Falling Iron Ore Prices: China's Steel Industry Response

Table of Contents

Impact of Falling Iron Ore Prices on Chinese Steel Mills

The fluctuating price of iron ore, a fundamental raw material in steel production, directly impacts the profitability and operational strategies of Chinese steel mills. This impact manifests in several key areas:

Reduced Production Costs

Lower iron ore prices translate into significantly reduced production costs for Chinese steel mills. This presents several advantages:

- Increased Profit Margins: Efficient producers can leverage these lower input costs to bolster their profit margins, gaining a competitive edge.

- Enhanced Global Competitiveness: With lower production costs, Chinese steel mills can become more competitive in the global steel market, potentially increasing steel exports.

- Potential for Increased Output: Provided demand remains stable or increases, the lower costs could incentivize higher steel production levels.

These benefits, however, are not uniformly distributed across all steel mills. The ability to capitalize on reduced iron ore prices often hinges on existing operational efficiency and debt levels.

Increased Price Competition

While lower production costs are beneficial, the falling iron ore prices also intensify price competition within China's steel industry.

- Pressure on Steel Prices: Mills compete fiercely to maintain market share, leading to pressure on steel prices.

- Potential for Price Wars: This competition can escalate into price wars, squeezing profit margins, particularly for less-efficient players.

- Need for Strategic Pricing and Differentiation: To survive, steel companies need to implement sophisticated pricing strategies and differentiate their products based on quality, specialized applications, or value-added services. This necessitates a shift away from simple price-based competition.

The resulting market dynamics necessitate strategic adaptation and innovation to maintain profitability.

Financial Implications for Steel Companies

The impact of falling iron ore prices extends beyond immediate production costs and directly impacts the financial health of steel companies.

- Improved Cash Flow: For companies with strong debt management, lower raw material costs lead to improved cash flow, providing more financial flexibility.

- Increased Investment Opportunities: This improved cash flow could be channeled into modernization, upgrading facilities, and implementing efficiency-enhancing technologies.

- Challenges for Highly Indebted Companies: However, companies with high debt levels and low operational efficiency may struggle, facing difficulties in servicing their debts even with lower production costs.

China's Steel Industry Response Strategies

Faced with these challenges, China's steel industry is actively implementing several strategies to adapt and thrive in this volatile market:

Cost Optimization and Efficiency Improvements

A key focus is on maximizing efficiency and minimizing waste at every stage of the production process.

- Operational Efficiency Improvements: Steel mills are implementing lean manufacturing principles, streamlining processes, and reducing downtime to enhance overall operational efficiency.

- Automation and Technological Advancements: The adoption of automation and advanced technologies, such as AI-powered predictive maintenance, reduces labor costs and improves productivity.

- Strategic Raw Material Sourcing: Steel mills are actively seeking out more competitive pricing for raw materials, including iron ore, through strategic sourcing and long-term contracts.

These measures are crucial for maintaining competitiveness amidst fluctuating raw material prices.

Diversification of Steel Products and Markets

To mitigate reliance on a single product or market, Chinese steel companies are diversifying their offerings and expanding their reach.

- Higher-Value Steel Products: The focus is shifting toward producing higher-value steel products with specialized applications, such as advanced high-strength steels for the automotive and construction industries.

- Exploration of New Export Markets: Companies are actively seeking new export markets to reduce dependence on domestic demand and capitalize on global opportunities.

- Development of New Steel Alloys and Processing Techniques: Investment in research and development leads to the creation of new steel alloys and improved processing techniques, enhancing product differentiation and value.

This diversification strategy is key to building resilience against market fluctuations.

Government Policies and Support

The Chinese government plays a significant role in shaping the steel industry's response to fluctuating iron ore prices.

- Market Stabilization Policies: The government may intervene to stabilize the steel market through various policy tools, including price controls or subsidies.

- Stimulating Domestic Demand: Policies aimed at stimulating domestic steel demand, such as infrastructure projects, can help absorb excess capacity and support steel prices.

- Support for R&D and Technological Advancement: Government support for research and development in steel production helps foster innovation and the development of more efficient and sustainable technologies.

Long-Term Outlook for China's Steel Industry

The long-term prospects for China's steel industry are intertwined with the continued impact of global iron ore prices, as well as broader economic and environmental considerations.

Continued Impact of Global Iron Ore Prices

Predicting the future trajectory of iron ore prices remains challenging, making strategic planning crucial for steel mills.

- Uncertainty and Price Volatility: The inherent uncertainty surrounding future iron ore prices necessitates robust strategic planning to manage price volatility effectively.

- Potential for Stabilization or Further Fluctuations: The market may experience long-term price stabilization or further periods of significant price fluctuations, depending on global supply and demand dynamics.

Adaptability and resilience are key to navigating this uncertainty.

Sustainable Development and Environmental Concerns

Growing environmental awareness and stricter regulations are reshaping the steel industry's landscape.

- Sustainable Steel Production: There is a growing emphasis on sustainable steel production practices, including reducing carbon emissions and improving resource efficiency.

- Investment in Clean Technologies: Steel mills are investing in cleaner technologies and emission reduction strategies to meet increasingly stringent environmental regulations.

- Impact on Production Costs and Competitiveness: These investments may impact production costs but are crucial for long-term sustainability and competitiveness.

Conclusion:

The fluctuating prices of iron ore present both challenges and opportunities for China's steel industry. Falling iron ore prices offer the chance to improve profitability and competitiveness; however, the industry must adapt through cost optimization, product diversification, and strategic planning to navigate this volatile market. Understanding the dynamics of falling iron ore prices and their impact on China's steel sector is vital for investors, businesses, and policymakers. To stay informed about the latest developments in this crucial market, continue monitoring news and analysis related to falling iron ore prices and their effects on China's steel industry.

Featured Posts

-

Nyt Strands Game 405 Hints And Solutions For April 12

May 09, 2025

Nyt Strands Game 405 Hints And Solutions For April 12

May 09, 2025 -

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025 -

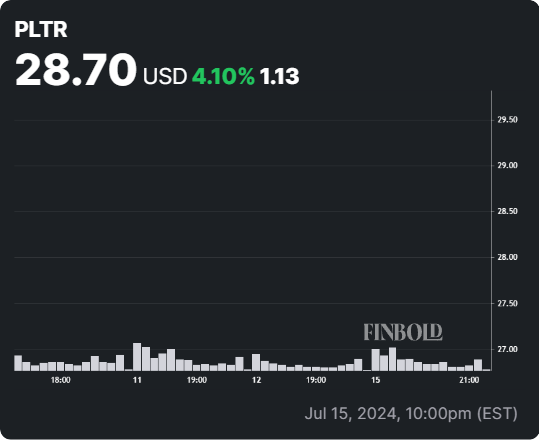

30 Drop For Palantir Time To Invest

May 09, 2025

30 Drop For Palantir Time To Invest

May 09, 2025 -

Expert Claims About Daycare A Critical Examination

May 09, 2025

Expert Claims About Daycare A Critical Examination

May 09, 2025 -

Analysis Williams Reaction To Colapinto Rumors And Doohans Status

May 09, 2025

Analysis Williams Reaction To Colapinto Rumors And Doohans Status

May 09, 2025