Credit Weekly Report: Widening Cracks In The Private Credit Market

Table of Contents

Rising Default Rates and Delinquencies in Private Credit

The recent surge in defaults and delinquencies within the private credit market is a primary concern. Several factors are driving this trend, creating a ripple effect throughout the industry.

Impact of Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes are significantly impacting borrowers' ability to repay private credit loans. This has led to:

- Increased borrowing costs: Higher interest rates translate directly into increased financing expenses for businesses, squeezing profit margins and limiting investment opportunities.

- Reduced profitability for businesses: Many companies, especially those with high debt levels, are finding it increasingly difficult to maintain profitability in this high-interest-rate environment.

- Strain on cash flows: The increased cost of debt servicing puts significant pressure on already tight cash flows, making it harder for businesses to meet their repayment obligations.

- Higher refinancing costs: As interest rates rise, refinancing existing debt becomes significantly more expensive, potentially pushing companies into default.

Sector-Specific Vulnerabilities

Certain sectors are feeling the pressure more acutely than others. The current market conditions expose vulnerabilities in:

- Real Estate: Declining property values are impacting real estate investment trusts (REITs) and other borrowers heavily reliant on real estate collateral. This translates into higher default rates within private credit portfolios focused on this sector.

- Leveraged Buyouts (LBOs): Companies burdened with significant debt from leveraged buyouts are particularly vulnerable to rising interest rates and economic downturns. Their ability to service their debt is severely tested, leading to increased risk of default.

- Technology: The tech sector, after a period of rapid growth fueled by low-interest rates and abundant venture capital, is seeing a correction. Many overvalued companies are struggling, increasing the risk of defaults in private credit portfolios with significant tech exposure.

Increased Scrutiny from Regulators

Regulatory bodies are increasingly scrutinizing the private credit market, leading to potential changes in oversight:

- Increased capital requirements: Regulators may mandate higher capital reserves for private credit funds to enhance their resilience against losses.

- Stricter lending guidelines: New regulations could enforce stricter underwriting standards and more stringent due diligence processes for private credit lenders.

- Tighter oversight of private credit funds: Increased monitoring and reporting requirements are likely to increase the cost and complexity of operating within the private credit market.

Reduced Liquidity and Market Volatility in Private Credit

The current environment is characterized by a significant reduction in liquidity and increased volatility within the private credit market.

Challenges in Raising New Capital

Private credit funds are facing considerable challenges in raising new capital due to investor apprehension:

- Decreased investor appetite for risk: Investors are becoming more risk-averse, seeking safer investment options in the face of economic uncertainty.

- Difficulty in attracting new investments: The combination of higher risk and lower returns is making it challenging for funds to attract fresh capital.

- Potential for fund closures: Some private credit funds may be forced to close or liquidate assets due to an inability to raise sufficient capital.

Impact on Secondary Market Transactions

The reduced liquidity is severely affecting the secondary market for private credit assets:

- Fewer transactions: The lack of buyers is leading to a significant decrease in the volume of private credit asset transactions.

- Wider bid-ask spreads: The scarcity of liquidity is resulting in wider spreads between bid and ask prices, making it more difficult to execute trades efficiently.

- Difficulty valuing private credit investments: The absence of frequent transactions makes it challenging to accurately determine the fair market value of private credit investments.

Potential for Contagion

The interconnectedness of financial institutions raises concerns about potential contagion:

- Interconnectedness of financial institutions: Defaults in one part of the private credit market could trigger a domino effect, affecting other institutions and exacerbating the overall instability.

- Potential for domino effect: A series of defaults could create a cascade effect, leading to widespread financial distress.

- Systemic risk implications: In a worst-case scenario, the instability in the private credit market could pose systemic risk to the broader financial system.

Strategies for Navigating the Challenging Private Credit Landscape

Successfully navigating the current challenges requires proactive and strategic approaches.

Due Diligence and Risk Assessment

Thorough due diligence and robust risk assessment are paramount for investors and lenders:

- Careful borrower selection: A rigorous selection process focusing on creditworthiness and financial stability is crucial.

- Comprehensive financial analysis: In-depth analysis of borrowers' financial statements and business models is essential to identify potential risks.

- Stress testing scenarios: Simulating various economic scenarios allows for a more accurate assessment of potential losses.

