CoreWeave Stock: What's Happening And What To Expect

Table of Contents

CoreWeave's Business Model and Competitive Landscape

CoreWeave is making waves in the cloud computing sector, but understanding its position requires examining its business model and competitive standing.

The CoreWeave Advantage

CoreWeave differentiates itself through several key strategies:

-

Sustainable and Energy-Efficient Data Centers: CoreWeave leverages sustainable energy sources, reducing its carbon footprint and operational costs. This resonates with environmentally conscious clients and investors, a crucial differentiator in today's market. This commitment to sustainability is a significant part of their brand identity and a growing appeal to environmentally conscious businesses.

-

Specialization in High-Performance Computing (HPC) and AI Workloads: CoreWeave focuses on providing infrastructure specifically tailored for the demanding needs of AI and HPC applications. This niche focus allows for optimized performance and attracts clients requiring high-compute power for tasks such as machine learning, deep learning, and scientific simulations. This specialization is a key component of their competitive advantage.

-

Strategic Partnerships with Leading Technology Companies: Collaborations with major players in the tech industry provide CoreWeave with access to cutting-edge technologies and expanded market reach. These partnerships often translate into enhanced services and a broader client base.

-

Unique Selling Proposition (USP): CoreWeave's USP lies in its combination of sustainable infrastructure, specialized HPC/AI solutions, and strategic partnerships. This trifecta sets it apart from general-purpose cloud providers.

-

Key Advantages over Competitors:

- Superior Performance for AI/HPC workloads: CoreWeave’s infrastructure is optimized for these demanding applications, exceeding the performance of general-purpose clouds.

- Reduced Carbon Footprint: CoreWeave’s commitment to sustainability attracts environmentally conscious businesses.

- Stronger Partnerships: CoreWeave boasts strategic alliances with leading technology companies.

- Competitive Pricing: While specific pricing details may vary, CoreWeave aims to provide competitive options tailored to client needs.

