Currency Swaps Indicate Sustained Foreign Investment In Japanese Bonds

Table of Contents

The Role of Currency Swaps in Foreign JGB Investment

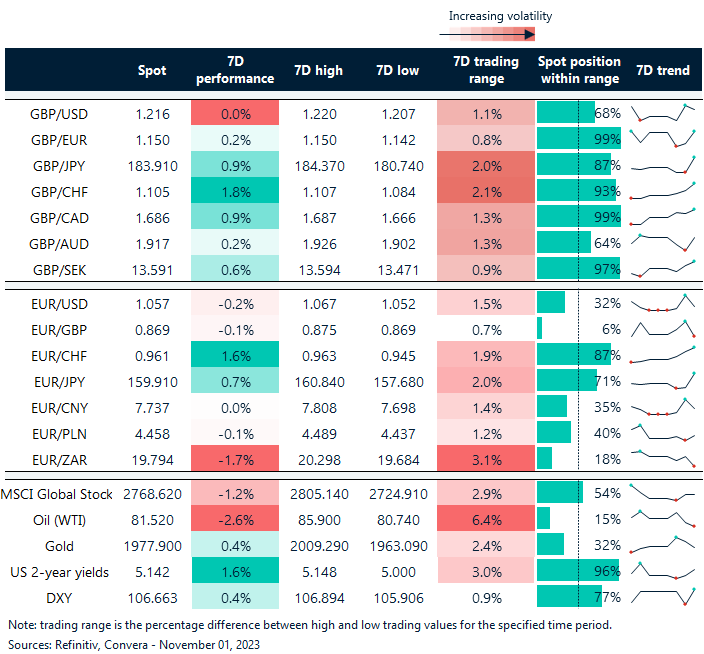

Currency swaps are a vital tool enabling foreign investors to participate in the Japanese Government Bond (JGB) market while mitigating the risk associated with Yen fluctuations. These swaps essentially allow investors to exchange principal and interest payments in one currency for those in another. This process significantly reduces the complexities and potential losses stemming from exchange rate volatility.

The mechanics are relatively straightforward: an investor holding another currency, say US dollars, agrees to exchange future interest payments and principal with a counterparty in Japan holding Yen. This effectively allows the investor to receive the returns of JGBs in their home currency, eliminating the direct exposure to Yen risk.

- Hedging against Yen fluctuations: This is the primary benefit. Currency swaps provide a hedge against adverse movements in the Yen exchange rate.

- Access to JGB yields without direct Yen exposure: Investors can gain exposure to the attractive yields offered by JGBs without the need to convert their funds into Yen.

- Reduced transaction costs compared to direct investment: The cost of repeatedly buying and selling Yen to manage exposure is eliminated, leading to significant cost savings.

- Increased investment flexibility: Currency swaps offer greater flexibility in managing investment portfolios by allowing for easier entry and exit from the JGB market.

Attractiveness of Japanese Government Bonds (JGBs)

The sustained foreign interest in JGBs isn't accidental. Several factors contribute to their enduring appeal in a diverse global investment landscape.

- Relatively high credit rating and low default risk: Japan boasts a very strong credit rating, making JGBs considered extremely safe investments with a low probability of default. This is a major draw for risk-averse investors.

- Safe-haven asset status during times of global economic uncertainty: During periods of market turmoil, investors often seek refuge in safe-haven assets. JGBs, due to their low risk profile, consistently attract capital as investors seek to protect their portfolios.

- Attractive yields compared to other developed markets: While potentially low in absolute terms, JGB yields offer a competitive return compared to similar bonds issued by other developed nations, particularly when considering the low risk.

- Yen's perceived stability (relative to other currencies): While subject to fluctuations, the Yen historically demonstrated relative stability, further enhancing the appeal of JGBs for investors seeking to minimize currency risks.

Impact of Global Economic Factors on JGB Investment

Global economic conditions significantly influence the flow of foreign investment into JGBs. Changes in the international financial landscape directly impact investor sentiment and investment decisions.

- Flight to safety during periods of market volatility: During times of economic uncertainty or market crises, investors often seek safety. The resulting "flight to safety" leads to increased demand for JGBs, driving up their prices.

- Impact of interest rate differentials between Japan and other countries: Interest rate differentials between Japan and other countries influence the attractiveness of JGBs. Higher interest rates elsewhere might pull investment away from Japan, while lower rates could make JGBs more appealing.

- Influence of global inflation and monetary policy decisions: Global inflation and the responses by central banks worldwide impact both the relative attractiveness of JGBs and the value of the Yen.

- Changes in investor sentiment towards Japanese assets: Investor confidence in the Japanese economy and its long-term prospects play a significant role in determining foreign investment in JGBs.

Implications for the Japanese Economy

Sustained foreign investment in JGBs has significant implications for the Japanese economy, both positive and potentially negative.

- Impact on Yen exchange rates: Large inflows of foreign capital can strengthen the Yen, influencing trade balances and impacting Japanese businesses involved in international trade.

- Influence on Japanese interest rates and monetary policy: The Bank of Japan's monetary policy is significantly influenced by foreign investment flows into the JGB market. Large foreign purchases can put downward pressure on interest rates.

- Effect on overall economic growth and stability: Foreign investment in JGBs contributes to the stability of the Japanese financial system and can help to finance government spending.

