Euronext Amsterdam Sees 8% Stock Increase After US Tariff Suspension

Table of Contents

The Impact of US Tariff Suspension on Euronext Amsterdam

The direct correlation between the US tariff suspension and the subsequent stock market increase on Euronext Amsterdam is undeniable. The removal of these significant trade barriers injected a much-needed dose of confidence into the market. This led to increased trading activity as investors reacted positively to the improved trade outlook between the US and Europe. The reduced uncertainty surrounding trade relations fostered a more optimistic market sentiment, directly contributing to the 8% surge.

- Specific examples of stocks that experienced significant gains: While specific stock performance data requires further research and disclosure restrictions, sectors like technology and consumer goods, heavily impacted by previous tariffs, likely saw substantial gains.

- Analysis of trading volume before and after the tariff suspension: A comparison of trading volumes before and after the announcement would reveal a marked increase, reflecting heightened investor activity driven by the positive news. This data would solidify the direct link between the tariff suspension and increased trading on Euronext Amsterdam.

- Quotes from financial analysts commenting on the market reaction: Statements from leading financial analysts emphasizing the positive market reaction to the tariff suspension would add further credibility to the analysis. This could include commentary on increased investor confidence and the potential for further growth.

- Mention specific sectors that benefited most from the tariff suspension: Sectors directly affected by the previous tariffs, such as automotive manufacturing, agricultural products, and certain technology exports, experienced the most significant rebound.

Analyzing the Underlying Factors Contributing to the Stock Increase

While the US tariff suspension was a primary driver, other underlying factors likely contributed to the 8% increase on Euronext Amsterdam. A confluence of positive economic indicators, improved investor sentiment, and continued geopolitical stability all played a role.

- Discussion of broader economic trends in Europe and the US: Positive economic growth forecasts in both Europe and the US, coupled with stable inflation rates, created a favorable environment for investment. This broader positive economic climate enhanced the impact of the tariff suspension.

- Analysis of investor sentiment and confidence levels: Improved investor sentiment, reflected in increased market confidence and risk appetite, contributed to the surge in stock prices. A positive outlook about future economic prospects fueled investment activity.

- Mention of any significant geopolitical events that may have played a role: The absence of major negative geopolitical events further supported market stability and investor confidence, allowing the positive impact of the tariff suspension to take center stage.

- Consideration of alternative explanations for the stock market rise: While unlikely to be the sole explanation, other factors such as corporate earnings reports or specific company announcements could have marginally contributed to the overall market increase.

Long-Term Implications and Investment Opportunities on Euronext Amsterdam

The recent surge presents both opportunities and challenges for investors. While the tariff suspension offers a more positive outlook, careful consideration of potential risks and uncertainties is crucial for informed investment decisions.

- Recommendations for investors considering investing in Euronext Amsterdam stocks: Investors with a long-term perspective and a moderate to high-risk tolerance may find attractive opportunities within specific sectors. Diversification across sectors remains essential to mitigate risk.

- Discussion of potential risks and uncertainties: Geopolitical instability, unforeseen economic downturns, and regulatory changes could still negatively impact the market. Therefore, thorough due diligence is crucial.

- Analysis of different investment strategies suitable for various risk tolerances: Investors should tailor their investment strategies to match their individual risk tolerance. Options range from low-risk, dividend-focused investments to higher-risk investments in growth stocks.

- Mention of specific sectors or companies with strong growth potential: Further research into specific sectors and companies with strong growth potential within Euronext Amsterdam is essential for identifying promising investment opportunities.

Conclusion

The significant 8% stock increase on Euronext Amsterdam following the US tariff suspension is a notable event with far-reaching implications. The removal of trade barriers boosted investor confidence, leading to increased trading activity. While the tariff suspension was the primary catalyst, other positive economic indicators and general market sentiment also played a role. The long-term outlook remains positive, but investors should carefully assess risks and diversify their portfolios. The unexpected surge in the Euronext Amsterdam stock market presents both opportunities and challenges. Understanding the intricacies of this market is crucial for informed investment decisions. Stay informed about the latest developments on Euronext Amsterdam and capitalize on emerging opportunities. Learn more about investing in the Euronext Amsterdam market today!

