European Shares Rise On Trump's Tariff Hint; LVMH Slumps

Table of Contents

Positive Impact of Trump's Tariff Hint on European Shares

Headline: Trump's Tariff Comments Boost European Market Sentiment

President Trump's recent comments, while not a concrete policy shift, suggested a potential softening of his stance on tariffs, sparking a surge of positive sentiment in European markets. Although the exact phrasing remained vague, the market interpreted it as a signal of reduced trade war uncertainty. This interpretation led to a rally across various sectors.

Sectors that benefited most included:

- Automakers: Companies like BMW and Volkswagen, heavily reliant on international trade, saw significant gains.

- Technology: Tech firms, particularly those with substantial export operations to the US, experienced a boost in investor confidence.

- Export-Oriented Businesses: Companies across various sectors whose revenue streams depend on exports experienced a rise in their share prices.

Specific examples of stock performance include:

- BMW saw a 3% increase in share price.

- The STOXX 600 index, a benchmark for European large-cap stocks, rose by 1.5%.

This positive reaction stemmed from several factors:

- Reduced Trade War Uncertainty: The ambiguity surrounding future trade policies has been a significant source of volatility for European businesses. Trump's comments, even if imprecise, alleviated some of that uncertainty.

- Potential Increase in Export Demand: A lessening of trade tensions could lead to increased demand for European goods in the US market.

- Increased Investor Confidence: The perception of reduced risk prompted investors to pour more money into European equities.

Keywords: European stock market, tariff reduction, trade war, investor sentiment, stock market rally

LVMH Slump Amidst Broader Market Gains

Headline: LVMH Stock Takes a Hit: Analyzing the Contrasting Performance

While the broader European stock market celebrated, LVMH, the world's largest luxury goods company, experienced a significant downturn. This contrasting performance highlights the complexities of market reactions and the unique vulnerabilities of specific sectors.

Several factors contributed to LVMH's underperformance:

- Geopolitical Concerns: Rising tensions in certain key markets for luxury goods could be impacting investor confidence in the sector.

- Global Economic Slowdown: Fears of a global economic slowdown could reduce consumer spending on luxury items, impacting LVMH's profitability.

- Company-Specific Factors: While not explicitly stated, potential internal company factors like quarterly earnings reports or supply chain issues could also have contributed.

LVMH's recent performance reflects this downturn:

- LVMH share price decreased by 2%.

- Trading volume increased significantly, suggesting heightened market uncertainty surrounding the company's prospects.

LVMH's exposure to specific markets heavily affected by trade disputes adds another layer of complexity. Any potential resolution to these trade disputes could positively impact the company. However, until such resolution is realized, uncertainty remains.

Keywords: LVMH stock price, luxury goods sector, market analysis, economic factors, consumer spending

Market Volatility and Future Outlook

Headline: What Does the Future Hold for European Shares?

The market's reaction to President Trump's comments underscores the inherent volatility of the global stock market, especially in the face of uncertainty regarding trade policies. While the immediate reaction was positive, the long-term outlook remains uncertain.

Potential risks and opportunities for investors include:

- Risk: Continued trade tensions could reverse the current positive market sentiment, leading to renewed volatility.

- Opportunity: If tariff reductions materialize, substantial opportunities may arise for specific sectors, particularly those heavily impacted by previous trade disputes.

Expert opinions vary, but several analysts suggest that the market's reaction is likely a short-term phenomenon. The long-term performance of European shares will depend on various factors including the evolution of US trade policy, global economic growth, and company-specific performance.

Keywords: Market volatility, risk assessment, investment strategy, future market outlook, economic forecast

Conclusion

President Trump's hints regarding tariffs led to a positive impact on European shares overall, yet LVMH experienced a distinct downturn. This highlights the differentiated impact of global economic and political factors on various market segments. The contrast between the broader market's gains and LVMH's losses underscores the importance of conducting thorough due diligence and understanding the unique vulnerabilities of individual companies within a broader market trend. Monitoring global economic and political factors is crucial for making informed investment decisions related to European shares.

Stay informed about the latest developments affecting European shares and the luxury goods sector. Monitor market trends closely to make smart investment decisions. Understanding the interplay between US trade policy, global economic conditions, and the specific circumstances of individual companies is paramount for navigating the complexities of the European share market. Keywords: European shares, stock market analysis, investment strategies, market trends, LVMH

