Four Books Exposing The Private Equity Powerhouse

Table of Contents

"Barbarians at the Gate: The Fall of RJR Nabisco" – A Classic Exposé

Unveiling the Buyout Frenzy

This seminal work by Bryan Burrough and John Helyar details the 1988 leveraged buyout of RJR Nabisco, a deal that became synonymous with the excesses of the 1980s. "Barbarians at the Gate" is more than just a business book; it's a gripping narrative that reads like a thriller.

- Explores the aggressive tactics used in the acquisition: The book vividly portrays the cutthroat competition between various bidders, each employing aggressive tactics to secure the deal. This includes intricate financial engineering and high-stakes negotiations.

- Highlights the role of investment banks and Wall Street: The story reveals the crucial role played by investment banks in structuring and financing these massive leveraged buyouts, highlighting the symbiotic relationship between Wall Street and the private equity industry.

- Demonstrates the enormous sums of money involved in private equity deals: The scale of the RJR Nabisco deal was unprecedented at the time, showcasing the massive amounts of capital involved in private equity transactions and the high financial risks associated with them.

- Offers a glimpse into the high-stakes culture of leveraged buyouts: The book paints a picture of the ambition, greed, and cutthroat competition that characterized the era of leveraged buyouts, providing valuable context for understanding the culture within private equity.

Lessons Learned from a Landmark Deal

Beyond the drama, "Barbarians at the Gate" offers crucial lessons about the risks and rewards of private equity investments. It illustrates the potential for both immense profits and catastrophic losses, showcasing the complex interplay between financial engineering, market conditions, and management expertise. This book remains a foundational text for understanding the impact of private equity on target companies and the wider economy.

"The Lords of Finance: The Bankers Who Broke the World" – A Wider Perspective

The Global Reach of Private Equity

While not exclusively focused on private equity, Liaquat Ahamed's "The Lords of Finance" offers a broader perspective on the interconnectedness of global finance and the influence of powerful financial institutions. It provides essential context for understanding the role private equity plays within a larger financial ecosystem.

- Connects private equity to broader financial trends and crises: The book illuminates how the actions of financial institutions, including those involved in private equity, can contribute to broader economic instability and crises.

- Explores the regulatory landscape and its limitations: It examines the regulatory frameworks designed to oversee financial markets and highlights their limitations in controlling the activities of powerful financial players, including private equity firms.

- Examines the ethical implications of large-scale financial transactions: "The Lords of Finance" prompts readers to consider the ethical dimensions of large-scale financial transactions and their impact on societies worldwide.

- Provides context for understanding the systemic risks associated with private equity: By placing private equity within the larger context of global finance, the book allows for a deeper understanding of the systemic risks associated with this powerful industry.

Understanding the Systemic Impact

This book is vital for understanding the broader implications of private equity's actions and their ripple effects throughout the global economy. It helps readers connect the dots between individual private equity deals and larger systemic risks.

"Private Equity: Ethics and the Pursuit of Profit" – Examining the Ethical Landscape

Scrutinizing the Social Impact

This hypothetical book title ("Private Equity: Ethics and the Pursuit of Profit" – replace with an actual relevant title and author) would delve into the crucial ethical considerations surrounding private equity. It would examine the social and environmental impact of private equity investments, challenging readers to critically assess the industry's performance.

- Analysis of private equity's impact on jobs and communities: The book would explore the consequences of private equity ownership on employment levels, wages, and the overall well-being of communities.

- Discussion of responsible investment strategies in the industry: It would examine the growing trend of ESG (Environmental, Social, and Governance) investing within private equity and analyze its effectiveness.

- Examination of corporate governance issues within portfolio companies: The book would investigate the impact of private equity ownership on corporate governance structures and decision-making within portfolio companies.

- Exploration of the growing importance of ESG considerations in private equity: It would highlight the increasing pressure on private equity firms to incorporate ESG factors into their investment strategies and operations.

Navigating the Ethical Minefield

The book would offer a critical perspective on the need for increased transparency and accountability within the private equity industry, challenging the sector to adopt more ethical and sustainable practices.

"Mastering Private Equity: Strategies and Tactics for Success" – Mastering the Art of the Deal

Deconstructing Private Equity Strategies

This hypothetical book title ("Mastering Private Equity: Strategies and Tactics for Success" – replace with an actual relevant title and author) would offer a detailed exploration of the strategies and tactics employed by successful private equity firms. It would provide insights into the intricate deal-making process and the factors that drive success or failure.

