Grim Retail Sales: Are Rate Cuts On The Horizon?

Table of Contents

Analyzing the Decline in Retail Sales

The dramatic fall in retail sales is a complex issue with several contributing factors. Understanding these factors is crucial to predicting future economic trends and the potential for policy interventions like rate cuts.

Consumer Spending Slowdown

Weakening consumer confidence lies at the heart of the decline in retail sales. Consumers are tightening their belts in the face of numerous economic headwinds.

- Rising inflation: Persistently high inflation erodes purchasing power, leaving consumers with less disposable income to spend on non-essential goods and services. This impacts everything from clothing and electronics to restaurant meals and entertainment.

- Increased interest rates: Higher interest rates increase borrowing costs, making it more expensive to finance purchases like homes, cars, and appliances. This dampens demand and reduces consumer spending.

- Elevated debt levels: Many households are already burdened with high levels of debt, making them more vulnerable to rising interest rates and less likely to take on new debt for purchases.

- Job market uncertainty: While unemployment remains relatively low in some sectors, concerns about potential layoffs and economic slowdown are impacting consumer confidence and willingness to spend. This uncertainty leads to increased savings and decreased spending.

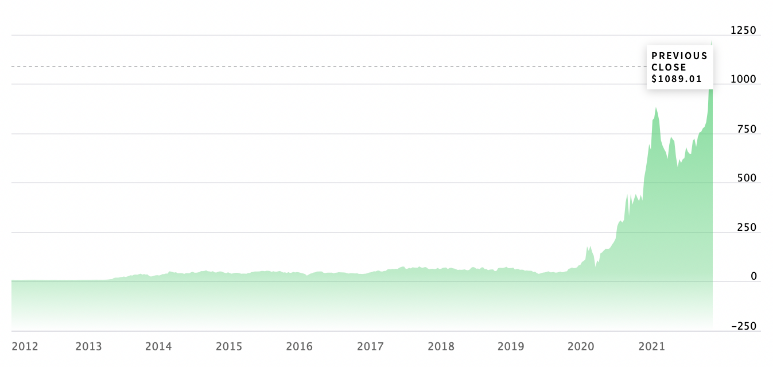

Impact of High Interest Rates

The aggressive interest rate hikes implemented by central banks worldwide to combat inflation are having a significant impact on both consumer spending and business investment. Increased borrowing costs directly reduce consumer purchasing power and discourage businesses from investing in expansion and job creation.

- Mortgage rates: Soaring mortgage rates are making homeownership less attainable for many, significantly impacting the housing market and related industries.

- Credit card debt: The rising cost of borrowing on credit cards is further squeezing household budgets, limiting discretionary spending.

- Business loan rates: Higher borrowing costs for businesses translate into reduced investment in new equipment, hiring, and expansion, ultimately hindering economic growth and impacting retail sales.

- Impact on investment: Businesses are delaying or canceling investments due to the increased cost of capital, further contributing to the slowdown in economic activity.

Global Economic Uncertainty

The decline in retail sales is not solely a domestic issue; global economic uncertainty plays a significant role. Geopolitical factors and a broader global slowdown are impacting supply chains, consumer sentiment, and overall economic confidence.

- Supply chain disruptions: Ongoing supply chain bottlenecks continue to contribute to higher prices and reduced availability of goods, impacting consumer spending.

- War in Ukraine: The war in Ukraine has created significant energy price volatility and disrupted global trade, contributing to inflationary pressures and economic uncertainty.

- Energy crisis: The energy crisis in Europe and elsewhere has driven up energy prices, impacting household budgets and business costs.

- Recessionary fears: Growing concerns about a potential global recession are further dampening consumer and business confidence, leading to reduced spending and investment.

The Case for Rate Cuts

Given the grim retail sales figures and the weakening economic outlook, the argument for rate cuts is gaining traction. However, the decision to lower interest rates is fraught with complexity.

Easing Monetary Policy

Central banks may consider lowering interest rates to stimulate economic activity and combat the negative consequences of the slowdown.

