Elliott Management's Exclusive Bet: A Russian Gas Pipeline Investment

Table of Contents

Elliott Management's Investment Strategy and Rationale

Elliott Management Corporation is known for its activist investing approach, targeting undervalued assets and pushing for corporate governance changes to maximize shareholder value. This strategy often involves high-risk, high-reward ventures. Their reputation is built on identifying opportunities where significant returns can be achieved through strategic interventions.

Activist Investing Approach

As an activist hedge fund, Elliott typically acquires a significant stake in a company, then uses its influence to pressure management into making changes it believes will improve profitability. This can involve advocating for restructuring, divestitures, or even outright changes in leadership. Techniques employed by Elliott and other activist investors include shareholder activism, proxy fights, and engaging directly with company management. The ultimate goal is to increase the value of the investment and generate significant returns on investment.

Potential for High Returns

Elliott likely viewed this Russian gas pipeline investment as a high-potential opportunity, despite the inherent risks. Several factors might have influenced this decision:

- Potential for increased efficiency: Elliott may have identified opportunities to streamline operations, reduce costs, and enhance the profitability of the pipeline.

- Privatization opportunities: The possibility of future privatization could significantly increase the value of the investment.

- Favorable regulatory changes: Changes in Russian energy regulations could lead to increased profitability and improved market access.

Bullet Points:

- Elliott's successful high-risk investments include its involvement with several major corporations, resulting in significant profit increases following restructuring and changes in management. Specific examples should be cited if publicly available.

- The pipeline's potential profitability hinges on factors like global gas demand, transportation costs, and regulatory approvals. A thorough financial analysis is crucial in evaluating this aspect.

- Capital appreciation is another major factor. The potential for substantial increases in the pipeline's market value due to increased efficiency and market conditions is a strong incentive.

Geopolitical Risks and Challenges

Investing in a Russian gas pipeline carries substantial geopolitical risks. The current strained relationship between Russia and the West, coupled with the ongoing energy crisis, creates a volatile investment environment.

Sanctions and International Relations

The significant risk of sanctions imposed by Western governments cannot be ignored. These sanctions, already in place following the conflict in Ukraine, could severely restrict the pipeline's operation and impact the financial viability of the project. Any further escalation of the geopolitical situation could worsen the situation, leading to even more stringent sanctions or complete asset seizure. This geopolitical risk significantly impacts the investment climate and the long-term sustainability of the project. The Russia-West relations will play a crucial role in shaping the future of this investment.

Regulatory Uncertainty

The regulatory landscape surrounding the Russian energy sector is notoriously complex and prone to change, adding another layer of risk. Changes in Russian regulations, potential nationalization, or disputes with regulatory bodies could negatively impact the pipeline's operations and profitability. This regulatory risk necessitates careful monitoring of the regulatory environment and proactive risk management strategies.

Bullet Points:

- Current sanctions, such as those targeting specific Russian entities or restricting access to certain financial markets, need to be carefully analyzed for their potential impact on Elliott's investment.

- Potential future regulatory changes, such as increased taxation, stricter environmental regulations, or changes in ownership restrictions, need to be considered.

- The political stability in the region and Russia's internal political climate are critical factors that could affect the pipeline’s operational stability and profitability.

Financial Analysis and Potential Outcomes

A complete understanding of Elliott Management's Russian gas pipeline investment necessitates a thorough financial analysis. Details about the exact investment size and structure are often kept confidential.

Investment Size and Structure

While the precise figures remain undisclosed, estimates of the investment capital involved would help assess the scale of this gamble. Further research into publicly available financial statements and press releases is needed to gain a better understanding of the investment structure – whether it involves an equity stake, debt financing, or other financial instruments.

Projected ROI and Exit Strategy

The projected return on investment (ROI) is highly speculative, largely dependent on factors beyond Elliott's control, such as geopolitical stability, sanctions, and global gas prices. Elliott's exit strategy likely involves divesting from the project once a profitable opportunity arises. However, finding a buyer in a volatile geopolitical market might present a significant challenge.

