Final X Debt Sale: Exclusive Insight Into Wall Street Banks' Transactions With Elon Musk

Table of Contents

The Players Involved: Key Wall Street Banks and Their Roles in the Final X Debt Sale

The Final X Debt Sale wasn't a solo act. Several key Wall Street banks played crucial roles, each contributing their expertise to this complex transaction. Understanding their involvement is crucial to grasping the full scope of the deal. These institutions, with their extensive networks and financial prowess, were essential in bringing the sale to fruition.

-

Goldman Sachs: Often acting as the lead underwriter, Goldman Sachs likely played a significant role in structuring the deal, assessing risk, and marketing the debt to investors. Their contribution included setting the terms, managing the process, and potentially taking on a portion of the debt themselves. Potential profit is substantial, considering the scale of the transaction.

-

Morgan Stanley: Morgan Stanley, another major player, might have contributed to syndication efforts, distributing the debt amongst various investors to mitigate risk for any single institution. The potential risks for Morgan Stanley lie in the possibility of unsold portions of the debt or unforeseen challenges in the Musk ventures.

-

Bank of America: Bank of America's involvement might have included providing advisory services, leveraging their extensive network to connect Musk with suitable investors. Their unique contribution might have focused on specific investor relationships critical to the success of the Final X Debt Sale.

The Mechanics of the Final X Debt Sale: Understanding the Transaction Structure

The Final X Debt Sale likely involved a mix of high-yield bonds and term loans, reflecting the high-risk, high-reward nature of Musk's ventures. This sophisticated blend of financing mechanisms ensures sufficient capital while managing the overall risk profile.

-

Interest Rate Specificity: The interest rates offered likely reflected the perceived risk associated with Musk's companies, potentially exceeding market rates to incentivize investment. The exact figures remain undisclosed, adding to the intrigue surrounding the deal.

-

Maturity Date and Refinancing: The maturity date of the debt is a critical factor, determining the timeframe for repayment. Future refinancing will depend on the financial health of Musk's companies and market conditions at that time, posing potential challenges.

-

Significant Covenants: The debt agreement likely includes various covenants, imposing conditions on Musk's companies to safeguard the interests of lenders. These covenants could restrict further debt issuance, impose financial reporting requirements, or limit dividend payouts.

Market Reactions and Analyses: Impact of the Final X Debt Sale on the Financial Markets

The announcement of the Final X Debt Sale sent ripples through the financial markets, triggering a mix of reactions. The impact on investor confidence, and ultimately the value of Musk's companies, is crucial to assess.

-

Stock Market Performance: Following the announcement, the stock prices of Musk's companies experienced volatility, reflecting investor uncertainty about the long-term implications of the significant debt burden. Further analysis is needed to determine the long-term trend.

-

Credit Rating Agency Assessments: Credit rating agencies closely scrutinized the debt sale, assessing its impact on the creditworthiness of Musk's companies. Their ratings will influence future investor decisions and borrowing costs.

-

Expert Opinions: Financial analysts offered diverse opinions, ranging from cautious optimism to concerns about the sustainability of the debt burden. These varied perspectives highlight the complexity of evaluating the deal's overall impact.

Potential Risks and Rewards: Assessing the Long-Term Implications of the Final X Debt Sale

While the Final X Debt Sale offers immediate financial relief, enabling expansion and innovation, it also presents significant long-term risks. Balancing these factors is crucial for understanding the deal's overall success.

-

Meeting Debt Obligations: Meeting the debt obligations presents a key challenge, especially in the face of unforeseen economic downturns or setbacks in Musk's ventures. A potential default would have severe repercussions.

-

Expansion and Innovation: The infusion of capital creates opportunities for significant expansion and innovation across Musk's ventures, potentially generating substantial long-term growth.

-

Future Fundraising: The success or failure of the Final X Debt Sale will significantly impact Musk's ability to secure future funding, influencing his access to capital for future projects.

Decoding the Final X Debt Sale: A Look Ahead

The Final X Debt Sale represents a pivotal moment in the financial landscape surrounding Elon Musk's empire. It involved key Wall Street banks, employed a complex financial structure, triggered market reactions, and presents both significant risks and rewards. Understanding its intricacies is vital for investors and market observers. To stay informed about future developments related to the Final X Debt Sale and Elon Musk's financial activities, subscribe to our newsletter or follow us on social media. Further research into "Elon Musk debt financing strategies" or "high-yield debt market analysis" will provide deeper insights into this fascinating and complex financial saga.

