Goldman Sachs CEO's Campaign To Silence Internal Critics

Table of Contents

Allegations of Retaliation Against Internal Whistleblowers

Serious allegations of retaliation against employees who raised ethical concerns have emerged, casting a shadow over Goldman Sachs' reputation. These accusations involve whistleblowers who reported potential wrongdoing, ranging from unethical trading practices to conflicts of interest. The keywords here are whistleblowers, retaliation, SEC, and regulatory scrutiny.

-

Specific Instances of Alleged Retaliation: While specifics are often kept confidential due to ongoing investigations and legal proceedings, reports suggest that whistleblowers faced demotions, transfers to less desirable roles, or even termination after voicing concerns. These actions, if proven, constitute serious violations of both internal company policies and potentially federal laws.

-

Potential Legal Ramifications: The Securities and Exchange Commission (SEC) has a vested interest in ensuring financial institutions maintain robust compliance programs. Allegations of retaliation against whistleblowers invite intense regulatory scrutiny, potentially leading to significant fines and reputational damage for Goldman Sachs. The firm could also face numerous lawsuits from affected employees.

-

Impact on Employee Morale and Reputation: A culture where whistleblowers are silenced fosters an environment of fear and distrust. This severely impacts employee morale, creating a toxic workplace where open communication is stifled. This can negatively affect risk management, as crucial information might remain unreported. The resulting reputational damage can be profound, affecting Goldman Sachs’ ability to attract and retain top talent.

-

Lawsuits and Legal Actions: While the specifics of any lawsuits remain confidential in many cases, the existence of legal actions further underscores the gravity of the allegations and the potential for significant financial consequences for Goldman Sachs.

The Role of the CEO in Creating a Culture of Fear

The CEO's leadership style plays a pivotal role in shaping a company's culture. David Solomon's leadership style, according to some reports, has contributed to a climate of fear and intimidation, discouraging open dissent and criticism. Key words here include corporate culture, leadership, toxic workplace, fear, and intimidation.

-

Solomon's Leadership and its Impact: Critics argue that Solomon's emphasis on certain aspects of the firm's performance over ethical concerns may have inadvertently created an environment where speaking up carries significant personal risk. This approach, if true, directly contradicts the principles of responsible corporate governance.

-

Impact on Open Communication and Risk Management: The suppression of dissenting voices can severely impair a firm's ability to effectively manage risk. Crucial information may remain hidden, leading to potentially catastrophic consequences. A lack of open communication creates a breeding ground for unethical practices to flourish undetected.

-

Examples of Suppressed Criticism: While specific instances are often kept private due to legal concerns, reports suggest instances where criticism, even constructive feedback, was met with swift and negative consequences, reinforcing a culture of silence.

Impact on Goldman Sachs' Reputation and Investor Confidence

These allegations have undoubtedly impacted Goldman Sachs' reputation and investor confidence. Keywords relevant to this section include reputation management, investor confidence, stock price, brand image, and public perception.

-

Damage to Brand Image: The accusations have severely tarnished Goldman Sachs' image as a leading and ethical financial institution. The negative publicity erodes public trust and raises serious questions about the firm's commitment to ethical conduct.

-

Impact on Investor Confidence and Stock Price: Negative news stories and potential legal ramifications can negatively impact investor confidence, leading to fluctuations or declines in the firm's stock price. Investors are increasingly demanding high ethical standards from the companies in which they invest.

-

Reputation Management Efforts: Goldman Sachs has likely undertaken significant reputation management efforts to mitigate the damage. These may include internal investigations, public statements, and efforts to engage with stakeholders to address concerns. However, the effectiveness of these efforts remains to be seen.

Broader Implications for the Financial Industry

The Goldman Sachs situation highlights crucial issues within the broader financial industry. Keywords here include financial regulation, corporate governance, ethical standards, and Wall Street culture.

-

Ethical Standards and Corporate Governance: These allegations raise serious questions about the ethical standards and corporate governance practices within the financial industry as a whole. The incident underscores the need for stronger regulatory oversight and more robust internal compliance programs.

-

Role of Regulatory Bodies: Regulatory bodies like the SEC have a crucial role to play in investigating such allegations and enforcing regulations to prevent similar occurrences. Increased scrutiny and potentially stricter penalties may become necessary to ensure ethical conduct.

-

Similar Issues in Other Institutions: It is crucial to acknowledge that the potential for similar issues to exist in other financial institutions cannot be discounted. This underscores the need for systemic reforms to promote a culture of transparency and accountability across the industry.

Conclusion

This article has explored the serious allegations surrounding Goldman Sachs CEO David Solomon and a potential campaign to silence internal critics. The potential for retaliation against whistleblowers, the creation of a culture of fear, and the subsequent impact on the firm's reputation and investor confidence are significant concerns. These issues raise crucial questions about corporate governance, ethical standards, and the overall health of the financial industry.

Call to Action: Understanding the implications of the Goldman Sachs CEO's alleged campaign to silence internal critics is crucial for promoting transparency and ethical conduct within the financial industry. Further investigation and rigorous scrutiny are needed to ensure accountability and prevent similar situations from arising. Stay informed about developments in this ongoing story and continue to demand ethical practices from leaders in the financial sector. Continue to search for updates on the Goldman Sachs CEO’s actions and the ongoing fight against silencing internal critics. The future of ethical leadership in finance hinges on the responses to this critical issue.

