D-Wave Quantum (QBTS) Stock Decline: Analyzing Monday's Dip

Table of Contents

Market Sentiment and Investor Reaction

The overall market sentiment on Monday played a role in the QBTS stock decline. A negative market trend often impacts even fundamentally strong companies. In addition to broader market conditions, the quantum computing sector itself faced scrutiny. News headlines and social media discussions surrounding D-Wave and the broader quantum computing field exhibited a cautious tone.

- Negative News: While specific negative news directly impacting D-Wave might not have been prevalent on that particular day, the absence of positive catalysts in a volatile market can trigger sell-offs. Any negative sentiment toward the broader quantum computing industry would likely spill over to individual stocks like QBTS.

- Trading Volume and Price Fluctuations: A significant increase in trading volume alongside the price drop indicates a strong selling pressure. Monitoring these metrics provides key insights into the market's reaction to the D-Wave Quantum (QBTS) stock. Analyzing the specific price movements throughout the day can reveal the intensity and timing of the sell-off.

- Analyst Reports: Pre-existing concerns raised by analysts about D-Wave's growth trajectory or the competitive landscape could have been exacerbated by the general market downturn, leading to further downward pressure on the stock price.

D-Wave Quantum's Recent Financial Performance

D-Wave Quantum's recent financial performance is crucial in understanding the QBTS stock decline. While specific numbers require referencing their official financial reports, investors should analyze key metrics:

- Revenue and Net Income: Any significant miss on revenue projections or a decline in net income compared to previous quarters would likely contribute to negative investor sentiment and a stock price drop. Analyzing the revenue growth rate is especially crucial for a company in a rapidly evolving sector like quantum computing.

- Earnings Per Share (EPS): A lower-than-expected EPS would directly impact investor expectations and could trigger a sell-off. Understanding the factors contributing to EPS changes—like increased operating expenses or lower-than-anticipated sales—is important for assessing the long-term outlook.

- Future Outlook: Investors are keenly interested in a company's guidance for future performance. Any downward revision to future revenue or earnings projections could immediately negatively impact the stock price.

Competitive Landscape and Technological Advancements

The quantum computing industry is highly competitive. Companies like IBM, Google, IonQ, and Rigetti are pushing the boundaries of quantum technology.

- Competitor Advancements: Any significant breakthroughs or product announcements from competitors, especially regarding advancements in qubit technology or algorithm development, could put pressure on D-Wave's stock price. The perception of D-Wave falling behind its competitors is a serious concern for investors.

- Technological Disruption: The rapid pace of innovation in quantum computing means that disruptive technologies could render existing approaches obsolete. Any news regarding such developments can trigger uncertainty and risk aversion among investors.

- Market Share: Concerns about D-Wave's ability to maintain or increase its market share in the face of intense competition could contribute to the stock decline. Analyzing market share data and projections is crucial for assessing the long-term viability of the company.

Technical Analysis of the QBTS Stock Chart

A technical analysis of the QBTS stock chart can reveal potential reasons for the decline.

- Support and Resistance Levels: Identifying whether the stock price broke through key support levels could explain the sharp drop. This shows the market's rejection of the previously established price floor.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can indicate the overall trend and provide insights into potential reversal points. A break below a significant moving average is often considered a bearish signal.

- Chart Patterns: Identifying chart patterns like head and shoulders or double tops could suggest a continuation of the downward trend. These patterns provide visual confirmation of the bearish sentiment in the market. (Charts would be included here in a published article).

Conclusion: Navigating the Future of D-Wave Quantum (QBTS) Stock

The D-Wave Quantum (QBTS) stock decline on Monday was likely a confluence of factors. Market sentiment, D-Wave's financial performance, the competitive landscape, and technical indicators all played a role. While the short-term outlook might appear uncertain, the long-term potential of quantum computing remains significant. To make informed decisions, continue to analyze the D-Wave Quantum (QBTS) stock performance, monitoring key financial metrics, competitive developments, and overall market sentiment. Stay informed on the D-Wave Quantum (QBTS) stock trends and conduct thorough research before making any investment decisions. Remember, carefully monitor the D-Wave Quantum (QBTS) stock closely.

