Frankfurt Stock Market Report: DAX Underperforms, Closes Below 24,000

Table of Contents

DAX Index Performance Analysis

Today's trading session saw a considerable decline in the DAX, Germany's leading stock market index. Let's break down the day's performance:

- Opening: (Insert Opening Value)

- Closing: (Insert Closing Value) – a significant drop below the 24,000 threshold.

- High: (Insert High Value)

- Low: (Insert Low Value)

- Percentage Change: (Insert Percentage Drop) – This represents a considerable daily loss and a departure from recent trends.

Compared to yesterday's closing value, the DAX experienced a (Insert Percentage) drop. This performance contrasts with other major European indices. While the (Insert Comparison to CAC 40, e.g., CAC 40 showed a more modest decline), the (Insert Comparison to FTSE 100, e.g., FTSE 100 experienced a similar downturn). This suggests that the DAX's underperformance might be linked to specific German market factors rather than a purely pan-European trend. Analyzing the weekly and monthly trends will provide further context to understand if this is a short-term fluctuation or a more significant shift.

Factors Contributing to DAX Underperformance

Several interconnected factors likely contributed to the DAX's disappointing performance:

-

Macroeconomic Headwinds: The global economy faces significant challenges.

- Inflation Concerns: Persistent inflation continues to erode consumer spending power and impact corporate profitability, leading to investor apprehension.

- Rising Interest Rates: Central banks' efforts to curb inflation through interest rate hikes increase borrowing costs for businesses, potentially hindering investment and growth. This is particularly relevant for debt-heavy sectors within the DAX.

- Geopolitical Risks: Ongoing geopolitical uncertainties, including (mention specific events like the war in Ukraine or other relevant geopolitical tensions), create market instability and negatively impact investor confidence.

-

Sector-Specific Performance: The DAX's composition reveals a mixed bag of sector performances. While (mention a performing sector, e.g., the energy sector benefited from high commodity prices), the (mention underperforming sectors, e.g., technology and automotive sectors) experienced significant setbacks. This suggests that sector-specific issues are playing a role in the overall index performance.

-

Company-Specific News: (Mention specific companies whose negative news or poor earnings reports may have significantly affected the index. Provide details and links if available.) Negative news regarding these key players likely contributed to the overall negative sentiment.

-

Global Market Influences: The DAX is not immune to global market trends. A decline in the US markets, often a leading indicator, may have exerted downward pressure on the DAX.

Investor Sentiment and Market Volatility

Today's trading volume (Insert trading volume data and compare to recent averages) suggests a heightened level of market activity, reflecting investor concern. The volatility (mention relevant volatility index, if available, and its levels) indicates significant uncertainty in the market. Analyst sentiment is currently (mention whether it’s bearish or cautious, and cite sources if available). Many analysts are (mention their predictions for the coming weeks – bullish, bearish, or neutral).

Potential Implications and Future Outlook for the Frankfurt Stock Market

The DAX's underperformance has several potential implications:

- Impact on the German Economy: A sustained decline in the DAX could negatively impact investor confidence, reduce investment, and hinder economic growth in Germany.

- Investor Reactions and Strategies: Investors might adopt defensive strategies, shifting towards safer assets like bonds, or seek opportunities in other, more resilient markets.

- Near-Future DAX Forecast: The short-term outlook for the DAX remains uncertain. Recovery hinges on addressing macroeconomic headwinds, improving company-specific performances, and a stabilization of global markets.

Conclusion: Frankfurt Stock Market Report: DAX Underperformance and Next Steps

This Frankfurt Stock Market report highlighted the DAX's significant underperformance, closing below 24,000, driven by a confluence of macroeconomic factors, sector-specific challenges, and global market influences. Monitoring the Frankfurt Stock Market and the DAX index remains crucial for investors and economic analysts. Stay informed about future developments by regularly consulting our site for updated Frankfurt Stock Market reports and in-depth DAX analysis. [Link to relevant resources/further analysis]. Understanding the intricacies of the Frankfurt Stock Market and the DAX is paramount for navigating the complexities of the German and European economies.

