Global Risk Rally: Stocks Surge On U.S.-China Trade Deal

Table of Contents

Market Reactions to the Trade Deal

The positive news surrounding the US-China trade deal sent shockwaves through global markets, triggering a significant risk-on sentiment.

Stock Market Gains

Major global stock indices experienced substantial gains in the immediate aftermath of the announcement. The Dow Jones Industrial Average surged by X%, the S&P 500 climbed Y%, and the Nasdaq Composite soared by Z%. Similarly, the FTSE 100 in the UK and the Shanghai Composite in China saw impressive increases. This widespread upward trend reflects a broad-based increase in investor confidence.

- Tech giants: Companies like Apple, Microsoft, and Intel saw significant gains, benefiting from reduced tariffs on imported components and increased access to the Chinese market.

- Manufacturing and export-oriented firms: Businesses heavily reliant on international trade also experienced substantial stock price increases, reflecting the easing of trade restrictions.

- Trading volume spiked significantly across major exchanges, indicating a surge in investor activity driven by the positive news and the associated reduction in perceived risk.

Currency Movements

The trade deal also influenced currency markets. The US dollar (USD) initially strengthened against the Chinese yuan (CNY), reflecting increased investor confidence in the US economy. However, the Euro (EUR) also experienced some appreciation against the USD, suggesting a broader positive impact on global economic sentiment.

- USD/CNY: The USD/CNY exchange rate saw a fluctuation of approximately X%, reflecting the complexities of the immediate market response.

- EUR/USD: The EUR/USD pair experienced a Y% increase, indicating a positive outlook for the European economy as well.

Commodity Prices

The impact on commodity markets was mixed. Oil prices generally rose, reflecting expectations of increased global economic activity and demand. However, gold, often considered a safe-haven asset, saw a slight dip as investors shifted their focus toward riskier assets.

- Crude Oil: Oil prices increased by X% on increased demand forecasts.

- Gold: Gold prices decreased slightly by Y%, reflecting the reduced risk aversion in the market.

Economic Implications of the Reduced Trade Tensions

The reduction in trade tensions between the US and China is expected to have significant positive economic consequences globally.

Global Growth Projections

Reputable economic organizations have already revised their global growth projections upward in response to the deal.

- IMF: The International Monetary Fund (IMF) is expected to increase its global growth forecast by approximately X% for the next year.

- World Bank: The World Bank has similarly projected a positive impact on global growth, citing improved trade and investment flows.

Supply Chain Impacts

The agreement is poised to improve supply chain efficiency and reduce disruptions caused by tariffs and trade barriers.

- Manufacturing: The manufacturing sector is projected to benefit greatly from the smoother flow of goods and reduced production costs.

- Technology: The technology sector, reliant on global supply chains, will also see improvements in efficiency and cost reduction.

Consumer Confidence

The improved economic outlook is likely to boost consumer confidence and spending.

- Increased consumer spending: Consumers are likely to feel more secure and increase spending, leading to economic growth across multiple sectors.

- Positive ripple effect: This increased spending will further stimulate economic activity and create a positive feedback loop.

Risks and Uncertainties Remaining

While the trade deal marks a significant step forward, certain risks and uncertainties remain.

Potential for Future Disputes

Despite the current agreement, the potential for future trade disagreements remains. Specific areas of ongoing concern could lead to further negotiations or even renewed tensions.

- Intellectual Property Rights: Continued disputes over intellectual property rights could re-ignite tensions.

- Technology Transfer: The issue of technology transfer and forced technology sharing remains a potential point of conflict.

Geopolitical Risks

Other geopolitical factors could still impact market sentiment, potentially overshadowing the positive effects of the trade deal.

- Political Instability: Political instability in various regions could negatively affect investor confidence and global economic growth.

- Regional Conflicts: Escalating regional conflicts could also negatively impact markets and investor sentiment.

Economic Volatility

The market's positive reaction could be short-lived, and further economic fluctuations are possible.

- Market Corrections: Unexpected economic downturns or geopolitical events could trigger market corrections.

- Unforeseen Circumstances: Unforeseen circumstances and shifts in global economic conditions could also significantly influence market performance.

Conclusion

The Global Risk Rally triggered by the US-China trade deal represents a significant shift in market sentiment. Stock markets surged, currencies fluctuated, and commodity prices adjusted, all reflecting increased investor confidence and reduced risk aversion. The deal's positive economic implications are substantial, promising improved global growth, enhanced supply chain efficiency, and potentially increased consumer spending. However, it's crucial to acknowledge the persistent risks and uncertainties, including the potential for future trade disputes and other geopolitical challenges. To stay informed about the evolving dynamics of this Global Risk Rally and its impact on global markets, follow reputable financial news sources and subscribe to relevant newsletters for continued updates. Understanding the nuances of this ongoing situation is key to navigating the complexities of the global economy.

Featured Posts

-

How To Watch Captain America Brave New World From Home

May 14, 2025

How To Watch Captain America Brave New World From Home

May 14, 2025 -

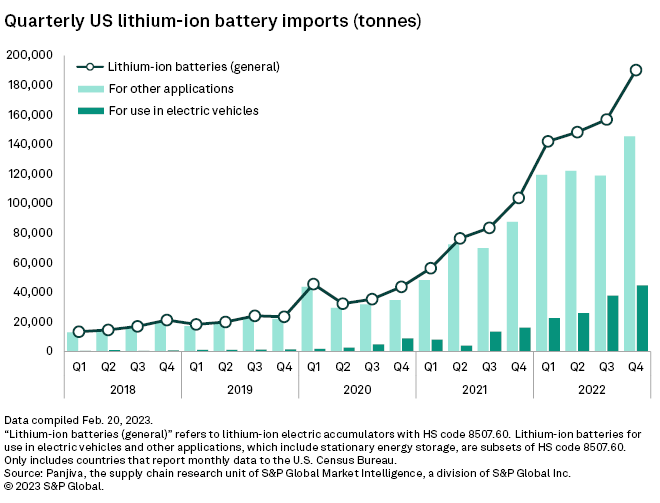

Chinas Lithium Export Policy Shift Implications For Eramets Growth

May 14, 2025

Chinas Lithium Export Policy Shift Implications For Eramets Growth

May 14, 2025 -

Review Apples Murderbot Series Funny Dark And Deeply Relatable Sci Fi

May 14, 2025

Review Apples Murderbot Series Funny Dark And Deeply Relatable Sci Fi

May 14, 2025 -

Dean Huijsen Naar Real Madrid Voor E50 Miljoen

May 14, 2025

Dean Huijsen Naar Real Madrid Voor E50 Miljoen

May 14, 2025 -

Bellinghams Brother Next United Target

May 14, 2025

Bellinghams Brother Next United Target

May 14, 2025