GOP's Student Loan Plan: What Pell Grant And Repayment Changes Mean For You

Table of Contents

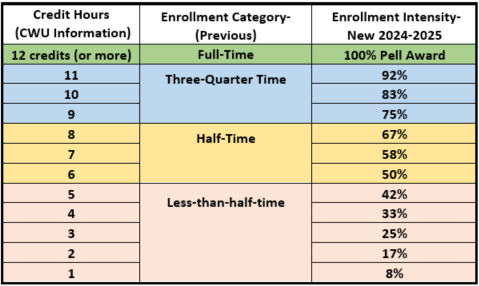

Proposed Changes to Pell Grants Under the GOP Plan

The GOP's student loan plan includes several proposed changes to the Pell Grant program, a crucial source of funding for millions of low-income college students. Understanding these potential alterations is critical for anyone considering higher education.

Funding Reductions and Eligibility Criteria

The GOP's plan may involve significant reductions in Pell Grant funding. This could manifest in several ways:

- Direct Funding Cuts: A reduction in the overall budget allocated to the Pell Grant program.

- Increased Eligibility Requirements: More stringent income limits, higher GPA requirements, or stricter restrictions on the types of institutions eligible to receive Pell Grant funding.

- Geographic Disparities: Funding cuts could disproportionately affect students in specific regions, exacerbating existing inequalities in access to higher education.

These proposed "GOP Pell Grant cuts" could severely limit access to higher education for low-income students, pushing college further out of reach for many. The potential impact on Pell Grant eligibility would be significant for students already facing financial barriers.

Impact on College Affordability and Access

Changes to Pell Grant funding directly impact college affordability and access, particularly for underprivileged students. The potential consequences include:

- Increased Tuition Costs: Reduced Pell Grant support might force colleges to raise tuition to compensate for the loss of funding, placing a greater burden on students.

- Decreased Enrollment: Many students may be unable to afford college without adequate Pell Grant support, leading to a decrease in overall enrollment, particularly among low-income and minority groups.

- Limited Program Options: Students might be forced to forgo certain programs or institutions due to funding limitations, further limiting their educational choices.

The resulting impact on college affordability could be dramatic, potentially creating a significant barrier to higher education for many who would otherwise have access. The effect of Pell Grant funding cuts on college access needs careful consideration.

Repayment Plan Modifications Proposed by the GOP

The GOP's student loan plan also includes proposed modifications to student loan repayment plans, potentially impacting millions of borrowers.

Income-Driven Repayment (IDR) Plan Changes

The GOP may propose changes to existing Income-Driven Repayment (IDR) plans, aiming to adjust payment calculations and potentially increase minimum payments. These changes could:

- Increase Monthly Payments: Higher minimum payments could create a substantial financial burden for borrowers, especially those with lower incomes.

- Extend Repayment Timelines: Even with increased payments, the overall repayment period might be extended, resulting in higher total interest paid over the life of the loan.

- Reduce Affordability: These adjustments could make IDR plans less affordable and more challenging for borrowers to manage.

Understanding these potential "IDR plan changes" is crucial for borrowers currently utilizing or planning to utilize income-driven repayment options. The impact on student loan repayment could be extensive.

Potential for Increased Loan Forgiveness Restrictions

The GOP might also introduce stricter limitations or even eliminate existing loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF). This could lead to:

- Increased Debt Burden: Borrowers who relied on loan forgiveness programs to manage their debt would face a significantly increased financial burden.

- Reduced Incentive for Public Service: The elimination of loan forgiveness programs could discourage individuals from pursuing careers in public service, potentially impacting essential sectors like education and healthcare.

- Long-Term Financial Instability: The inability to access loan forgiveness could lead to long-term financial instability for many borrowers.

These potential restrictions on "student loan forgiveness" would significantly impact borrowers' long-term financial prospects and have far-reaching consequences.

Potential Impact on Different Student Demographics

The proposed changes in the GOP's student loan plan could disproportionately affect specific student demographics.

