AI

CoreWeave's future trajectory is largely dependent on its ability to continue innovating and adapting to the ever-changing AI landscape. Factors that will impact its success include:

- Technological Advancements: The pace of technological advancements in AI is breathtaking. CoreWeave must proactively integrate new hardware and software technologies to maintain its cutting-edge capabilities and remain competitive.

- Strategic Partnerships: Establishing strategic partnerships with other leading AI companies can significantly expand CoreWeave's reach and influence within the AI ecosystem.

- Long-Term Investment: Investing in CoreWeave (CRWV) presents both significant opportunities and inherent risks. Investors should carefully evaluate the company's financial health, competitive position, and long-term growth potential before making any investment decisions. A comprehensive CRWV stock analysis is crucial.

Conclusion: Investing in the Future of AI with CoreWeave (CRWV)

While a specific public statement from Jim Cramer regarding CoreWeave (CRWV) remains elusive, his general commentary on the AI sector suggests a positive outlook for companies operating in this space. CoreWeave's specialized infrastructure, focus on AI workloads, and strategic position in the rapidly growing AI computing market present compelling opportunities for investors. However, the competitive landscape and potential regulatory hurdles necessitate a thorough risk assessment. Conduct further research, consider consulting with a financial advisor, and make informed decisions before investing. Learn more about CoreWeave (CRWV) today and invest wisely in the future of AI!

Featured Posts

-

Reyting Providnikh Finansovikh Kompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 22, 2025

Reyting Providnikh Finansovikh Kompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 22, 2025 -

Fastest Trans Australia Foot Race New Record Achieved

May 22, 2025

Fastest Trans Australia Foot Race New Record Achieved

May 22, 2025 -

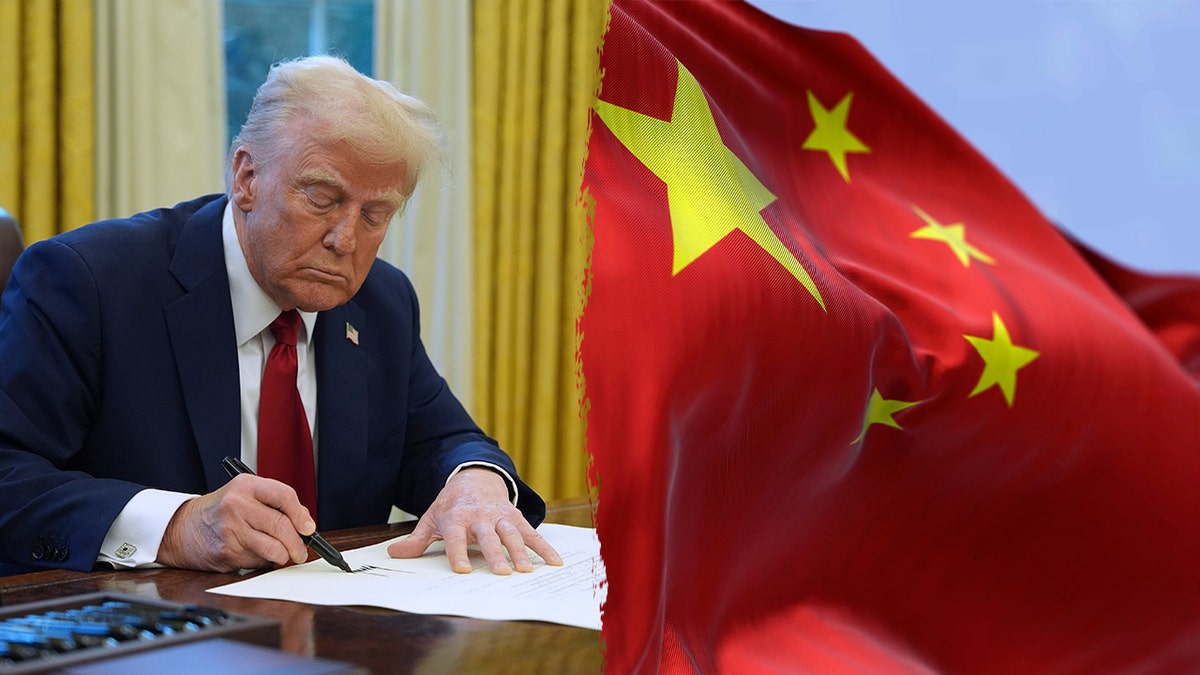

Joint Statement Switzerland And China Call For Tariff Talks

May 22, 2025

Joint Statement Switzerland And China Call For Tariff Talks

May 22, 2025 -

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025 -

Remembering Adam Ramey A Tribute To The Dropout Kings Vocalist

May 22, 2025

Remembering Adam Ramey A Tribute To The Dropout Kings Vocalist

May 22, 2025

Latest Posts

-

Steelers Intense Interest In Nfl Draft Quarterbacks A Deep Dive

May 22, 2025

Steelers Intense Interest In Nfl Draft Quarterbacks A Deep Dive

May 22, 2025 -

Pittsburgh Steelers Schedule A Breakdown Of Key Takeaways

May 22, 2025

Pittsburgh Steelers Schedule A Breakdown Of Key Takeaways

May 22, 2025 -

Pittsburgh Steelers 2025 Schedule Predictions And Analysis

May 22, 2025

Pittsburgh Steelers 2025 Schedule Predictions And Analysis

May 22, 2025 -

Steelers Hold Onto Pickens An Insiders Look At The Decision

May 22, 2025

Steelers Hold Onto Pickens An Insiders Look At The Decision

May 22, 2025 -

Steelers Pickens Why The Trade Deadline Passed Him By

May 22, 2025

Steelers Pickens Why The Trade Deadline Passed Him By

May 22, 2025