Goldman's Economic Outlook: Comparing Australian Labor And Coalition Fiscal Policies

Table of Contents

Labor's Fiscal Strategy: Focus on Social Spending and Economic Stimulus

Labor's fiscal strategy prioritizes increased social spending and targeted economic stimulus to boost growth and reduce inequality. This approach contrasts sharply with the Coalition's emphasis on tax cuts and fiscal restraint.

Increased Spending on Social Programs

Labor plans significant increases in spending across key social programs:

- Increased investment in healthcare, education, and aged care: This includes funding for more hospital beds, improved teacher salaries, and expanded aged care services. The projected cost is substantial, and its impact on the national debt and budget deficit requires careful analysis. The potential economic multiplier effect of such spending – increased demand leading to job creation and further economic activity – is a key element of Labor's strategy.

- Expansion of childcare subsidies and affordable housing initiatives: These measures aim to reduce the cost of living for families and increase workforce participation. Specific policy proposals, such as increased childcare rebates and funding for social housing projects, come with significant price tags, needing further scrutiny regarding their long-term financial sustainability.

- Bullet points detailing specific policy proposals and their projected costs: A detailed breakdown of these proposals, including specific funding allocations and projected budgetary impacts, is crucial for comprehensive assessment. This data will likely be released in budget papers and policy documents.

Investment in Infrastructure and Renewable Energy

Labor's plan includes substantial investment in infrastructure and renewable energy:

- Planned investments in infrastructure projects nationwide: This includes road, rail, and public transport upgrades, aiming to improve productivity and reduce congestion. The effectiveness and cost-benefit analysis of these projects are key considerations.

- Funding for renewable energy initiatives and the transition to a low-carbon economy: Significant investment is proposed in renewable energy sources, aiming to create jobs and reduce carbon emissions. The long-term economic benefits, including attracting foreign investment in green technologies, need to be weighed against potential short-term costs.

- Comparison of Labor's infrastructure spending plans to previous administrations: Analyzing Labor's proposed spending compared to previous governments' infrastructure investments allows for a more nuanced understanding of its potential impact and efficiency.

Coalition's Fiscal Strategy: Emphasis on Tax Cuts and Budget Restraint

The Coalition's approach emphasizes tax cuts, particularly for businesses and high-income earners, alongside fiscal consolidation and debt reduction.

Tax Cuts and Incentives for Businesses

The Coalition's proposed tax cuts aim to stimulate economic growth by encouraging investment and job creation:

- Proposed tax cuts for businesses and high-income earners: These cuts are intended to incentivize businesses to invest and expand, boosting economic activity. However, concerns remain regarding their impact on income inequality.

- Arguments for and against the effectiveness of tax cuts as economic stimulus: The debate surrounding the effectiveness of tax cuts as a stimulus measure is ongoing. Economists offer varying perspectives on the extent to which such cuts trickle down to the wider economy.

- Bullet points outlining specific tax cut proposals and their projected revenue impact: A comprehensive list of proposed tax cuts, accompanied by detailed projections of their revenue implications, is essential for effective analysis. These figures often form a cornerstone of the Coalition's economic modelling.

Fiscal Consolidation and Debt Reduction

The Coalition prioritizes reducing the budget deficit and national debt:

- Focus on reducing the budget deficit and national debt: This strategy involves implementing measures to control government spending and increase revenue. The potential consequences of fiscal austerity on essential services need careful consideration.

- Strategies for achieving fiscal consolidation without harming economic growth: The challenge lies in balancing debt reduction with maintaining economic growth. This involves intricate policy choices and strategic spending decisions.

- Comparison of Coalition's debt reduction targets with Labor's approach: Comparing the Coalition's debt reduction plans to Labor's provides a clearer picture of their contrasting fiscal priorities and long-term implications.

Goldman Sachs' Predictions and Comparative Analysis

Goldman Sachs' economic forecasts provide a comparative analysis of the potential outcomes under each party's policies:

- Goldman Sachs' economic forecasts under each party's policies: This includes projections for key economic indicators such as GDP growth, inflation, and unemployment. These forecasts are vital for evaluating the potential economic consequences of each party's approach.

- Comparative analysis of GDP growth projections, inflation rates, and unemployment rates: Comparing the predicted outcomes under different fiscal policies allows for a direct assessment of their relative merits.

- Assessment of the potential risks and uncertainties associated with each approach: Goldman Sachs' analysis should also include an evaluation of the potential risks and uncertainties inherent in each approach, such as global economic shocks or unexpected policy changes.

- Detailed examination of Goldman Sachs' specific economic models and assumptions: Understanding the underlying assumptions and methodologies used in Goldman Sachs' modelling is crucial for evaluating the reliability and validity of their projections. This provides transparency and accountability.