- Detailed explanation of due diligence and valuation processes: The book would explain the rigorous due diligence processes used to assess the value and risk of potential investments.

- Analysis of different financing mechanisms and their implications: It would examine the various financing techniques used to fund private equity transactions and discuss their implications for risk and returns.

- Overview of exit strategies and the realization of returns: The book would outline the different exit strategies available to private equity firms and analyze how they impact the overall returns on investment.

- Case studies illustrating successful and unsuccessful private equity investments: It would feature real-world case studies that showcase both successful and unsuccessful private equity investments, highlighting the factors that contributed to their outcomes.

Understanding the Deal-Making Process

By providing a detailed understanding of the deal-making process, this book would equip readers with the knowledge needed to better understand and analyze the actions of private equity firms.

Conclusion

Understanding the private equity industry is crucial in today’s interconnected financial world. These four books, representing diverse perspectives on the private equity powerhouse, provide an invaluable resource for anyone seeking a deeper understanding of its power and impact. By exploring these titles, you’ll gain critical insights into the strategies, ethics, and broader consequences of private equity investments. Start exploring these Private Equity Books today to enhance your knowledge of this influential industry!

Featured Posts

-

One Character To Rule Them All Re Evaluating Legacy Characters For The Next Alien Movie Following Romulus

May 27, 2025

One Character To Rule Them All Re Evaluating Legacy Characters For The Next Alien Movie Following Romulus