Impact on Minority Students

Minority students are often already facing significant barriers to accessing higher education. The proposed changes could exacerbate existing inequalities:

- Reduced Access: Funding cuts and eligibility restrictions could disproportionately impact minority students, who are often from lower-income backgrounds.

- Increased Educational Inequality: These changes could widen the existing gap in educational attainment between minority and non-minority students.

- Need for Targeted Support: Specific initiatives and targeted support programs will be needed to mitigate the negative impacts on minority students.

Understanding the impact on "minority students" is crucial for ensuring educational equity and creating a more just and inclusive higher education system.

Impact on Low-Income Students

Low-income students are particularly vulnerable to the potential changes proposed by the GOP. The consequences could include:

- Increased Financial Burden: Reduced Pell Grant funding and stricter repayment terms could significantly increase the financial burden on low-income students and their families.

- Limited Access to Higher Education: Many low-income students might be unable to afford college if these changes are implemented.

- Long-Term Financial Instability: Increased student loan debt can lead to long-term financial instability, hindering future opportunities and economic mobility.

The effect on "low-income students" needs to be closely examined, as these changes could severely limit their opportunities for upward mobility.

Conclusion

The GOP's proposed student loan plan, with its potential alterations to Pell Grants and repayment plans, could have profound and far-reaching consequences for millions of students and borrowers. Reductions in Pell Grant funding and stricter repayment terms could disproportionately impact low-income and minority students, hindering their access to higher education and increasing their long-term financial burdens. Understanding the implications of the GOP's student loan plan is crucial. Stay informed about these potential changes to Pell Grants and repayment plans, and advocate for policies that support accessible and affordable higher education. Engage with relevant organizations and your government representatives to ensure that the voices of students and borrowers are heard in the ongoing debate surrounding student loan debt and the future of higher education.

