Energy Market Insights: Oil News And Analysis - May 16, 2024

Table of Contents

Global Crude Oil Price Fluctuations and Their Drivers

Global crude oil prices, as measured by benchmarks like West Texas Intermediate (WTI) and Brent crude, have shown considerable fluctuation in recent weeks. Understanding these price swings requires examining several interconnected factors:

-

OPEC+ Production Decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) frequently adjust their production quotas, directly influencing global supply and, consequently, prices. Recent production cuts by certain OPEC+ nations have contributed to upward pressure on crude oil prices. Analysis of these decisions requires careful consideration of the individual member states' economic needs and geopolitical considerations.

-

Geopolitical Instability: Tensions in various regions, particularly [mention specific region experiencing instability and its impact on oil prices e.g., the ongoing situation in the Middle East], create uncertainty in the market and can lead to price spikes. Disruptions to oil supply routes due to conflict or sanctions significantly impact global energy prices.

-

Global Economic Growth Forecasts: Robust global economic growth generally translates into increased demand for oil, pushing prices higher. Conversely, economic slowdowns or recessions can decrease demand, leading to price drops. Current economic forecasts from organizations like the IMF and World Bank play a crucial role in energy market predictions.

-

Demand Shifts: Seasonal variations and unexpected economic events can dramatically alter the demand for oil. For example, increased driving during summer months can influence gasoline prices, and economic shocks can lead to decreased industrial activity and lower oil demand.

-

Inventory Levels and Storage Capacity: Global oil inventories and the available storage capacity are critical factors in determining price levels. High inventory levels can signal a surplus, putting downward pressure on prices, while low levels indicate scarcity and can lead to price increases. Tracking changes in these levels is essential for oil market analysis.

Impact of Renewable Energy on Oil Demand and Prices

The rise of renewable energy sources like solar and wind power is gradually reshaping the energy landscape. This transition has significant implications for future oil demand and prices:

-

Decreasing Oil Demand: The increasing adoption of renewable energy for electricity generation directly reduces the reliance on oil-based fuels, leading to a long-term decline in oil demand for power generation. This shift is accelerating due to technological advancements and cost reductions in renewable energy technologies.

-

Government Policies and Incentives: Many governments worldwide are actively promoting renewable energy through subsidies, tax credits, and regulatory frameworks. These policies further accelerate the shift away from fossil fuels and influence investment decisions.

-

Long-Term Oil Demand Projections: Numerous studies and reports predict a decline in global oil demand in the coming decades as renewable energy sources continue to penetrate the market. However, the pace of this decline remains a subject of ongoing debate and research. Understanding these projections is crucial for both consumers and investors.

-

Future of Oil in a Renewable Landscape: While oil demand may decrease, it's unlikely to disappear entirely in the foreseeable future. Oil will likely remain vital for transportation, certain industrial processes, and petrochemical production for many years.

Key Geopolitical Events and Their Influence on the Oil Market

Geopolitical events often exert significant influence on the oil market, creating both opportunities and risks:

-

Sanctions and Conflicts: International sanctions targeting oil-producing nations or conflicts disrupting oil production and transportation can cause substantial price volatility. Recent events in [mention specific geopolitical event and its impact on oil prices] highlight this dependence.

-

Disruptions to Oil Transportation Routes: Any disruption to major oil pipelines, shipping lanes, or other transportation infrastructure can create significant supply shortages and drive up prices. This vulnerability highlights the importance of diversified transportation routes.

-

Agreements and Alliances: International agreements and alliances between oil-producing and consuming nations can influence oil production levels, pricing mechanisms, and market stability. These arrangements can lead to both price stability and increased volatility depending on the terms of the agreements.

-

Risk Assessment: Analyzing geopolitical risk factors is crucial for understanding potential disruptions and their likely impact on the oil market. This often involves assessing the probability and severity of various scenarios.

Investment Strategies in the Oil and Gas Sector

The oil and gas sector continues to attract investment despite the shift towards renewable energy:

-

Exploration and Production: Investment in oil and gas exploration and production remains significant, driven by continued global demand for oil and gas. However, ESG considerations are shaping investment strategies.

-

Major Oil and Gas Company Performance: The performance of major oil and gas companies is often linked to global oil prices and investment decisions. Understanding company-specific strategies and financial results is crucial.