Featured Posts

-

Couple Fights Over Joe Jonas His Classy Response

May 24, 2025

Couple Fights Over Joe Jonas His Classy Response

May 24, 2025 -

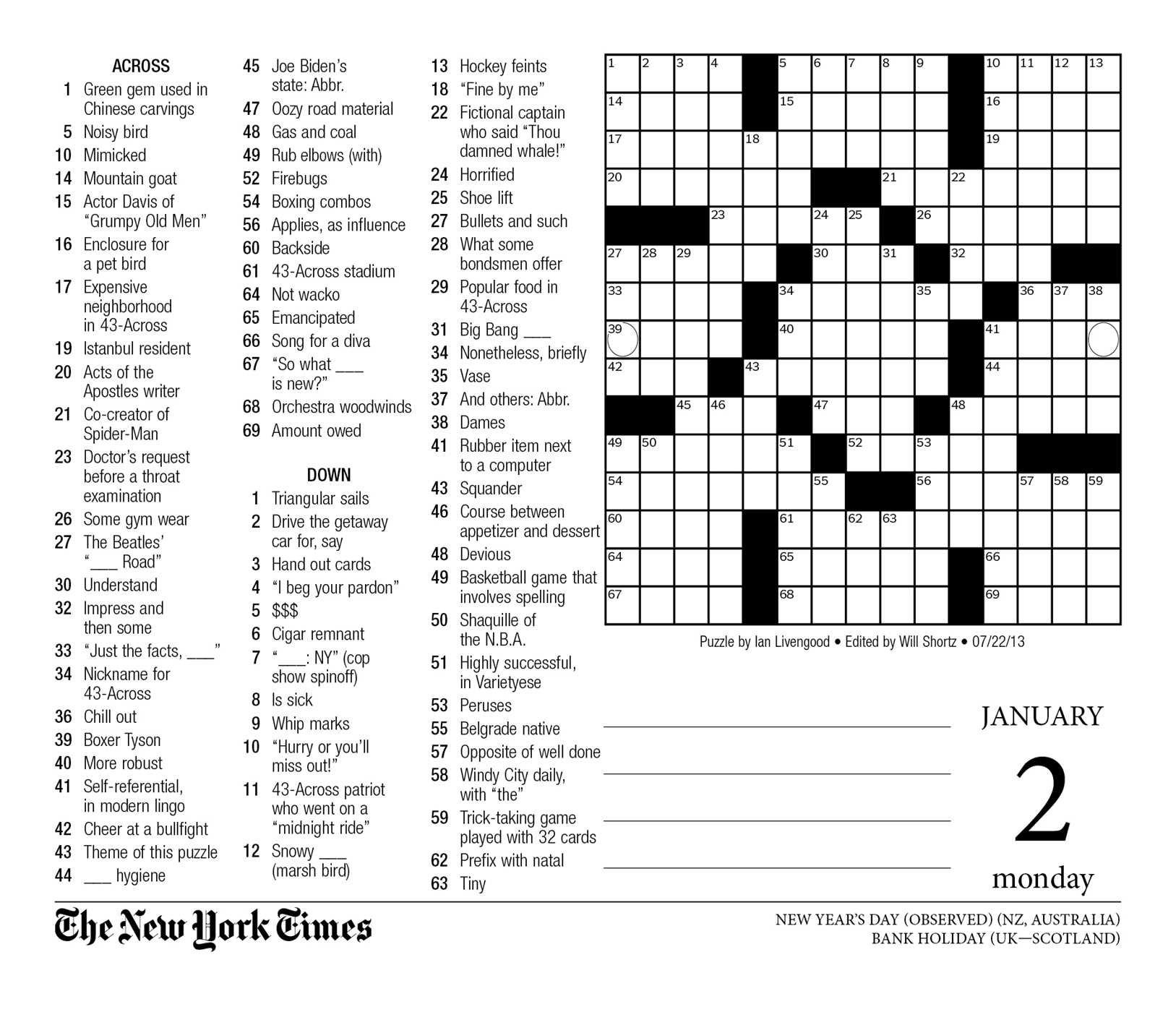

Solve The Nyt Mini Crossword April 6 2025 Complete Guide

May 24, 2025

Solve The Nyt Mini Crossword April 6 2025 Complete Guide

May 24, 2025 -

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025 -

Nyi Rafdrifnir Porsche Macan Hvad T Harftu Ad Vita

May 24, 2025

Nyi Rafdrifnir Porsche Macan Hvad T Harftu Ad Vita

May 24, 2025 -

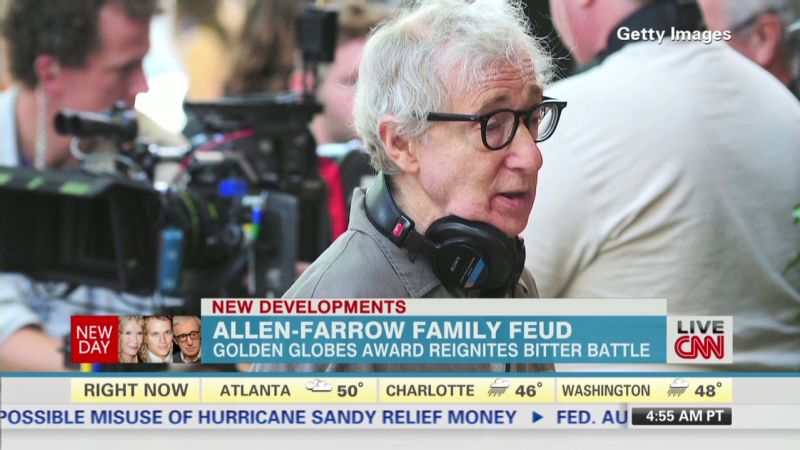

Sean Penns Backing Of Woody Allen Fuels Debate On Past Sexual Abuse Claims

May 24, 2025

Sean Penns Backing Of Woody Allen Fuels Debate On Past Sexual Abuse Claims

May 24, 2025