Eni Maintains Share Buyback Amid Reduced Cash Flow Through Cost-Cutting Measures

Table of Contents

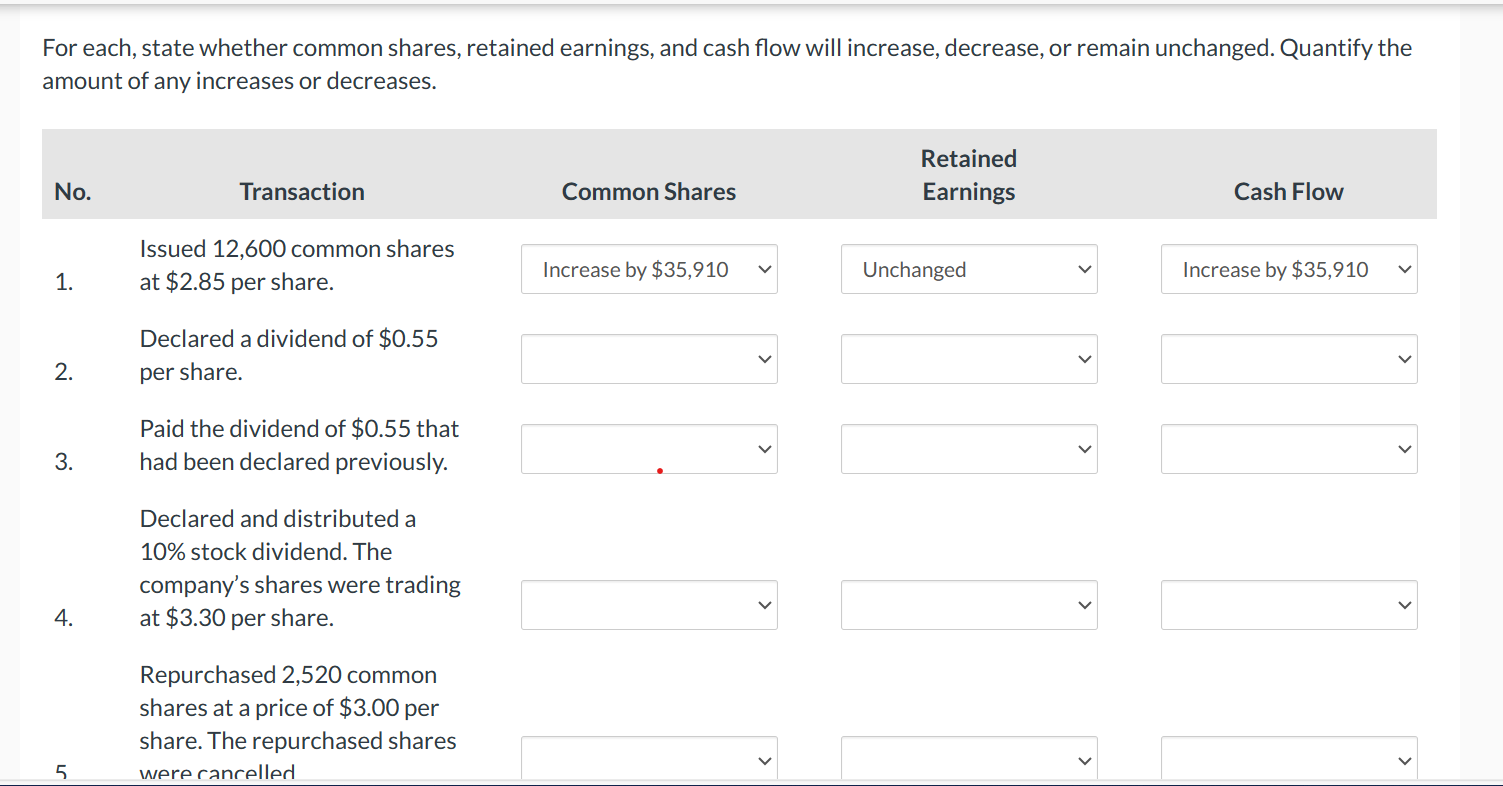

Eni's Commitment to Shareholder Value

Eni's rationale for continuing the share buyback program, even with reduced cash flow, centers on its unwavering commitment to delivering strong returns to its shareholders. This underscores the importance of shareholder returns as a cornerstone of Eni's overall financial strategy. The company believes that maintaining the buyback program sends a powerful signal of confidence in its future profitability and resilience.

- Demonstration of confidence in future profitability: By continuing the share buyback, Eni signals its belief in its ability to overcome current challenges and generate strong future earnings.

