Global Oil Supply: Big Oil's Resistance Before OPEC+ Announcement

Table of Contents

Big Oil's Production Hesitations

Big Oil's reluctance to ramp up production is a complex issue driven by several key factors.

Profit Maximization Strategies

Current oil prices are incredibly lucrative for major producers. This high-profit environment incentivizes them to maintain existing production levels rather than increasing supply, potentially driving prices even higher.

- Record Profit Margins: Many major oil companies have reported record-breaking profits in recent quarters, fueled by elevated oil prices. This naturally encourages a focus on maximizing shareholder returns through dividends and stock buybacks rather than investing heavily in increased production capacity.

- Shareholder Pressure: Shareholders are often more concerned with immediate returns than long-term growth strategies. Increased production, especially with the uncertainty surrounding the transition to renewable energy, might not be viewed favorably by investors prioritizing short-term profits.

- Diversification into Renewables: Major oil companies are increasingly investing in renewable energy sources, shifting their focus away from solely maximizing fossil fuel production. This strategic diversification may reduce their incentive to increase oil output.

- Supply Discipline: The concept of “supply discipline” suggests that limiting supply can artificially inflate prices, leading to higher profits. Some argue this strategy is at play within Big Oil's production decisions.

Investment Challenges & Uncertainty

Increasing oil production is a capital-intensive undertaking fraught with challenges and uncertainties.

- High Exploration and Production Costs: Finding, extracting, and processing oil requires massive upfront investment, especially in challenging environments like deepwater drilling or remote locations. The return on investment (ROI) might not be attractive enough to justify increased production, given the uncertainties of future demand.

- Geopolitical Instability: Oil production is inherently vulnerable to geopolitical risks. Conflicts, sanctions, and political instability in key oil-producing regions can significantly impact production and investment decisions.

- Environmental Regulations: Stringent environmental regulations, designed to mitigate the impact of oil production on climate change, add significant costs and complexities, potentially deterring increased production.

- Cancelled Projects: Several major oil projects have been delayed or cancelled in recent years due to a combination of factors, including cost overruns, environmental concerns, and shifting market demand. These decisions highlight the challenges and risks involved in expanding oil production capacity.

