Cryptocurrency's Resilience: A Winning Strategy Amidst Trade Tensions

Table of Contents

Decentralization as a Hedge Against Geopolitical Risk

Cryptocurrencies, unlike traditional fiat currencies, offer a unique hedge against geopolitical instability. Their decentralized nature significantly reduces their vulnerability to the whims of national governments and central banks.

Reduced Reliance on Central Authorities

The core strength of cryptocurrency lies in its independence from centralized control. This inherent decentralization provides several key advantages during times of global uncertainty:

- Reduced exposure to currency devaluation: Trade disputes and sanctions often lead to currency devaluation. Cryptocurrencies, operating outside national borders, are less susceptible to these fluctuations. This makes them an attractive alternative for investors concerned about the impact of trade wars on their portfolios.

- Increased accessibility: In countries with unstable economies or restrictive financial systems, cryptocurrencies offer increased accessibility to financial services. Individuals can bypass capital controls and censorship, fostering financial inclusion.

- Protection against government censorship and capital controls: Governments may impose capital controls or censor financial transactions during times of crisis. Cryptocurrencies, with their decentralized and transparent nature, offer a degree of protection against such measures.

Transparency and Immutability

Built on blockchain technology, cryptocurrencies boast unparalleled transparency and immutability. Every transaction is recorded on a public, distributed ledger, strengthening trust and security:

- Increased transparency reduces manipulation and fraud: The public nature of the blockchain makes it incredibly difficult to manipulate transactions or engage in fraudulent activities. This enhanced transparency fosters greater confidence in the system.

- Immutability protects against alteration or censorship: Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This immutability protects against censorship and ensures the integrity of the transaction history.

- Enhanced security through cryptographic hashing and consensus mechanisms: Complex cryptographic techniques and consensus algorithms secure the blockchain network, making it highly resistant to hacking and manipulation.

Portfolio Diversification and Risk Mitigation

Cryptocurrencies offer significant benefits for portfolio diversification and risk mitigation, particularly during periods of global economic uncertainty.

Uncorrelated Asset Class

Cryptocurrencies often demonstrate low correlation with traditional asset classes like stocks and bonds. This lack of correlation provides crucial diversification benefits:

- Reduces overall portfolio volatility: By including cryptocurrencies in a portfolio, investors can potentially reduce the overall volatility of their investments, creating a more stable investment strategy.

- Provides a potential hedge against downturns in traditional markets: During market downturns, cryptocurrencies might perform differently than traditional assets, potentially mitigating losses.

- Opportunity for higher risk-adjusted returns: The potential for higher returns, combined with diversification benefits, can improve overall risk-adjusted returns.

Inflation Hedge Potential

Many believe that certain cryptocurrencies, especially Bitcoin, have the potential to act as a store of value and a hedge against inflation. This becomes particularly relevant during times of economic instability:

- Limited supply protects against inflation: The limited supply of Bitcoin, for example, acts as a natural constraint against inflation, potentially preserving its value.

- Decentralized nature makes them less susceptible to inflationary monetary policies: Unlike fiat currencies, cryptocurrencies are not subject to the inflationary pressures of government monetary policies.

- Potential for long-term value appreciation: This inherent scarcity and independent nature makes cryptocurrencies a potentially attractive long-term investment during inflationary periods.

Technological Innovation and Adoption

The cryptocurrency ecosystem is dynamic and constantly evolving, driving further resilience and adoption.

Continued Development and Improvement

Ongoing innovation is a key factor driving cryptocurrency's resilience. Significant improvements are being made in several areas:

- Layer-2 scaling solutions improve transaction speeds and reduce fees: Innovations like Lightning Network address scalability issues, making cryptocurrencies more practical for everyday use.

- Enhanced security protocols mitigate vulnerabilities and risks: Constant development of security protocols and consensus mechanisms enhances the overall security and resilience of the cryptocurrency ecosystem.