- Attracting investors and maintaining a strong stock price: The buyback program helps to support the stock price, making Eni a more attractive investment for potential and existing shareholders. A strong stock price is crucial for attracting capital and facilitating future growth initiatives.

- Returning value to shareholders despite economic headwinds: Despite the reduced cash flow, Eni prioritizes returning value to its shareholders, demonstrating a commitment to long-term value creation.

Cost-Cutting Measures Implemented by Eni

To mitigate the impact of reduced cash flow, Eni has implemented a range of significant cost-cutting measures across its operations. These measures are designed to improve efficiency and preserve financial flexibility. While specific figures may not be publicly available in detail, the company has emphasized substantial savings achieved through these initiatives.

- Operational efficiency improvements: Eni has focused on streamlining its operational processes, reducing redundancies, and improving the overall efficiency of its production and distribution networks.

- Capital expenditure optimization: The company has carefully reviewed its capital expenditure plans, prioritizing projects with the highest potential return on investment and delaying or scaling back less profitable ventures.

- Supply chain optimization: Eni is actively working to optimize its supply chain, negotiating better terms with suppliers and improving logistics to reduce costs.

Impact of Reduced Cash Flow on Eni's Operations

The reduction in Eni's cash flow is primarily attributed to several factors, including fluctuating energy prices, increased competition, and geopolitical uncertainties impacting the global energy market. These factors have a direct impact on the company's operational capacity and future investment plans.

- Impact on exploration and production activities: Reduced cash flow may necessitate a more cautious approach to exploration and production activities, potentially delaying the commencement or scaling back certain projects.

- Effect on renewable energy investments: While Eni is committed to renewable energy, the reduced cash flow may impact the pace of investments in this sector, potentially slowing down the transition to a more sustainable energy portfolio.

- Potential for delaying or scaling back projects: Certain projects, particularly those with longer payback periods or higher risks, might be delayed or even cancelled to conserve capital.

Analyst Reaction and Market Response to Eni's Strategy

The market's response to Eni's decision to maintain the share buyback program has been mixed. Some analysts applaud the company's commitment to shareholder value, seeing it as a sign of confidence in the long-term outlook. Others express concern about the potential strain on the company's balance sheet given the reduced cash flow.

- Positive and negative opinions on the strategy: Financial analysts are divided on the effectiveness of the strategy, with some praising its boldness and others questioning its timing.

- Analysis of the stock price performance following the announcement: The stock price has shown some volatility following the announcement, reflecting the uncertainty surrounding the long-term implications of the strategy.

- Comparison to competitor strategies: Eni's strategy can be compared to those of its competitors, revealing different approaches to managing financial challenges in the energy sector.

Long-Term Implications of the Eni Share Buyback and Cost-Cutting Measures

The long-term success of Eni's strategy hinges on the sustainability of its cost-cutting measures and its ability to generate sufficient cash flow to support both the share buyback program and its investment plans. There are both potential risks and rewards associated with this approach.

- Long-term impact on debt levels: Continuing the share buyback while experiencing reduced cash flow could potentially lead to an increase in debt levels, increasing financial risk.

- Potential for future dividend adjustments: If cash flow remains constrained, Eni may need to consider adjustments to its dividend policy to maintain financial stability.

- Sustainability of the cost-cutting measures: The long-term effectiveness of the cost-cutting measures will be crucial in determining the overall success of the strategy.

Conclusion: Assessing the Eni Share Buyback amidst Financial Adjustments

Eni's decision to maintain its share buyback program while implementing significant cost-cutting measures represents a bold strategic choice in the face of reduced cash flow. This approach demonstrates a commitment to shareholder returns and confidence in the company's long-term prospects. However, the success of this strategy hinges on the sustainability of the cost-cutting measures and the company's ability to navigate the challenges posed by the volatile energy market. The long-term impact on debt levels and dividend policy remains to be seen. Stay tuned for updates on Eni's progress in navigating this challenging period and the continued impact of its share buyback strategy.

