Dax Performance: Analyzing The Impact Of Political And Economic Factors

Table of Contents

The Impact of Economic Factors on Dax Performance

The German economy, and by extension the Dax index, is heavily influenced by various economic indicators. Analyzing these factors is crucial for predicting Dax performance and formulating effective investment strategies. Key economic factors include:

-

GDP Growth: Robust German GDP growth typically translates into a positive Dax performance. As the German economy expands, businesses see increased profits, leading to higher stock prices. Conversely, periods of recession, as witnessed during the 2008 financial crisis, significantly impact the Dax, resulting in market downturns. Monitoring GDP growth forecasts is therefore critical for assessing future Dax performance.

-

Inflation & Interest Rates: High inflation erodes corporate profitability and often prompts the European Central Bank (ECB) to raise interest rates. Higher interest rates increase borrowing costs for businesses, impacting investment and potentially leading to decreased Dax performance. Conversely, controlled inflation and strategically managed interest rates by the ECB can create a stable economic environment, fostering positive Dax performance.

-

Unemployment Rates: Low unemployment figures generally indicate a healthy economy with strong consumer spending. This increased consumer demand boosts company revenues, contributing to positive Dax performance. High unemployment, however, signals economic weakness, potentially leading to lower corporate profits and a negative impact on the Dax. Tracking unemployment data provides valuable insights into the overall health of the German economy and its effect on the Dax.

-

Eurozone Economy: Germany's economic success is intrinsically linked to the broader Eurozone. The performance of the Eurozone economy significantly impacts the Dax, as German businesses are deeply integrated into the European market. A strong Eurozone contributes to positive Dax performance, while weakness in other Eurozone economies can have negative repercussions.

-

Consumer Confidence: Positive consumer sentiment is a key driver of economic growth and directly impacts Dax performance. High consumer confidence translates into increased spending, boosting company sales and reinforcing a positive feedback loop that strengthens the Dax. Conversely, low consumer confidence dampens spending, impacting business revenues and potentially leading to decreased Dax performance.

Political Factors Influencing Dax Performance

Political factors, both domestically within Germany and internationally within the EU and globally, play a substantial role in shaping Dax performance. These factors create uncertainty or confidence in the market, impacting investor decisions:

-

Government Policies: The German government's fiscal and monetary policies significantly influence businesses and investor sentiment. Tax reforms, infrastructure spending, and regulatory changes directly impact corporate profitability and overall market confidence. Pro-business policies generally support positive Dax performance, while restrictive policies may have a negative impact.

-

European Union Policies: EU regulations and policies profoundly impact German businesses. Decisions related to trade, environmental regulations, and the single market can either stimulate or hinder economic growth and subsequently Dax performance. EU-driven initiatives impacting specific sectors can have a disproportionate effect on related companies listed on the Dax.

-

Geopolitical Risks: Global events, such as international conflicts, trade wars, or political instability in key trading partners, create uncertainty and volatility in the market, directly affecting Dax performance. These geopolitical risks can trigger market downturns as investors seek safer investments.

-

Political Stability: Political stability within Germany and the EU is paramount for maintaining investor confidence. Periods of political uncertainty or instability, such as major elections or government crises, can trigger market downturns as investors react to the perceived risk.

Analyzing Specific Events and their Impact on Dax Performance

The COVID-19 pandemic serves as a prime example of how intertwined economic and political factors influence Dax performance. The initial outbreak led to widespread lockdowns, severely impacting German GDP growth and consumer confidence. This resulted in a sharp decline in the Dax. However, subsequent government stimulus packages and the eventual rollout of vaccines helped mitigate the economic damage, leading to a gradual recovery in the Dax. This case study highlights the dynamic relationship between economic shocks and political responses in shaping market movements.

Conclusion

Dax performance is a multifaceted reflection of Germany's economic health and the broader political landscape. Understanding the interplay of economic factors like GDP growth, inflation, and unemployment, combined with the influence of political factors such as government policies, EU regulations, and geopolitical risks, is critical for interpreting market trends and predicting future Dax movements. Regularly monitoring these factors and analyzing their impact is essential for formulating effective investment strategies. Stay informed about key economic and political developments to effectively navigate the complexities of Dax performance and optimize your investment strategy in the German stock market. Understanding Dax performance is key to successful investing in the German market.