Featured Posts

-

Reduce Your Student Loan Burden A Financial Planners Perspective

May 17, 2025

Reduce Your Student Loan Burden A Financial Planners Perspective

May 17, 2025 -

Fargo Educator Eagleson Receives Outstanding Science Educator Award

May 17, 2025

Fargo Educator Eagleson Receives Outstanding Science Educator Award

May 17, 2025 -

Creatine For Muscle Growth Facts And Considerations

May 17, 2025

Creatine For Muscle Growth Facts And Considerations

May 17, 2025 -

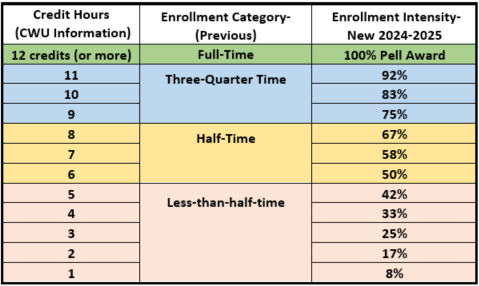

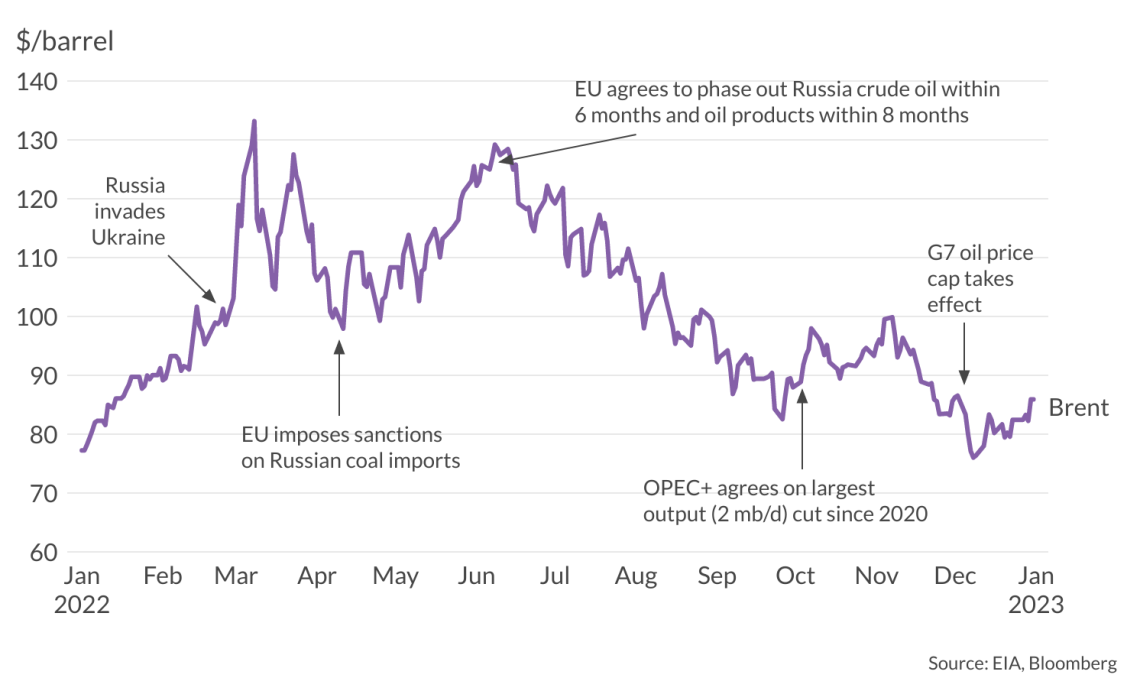

Crude Oil Market Report Key Developments On May 16 2024

May 17, 2025

Crude Oil Market Report Key Developments On May 16 2024

May 17, 2025 -

All The Latest Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

All The Latest Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Latest Posts

-

La Lakers News Scores And Highlights Vavel United States

May 17, 2025

La Lakers News Scores And Highlights Vavel United States

May 17, 2025 -

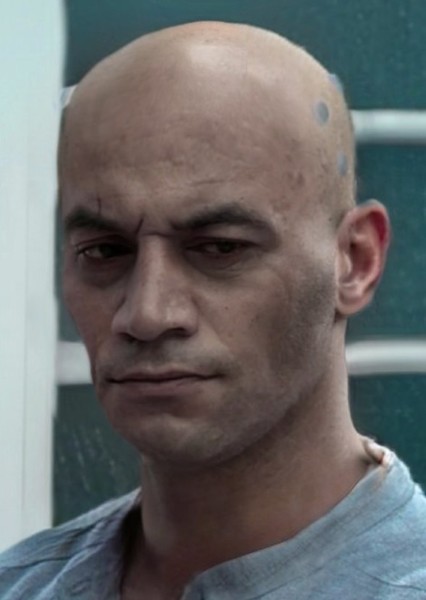

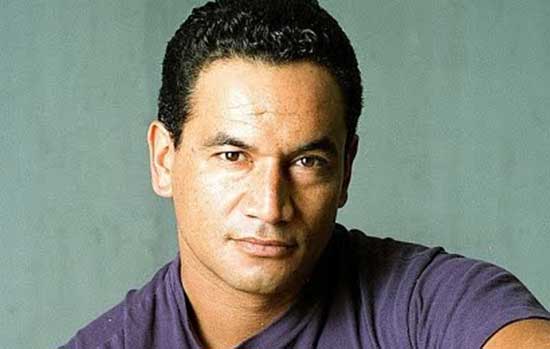

Temuera Morrison In End Of The Valley Your Guide To The Listeners March Programming

May 17, 2025

Temuera Morrison In End Of The Valley Your Guide To The Listeners March Programming

May 17, 2025 -

End Of The Valley A March Viewing Guide For The Listener

May 17, 2025

End Of The Valley A March Viewing Guide For The Listener

May 17, 2025 -

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025 -

No Doctor Who Christmas Special Reasons For Cancellation And Future Implications

May 17, 2025

No Doctor Who Christmas Special Reasons For Cancellation And Future Implications

May 17, 2025