Featured Posts

-

Ysl Autumn Winter Suits Style And The Laura Craik Review

Apr 25, 2025

Ysl Autumn Winter Suits Style And The Laura Craik Review

Apr 25, 2025 -

Celebracion De Los Premios Caonabo De Oro 2025 Conozca A Los Ganadores

Apr 25, 2025

Celebracion De Los Premios Caonabo De Oro 2025 Conozca A Los Ganadores

Apr 25, 2025 -

Analysis Trumps Response To The Kyiv Attacks And Putins Role

Apr 25, 2025

Analysis Trumps Response To The Kyiv Attacks And Putins Role

Apr 25, 2025 -

Trump Accuses Zelensky Amidst Stalled Ukraine Peace Negotiations

Apr 25, 2025

Trump Accuses Zelensky Amidst Stalled Ukraine Peace Negotiations

Apr 25, 2025 -

The Next Godzilla X Kong Film A Rogue Heros Entrance

Apr 25, 2025

The Next Godzilla X Kong Film A Rogue Heros Entrance

Apr 25, 2025

Latest Posts

-

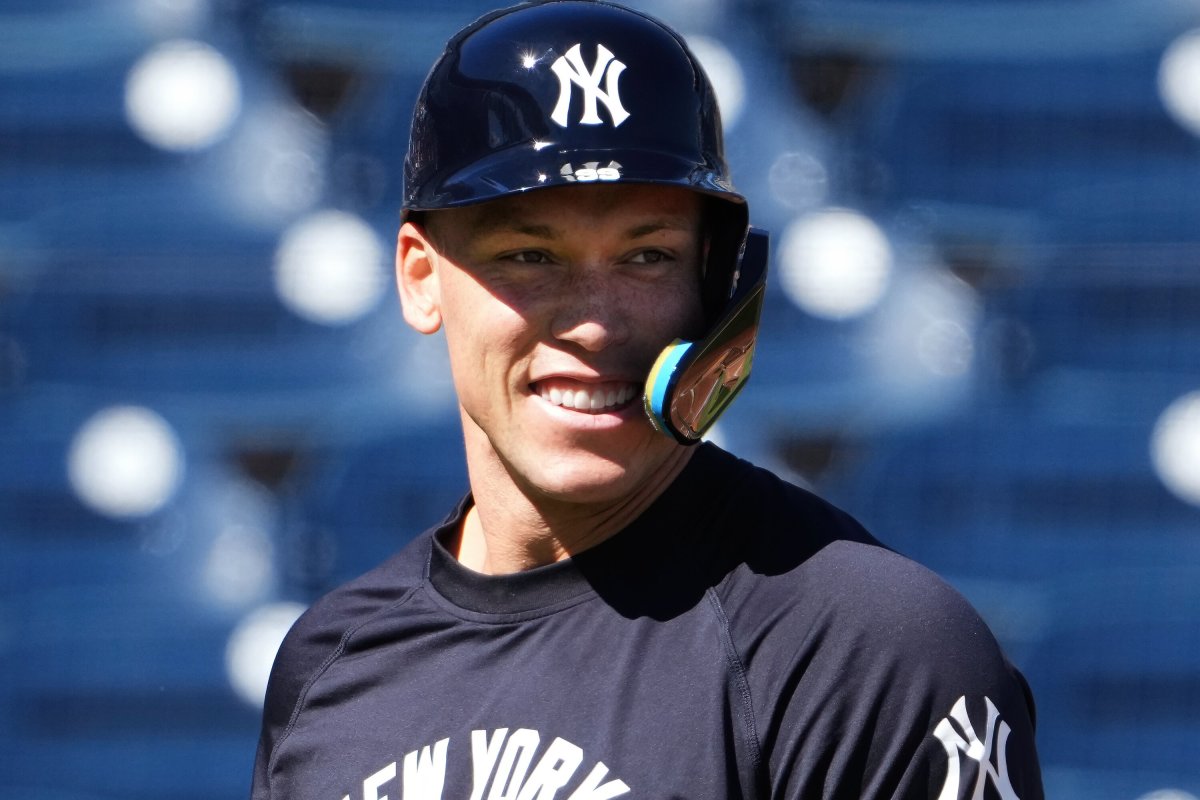

Yankees Lineup Shuffle Where Will Aaron Judge Bat Boones Plan Unveiled

Apr 28, 2025

Yankees Lineup Shuffle Where Will Aaron Judge Bat Boones Plan Unveiled

Apr 28, 2025 -

Aaron Boones Lineup Choices The Case Of Aaron Judges Position

Apr 28, 2025

Aaron Boones Lineup Choices The Case Of Aaron Judges Position

Apr 28, 2025 -

The Aaron Judge Lineup Question Boones Comments And Potential Implications

Apr 28, 2025

The Aaron Judge Lineup Question Boones Comments And Potential Implications

Apr 28, 2025 -

Yankees Manager Boone On Lineup Decisions Addressing Aaron Judges Role

Apr 28, 2025

Yankees Manager Boone On Lineup Decisions Addressing Aaron Judges Role

Apr 28, 2025 -

Will Aaron Judge Get His Desired Lineup Spot Boone Explains His Strategy

Apr 28, 2025

Will Aaron Judge Get His Desired Lineup Spot Boone Explains His Strategy

Apr 28, 2025