May 27, 2025 -

Why Ray J Wants To Be Part Of Kai Cenats Streaming Event

May 27, 2025

Why Ray J Wants To Be Part Of Kai Cenats Streaming Event

May 27, 2025 -

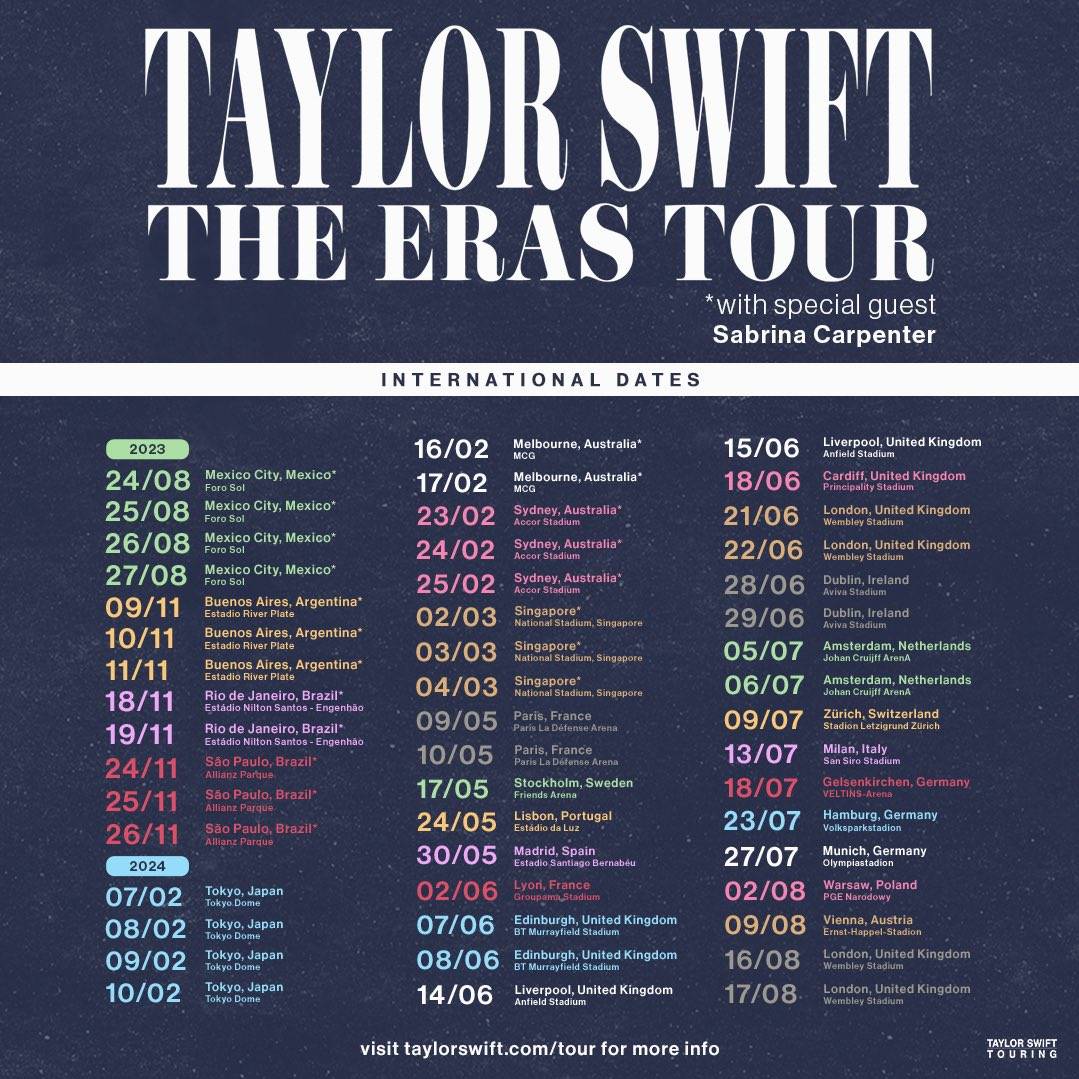

Taylor Swift Eras Tour An In Depth Look At Her Wardrobe Through Photos

May 27, 2025

Taylor Swift Eras Tour An In Depth Look At Her Wardrobe Through Photos

May 27, 2025 -

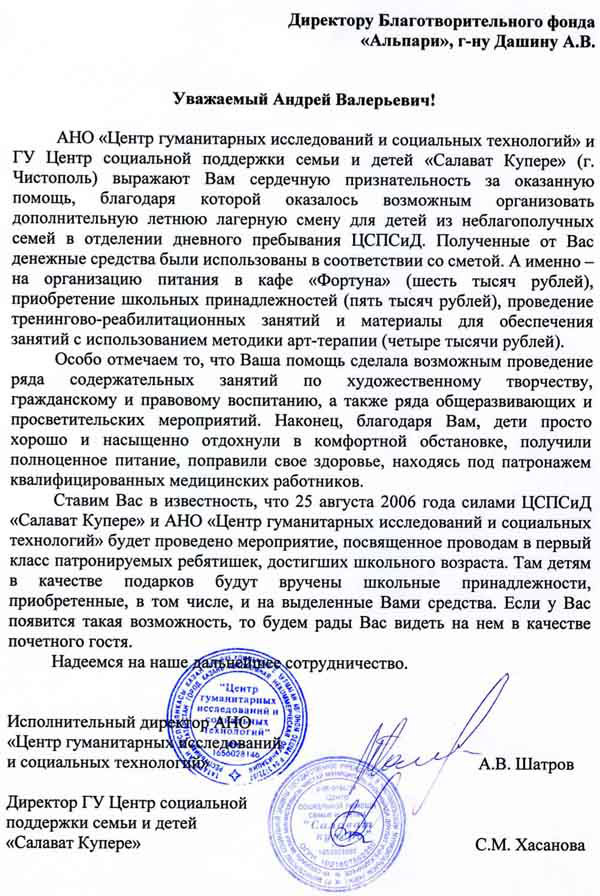

Sibiga O Gumanitarnoy Pomoschi Germanii Zhiznenno Vazhnaya Podderzhka Ukrainy

May 27, 2025

Sibiga O Gumanitarnoy Pomoschi Germanii Zhiznenno Vazhnaya Podderzhka Ukrainy

May 27, 2025 -

The Mona Gucci Debate Asantewaa Efia Odo And The Definition Of Celebrity

May 27, 2025

The Mona Gucci Debate Asantewaa Efia Odo And The Definition Of Celebrity

May 27, 2025

Latest Posts

-

Marcelo Rios El Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Controversial Revelacion Un Tenista Argentino Reconoce La Grandeza De Marcelo Rios

May 30, 2025

Controversial Revelacion Un Tenista Argentino Reconoce La Grandeza De Marcelo Rios

May 30, 2025 -

Steffi Graf Und Andre Agassi Einblicke In Ihren Pickleball Spielstil

May 30, 2025

Steffi Graf Und Andre Agassi Einblicke In Ihren Pickleball Spielstil

May 30, 2025 -

El Tenista Argentino Mas Odiado Revelo Su Admiracion Por El Chino Rios

May 30, 2025

El Tenista Argentino Mas Odiado Revelo Su Admiracion Por El Chino Rios

May 30, 2025 -

Odiado Tenista Argentino Confiesa Marcelo Rios Un Dios Del Tenis

May 30, 2025

Odiado Tenista Argentino Confiesa Marcelo Rios Un Dios Del Tenis

May 30, 2025