- Presentation of data in charts and graphs for clear visualization: Visual representations of the data make the comparison of projected economic outcomes readily understandable.

Impact on Key Economic Sectors

The differing fiscal policies will have varying impacts across different sectors of the Australian economy:

- Analysis of the effects on specific industries (e.g., mining, agriculture, tourism): Each industry will likely experience different levels of growth or contraction under each party's policies.

- Potential impacts on employment in various sectors: Changes in government spending and taxation will affect employment levels in various industries.

- Regional variations in the economic effects of each policy: The economic effects of each party's policies may differ depending on the region within Australia.

- Discussion of potential winners and losers under each party's policies: Some sectors and demographics might benefit more than others under each policy approach. This necessitates a balanced consideration of distributional impacts.

- Incorporating relevant statistics and industry reports: Using up-to-date data from reliable sources, such as the Australian Bureau of Statistics and industry reports, provides concrete evidence and strengthens the analysis.

Conclusion

Goldman Sachs' economic outlook offers a valuable comparison of Australian Labor and Coalition fiscal policies. Understanding these contrasting strategies is critical for informed decision-making. This analysis reveals the potential economic consequences of each approach, impacting various sectors and the overall trajectory of the Australian economy. Further research into specific policy proposals and ongoing economic developments is recommended for a comprehensive understanding of Australian Labor and Coalition fiscal policies. Staying informed about the latest analyses of Australian Labor and Coalition fiscal policies is crucial for navigating the Australian economic landscape.

Featured Posts

-

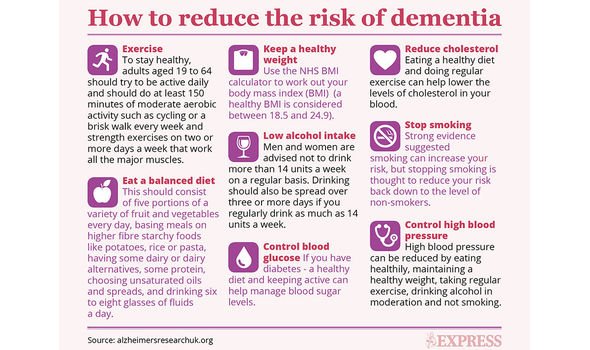

Metabolic Syndrome Reducing Your Risk Of Developing Dementia

Apr 25, 2025

Metabolic Syndrome Reducing Your Risk Of Developing Dementia

Apr 25, 2025 -

Significant Events Of April 1945 Shaping The Post War World

Apr 25, 2025

Significant Events Of April 1945 Shaping The Post War World

Apr 25, 2025 -

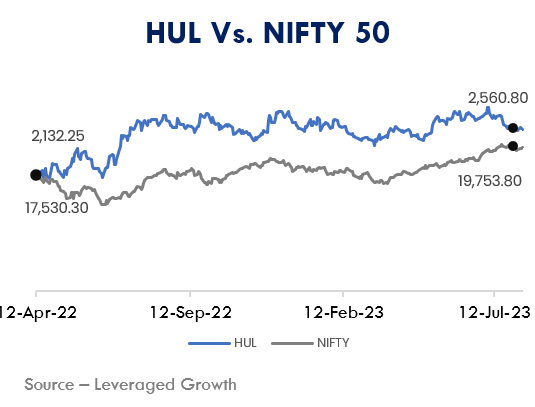

Hindustan Unilevers Profit Holds Steady Despite Reduced Consumer Spending

Apr 25, 2025

Hindustan Unilevers Profit Holds Steady Despite Reduced Consumer Spending

Apr 25, 2025 -

Aussie War Heros Warning After Anzac Day School Snub

Apr 25, 2025

Aussie War Heros Warning After Anzac Day School Snub

Apr 25, 2025 -

Eurovision Festival Manchester What To Expect This Week

Apr 25, 2025

Eurovision Festival Manchester What To Expect This Week

Apr 25, 2025

Latest Posts

-

Hjz Rhlat Tyran Alerbyt Ila Kazakhstan Mn Abwzby

Apr 28, 2025

Hjz Rhlat Tyran Alerbyt Ila Kazakhstan Mn Abwzby

Apr 28, 2025 -

Aktshf Kazakhstan Me Tyran Alerbyt Rhlat Mbashrt Mn Abwzby

Apr 28, 2025

Aktshf Kazakhstan Me Tyran Alerbyt Rhlat Mbashrt Mn Abwzby

Apr 28, 2025 -

Abwzby Kazakhstan Tyran Alerbyt Ydyf Khtwt Tyran Jdydt

Apr 28, 2025

Abwzby Kazakhstan Tyran Alerbyt Ydyf Khtwt Tyran Jdydt

Apr 28, 2025 -

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025 -

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025