EToro's IPO Back On Track: Seeking $500 Million Investment

Table of Contents

eToro's Resurgence and Market Positioning

eToro's recent performance has been remarkable, demonstrating significant market share gains. The company has experienced considerable growth in both its user base and trading volume, fueled by several strategic initiatives. eToro's competitive advantage stems from its unique blend of social trading features, allowing users to copy the trades of successful investors, coupled with a comprehensive range of investment products. This innovative approach to online trading has attracted a significant number of new investors, particularly among younger demographics.

eToro's success is further bolstered by:

- Increased user base and trading volume: eToro boasts millions of registered users globally, with consistent growth in trading activity.

- Successful product launches and innovations: Continuous development and enhancement of its platform have kept eToro at the forefront of innovation.

- Strong brand recognition and reputation: eToro's established brand and positive reputation within the industry contribute to investor confidence.

- Expansion into new markets and demographics: Strategic expansion into new geographic regions and diversification across various user demographics has fueled growth.

Details of the $500 Million Investment

The planned $500 million investment is strategically crucial for eToro's future. The funds are earmarked for several key initiatives including: significant technological upgrades to enhance the platform's functionality and security, aggressive marketing campaigns to expand its reach and brand awareness, and further expansion into new and existing markets. eToro is targeting a mix of venture capitalists and institutional investors known for their experience in the fintech and online trading sectors.

Key aspects of the investment include:

- Breakdown of investment allocation: A significant portion of the funds will be directed toward technology development, followed by marketing and international expansion.

- Potential timeline for the IPO completion: While a specific date remains undisclosed, eToro aims to complete the IPO within a reasonable timeframe.

- Expected return on investment for investors: eToro anticipates delivering strong returns to its investors, based on projected revenue growth and market expansion.

- Key performance indicators (KPIs) for measuring success: The success of the IPO will be measured by factors like user growth, trading volume, platform engagement, and overall profitability.

Factors Contributing to eToro's IPO Success

eToro's renewed IPO push is underpinned by several critical factors. The company’s improved financial performance, displaying substantial revenue growth and increased profitability, has instilled confidence among potential investors. Crucially, eToro has secured necessary regulatory approvals and maintains strong compliance across various jurisdictions. This regulatory compliance mitigates risk and fosters trust among investors. Positive market sentiment towards eToro, fueled by its innovative approach and strong growth trajectory, further enhances its IPO prospects. Finally, the company benefits from aligning with the broader industry trend of increased demand for accessible and user-friendly online trading platforms.

Specific factors include:

- Strong financial reporting and transparency: eToro's commitment to transparent financial reporting has strengthened investor confidence.

- Secured regulatory licenses and compliance: Compliance with international regulations minimizes risks and enhances trust.

- Positive media coverage and investor confidence: Favorable media attention and a growing reputation have built investor confidence.

- Alignment with growing demand for online trading and investment platforms: eToro is well-positioned to capitalize on the expanding online trading market.

Potential Challenges and Risks

While eToro's IPO outlook is positive, certain challenges and risks must be acknowledged. Market volatility remains a significant concern, and any significant downturn could impact investor sentiment. The online trading industry is fiercely competitive, with established players posing significant challenges. Regulatory hurdles and potential changes in legislation could also affect eToro's operations. However, eToro has robust risk management strategies in place to address these potential obstacles.

Potential challenges include:

- Market fluctuations and economic uncertainties: Global economic instability could negatively impact investor appetite.

- Competition from established brokers and fintech companies: Competition from established players requires a proactive and adaptive approach.

- Potential regulatory changes and compliance requirements: Adapting to evolving regulations is crucial for long-term sustainability.

- Risk management strategies employed by eToro: eToro employs a multi-layered approach to risk management, including robust security measures and diversification strategies.

eToro's IPO and the Future of Online Trading

eToro's renewed IPO is poised for success, driven by its strong performance, innovative platform, and strategic investment plans. The $500 million investment will fuel growth, enhance technology, and solidify eToro's position within the competitive online trading landscape. The success of this IPO could signify a significant step forward for the industry, setting a precedent for future fintech IPOs. eToro's future is bright, and its continued success will be a key indicator of the broader trends shaping the online investment market.

Stay tuned for updates on eToro's IPO and its impact on the future of online investing. Follow our blog for the latest news and analysis on eToro and other key players in the market.