Featured Posts

-

Royals Defeat Guardians 4 3 Garcia Homer And Witts Game Winning Hit

Apr 30, 2025

Royals Defeat Guardians 4 3 Garcia Homer And Witts Game Winning Hit

Apr 30, 2025 -

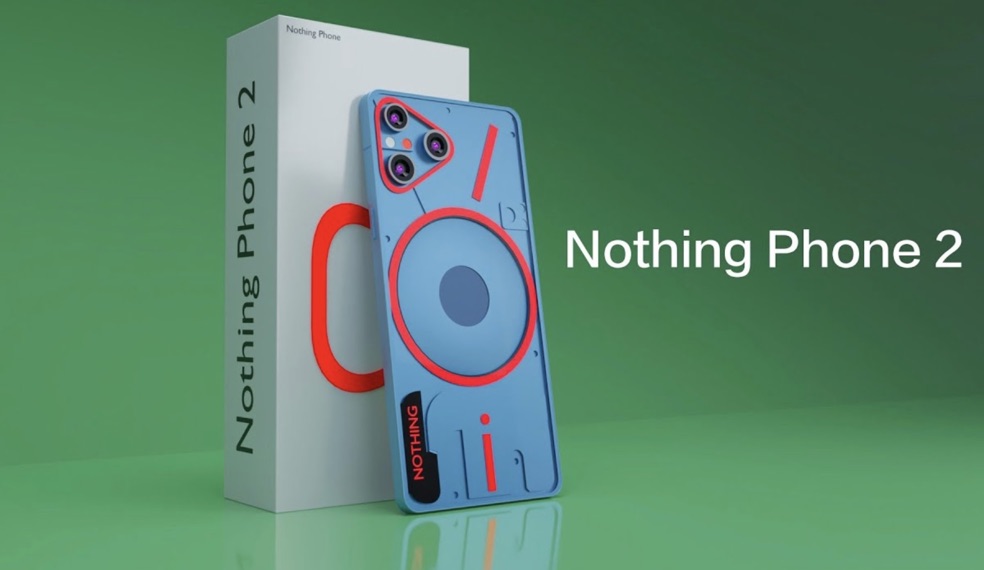

The Nothing Phone 2 Modular Design And Its Implications

Apr 30, 2025

The Nothing Phone 2 Modular Design And Its Implications

Apr 30, 2025 -

A Day In The Life Our Farm Next Door With Amanda Clive And Kids

Apr 30, 2025

A Day In The Life Our Farm Next Door With Amanda Clive And Kids

Apr 30, 2025 -

Documentario Exibe Festas Luxuosas De P Diddy Trump Beyonce E Jay Z Entre Os Convidados

Apr 30, 2025

Documentario Exibe Festas Luxuosas De P Diddy Trump Beyonce E Jay Z Entre Os Convidados

Apr 30, 2025 -

Where To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free No Cable

Apr 30, 2025

Where To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free No Cable

Apr 30, 2025

Latest Posts

-

Kawhi Leonard And The Clippers Dominant Victory Over The Cavaliers

Apr 30, 2025

Kawhi Leonard And The Clippers Dominant Victory Over The Cavaliers

Apr 30, 2025 -

Hunters 32 Point Performance Secures Cavaliers 50th Win

Apr 30, 2025

Hunters 32 Point Performance Secures Cavaliers 50th Win

Apr 30, 2025 -

Cavaliers Defeat Blazers In Overtime Hunter Leads With 32 Points

Apr 30, 2025

Cavaliers Defeat Blazers In Overtime Hunter Leads With 32 Points

Apr 30, 2025 -

Hunters 32 Points Power Cavaliers To 10th Straight Win

Apr 30, 2025

Hunters 32 Points Power Cavaliers To 10th Straight Win

Apr 30, 2025 -

10 Game Winning Streak For Cavaliers De Andre Hunters Key Role In Victory

Apr 30, 2025

10 Game Winning Streak For Cavaliers De Andre Hunters Key Role In Victory

Apr 30, 2025