Bullet Points:

- Financial projections will vary significantly depending on various market scenarios, encompassing both optimistic and pessimistic forecasts considering possible changes in sanctions, energy prices, and regulatory frameworks.

- Divesting from the investment could prove significantly challenging given the current sanctions and geopolitical instability. Finding a suitable buyer willing to accept the inherent risks will be crucial for a successful exit.

- The potential for a successful exit strategy is directly linked to the long-term geopolitical stability of the region and the resolution of international sanctions.

Conclusion: Elliott Management's Russian Gas Pipeline Investment: A Calculated Risk?

Elliott Management's investment in the Russian gas pipeline showcases a high-stakes gamble, balancing potentially lucrative returns against substantial geopolitical and financial risks. The analysis presented here highlights the complex interplay between financial incentives and the volatile geopolitical landscape.

While the potential for high returns is undeniable, the significant challenges and risks associated with the investment cannot be overlooked. The long-term viability of such investments in volatile geopolitical regions remains a critical question.

To conclude, this investment raises significant questions about the ethical considerations, long-term sustainability, and potential consequences of investing in such a politically sensitive sector. Further research into Elliott Management's investment strategies and the overall complexities of high-risk, high-reward ventures in unstable regions is highly recommended. Understanding Elliott Management's Russian gas pipeline investment necessitates continuous monitoring of geopolitical developments and a careful analysis of the evolving financial landscape.