- Stimulate borrowing and spending: Lower interest rates make borrowing cheaper, encouraging consumers and businesses to spend and invest more, thereby boosting economic growth.

- Combat deflationary pressures: In a severe downturn, rate cuts can help prevent deflation, a dangerous spiral of falling prices and reduced economic activity.

- Boost investor confidence: Rate cuts can signal a shift towards a more accommodative monetary policy, potentially boosting investor confidence and encouraging investment.

Inflationary Pressures

The key challenge for central banks is balancing the need to stimulate economic growth with the ongoing threat of inflation. Rate cuts risk reigniting inflationary pressures.

- Balancing inflation control with economic growth: The delicate balance between controlling inflation and promoting economic growth is a central challenge for policymakers.

- Potential for stagflation: There's a risk that rate cuts could lead to stagflation – a period of slow economic growth combined with high inflation.

- Analyzing inflation data: Careful monitoring of inflation data is crucial to determine the appropriate monetary policy response, weighing the risks of inflation against the need for economic stimulus.

Market Expectations

Market expectations regarding future interest rate movements are crucial in influencing current economic activity and investor behavior.

- Analysis of bond yields: Bond yields provide insights into market expectations for future interest rates. Falling bond yields generally suggest expectations of future rate cuts.

- Expert opinions: The opinions of economists and financial analysts contribute to market sentiment and influence investor decisions.

- Market forecasts: Market forecasts and predictions about future interest rates play a significant role in shaping investor behavior and influencing economic activity.

Alternative Economic Solutions

While rate cuts are a potential response to grim retail sales, other policy interventions can also play a vital role in boosting the economy.

Fiscal Policy Interventions

Governments can employ fiscal policy measures to stimulate economic activity and support consumers and businesses.

- Fiscal stimulus: Government spending on infrastructure projects, tax cuts, or increased social safety net programs can boost aggregate demand and stimulate economic growth.

- Government spending: Targeted government spending on infrastructure development can create jobs and stimulate economic activity.

- Tax cuts: Tax cuts can increase disposable income for consumers and businesses, boosting spending and investment.

Supply-Side Reforms

Addressing underlying structural issues and improving economic productivity can contribute to long-term economic growth and resilience.

- Supply chain resilience: Investing in supply chain diversification and modernization can help reduce vulnerability to future disruptions.

- Economic productivity: Policies aimed at increasing worker productivity, such as investment in education and training, can improve overall economic output.

- Structural reforms: Deregulation and other structural reforms can improve efficiency and competitiveness in the economy.

Conclusion

The significant decline in retail sales presents a serious challenge to the global economy. While rate cuts are a potential response to address the grim retail sales figures and stimulate economic growth, the decision is complex, requiring a careful consideration of inflationary pressures and alternative policy options. Fiscal policy interventions and supply-side reforms can also play a vital role in supporting economic recovery. The path forward requires a balanced approach that addresses both the immediate need for economic stimulus and the long-term need for sustainable economic growth. Stay updated on the evolving situation by following our blog for more in-depth analysis of grim retail sales and the potential impact of future rate cuts.

Featured Posts

-

Mets Opening Day Roster Prediction Spring Training Week One Analysis

Apr 28, 2025

Mets Opening Day Roster Prediction Spring Training Week One Analysis

Apr 28, 2025 -

Ai Browser Wars A Conversation With Perplexitys Ceo

Apr 28, 2025

Ai Browser Wars A Conversation With Perplexitys Ceo

Apr 28, 2025 -

2000 Yankees Season A Game Recap Yankees Vs Royals

Apr 28, 2025

2000 Yankees Season A Game Recap Yankees Vs Royals

Apr 28, 2025 -

Can We Curb Americas Excessive Truck Sizes A Practical Look

Apr 28, 2025

Can We Curb Americas Excessive Truck Sizes A Practical Look

Apr 28, 2025 -

Strong Tech Sector Lifts Us Stock Market Teslas Leading Role

Apr 28, 2025

Strong Tech Sector Lifts Us Stock Market Teslas Leading Role

Apr 28, 2025