Gold Price Trends: After Trump's Less Aggressive Statements

Table of Contents

The Impact of Reduced Trade Tensions on Gold Prices

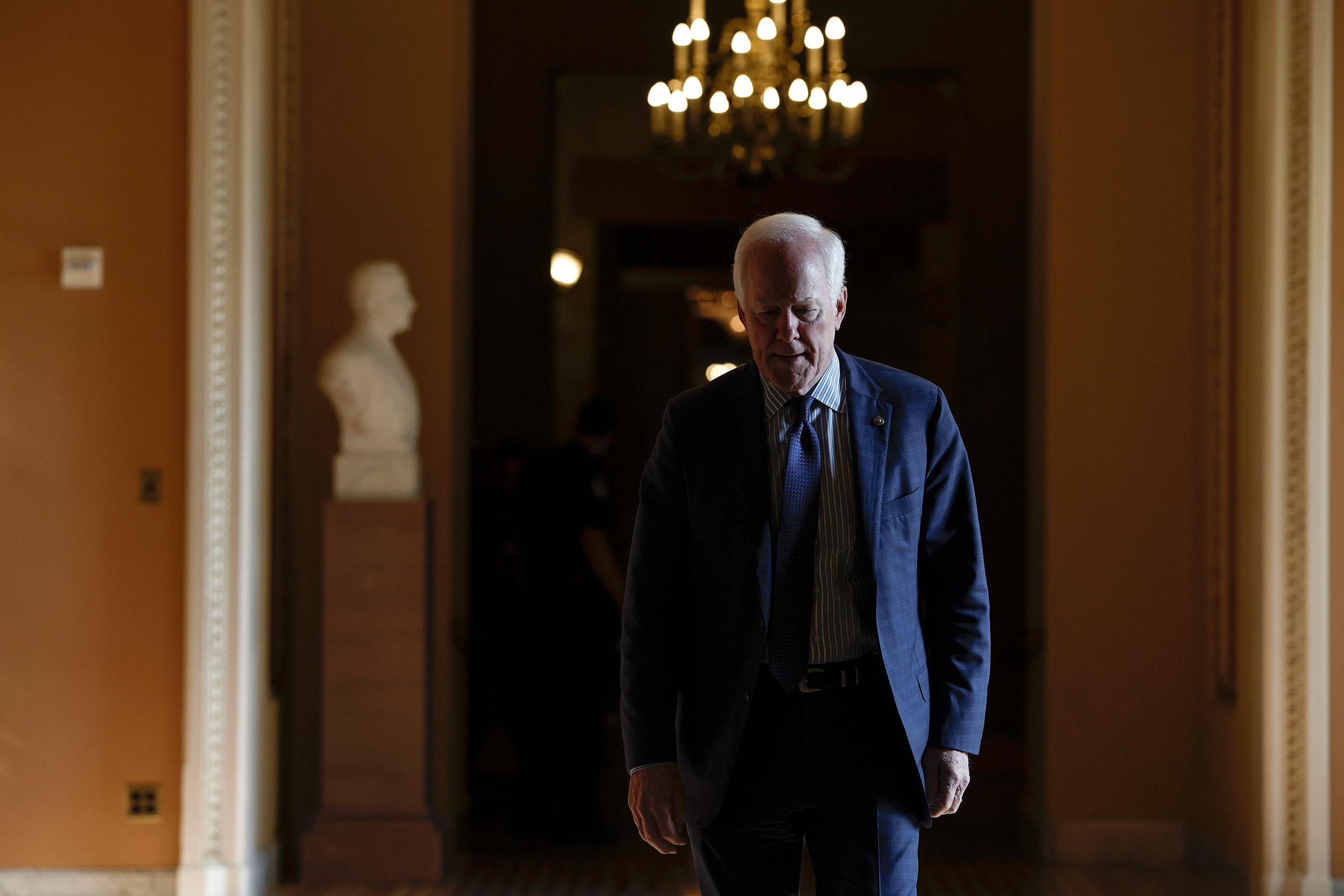

Trump's less confrontational stance has eased concerns about a protracted trade war, reducing market uncertainty. This lessened risk aversion has, in turn, impacted the demand for gold as a safe-haven asset. Gold price volatility, often linked to trade anxieties, has seen a relative decrease.

-

Reduced trade tensions lower investor anxiety: The lessening of trade war fears has led to a more optimistic market sentiment, reducing the need for investors to seek refuge in gold.

-

Decreased demand for safe-haven assets like gold: As risk aversion diminishes, investors are shifting their focus to potentially higher-yielding assets, leading to a decrease in gold demand.

-

Potential for gold price correction or consolidation: The decreased demand could result in a period of price correction or consolidation for gold, after the previous spikes driven by trade anxieties.

-

Impact on other precious metal prices (silver, platinum, palladium): The reduced demand for gold also impacts other precious metals, creating a ripple effect across the entire market for precious metals. Their prices often correlate with gold.

Inflationary Pressures and Gold's Role as a Hedge

Despite reduced trade tensions, inflationary pressures remain a concern in many economies. Gold often acts as a hedge against inflation, preserving purchasing power during periods of rising prices. The current inflation outlook will significantly influence gold prices moving forward. Understanding gold as an inflation hedge is key for long-term investors.