OPEC+ and the Geopolitical Landscape

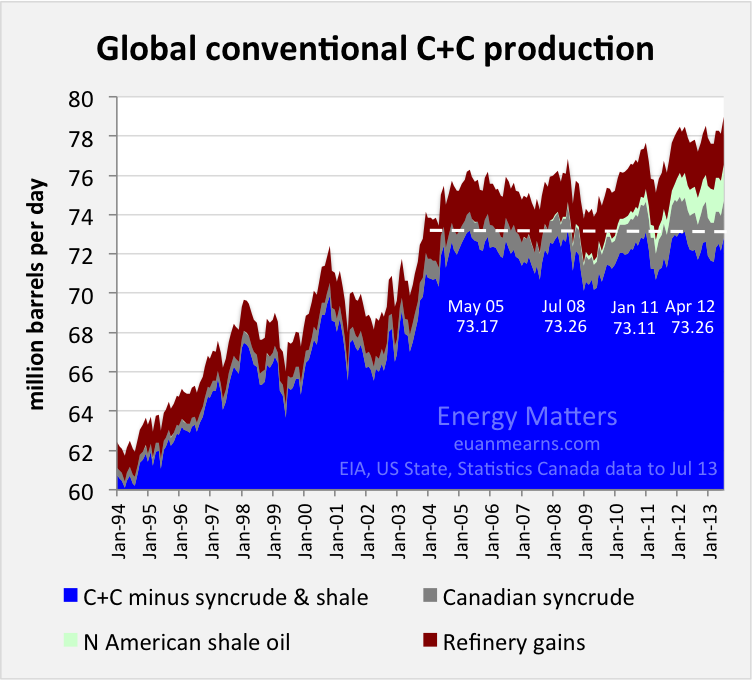

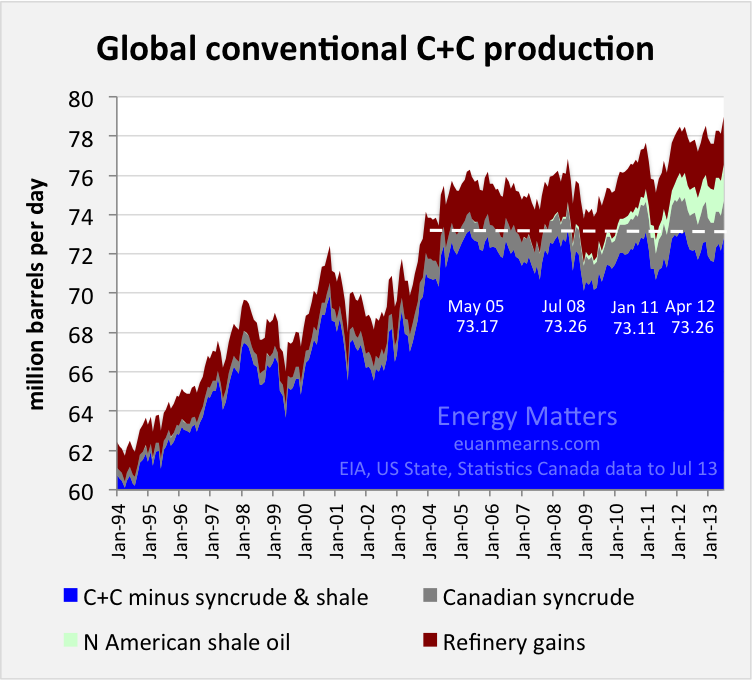

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) play a crucial role in shaping global oil supply.

OPEC+'s Role in Global Oil Supply

OPEC+ is a powerful cartel that significantly influences global oil prices through its production quotas. Its decisions collectively affect the overall supply available in the market.

- Key Member Countries: Major oil producers like Saudi Arabia, Russia, and others hold considerable sway in determining production levels.

- Historical Production Decisions: OPEC+'s history includes periods of both production cuts and increases, often reacting to global economic conditions and geopolitical events.

- Geopolitical Dynamics: The geopolitical relationships between OPEC+ member countries and other global actors significantly impact the cartel's decisions and the overall stability of the oil market.

Tensions Between Big Oil and OPEC+

A potential conflict of interest exists between Big Oil's profit-driven production decisions and OPEC+'s goal of stabilizing the market.

- Disagreements in Past Meetings: There have been instances of disagreements between OPEC+ member countries and individual oil companies regarding production levels and pricing strategies.

- Differing Perspectives on Future Demand: Big Oil and OPEC+ may hold differing views on the future demand for oil, influencing their respective production strategies.

- Potential for Price Volatility: The interplay between Big Oil's independent actions and OPEC+'s collective decisions can lead to significant price volatility, creating uncertainty in the market.

The Impact on Consumers and the Global Economy

The interplay between Big Oil's hesitations and OPEC+'s decisions has far-reaching consequences.

High Oil Prices and Inflation

The combined effect of limited oil supply and strong demand leads to higher oil prices, contributing to inflation and impacting global economic growth.

- Industries Reliant on Oil: Numerous industries, including transportation, manufacturing, and agriculture, are heavily reliant on oil, making them vulnerable to price hikes.

- Cascading Effect of High Energy Costs: Increased energy costs filter through the economy, impacting consumer spending, production costs, and overall economic activity.

- Potential for Economic Recession: Persistently high oil prices can dampen economic growth and potentially contribute to a global recession.

Alternative Energy Sources and Transition

The growing importance of renewable energy sources is influencing the long-term demand for oil, impacting Big Oil's investment strategies.

- Investments in Renewables: Many major oil companies are investing in renewable energy technologies to diversify their portfolios and adapt to the changing energy landscape.

- Government Policies Supporting Renewable Energy: Government policies worldwide are increasingly incentivizing the transition to renewable energy, further reducing the long-term demand for oil.

- Potential for Disruption in the Oil Market: The ongoing shift toward renewable energy has the potential to significantly disrupt the traditional oil market, impacting production levels and investment decisions.

Conclusion: Understanding Global Oil Supply Dynamics

In conclusion, Big Oil's reluctance to increase production, driven by profit maximization strategies and various investment challenges, coupled with the complex dynamics of OPEC+, significantly impacts global oil supply. This interplay has profound consequences for consumer prices, inflation, and overall economic stability. Understanding this relationship is crucial for navigating the evolving energy landscape. To stay informed, keep an eye on upcoming OPEC+ announcements, follow oil price forecasts, and research the ongoing renewable energy transition. Understanding the dynamics of global oil supply is not just important for industry experts, it's vital for anyone concerned about the future of the global economy.