- Increased user-friendliness through improved interfaces and wallets: Improvements in user interfaces and digital wallets are making cryptocurrencies more accessible to a wider audience.

Growing Institutional Interest

Institutional investors are increasingly recognizing the potential of cryptocurrencies, indicating a shift towards greater legitimacy and acceptance:

- Greater liquidity and market depth: Increased institutional participation leads to increased liquidity and market depth, promoting price stability.

- Increased price stability and reduced volatility: As institutional investors enter the market, volatility tends to decrease, making cryptocurrencies a more attractive investment option.

- Wider range of investment products and services: The growing institutional interest is leading to a wider range of investment products and services, making cryptocurrencies more accessible to different investor profiles.

Conclusion

Cryptocurrency's resilience in the face of global trade tensions is a compelling testament to its potential as a valuable asset class. Its decentralized nature, transparency, and potential as a hedge against geopolitical and economic uncertainty make it a viable addition to a diversified investment portfolio. While inherent risks exist within the cryptocurrency market, the ongoing technological advancements and growing institutional adoption suggest a strong potential for long-term growth. Don't miss out on the opportunity to explore the resilience of cryptocurrency and build a more robust investment strategy. Learn more about diversifying your portfolio with cryptocurrencies today.

Featured Posts

-

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025 -

Arsenal Psg Maci Hangi Kanalda Saat Kacta Canli Izle

May 08, 2025

Arsenal Psg Maci Hangi Kanalda Saat Kacta Canli Izle

May 08, 2025 -

Ahsan Urges Tech Integration To Boost Made In Pakistan Globally

May 08, 2025

Ahsan Urges Tech Integration To Boost Made In Pakistan Globally

May 08, 2025 -

Us Canada Trade Talks A More Harmonious Approach

May 08, 2025

Us Canada Trade Talks A More Harmonious Approach

May 08, 2025 -

Late Inning Heroics Paris Homer Delivers Angels Win Over White Sox In Downpour

May 08, 2025

Late Inning Heroics Paris Homer Delivers Angels Win Over White Sox In Downpour

May 08, 2025

Latest Posts

-

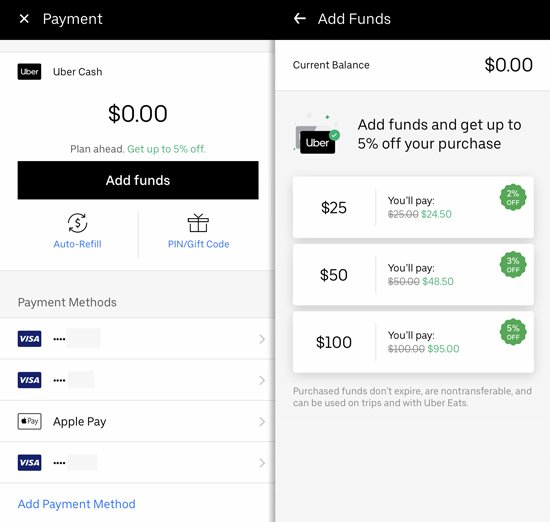

Uber Autos New Payment Policy What You Need To Know About Upi And Other Options

May 08, 2025

Uber Autos New Payment Policy What You Need To Know About Upi And Other Options

May 08, 2025 -

Is Upi Payment Still Working For Uber Auto Rides A Comprehensive Overview

May 08, 2025

Is Upi Payment Still Working For Uber Auto Rides A Comprehensive Overview

May 08, 2025 -

Understanding Uber Auto Payment Methods A Guide To Upi And Alternatives

May 08, 2025

Understanding Uber Auto Payment Methods A Guide To Upi And Alternatives

May 08, 2025 -

Sk

May 08, 2025

Sk

May 08, 2025 -

Uber Auto Payment Options Is Upi Still Available

May 08, 2025

Uber Auto Payment Options Is Upi Still Available

May 08, 2025