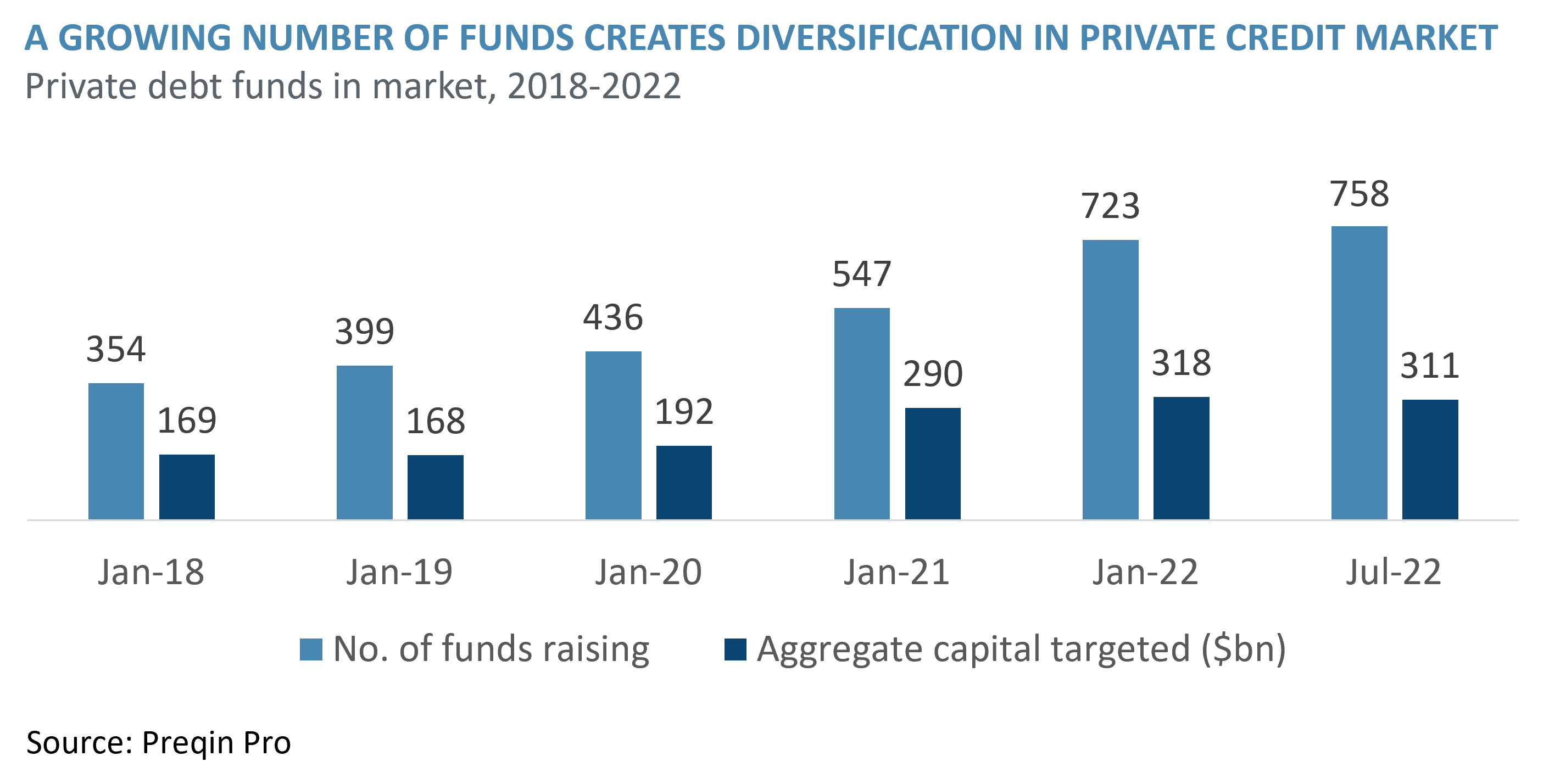

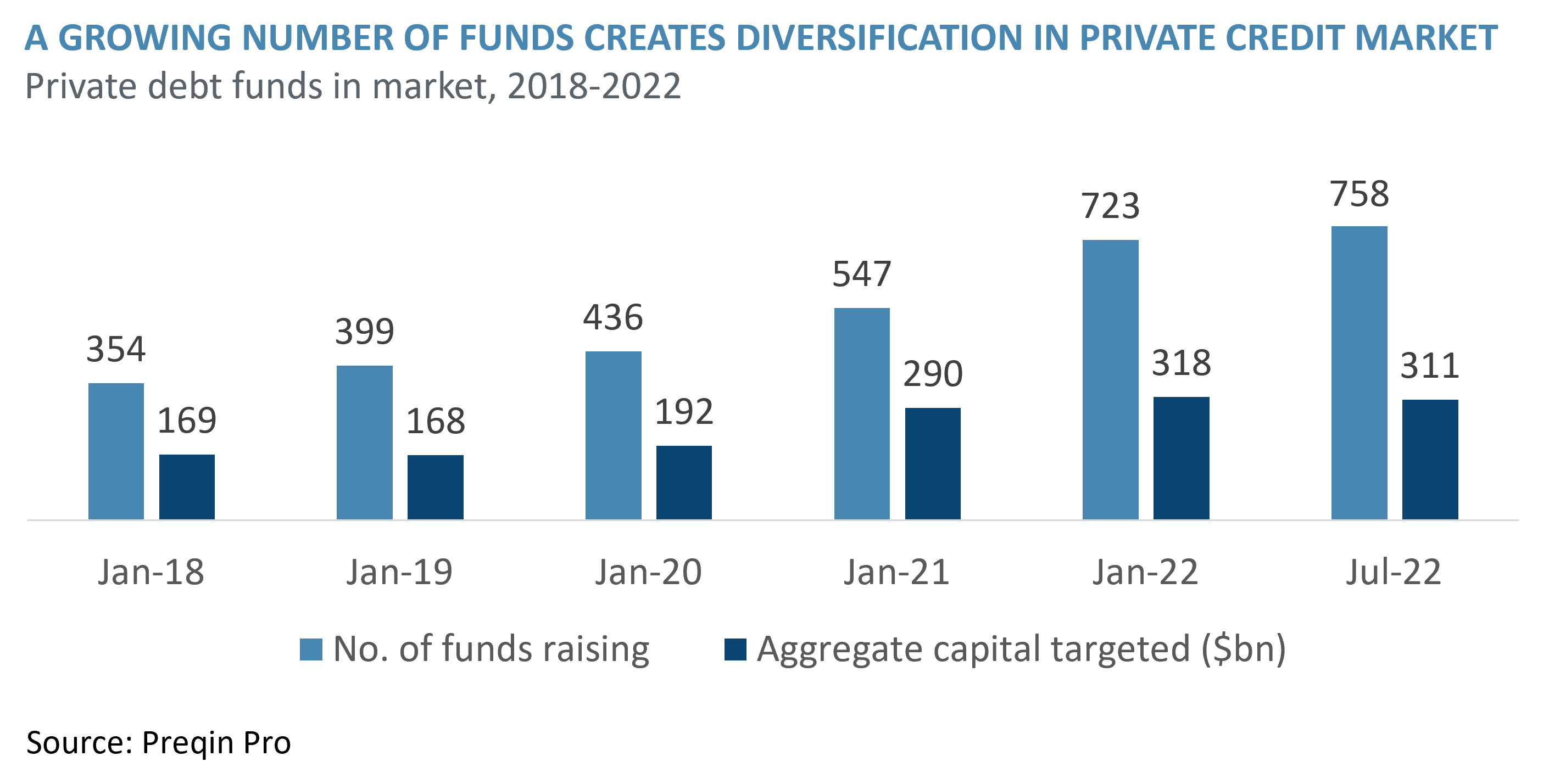

Portfolio Diversification

Diversification is a critical tool for mitigating risk:

- Reducing concentration risk: Spreading investments across various borrowers and sectors reduces exposure to any single point of failure.

- Spreading investments across different borrower types: Diversifying across different industries and company sizes can help to reduce overall portfolio volatility.

- Diversifying geographically: Reducing exposure to any single region or market can further mitigate risk.

Active Portfolio Management

Proactive portfolio management is crucial for adapting to changing market conditions:

- Regular monitoring of credit quality: Continuous monitoring of borrower performance allows for early detection of potential problems.

- Early intervention with struggling borrowers: Proactive measures to restructure debt or work with borrowers experiencing difficulties can minimize potential losses.

- Strategic adjustments to portfolio allocation: Adjusting portfolio allocations based on market conditions can help optimize returns and mitigate risk.

Conclusion

This Credit Weekly Report highlights the widening cracks in the private credit market, characterized by rising default rates, reduced liquidity, and increased market volatility. The impact of rising interest rates, sector-specific vulnerabilities, and increased regulatory scrutiny are significantly contributing factors. Investors and lenders must prioritize thorough due diligence, portfolio diversification, and active portfolio management to navigate this challenging landscape. Understanding the dynamics of the private credit market is crucial for all stakeholders. Stay tuned for next week's Credit Weekly Report for further analysis of the evolving private credit market and the latest strategies for mitigating risk in this evolving environment.