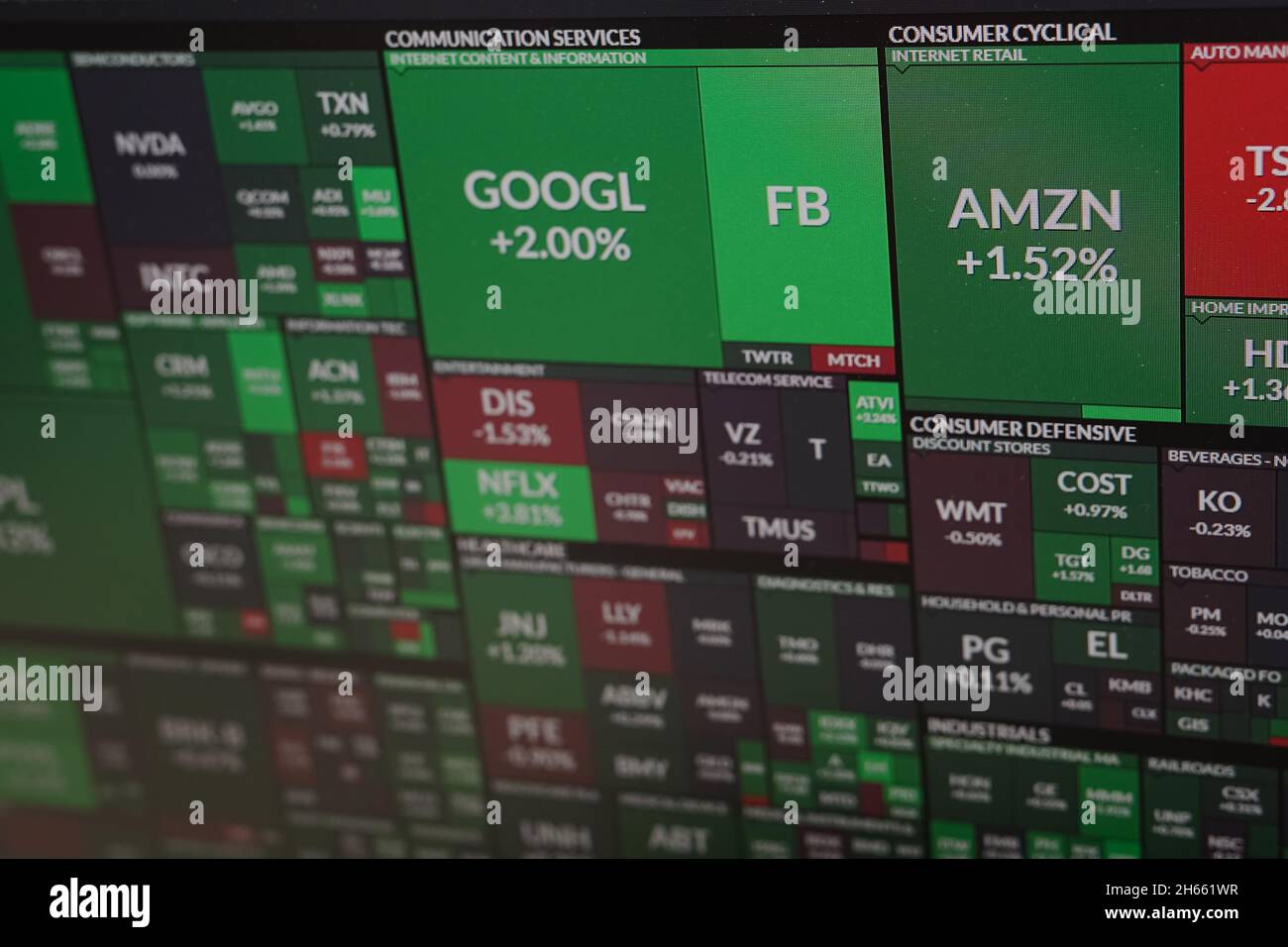

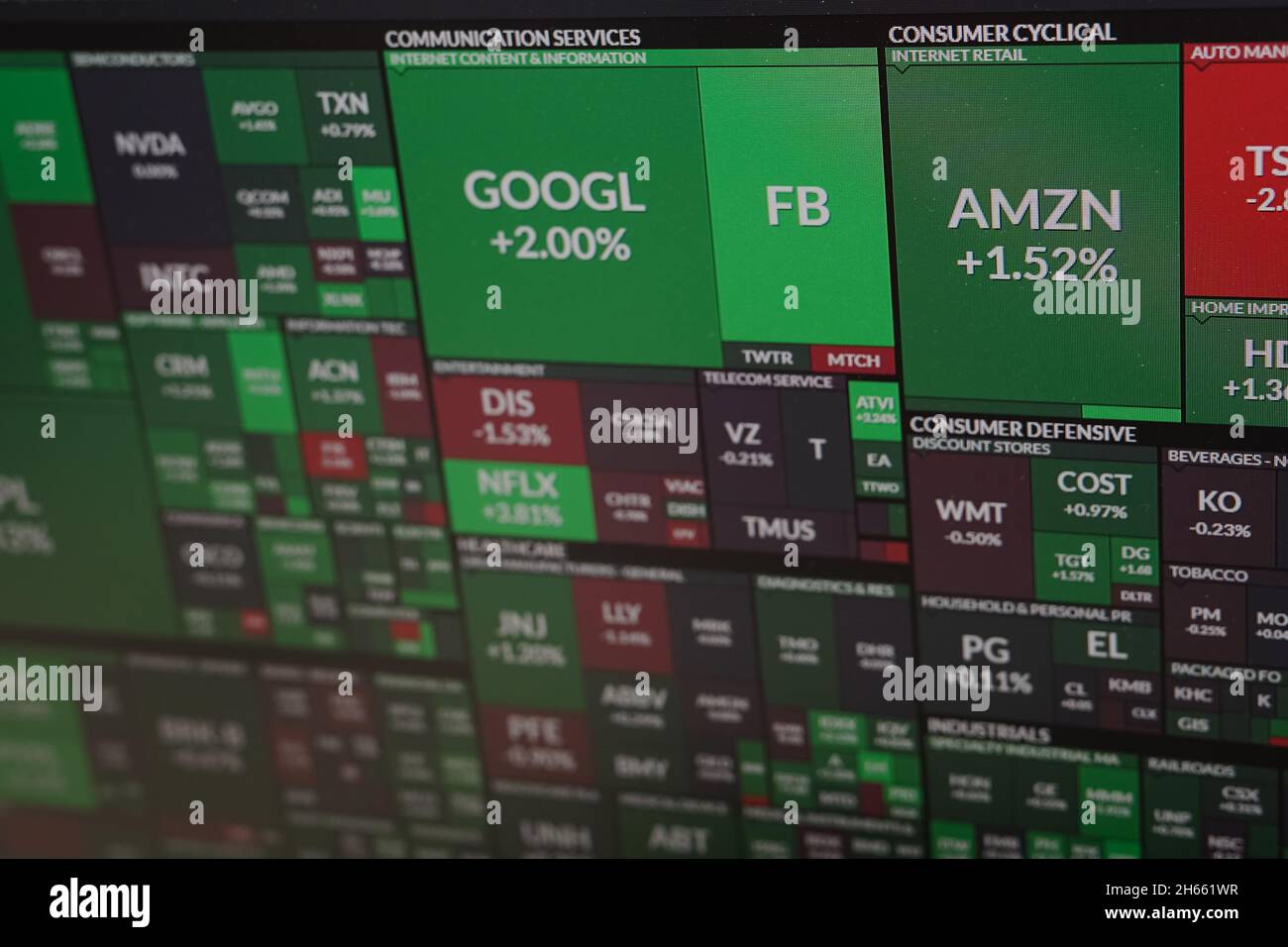

Competitive Analysis

CoreWeave faces competition from established giants like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. However, CoreWeave's specialization in HPC and AI, combined with its sustainability focus, creates a distinct niche.

- Main Competitors: AWS, GCP, Azure, and other smaller, specialized cloud providers.

- Market Share: While CoreWeave's market share is currently smaller than the giants, its rapid growth indicates a potential for significant market share gains in the specialized HPC/AI segment.