Featured Posts

-

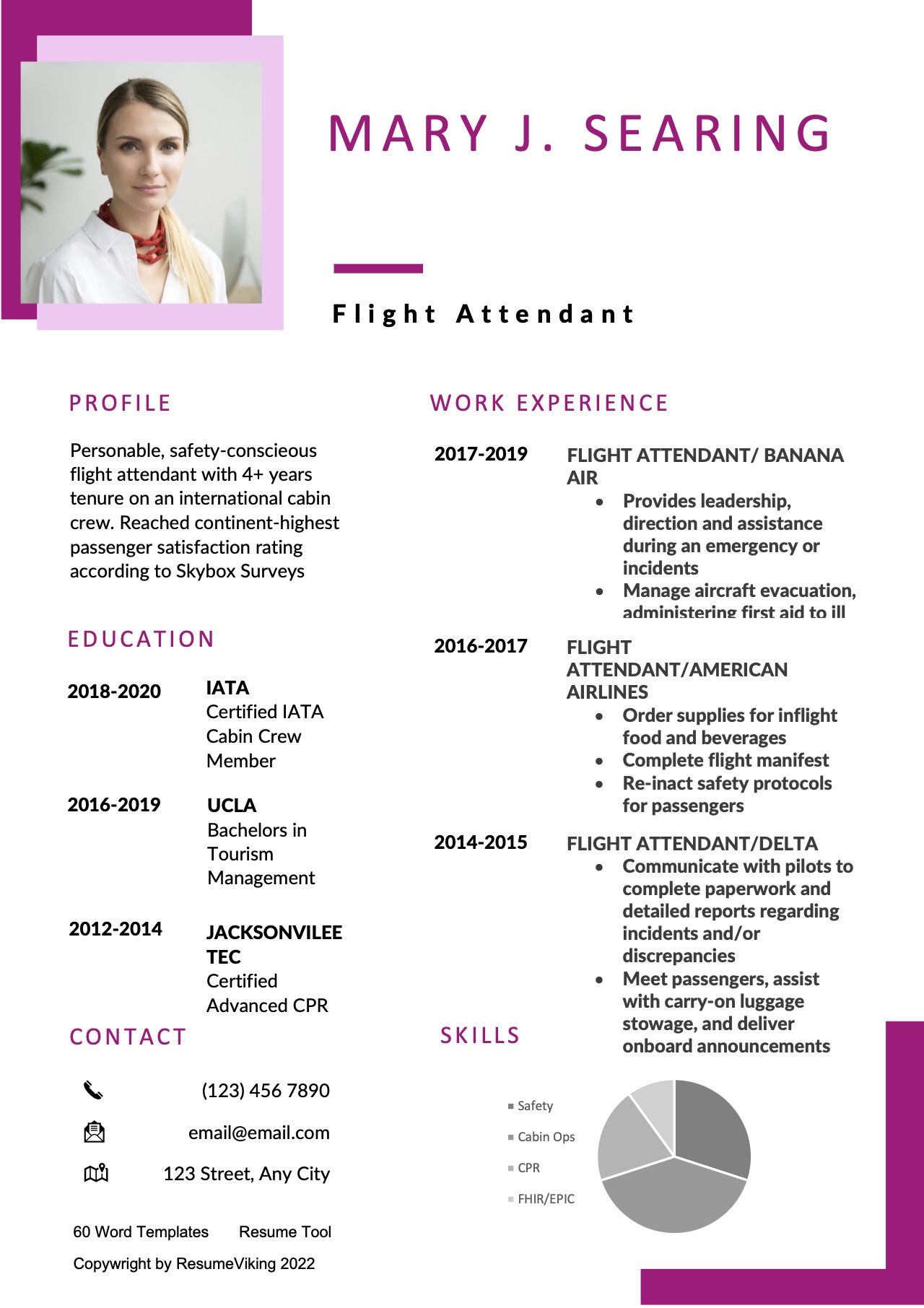

Ex Sia Flight Attendants Success Story Achieving The Dream Of Becoming A Pilot

May 11, 2025

Ex Sia Flight Attendants Success Story Achieving The Dream Of Becoming A Pilot

May 11, 2025 -

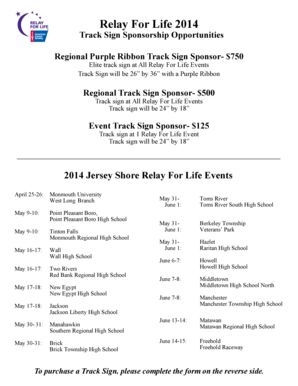

Get Free Tickets Tales From The Track Relay Sponsorship

May 11, 2025

Get Free Tickets Tales From The Track Relay Sponsorship

May 11, 2025 -

Indy Car Documentary Fox Sets May 18 Release Date

May 11, 2025

Indy Car Documentary Fox Sets May 18 Release Date

May 11, 2025 -

Crazy Rich Asians Tv Series Max Announces Adaptation

May 11, 2025

Crazy Rich Asians Tv Series Max Announces Adaptation

May 11, 2025 -

Astros Foundation College Classic In Houston Schedule Teams And Tickets

May 11, 2025

Astros Foundation College Classic In Houston Schedule Teams And Tickets

May 11, 2025

Latest Posts

-

She Dared To Dream A Flight Attendants Transformation Into A Pilot

May 11, 2025

She Dared To Dream A Flight Attendants Transformation Into A Pilot

May 11, 2025 -

Against All Odds A Pilots Story Of Defying Gender Expectations

May 11, 2025

Against All Odds A Pilots Story Of Defying Gender Expectations

May 11, 2025 -

Flight Attendant To Pilot A Womans Journey Against The Odds

May 11, 2025

Flight Attendant To Pilot A Womans Journey Against The Odds

May 11, 2025 -

From Flight Attendant To Pilot Overcoming Gender Barriers In Aviation

May 11, 2025

From Flight Attendant To Pilot Overcoming Gender Barriers In Aviation

May 11, 2025 -

Life After The Wings Latest News On A Former Sia Air Stewardess

May 11, 2025

Life After The Wings Latest News On A Former Sia Air Stewardess

May 11, 2025