DAX's Recent Surge: Understanding The Risks Of A US Market Rebound

Table of Contents

The DAX's Recent Rally: A Closer Look

The DAX index has shown impressive growth in recent weeks/months (specify timeframe and percentage gain, e.g., a 15% increase over the past three months). This upward trend can be attributed to several factors, including easing inflation concerns in Europe, positive economic data releases from Germany, and generally improved investor sentiment. However, a closer examination reveals a more nuanced picture.

-

Specific DAX Component Performance: While the overall index is up, individual components have shown varying degrees of success. For example, (mention specific companies and their performance – e.g., "Automakers like Volkswagen have seen strong gains, while technology companies have shown more moderate growth"). This disparity suggests that the rally may not be uniformly driven across all sectors.

-

Comparison to Other Major European Indices: The DAX's performance should be considered in the context of other major European indices like the CAC 40 (France) and FTSE 100 (UK). Comparing relative performance can offer insights into whether the DAX's surge is unique or part of a broader European market trend. (Include comparative data if available).

-

Significant News Events: Recent positive news events, such as (mention specific news events like positive manufacturing data or announcements from the European Central Bank), have likely influenced investor confidence and contributed to the DAX's upward trajectory.

The US Market's Influence on the DAX

The US and German economies are deeply intertwined, making the US market a significant driver of the DAX's performance. A US market rebound typically translates into positive spillover effects for the German economy and its stock market, primarily through:

-

Trade and Investment Flows: The US is a major trading partner for Germany, and a strong US economy stimulates demand for German exports. Furthermore, substantial US investment in German companies directly influences the DAX's performance.

-

Spillover Effects from US Economic Policies: US monetary policy decisions, such as interest rate adjustments, have a global impact. A shift in US policy can trigger corresponding adjustments in Europe, influencing investor behavior and the DAX's trajectory.

-

US Market Overvaluation Risks: A significant risk arises if the US market rebound is driven by speculative bubbles or overvaluation. If a correction occurs in the US, it could trigger a sell-off in the DAX, given the close interconnectedness of the two markets.

Identifying Potential Risks and Vulnerabilities

While the DAX's recent surge is encouraging, several underlying risks could lead to a market correction or downturn.

-

Inflation and Interest Rate Hikes: Persistent inflation pressures and subsequent interest rate hikes by the European Central Bank could dampen economic growth and negatively impact corporate earnings, thereby affecting the DAX.

-

Geopolitical Uncertainty: The ongoing war in Ukraine, tensions between the US and China, and other geopolitical instabilities create significant uncertainty, impacting investor sentiment and market volatility.

-

Energy Prices: High and volatile energy prices remain a significant concern for Germany, impacting both industrial production and consumer spending. This translates to potential risks for companies heavily reliant on energy.

-

Potential Market Corrections: The current DAX surge could be followed by a correction if investor sentiment shifts or if underlying economic weaknesses become more apparent. This highlights the need for cautious optimism.

Geopolitical Risks and their Impact on the DAX

Geopolitical factors significantly contribute to market volatility and uncertainty. The war in Ukraine, for example, has caused significant disruption to supply chains and energy markets, directly impacting German businesses and the DAX. Similarly, evolving US-China relations can create ripple effects throughout the global economy and impact investor confidence in the DAX.

-

Specific Geopolitical Events and their Impact: (Provide specific examples of geopolitical events and their documented impact on the DAX).

-

Future Geopolitical Risks: (Discuss potential future risks and their potential consequences – e.g., escalating conflicts, trade wars).

-

Expert Opinions: (Include quotes or summaries of expert opinions on the geopolitical landscape and their implications for the DAX).

Strategies for Navigating Market Uncertainty

Navigating market uncertainty requires a proactive approach to risk management.

-

Portfolio Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and geographies can help mitigate the impact of a potential DAX downturn.

-

Risk Mitigation Techniques: Employing risk mitigation strategies such as stop-loss orders can help limit potential losses. Regular portfolio rebalancing is also crucial to maintain a desired risk profile.

