Fed Holds Interest Rates: Balancing Inflation And Job Growth Risks

Table of Contents

The Inflationary Landscape: Persistent Pressures and Evolving Trends

Current inflation rates remain a significant concern, despite recent easing in some areas. While headline inflation may show some decline, the underlying pressures persist, making the Fed's task challenging.

- Core inflation remains stubbornly high: Excluding volatile food and energy prices, inflation continues to outpace the Fed's target, indicating broader price pressures.

- Supply chain issues are easing, but price pressures persist: While supply chain disruptions have lessened, their lingering impact contributes to elevated prices for many goods and services.

- Wage growth continues to be a factor: Robust wage growth, while positive for workers, can fuel inflationary pressures if it outpaces productivity gains.

- Energy prices remain volatile: Global geopolitical events and supply constraints continue to impact energy prices, creating further inflationary uncertainty.

The Fed's inflation target is typically around 2%. Current rates, while showing some improvement, are still significantly above this target. Potential inflationary risks include further disruptions to global supply chains, escalating geopolitical tensions, and unexpectedly strong consumer demand. The persistence of these factors necessitates careful monitoring by the Fed.

Job Market Strength: A Double-Edged Sword

The US job market currently boasts historically low unemployment rates and robust job creation. This strength, however, presents a dilemma for the Fed.

- Unemployment rate remains near historic lows: This indicates a tight labor market, with employers competing for a limited pool of workers.

- Strong wage growth, a positive for workers but inflationary pressure: Increased wages, while beneficial for employees, can contribute to a wage-price spiral, where rising wages lead to higher prices, which in turn necessitate further wage increases.

- Potential for labor shortages and their impact on inflation: Labor shortages in certain sectors can drive up wages and prices, adding to inflationary pressures.

This strong job market complicates the Fed's interest rate strategy. Raising rates to combat inflation risks triggering job losses and potentially a recession. The possibility of a wage-price spiral further complicates the situation, demanding a nuanced and cautious approach.

The Fed's Rationale for Holding Rates: A Cautious Approach

The Fed's decision to hold interest rates reflects a deliberate, data-driven strategy.

- Data-dependent approach: Waiting to see the impact of past rate hikes: The Fed is adopting a "wait-and-see" approach, assessing the effects of previous interest rate increases on inflation and economic growth.

- Risk of triggering a recession: Aggressive rate hikes could trigger a recession, leading to job losses and economic hardship.

- Desire to avoid overly aggressive monetary policy: The Fed aims to avoid drastic measures that could destabilize the economy.

- Assessment of future economic indicators: Future interest rate decisions will depend on a range of economic indicators, including inflation data, employment figures, and consumer spending.

A gradual approach to monetary policy is crucial to avoid unintended consequences. Both raising and lowering rates prematurely carry significant risks at this juncture. The Fed seeks to find the optimal balance to achieve price stability without sacrificing substantial economic growth.

The Impact of Geopolitical Factors

Global events significantly influence the inflationary landscape and the Fed's decisions.

- Impact of energy prices on inflation: The war in Ukraine and related sanctions have significantly impacted global energy markets, contributing to higher energy prices and overall inflation.

- Global economic uncertainty and its influence on US markets: Global economic instability and uncertainty influence investor sentiment and can impact US markets.

- Supply chain disruptions and their lasting impact: Ongoing disruptions to global supply chains continue to contribute to price increases for various goods.

Looking Ahead: Future Interest Rate Projections and Economic Outlook

The Fed's future projections for interest rates remain uncertain.

- Potential for future rate hikes depending on economic data: Future rate hikes will likely depend on incoming economic data, particularly inflation and employment figures.

- Market expectations and their influence on financial markets: Market expectations regarding future interest rate changes significantly influence financial markets.

- The ongoing uncertainty surrounding inflation and economic growth: The ongoing uncertainty surrounding inflation and economic growth makes accurate forecasting challenging.

The US economy's outlook in the coming months remains uncertain, with the potential for both positive and negative developments depending on how the various economic factors interplay.