Featured Posts

-

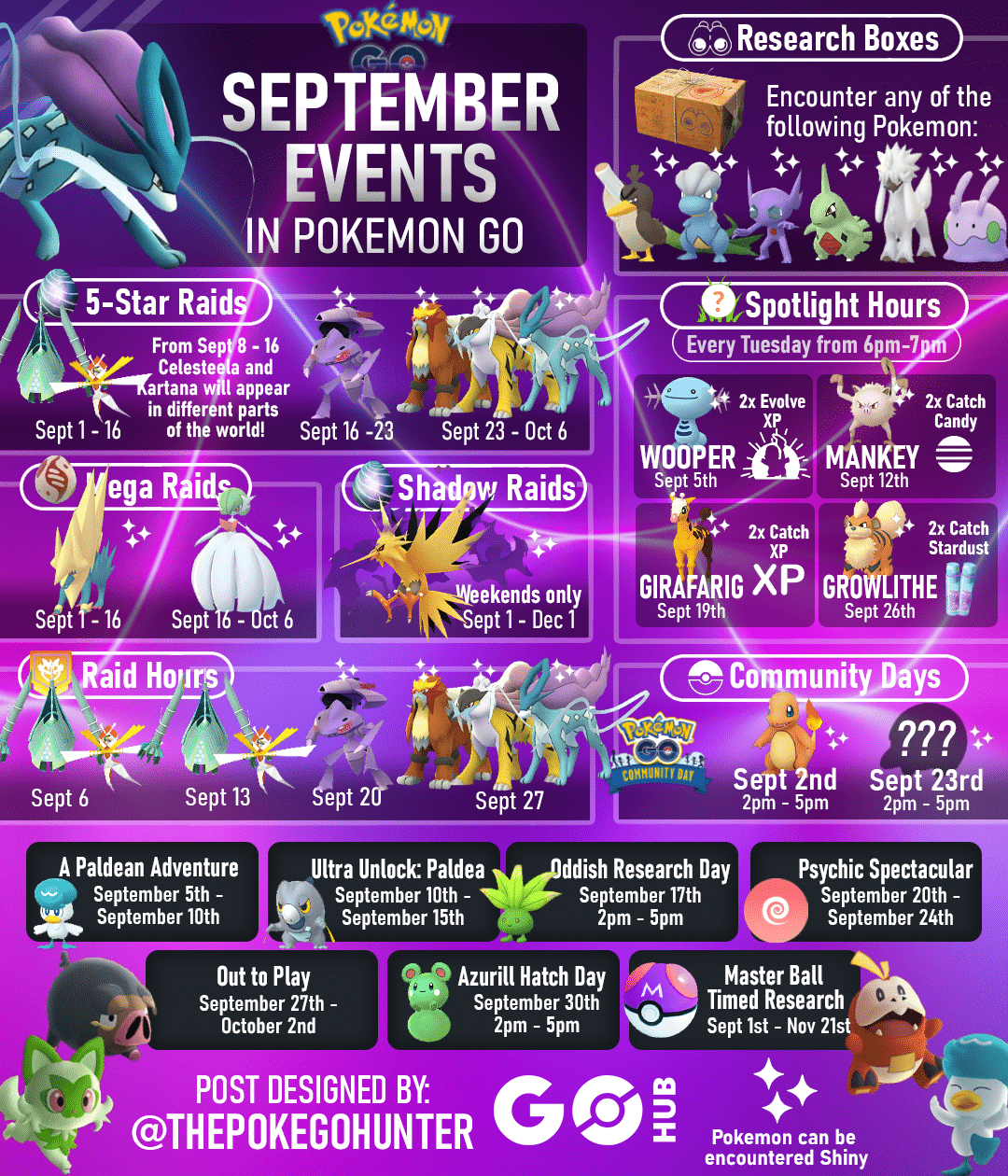

Pokemon Go May 2025 Raid Battles Spotlight Hours And Community Day Schedule

May 14, 2025

Pokemon Go May 2025 Raid Battles Spotlight Hours And Community Day Schedule

May 14, 2025 -

Kyf Snet Ywrwfyjn Njmt Ealmyt Mn Sylyn Dywn

May 14, 2025

Kyf Snet Ywrwfyjn Njmt Ealmyt Mn Sylyn Dywn

May 14, 2025 -

Bianca Censori In Bra And Thong Roller Skating Look

May 14, 2025

Bianca Censori In Bra And Thong Roller Skating Look

May 14, 2025 -

Eurojackpot 40 000 E Suomalainen Voittaja Jaa Kokemuksensa

May 14, 2025

Eurojackpot 40 000 E Suomalainen Voittaja Jaa Kokemuksensa

May 14, 2025 -

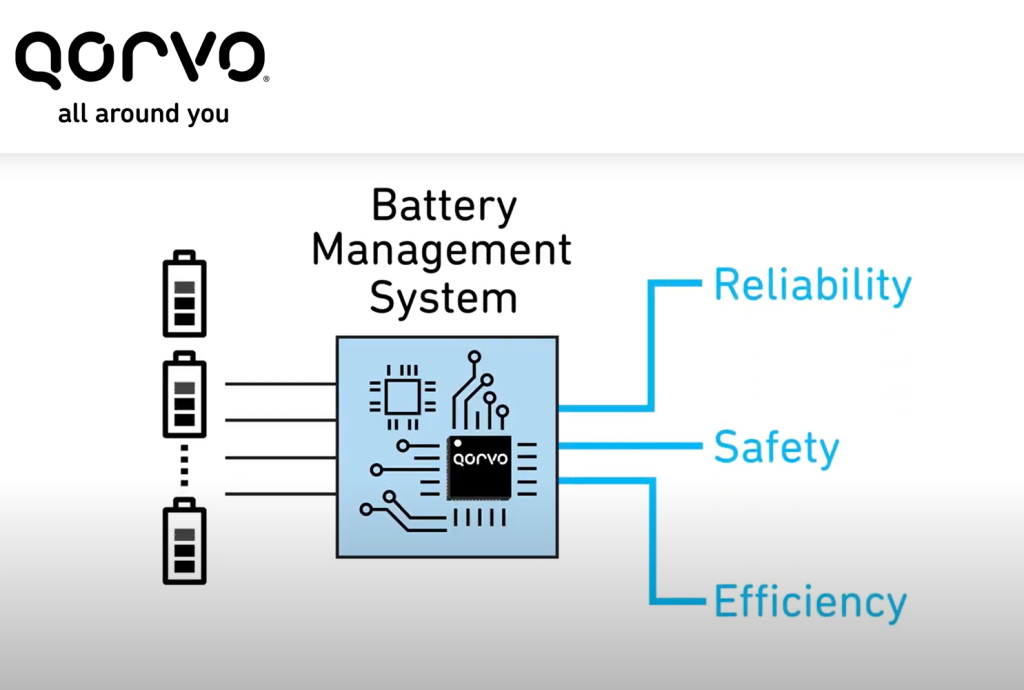

Apples Next I Os Update Intelligent Battery Management With Ai

May 14, 2025

Apples Next I Os Update Intelligent Battery Management With Ai

May 14, 2025