Dragon Den Showdown: Businessman Rejects Investors, Accepts Risky Offer

Table of Contents

The Businessman's Pitch and Initial Offers

The entrepreneur, let's call him Alex, presented a revolutionary new software solution for streamlining logistics in the e-commerce industry – an innovative startup with a unique business model poised to disrupt the market. His pitch highlighted the software's user-friendly interface, AI-powered optimization capabilities, and significant cost-saving potential for businesses. The Dragons, impressed by the market potential and the potential for disruptive growth, presented a series of attractive investment offers.

- Deborah Meaden: Offered £200,000 for a 25% equity stake, emphasizing her extensive experience in the retail sector. This offer presented a solid foundation with access to her industry expertise.

- Peter Jones: Offered £250,000 for a 30% equity stake, highlighting his success in scaling businesses. This was a larger investment but came with a higher dilution of Alex's ownership.

- Touker Suleyman: Offered £150,000 for a 20% equity stake, emphasizing his experience in building and selling businesses. This represented a lower equity stake but less funding.

Analyzing these investment offers reveals distinct pros and cons. Meaden's offer provided strong industry connections, while Jones's offered more capital but at a higher cost in terms of equity. Suleyman's offer balanced the two but provided less capital overall. The deal terms reflected the typical considerations in venture capital investment: funding amount, equity stakes, and the level of control each investor would exert.

Why the Rejection of Established Investors?

Despite the attractive offers, Alex surprised the Dragons by rejecting them. His decision stemmed from a strategic vision that extended beyond immediate funding:

- Differing Visions: Alex's long-term vision for his company differed from the Dragons'. They prioritized rapid scaling and a quick exit strategy, whereas Alex envisioned a more sustainable and controlled growth trajectory.

- Concerns about Control: He felt that accepting the established investors' offers would significantly dilute his ownership and compromise his control over the company's direction.

- Seeking Strategic Partnership: Alex was seeking not just capital but also a strategic partner who could provide invaluable industry expertise and connections beyond financial investment.

- Higher Potential Reward: He believed that the riskier option held the potential for exponentially higher returns in the long term, even if it involved a more challenging path.

The Risky Offer: Analysis and Implications

Alex's unconventional choice involved accepting a significantly smaller investment (£50,000) from a lesser-known angel investor with a deep understanding of AI and logistics. This high-risk investment came with no strings attached, allowing Alex to retain full control over his company's trajectory. While the initial funding was considerably less, the angel investor offered invaluable mentorship and connections within the tech industry.

This unconventional choice carries significant risks. Securing further funding rounds could be challenging with limited initial capital, and the lack of established investor support could hinder scaling. Potential pitfalls include slower growth, difficulties in navigating market competition, and the potential inability to capitalize on crucial opportunities due to limited funding.

However, the potential reward is substantial. Retaining full control allows Alex to execute his long-term vision without compromise. The angel investor's expertise and connections could lead to disruptive growth and access to crucial resources, maximizing the market opportunity. This high reward potential outweighs the immediate challenges.

Lessons Learned from the Dragon Den Showdown

This Dragon Den showdown offers several crucial takeaways for aspiring entrepreneurs:

- Align with the Right Investor: Finding an investor whose vision aligns with yours is paramount, even if it means foregoing larger, more immediate financial gains.

- Long-Term Vision over Short-Term Gains: Prioritizing a long-term sustainable strategy, even if it involves higher initial risk, can lead to greater success in the long run.

- Risk Assessment and Tolerance: Entrepreneurs must carefully assess their risk tolerance and make informed decisions based on their individual circumstances and business goals.

- Strong Business Understanding: A deep understanding of your business model and its potential is essential for making strategic decisions about investment and partnerships.

Conclusion: Navigating the Dragon Den Showdown – Your Next Steps

This Dragon Den showdown highlights the complexities of securing investment and the importance of choosing the right partner. Alex's unconventional choice, while risky, demonstrates the potential rewards of aligning with an investor who shares your vision and offers more than just capital. Learn from this Dragon Den showdown and prioritize finding the perfect investor for your business. Analyze your own risk tolerance before making investment decisions. Understand the Dragon's Den dynamics—and the dynamics of investment in general—to improve your pitch and increase your chances of success. Don't just seek funding; seek strategic partnerships that will propel your business towards sustainable growth.