- Potential risks associated with high levels of foreign ownership of JGBs: While beneficial in many ways, excessively high levels of foreign ownership could potentially create vulnerabilities in the event of a sudden shift in global investor sentiment.

Conclusion

The persistent use of currency swaps underscores the ongoing appeal of Japanese Government Bonds to foreign investors. The combination of a safe-haven status, relatively attractive yields, and effective hedging mechanisms via currency swaps makes JGBs a compelling investment option, even in a volatile global market. This sustained interest contributes significantly to the stability of the Japanese economy.

Understanding the dynamics of currency swaps and their impact on foreign investment in Japanese Government Bonds is crucial for investors and policymakers alike. Stay informed about the latest trends in the Japanese bond market and the role of currency swaps in shaping global investment strategies. Further research into the intricacies of currency swaps and their effect on Japanese Government Bonds (JGBs) is recommended to gain a comprehensive understanding of this vital aspect of the global financial market.

Featured Posts

-

Eurovision 2025 Your Guide To Betting And Winning

Apr 25, 2025

Eurovision 2025 Your Guide To Betting And Winning

Apr 25, 2025 -

Bears 2025 Draft Strategy Focusing On An Electrifying Playmaker

Apr 25, 2025

Bears 2025 Draft Strategy Focusing On An Electrifying Playmaker

Apr 25, 2025 -

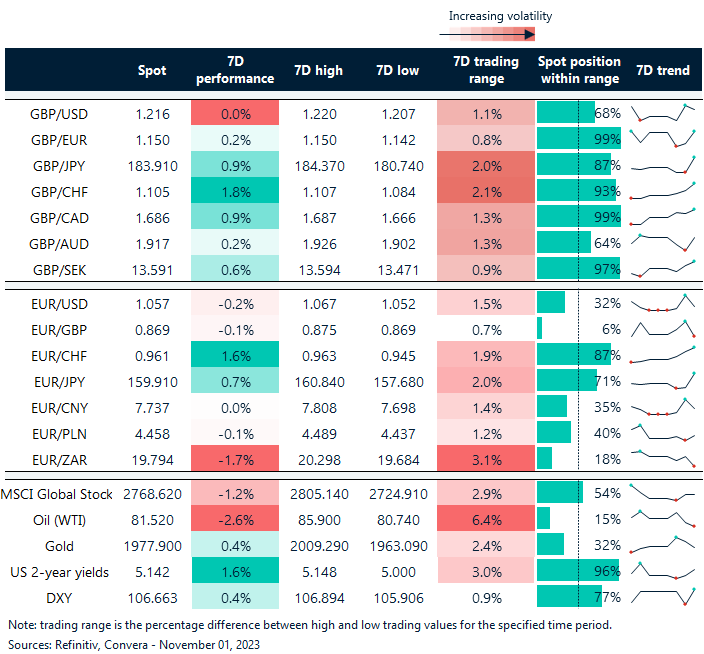

Trumps New Executive Order And University Accreditation What You Need To Know

Apr 25, 2025

Trumps New Executive Order And University Accreditation What You Need To Know

Apr 25, 2025 -

10 Unmissable European Shopping Adventures

Apr 25, 2025

10 Unmissable European Shopping Adventures

Apr 25, 2025 -

10 Key Facts About The 2025 Los Angeles Marathon

Apr 25, 2025

10 Key Facts About The 2025 Los Angeles Marathon

Apr 25, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

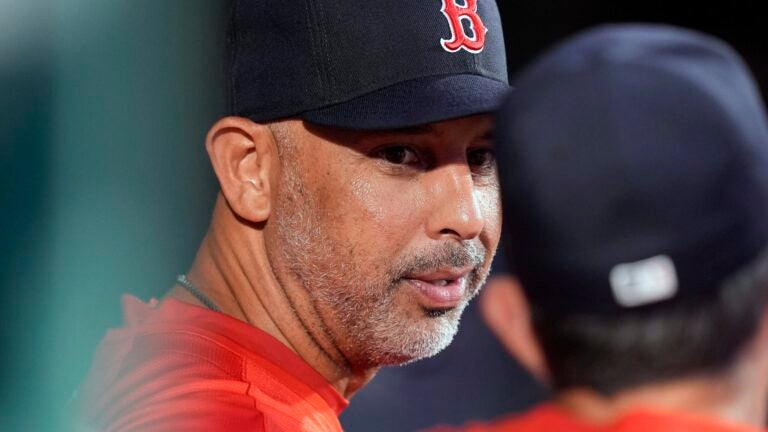

Game 1 Lineup Coras Red Sox Doubleheader Adjustments

Apr 28, 2025

Game 1 Lineup Coras Red Sox Doubleheader Adjustments

Apr 28, 2025 -

Alex Coras Strategic Lineup Changes For Red Sox Doubleheader

Apr 28, 2025

Alex Coras Strategic Lineup Changes For Red Sox Doubleheader

Apr 28, 2025 -

Boston Red Sox Lineup Coras Adjustments For Game 1

Apr 28, 2025

Boston Red Sox Lineup Coras Adjustments For Game 1

Apr 28, 2025 -

Red Sox Doubleheader Coras Minor Lineup Alterations

Apr 28, 2025

Red Sox Doubleheader Coras Minor Lineup Alterations

Apr 28, 2025