Featured Posts

-

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025 -

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025 -

Understanding Ariana Grandes Style Choices The Role Of Professional Experts

Apr 27, 2025

Understanding Ariana Grandes Style Choices The Role Of Professional Experts

Apr 27, 2025 -

Ramiro Helmeyer And The Glory Of Fc Barcelona

Apr 27, 2025

Ramiro Helmeyer And The Glory Of Fc Barcelona

Apr 27, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 27, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 27, 2025

Latest Posts

-

Investigation Into Toxic Chemical Persistence After Ohio Train Derailment

Apr 28, 2025

Investigation Into Toxic Chemical Persistence After Ohio Train Derailment

Apr 28, 2025 -

Ohio Train Derailment The Lingering Threat Of Toxic Chemicals

Apr 28, 2025

Ohio Train Derailment The Lingering Threat Of Toxic Chemicals

Apr 28, 2025 -

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

Apr 28, 2025

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

Apr 28, 2025 -

Months Long Lingering Of Toxic Chemicals After Ohio Train Derailment

Apr 28, 2025

Months Long Lingering Of Toxic Chemicals After Ohio Train Derailment

Apr 28, 2025 -

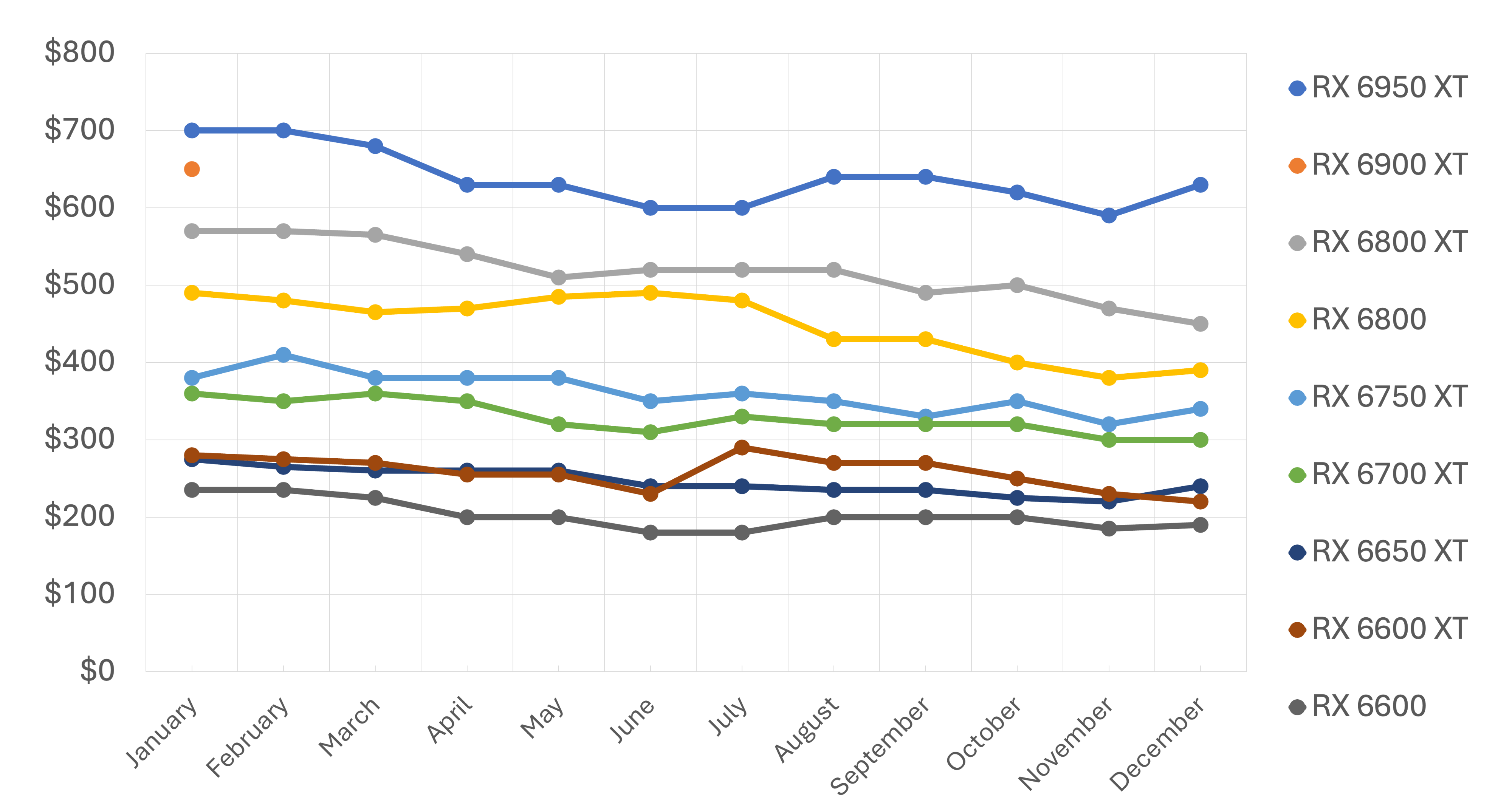

The Current State Of Gpu Pricing A Buyers Guide

Apr 28, 2025

The Current State Of Gpu Pricing A Buyers Guide

Apr 28, 2025