Featured Posts

-

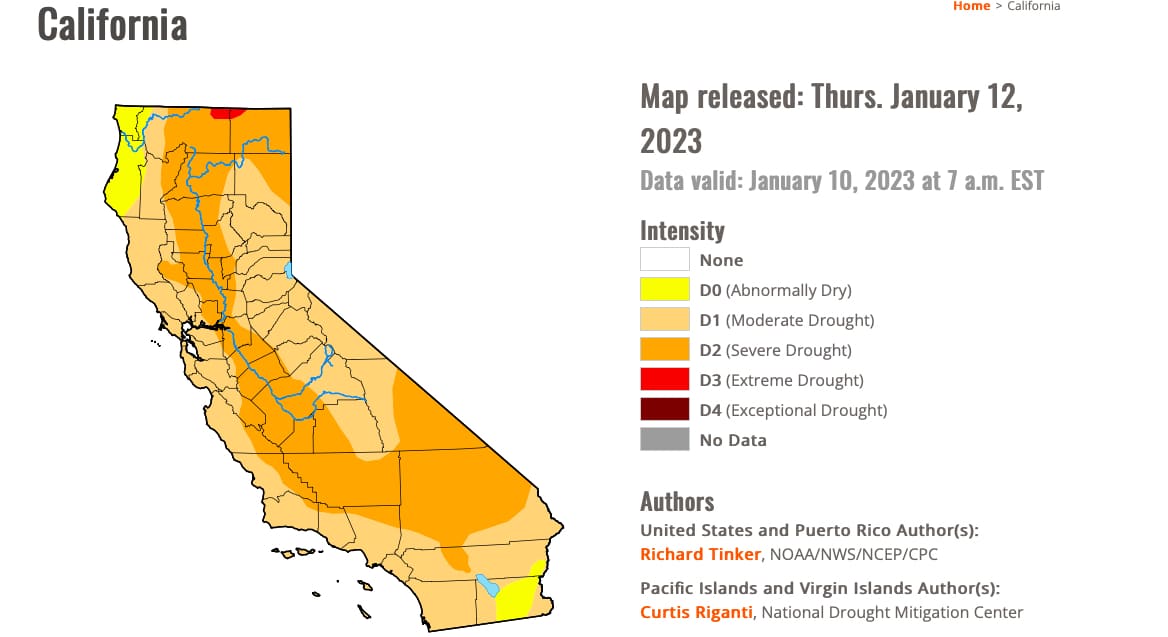

1968 And 2024 A Springtime Comparison And Summer Drought Outlook

May 28, 2025

1968 And 2024 A Springtime Comparison And Summer Drought Outlook

May 28, 2025 -

Understanding The Padres Cubs Series Results

May 28, 2025

Understanding The Padres Cubs Series Results

May 28, 2025 -

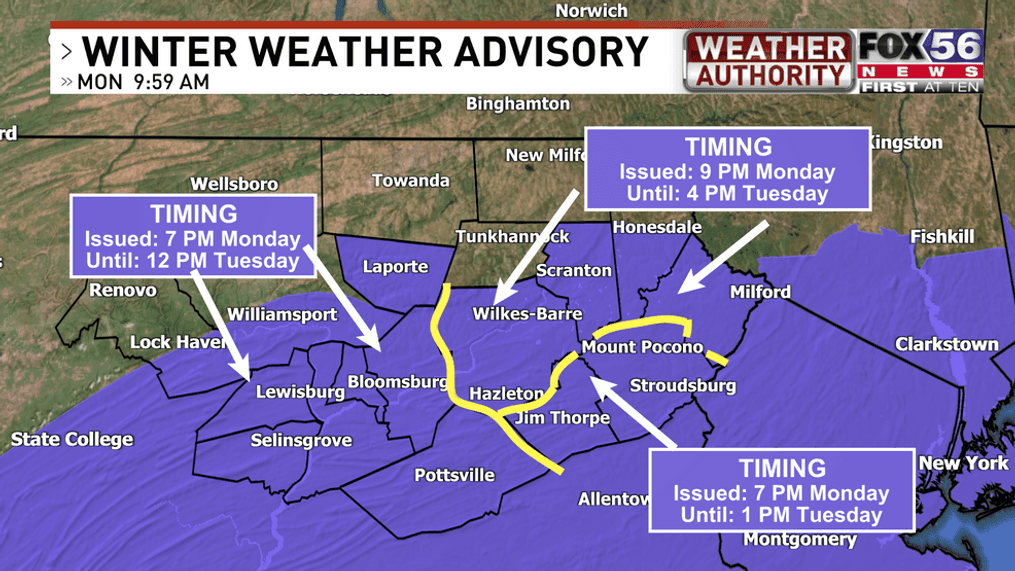

Important Weather Update Wind Advisory Plus Snowfall Tuesday

May 28, 2025

Important Weather Update Wind Advisory Plus Snowfall Tuesday

May 28, 2025 -

Chicago History The Day Cassius Clay Won The Golden Gloves

May 28, 2025

Chicago History The Day Cassius Clay Won The Golden Gloves

May 28, 2025 -

Nadals Last Roland Garros A Poignant Farewell And Sabalenkas Rise

May 28, 2025

Nadals Last Roland Garros A Poignant Farewell And Sabalenkas Rise

May 28, 2025