-

Due Diligence: Thorough research and analysis are vital before making any investment decisions. Understanding the underlying fundamentals of individual companies and the broader economic environment is crucial.

Conclusion:

The DAX's recent surge, while positive, is significantly influenced by the US market's rebound. However, this upward trend carries inherent risks, including persistent inflation, interest rate hikes, ongoing geopolitical uncertainty, and the possibility of a market correction. Investors must carefully consider these vulnerabilities and adopt a cautious approach. Understanding the intricacies of the DAX and its relationship with the US market is crucial for navigating its volatility. Stay informed about the latest developments and consider seeking professional financial advice before making any investment decisions in the DAX. Conduct thorough research and only invest what you can afford to lose. Understanding the risks associated with a US market rebound is key to successful DAX investing.

Featured Posts

-

The Sutton Hoo Ship Burial New Insights Into Sixth Century Cremation Practices

May 25, 2025

The Sutton Hoo Ship Burial New Insights Into Sixth Century Cremation Practices

May 25, 2025 -

When To Fly For The Cheapest Memorial Day 2025 Airfare

May 25, 2025

When To Fly For The Cheapest Memorial Day 2025 Airfare

May 25, 2025 -

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 25, 2025

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 25, 2025 -

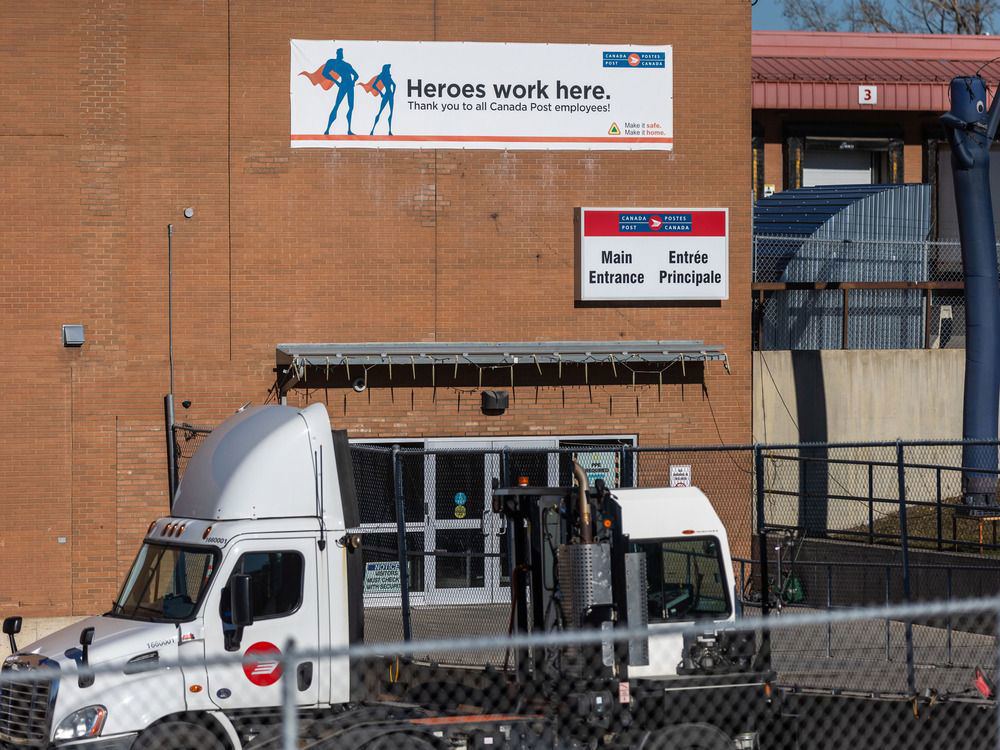

A Canada Post Strike Customer Concerns And Alternatives

May 25, 2025

A Canada Post Strike Customer Concerns And Alternatives

May 25, 2025 -

Brazils Banking Power Shift Brbs Acquisition Of Banco Master And The Implications

May 25, 2025

Brazils Banking Power Shift Brbs Acquisition Of Banco Master And The Implications

May 25, 2025