-

Analysis of current inflation rates and projections: Monitoring inflation rates globally is critical. High inflation rates generally drive up gold prices, as investors seek to protect their investments from currency devaluation.

-

The relationship between gold prices and inflation expectations: Market expectations concerning future inflation significantly influence current gold prices. Anticipated inflation leads to increased gold demand.

-

The role of central bank policies in impacting inflation and gold: Central banks' monetary policies, such as interest rate adjustments, play a crucial role in managing inflation and, consequently, influencing gold price trends and gold price prediction.

-

Potential for increased gold demand if inflation accelerates: Should inflation rise unexpectedly, we can expect a surge in demand for gold as a safe haven and inflation hedge.

Geopolitical Risks and Gold's Safe-Haven Status

Even with less aggressive trade rhetoric, geopolitical risks remain a significant factor influencing the price of gold. Ongoing international conflicts and political instability can increase demand for gold as a safe-haven asset. This makes gold a crucial component of a diversified investment strategy.

-

Identification of key geopolitical hotspots and their potential impact: Regions experiencing political instability or conflict directly impact investor sentiment and gold prices. Monitoring these hotspots is crucial for gold price prediction.

-

Assessment of the relative importance of geopolitical risk compared to economic factors: The interplay between geopolitical events and economic indicators is crucial. Sometimes, geopolitical uncertainty outweighs economic factors in influencing gold prices.

-

Gold's historical performance during periods of geopolitical uncertainty: Historically, gold has performed well during periods of geopolitical uncertainty, demonstrating its consistent safe-haven appeal.

-

Strategies for incorporating gold into a diversified investment portfolio: Adding gold to a portfolio can help mitigate risk during times of uncertainty. Various investment options exist, including physical gold, gold ETFs, and gold mining stocks.

The US Dollar and its Correlation with Gold Prices

The inverse relationship between the US dollar and gold prices is well-established. A weaker dollar generally leads to higher gold prices, and vice-versa. Analyzing US dollar movements is therefore crucial for understanding gold price trends. This correlation is a key factor in gold price prediction.

-

Explanation of the inverse correlation between the USD and gold: When the dollar weakens, gold becomes cheaper for holders of other currencies, increasing demand and pushing the price up.

-

Analysis of current USD trends and their projected impact on gold: Monitoring the strength of the dollar is essential for predicting gold price movements.

-

Factors influencing the strength of the US dollar: Various economic and political factors affect the dollar's value, impacting its relationship with gold.

Conclusion

The impact of President Trump's less aggressive statements on gold prices is multifaceted and complex. While reduced trade tensions have lessened market anxiety and decreased the immediate demand for gold as a safe haven, inflationary pressures and ongoing geopolitical risks remain significant factors. Investors should carefully consider these competing forces and their own risk tolerance when evaluating gold as part of their investment strategy. Understanding gold price trends, and the interplay between economic, political, and monetary factors, remains crucial for making informed investment decisions. Stay informed about gold price trends and adjust your portfolio accordingly. Monitor gold price prediction analyses to maximize your investment strategy.

Featured Posts

-

Visa Crackdown Fears Prompt College Students To Delete Published Work

Apr 25, 2025

Visa Crackdown Fears Prompt College Students To Delete Published Work

Apr 25, 2025 -

Blackbush Walk Thornaby Police Activity And Crime Scene Investigation

Apr 25, 2025

Blackbush Walk Thornaby Police Activity And Crime Scene Investigation

Apr 25, 2025 -

The Donald Trump Presidency A Look At April 23 2025

Apr 25, 2025

The Donald Trump Presidency A Look At April 23 2025

Apr 25, 2025 -

Strong Sales Growth For Unilever Successful Pricing And Increased Consumer Demand

Apr 25, 2025

Strong Sales Growth For Unilever Successful Pricing And Increased Consumer Demand

Apr 25, 2025 -

Then And Now North East Babies Born During Lockdown

Apr 25, 2025

Then And Now North East Babies Born During Lockdown

Apr 25, 2025

Latest Posts

-

How A Final Restart Cost Bubba Wallace At Martinsville

Apr 28, 2025

How A Final Restart Cost Bubba Wallace At Martinsville

Apr 28, 2025 -

Bubba Wallaces Second Place Finish At Martinsville A Detailed Look

Apr 28, 2025

Bubba Wallaces Second Place Finish At Martinsville A Detailed Look

Apr 28, 2025 -

The Martinsville Restart A Costly Mistake For Bubba Wallace

Apr 28, 2025

The Martinsville Restart A Costly Mistake For Bubba Wallace

Apr 28, 2025 -

Bubba Wallaces Martinsville Mishap Second Place Slip Explained

Apr 28, 2025

Bubba Wallaces Martinsville Mishap Second Place Slip Explained

Apr 28, 2025 -

Analysis Bubba Wallaces Late Race Move At Martinsville

Apr 28, 2025

Analysis Bubba Wallaces Late Race Move At Martinsville

Apr 28, 2025