Featured Posts

-

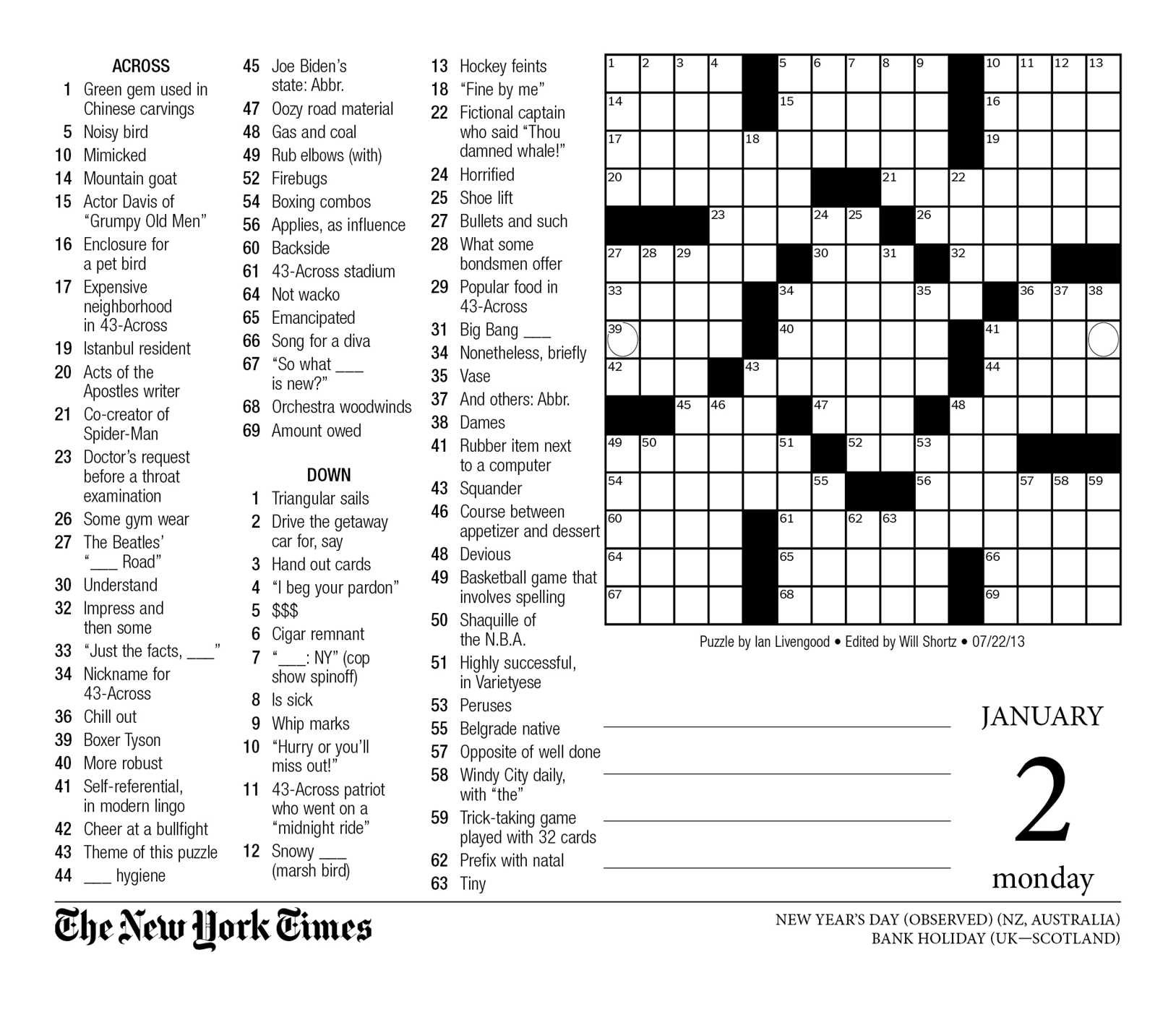

Nyt Mini Crossword Solutions March 3 2025

May 24, 2025

Nyt Mini Crossword Solutions March 3 2025

May 24, 2025 -

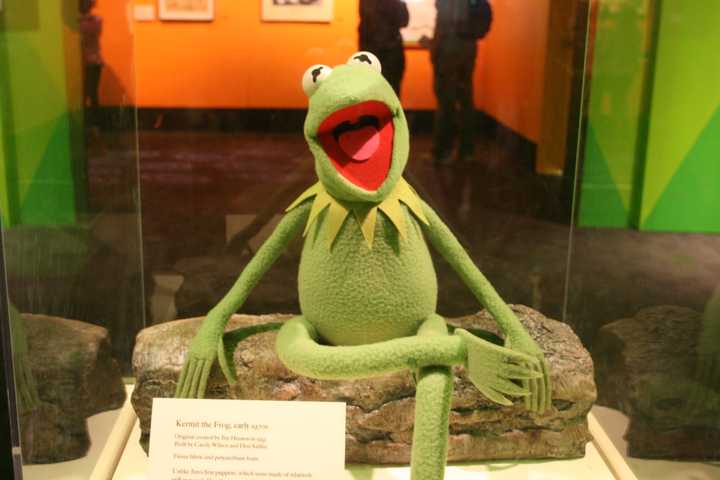

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025 -

Ranking The 10 Quickest Production Ferraris On Their Home Track

May 24, 2025

Ranking The 10 Quickest Production Ferraris On Their Home Track

May 24, 2025 -

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025 -

Job Offer Negotiation Addressing Best And Final Offers

May 24, 2025

Job Offer Negotiation Addressing Best And Final Offers

May 24, 2025