Featured Posts

-

Remember Monday Exclusive Eurovision 2025 Song Unveiled On Capital

May 01, 2025

Remember Monday Exclusive Eurovision 2025 Song Unveiled On Capital

May 01, 2025 -

De Andre Hunter Leads Cavaliers To 10th Straight Win Over Trail Blazers

May 01, 2025

De Andre Hunter Leads Cavaliers To 10th Straight Win Over Trail Blazers

May 01, 2025 -

Is This Scotlands Ceiling Analyzing Their Six Nations 2025 Potential

May 01, 2025

Is This Scotlands Ceiling Analyzing Their Six Nations 2025 Potential

May 01, 2025 -

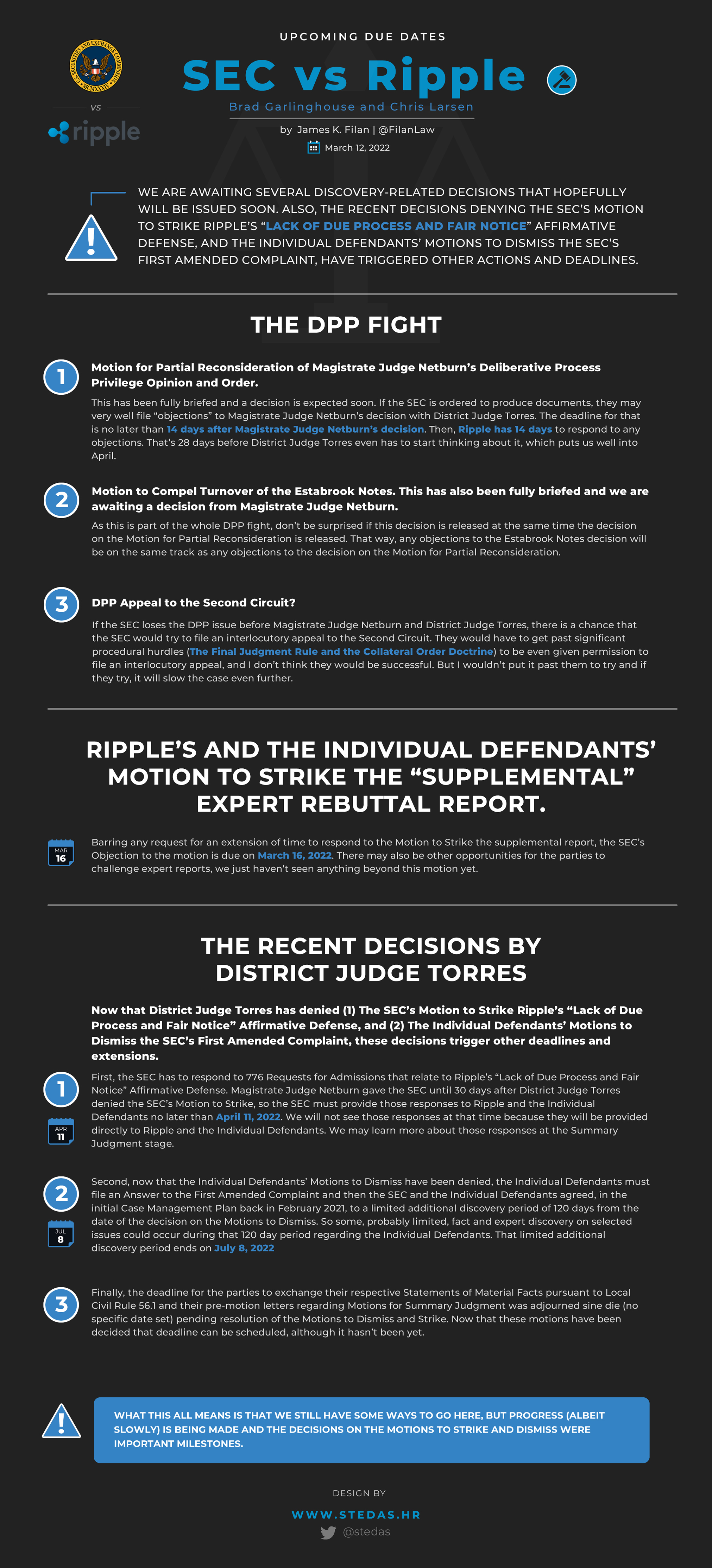

Ripple Lawsuit Sec Considers Xrp As Commodity In Settlement Negotiations

May 01, 2025

Ripple Lawsuit Sec Considers Xrp As Commodity In Settlement Negotiations

May 01, 2025 -

Can Celtic Conquer Their Homestand Championship Hopes On The Line

May 01, 2025

Can Celtic Conquer Their Homestand Championship Hopes On The Line

May 01, 2025