Featured Posts

-

Predicting Ufc Fight Night Sandhagen Vs Figueiredo A Detailed Preview

May 05, 2025

Predicting Ufc Fight Night Sandhagen Vs Figueiredo A Detailed Preview

May 05, 2025 -

Report Bianca Censori Facing Difficulties In Divorce From Kanye West

May 05, 2025

Report Bianca Censori Facing Difficulties In Divorce From Kanye West

May 05, 2025 -

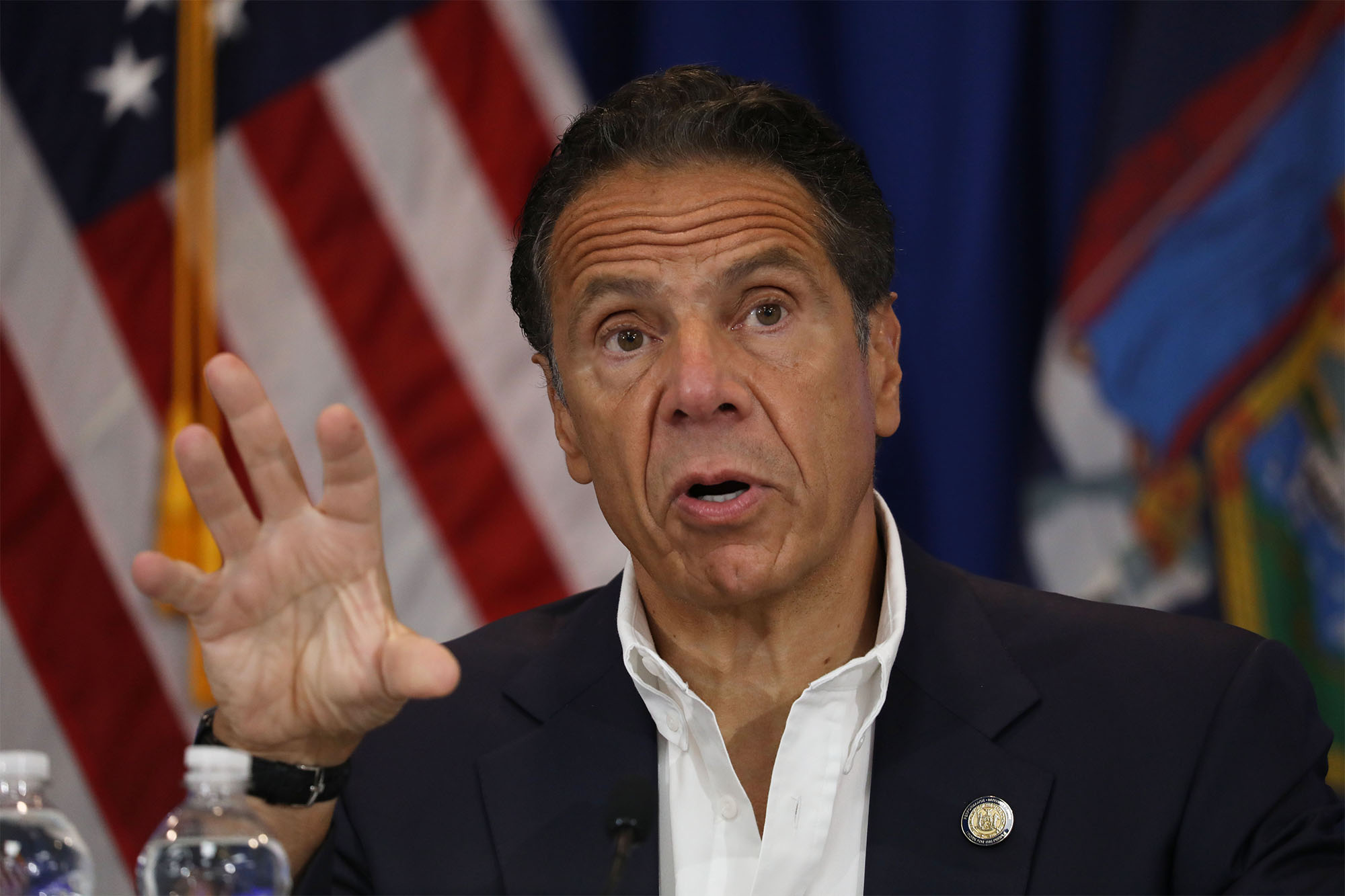

Andrew Cuomos Undisclosed Nuclear Startup Stock Options A 3 Million Investment

May 05, 2025

Andrew Cuomos Undisclosed Nuclear Startup Stock Options A 3 Million Investment

May 05, 2025 -

Seagrass Planting Bids Restoring Scotlands Coastline

May 05, 2025

Seagrass Planting Bids Restoring Scotlands Coastline

May 05, 2025 -

One Last Fight Ufc Legend Returns To Octagon On May 3rd

May 05, 2025

One Last Fight Ufc Legend Returns To Octagon On May 3rd

May 05, 2025

Latest Posts

-

Verstappens First Child Arrives Name Unveiled Before Miami Grand Prix

May 05, 2025

Verstappens First Child Arrives Name Unveiled Before Miami Grand Prix

May 05, 2025 -

Max Verstappen Welcomes Baby Name Announced Ahead Of Miami F1 Race

May 05, 2025

Max Verstappen Welcomes Baby Name Announced Ahead Of Miami F1 Race

May 05, 2025 -

September Showdown Canelos Size Advantage Against Crawford

May 05, 2025

September Showdown Canelos Size Advantage Against Crawford

May 05, 2025 -

Alvarez Vs Crawford Size Difference Could Decide September Bout

May 05, 2025

Alvarez Vs Crawford Size Difference Could Decide September Bout

May 05, 2025 -

Max Verstappen And Partner Welcome First Child Babys Name Revealed Before Miami Grand Prix

May 05, 2025

Max Verstappen And Partner Welcome First Child Babys Name Revealed Before Miami Grand Prix

May 05, 2025