Featured Posts

-

Trade War Intensifies Another Day Of Losses For Dutch Stocks

May 25, 2025

Trade War Intensifies Another Day Of Losses For Dutch Stocks

May 25, 2025 -

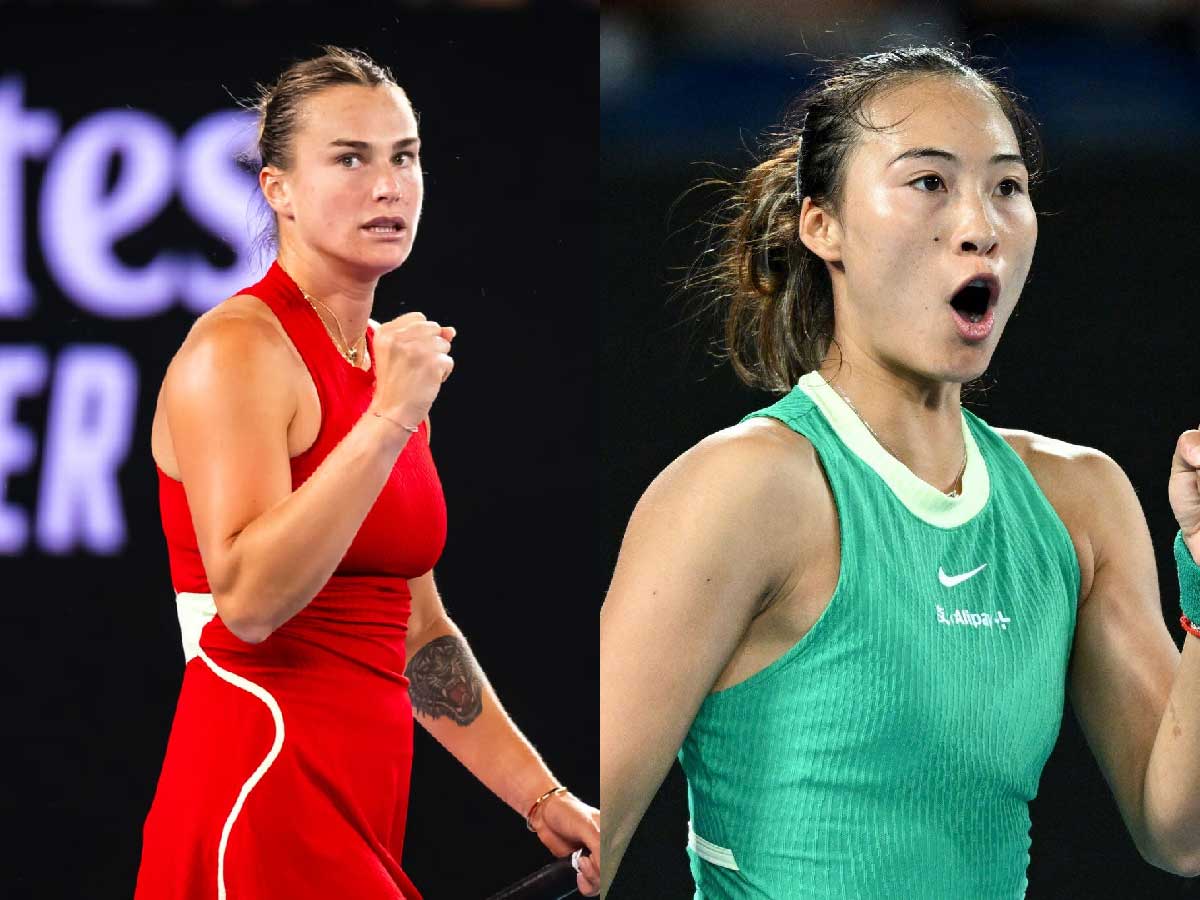

Zheng Qinwen Triumphs Over Sabalenka In Italian Open Quarterfinals

May 25, 2025

Zheng Qinwen Triumphs Over Sabalenka In Italian Open Quarterfinals

May 25, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Intensifying Trade War Concerns

May 25, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Intensifying Trade War Concerns

May 25, 2025 -

Sexisme Et Medias L Aveu De Laurent Baffie Et Ses Repercussions Sur Thierry Ardisson

May 25, 2025

Sexisme Et Medias L Aveu De Laurent Baffie Et Ses Repercussions Sur Thierry Ardisson

May 25, 2025 -

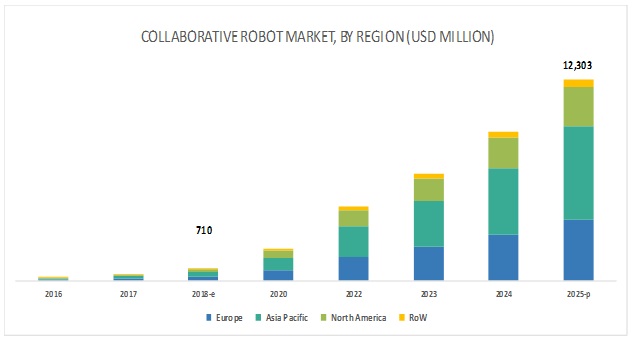

Bangladeshs European Market Return A Strategy For Collaborative Growth

May 25, 2025

Bangladeshs European Market Return A Strategy For Collaborative Growth

May 25, 2025