Conclusion

The Fed's decision to hold interest rates demonstrates a cautious balancing act between controlling inflation and maintaining a healthy job market. The ongoing economic uncertainty necessitates a data-dependent approach, with future interest rate decisions contingent on incoming economic indicators and the evolving inflationary environment. The interplay between inflation, employment, and global factors creates significant complexity in Fed interest rate decisions.

Call to Action: Stay informed about the Fed's actions and their impact on the economy by following expert analyses of interest rate decisions and future monetary policy. Understanding the complexities of Fed interest rate decisions is crucial for navigating the current economic environment and making informed financial decisions.

Featured Posts

-

Pam Bondis Plan To Kill American Citizens A Closer Look

May 09, 2025

Pam Bondis Plan To Kill American Citizens A Closer Look

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Injury And Potential Playoff Impact

May 09, 2025

Edmonton Oilers Leon Draisaitl Injury And Potential Playoff Impact

May 09, 2025 -

Plantation De Vignes A Dijon 2500 M Dans Le Secteur Des Valendons

May 09, 2025

Plantation De Vignes A Dijon 2500 M Dans Le Secteur Des Valendons

May 09, 2025 -

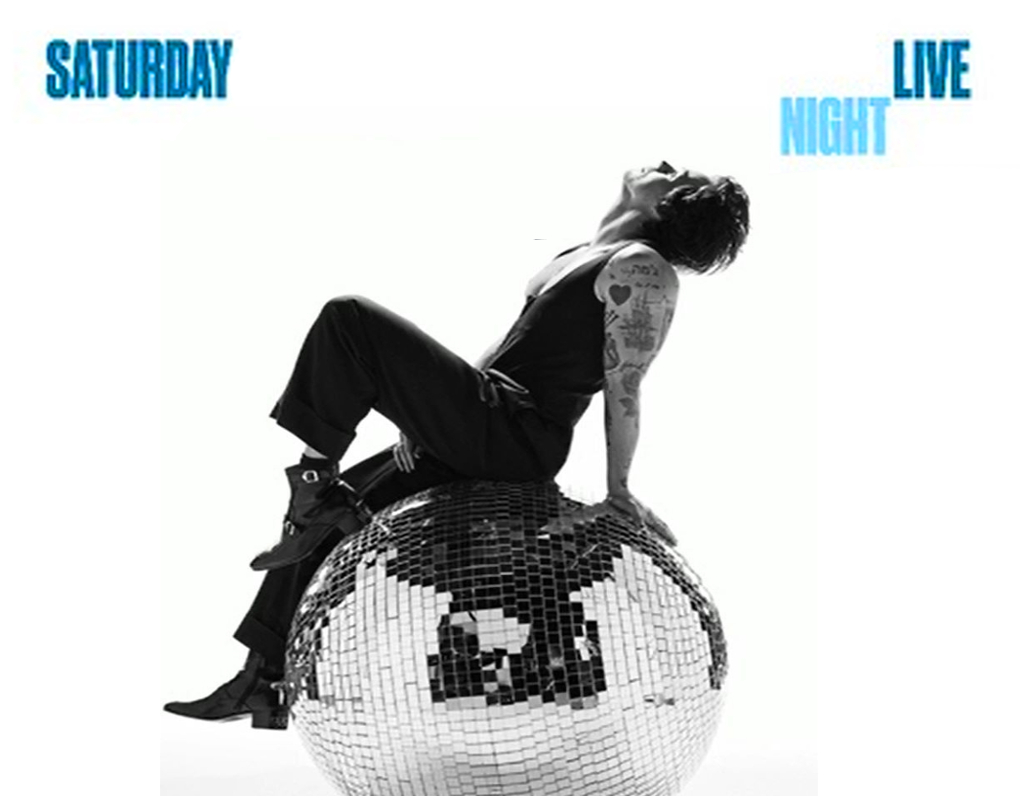

Harry Styles On That Snl Impression His Honest Reaction

May 09, 2025

Harry Styles On That Snl Impression His Honest Reaction

May 09, 2025 -

Police Make Arrest In Elizabeth City Weekend Shooting Incident

May 09, 2025

Police Make Arrest In Elizabeth City Weekend Shooting Incident

May 09, 2025