Featured Posts

-

Nyt Mini Crossword March 8th Solutions

May 20, 2025

Nyt Mini Crossword March 8th Solutions

May 20, 2025 -

Nyt Mini Crossword Solutions March 26 2025

May 20, 2025

Nyt Mini Crossword Solutions March 26 2025

May 20, 2025 -

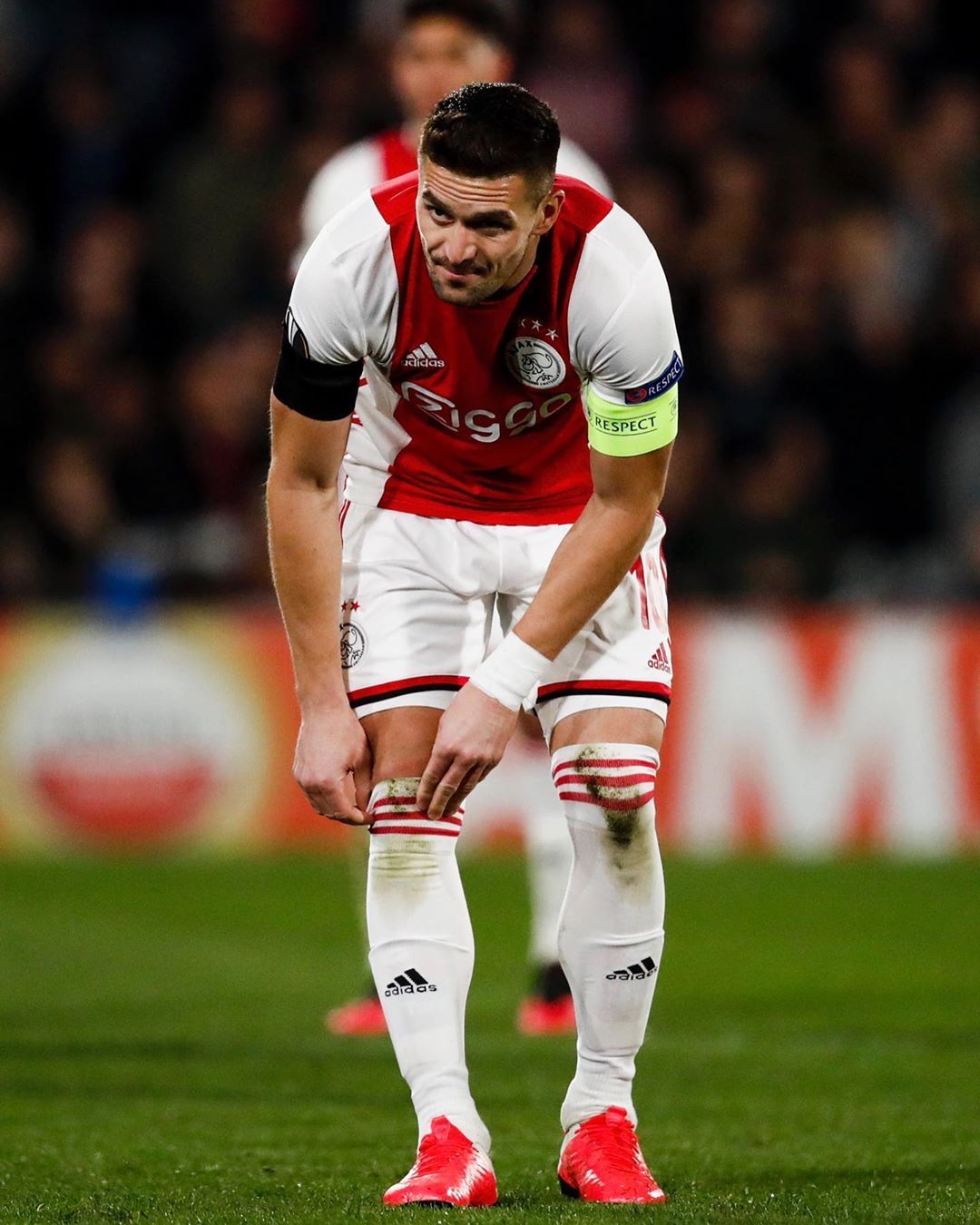

Dusan Tadic In Sueper Lig Deki 100 Maci

May 20, 2025

Dusan Tadic In Sueper Lig Deki 100 Maci

May 20, 2025 -

Amorims Coup A Major Forward Joins Man Utd

May 20, 2025

Amorims Coup A Major Forward Joins Man Utd

May 20, 2025 -

Solo Trips A New Way To Explore The Globe

May 20, 2025

Solo Trips A New Way To Explore The Globe

May 20, 2025