-

Investment Opportunities and Risks: Investing in the oil and gas sector presents both opportunities and substantial risks, largely dependent on global demand, geopolitical stability, and the regulatory environment. Thorough due diligence is essential.

-

ESG Factors: Environmental, Social, and Governance (ESG) factors are becoming increasingly important in investment decisions within the oil and gas sector. Investors are prioritizing companies with strong environmental performance, social responsibility, and good governance practices.

Conclusion: Staying Informed on the Ever-Changing Oil Market

In conclusion, the energy market remains highly dynamic, shaped by the interplay of crude oil prices, geopolitical events, renewable energy adoption, and investment strategies. Understanding the forces driving these changes is essential for navigating the complexities of this crucial sector. The ongoing evolution of the energy market underscores the need for continuous monitoring of oil news and analysis. Stay ahead of the curve with our daily updates on energy market insights: Subscribe to our oil news analysis today! For continuous updates on oil market trends and energy sector analysis, visit our website regularly. Understanding crude oil price forecasts requires close attention to the factors discussed in this article.

Featured Posts

-

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025 -

The Looming Cold War Over Scarce Rare Earth Minerals

May 17, 2025

The Looming Cold War Over Scarce Rare Earth Minerals

May 17, 2025 -

Everton Vina Vs Coquimbo Unido Cronica Del Empate A Cero

May 17, 2025

Everton Vina Vs Coquimbo Unido Cronica Del Empate A Cero

May 17, 2025 -

Angel Reeses Reebok Line Style Performance And Impact

May 17, 2025

Angel Reeses Reebok Line Style Performance And Impact

May 17, 2025 -

New Opportunities Chinas Ambassador Suggests Formal Trade Deal With Canada

May 17, 2025

New Opportunities Chinas Ambassador Suggests Formal Trade Deal With Canada

May 17, 2025

Latest Posts

-

Teisejo Klaida Rungtynese Tarp Pistons Ir Knicks Netiketa Rungtyniu Pabaiga

May 17, 2025

Teisejo Klaida Rungtynese Tarp Pistons Ir Knicks Netiketa Rungtyniu Pabaiga

May 17, 2025 -

Pre Series Injury Report Giants Vs Mariners April 4 6

May 17, 2025

Pre Series Injury Report Giants Vs Mariners April 4 6

May 17, 2025 -

Reta Nba Teisejo Klaida Pistons Ir Knicks Rungtyniu Rezultatas Pakeistas

May 17, 2025

Reta Nba Teisejo Klaida Pistons Ir Knicks Rungtyniu Rezultatas Pakeistas

May 17, 2025 -

Watch Seattle Mariners Vs Chicago Cubs Spring Training Baseball Online Free Today

May 17, 2025

Watch Seattle Mariners Vs Chicago Cubs Spring Training Baseball Online Free Today

May 17, 2025 -

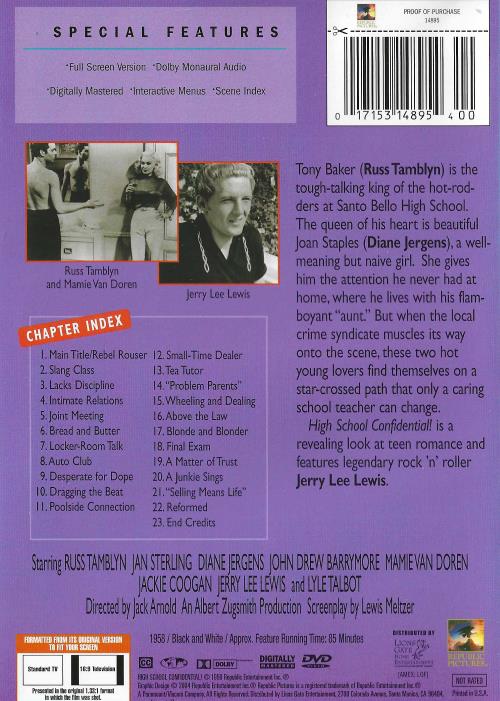

Week 26 2024 25 High School Confidential Review

May 17, 2025

Week 26 2024 25 High School Confidential Review

May 17, 2025