- Pricing and Services: CoreWeave's pricing strategy is likely competitive within its specialized niche, focusing on providing value through superior performance and sustainability. Direct price comparisons with AWS, GCP, and Azure require detailed analysis of specific service offerings.

- Threats and Opportunities: The main threats are competition from larger cloud providers expanding their AI/HPC offerings and potential economic downturns affecting IT spending. Opportunities exist in the burgeoning AI market and increasing demand for sustainable data center solutions.

Recent Developments and Financial Performance

Staying updated on CoreWeave's progress requires examining recent news and its financial health.

Recent News and Announcements

Keep an eye out for press releases, partnerships, funding rounds, and other significant announcements from CoreWeave. These events can significantly impact the CoreWeave stock price. (Note: Due to the dynamic nature of the stock market, including specific recent news here would require real-time data updates which is beyond the scope of this static article. Refer to reputable financial news sources for the latest information.)

Financial Performance Analysis

Analyzing CoreWeave's financial data (revenue growth, profitability, etc.) is crucial for assessing its financial strength and future prospects. (Again, including specific financial data here requires real-time data and is beyond the scope of this static article. Consult financial reports and reputable analysis for up-to-date figures.) Key metrics to consider include:

- Revenue growth year-over-year.

- Profitability (gross margin, operating margin, net income).

- Customer acquisition cost.

- Customer churn rate.

- Debt-to-equity ratio.

Comparing CoreWeave's performance to industry benchmarks provides context and helps evaluate its relative success.

Future Outlook and Investment Considerations

Predicting the future is challenging, but analyzing potential growth and risks is vital for investors.

Growth Potential and Market Opportunities

The future looks bright for cloud computing and AI, and CoreWeave is well-positioned to capitalize on this growth:

- Expanding Market: The demand for cloud computing and AI infrastructure is rapidly expanding, creating significant growth opportunities for CoreWeave.

- New Services and Customers: CoreWeave can expand its service offerings and target new customer segments within the HPC and AI sectors.

- Emerging Technologies: CoreWeave can leverage emerging technologies like quantum computing and edge computing to further enhance its offerings and maintain a competitive edge.

Investment Risks and Challenges

Investing in CoreWeave stock involves potential risks:

- Competition: Intense competition from established cloud providers is a significant challenge.

- Economic Downturns: Economic slowdowns can significantly impact IT spending and affect CoreWeave's growth.

- Regulatory Changes: Changes in regulations could impact CoreWeave's operations and profitability.

- Stock Market Volatility: Technology stocks, including CoreWeave, can experience significant price fluctuations.

Conclusion

This analysis of CoreWeave stock reveals a company with significant growth potential in the rapidly expanding cloud computing and AI infrastructure markets. While certain risks exist, CoreWeave's innovative business model, strong partnerships, and focus on sustainability position it for continued success.

Call to Action: Understanding the current market dynamics and future projections for CoreWeave stock is crucial for informed investment decisions. Continue your research and stay updated on the latest news and developments surrounding CoreWeave and other cloud computing stocks to make the best choices for your portfolio. Consider the potential benefits and risks carefully before investing in CoreWeave stock. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Het Kamerbrief Verkoopprogramma Abn Amro Een Diepgaande Analyse

May 22, 2025

Het Kamerbrief Verkoopprogramma Abn Amro Een Diepgaande Analyse

May 22, 2025 -

Peppa Pigs Baby Sister A Girl Is Coming

May 22, 2025

Peppa Pigs Baby Sister A Girl Is Coming

May 22, 2025 -

Wildfire Speculation Analyzing The Betting Odds On Los Angeles Fires

May 22, 2025

Wildfire Speculation Analyzing The Betting Odds On Los Angeles Fires

May 22, 2025 -

Switzerland Condemns Chinas Military Drills Near Taiwan

May 22, 2025

Switzerland Condemns Chinas Military Drills Near Taiwan

May 22, 2025 -

31 Year Old Singer Adam Ramey Dropout King Passes Away

May 22, 2025

31 Year Old Singer Adam Ramey Dropout King Passes Away

May 22, 2025

Latest Posts

-

Netflix Un Nou Serial Cu O Distributie De Exceptie

May 22, 2025

Netflix Un Nou Serial Cu O Distributie De Exceptie

May 22, 2025 -

Siren Trailer Julianne Moore Responds To Monster Allegations

May 22, 2025

Siren Trailer Julianne Moore Responds To Monster Allegations

May 22, 2025 -

Steelers Training Facility Aaron Rodgers Presence Fuels Trade Talk

May 22, 2025

Steelers Training Facility Aaron Rodgers Presence Fuels Trade Talk

May 22, 2025 -

Julianne Moore Addresses Monster Label In New Siren Trailer

May 22, 2025

Julianne Moore Addresses Monster Label In New Siren Trailer

May 22, 2025 -

Aaron Rodgers Steelers Training Facility Visit A Deeper Look

May 22, 2025

Aaron Rodgers Steelers Training Facility Visit A Deeper Look

May 22, 2025