Featured Posts

-

Canadas Divided Response To Trump Albertas Oil Industry And The National Narrative

Apr 27, 2025

Canadas Divided Response To Trump Albertas Oil Industry And The National Narrative

Apr 27, 2025 -

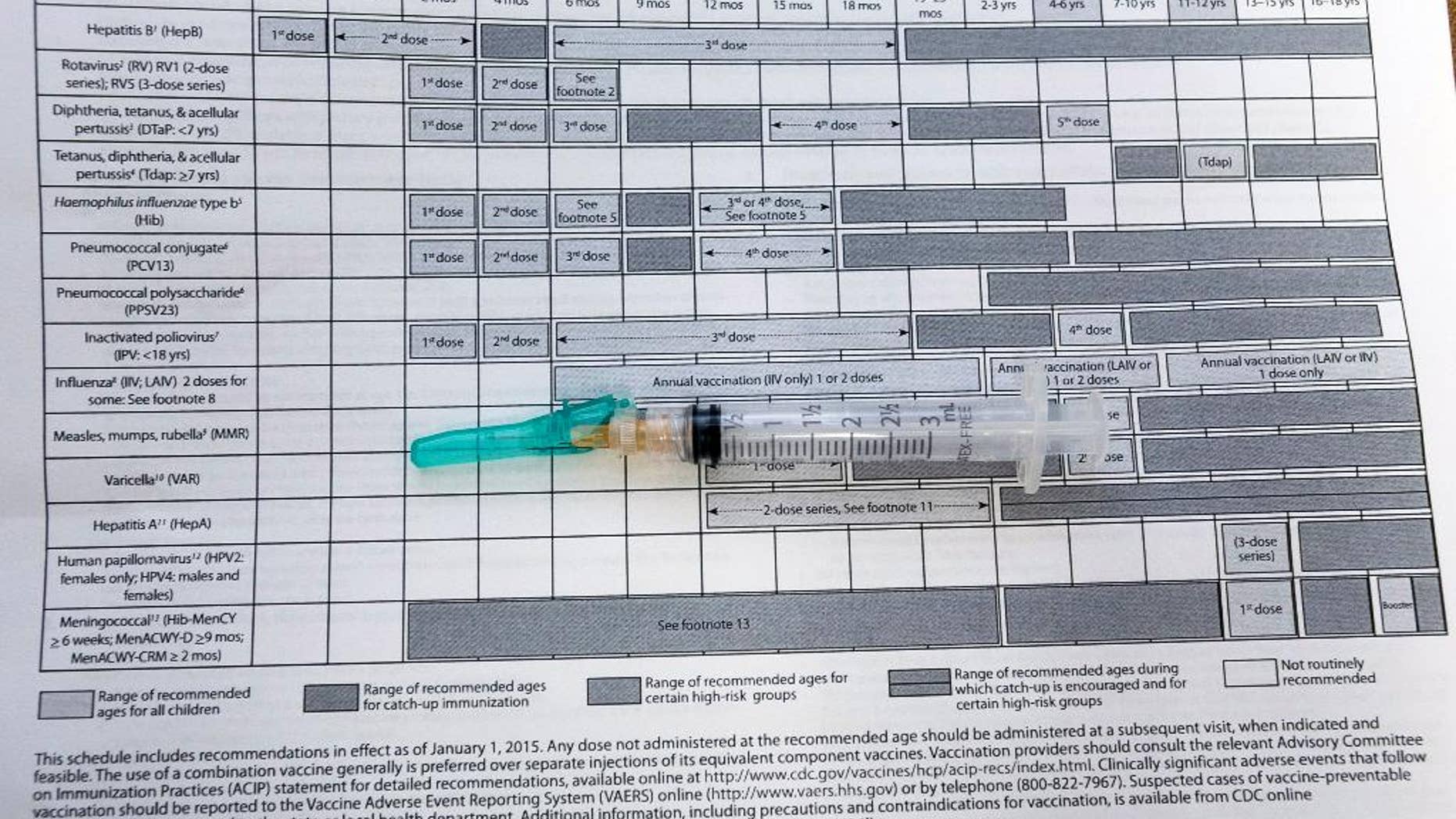

Discredited Misinformation Agent Hired For Cdc Vaccine Study Public Opinion

Apr 27, 2025

Discredited Misinformation Agent Hired For Cdc Vaccine Study Public Opinion

Apr 27, 2025 -

Ariana Grandes New Look Professional Help And Style Choices

Apr 27, 2025

Ariana Grandes New Look Professional Help And Style Choices

Apr 27, 2025 -

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025 -

Government Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025

Government Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025

Latest Posts

-

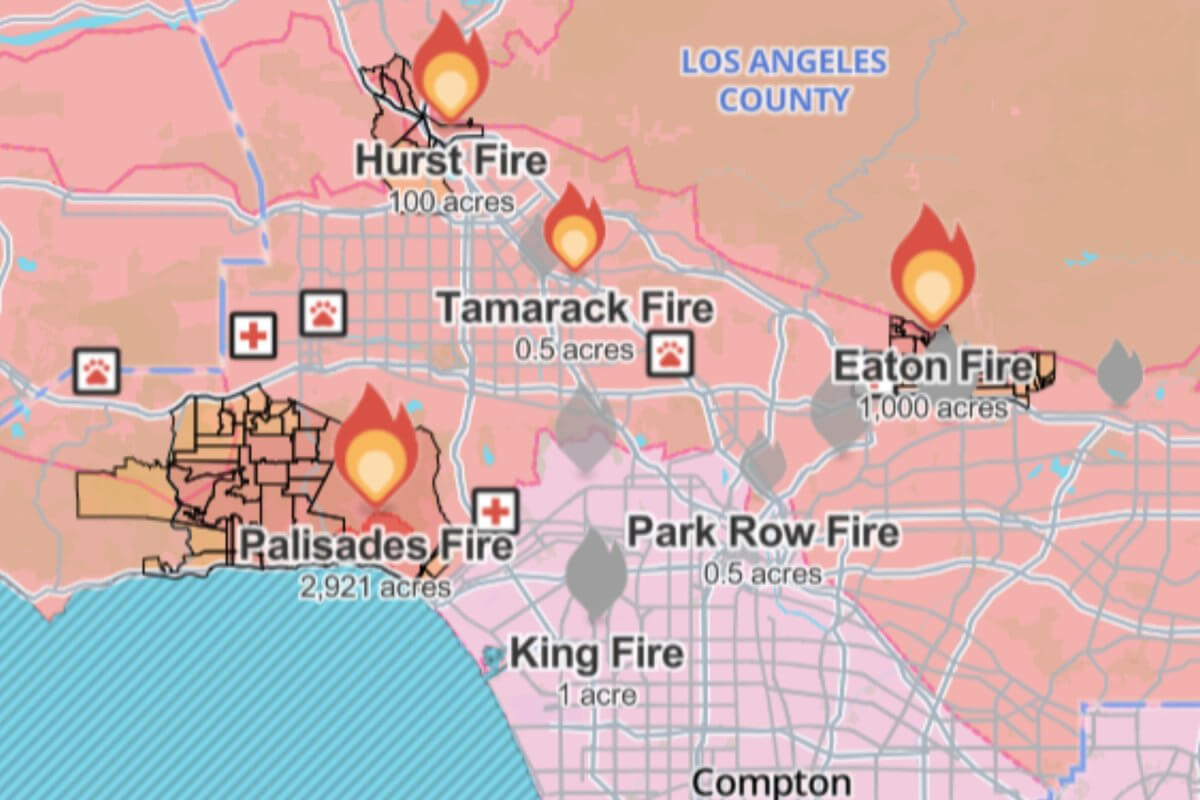

The Ethics Of Disaster Betting The Los Angeles Wildfires As A Prime Example

Apr 28, 2025

The Ethics Of Disaster Betting The Los Angeles Wildfires As A Prime Example

Apr 28, 2025 -

Los Angeles Wildfires And The Disturbing Trend Of Betting On Natural Disasters

Apr 28, 2025

Los Angeles Wildfires And The Disturbing Trend Of Betting On Natural Disasters

Apr 28, 2025 -

The Los Angeles Wildfires A Case Study In The Growing Market Of Disaster Betting

Apr 28, 2025

The Los Angeles Wildfires A Case Study In The Growing Market Of Disaster Betting

Apr 28, 2025 -

Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Betting

Apr 28, 2025

Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Betting

Apr 28, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Times

Apr 28, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Times

Apr 28, 2025