Grocery Shopping, $2000 Quarter, & DOGE Poll: Your GBR Weekly Roundup

Table of Contents

Mastering Your Grocery Shopping Budget

Sticking to a grocery shopping budget can feel like a constant uphill battle, but with the right strategies, it's entirely achievable. Saving money on groceries doesn't mean sacrificing quality; it's about making smart choices and implementing effective planning. Let's explore some key techniques to help you master your grocery shopping budget.

Planning is Key: The Foundation of Grocery Savings

Creating a detailed grocery shopping list based on a meticulously planned weekly menu is the cornerstone of budget-friendly grocery shopping. Impulse purchases are the biggest enemy of a grocery budget, and a well-thought-out plan eliminates most of them.

- Use a budgeting app: Many apps track spending, categorize expenses, and even help you create shopping lists based on your planned meals.

- Compare prices at different stores: Don't be loyal to one store blindly. Check flyers and compare prices across different supermarkets and discount stores.

- Look for sales and coupons: Take advantage of weekly sales and utilize coupons to drastically reduce your grocery bill. Many stores offer digital coupons through their apps.

- Cook at home more often: Eating out frequently is a major budget drain. Preparing meals at home is significantly cheaper and healthier.

Smart Shopping Strategies: Maximizing Your Savings

Beyond meal planning, employing smart shopping strategies can significantly boost your savings. These strategies require a bit of awareness and planning, but the payoff is well worth the effort.

- Buy in bulk (when appropriate): Buying non-perishable items in bulk can often lead to significant savings per unit. However, be mindful of storage space and potential spoilage.

- Choose generic brands: Store-brand products are often just as good as name brands but cost significantly less.

- Utilize store loyalty programs: Most major grocery stores offer loyalty programs that provide discounts, coupons, and exclusive deals.

- Avoid processed foods: Processed foods are typically more expensive and less nutritious than whole foods.

Tracking Your Spending: Monitoring Your Progress

Tracking your grocery spending is essential to understanding your spending habits and identifying areas where you can cut back. This crucial step allows for adjustments and refinement of your budget.

- Use a budgeting app to track spending: Many apps seamlessly integrate with your bank accounts and credit cards for automatic tracking.

- Review receipts regularly: Don't just throw away your receipts. Review them to identify areas of overspending and potential adjustments.

- Set a weekly or monthly grocery budget: Determine a realistic budget based on your income and needs. Adjust as needed based on your tracking data.

The $2000 Quarter – A Financial Windfall

Finding a $2000 quarter is a once-in-a-lifetime event for most people. While incredibly lucky, it presents a unique opportunity and challenge: managing a sudden influx of unexpected income. The key is responsible decision-making.

What to Do with Unexpected Money: Strategic Financial Planning

Receiving a large sum of money unexpectedly can be overwhelming. Here's how to approach it strategically:

- Pay off high-interest debt: Use the windfall to eliminate high-interest debt, such as credit card balances, which saves you money on interest payments.

- Boost your emergency fund: Having a robust emergency fund is crucial for financial stability. A significant portion of your windfall should go towards building or replenishing this fund.

- Invest in stocks or bonds: Investing a portion can grow your wealth over the long term. Consider consulting a financial advisor.

- Consider long-term savings goals: Think about larger financial goals, like a down payment on a house or retirement, and allocate some of the money accordingly.

The Psychology of Unexpected Wealth: Emotional Considerations

The emotional impact of a sudden windfall is significant. It's crucial to manage this impact responsibly:

- Avoid impulsive spending: Resist the urge to make large, frivolous purchases immediately. Take time to plan how to best use the money.

- Seek financial advice if needed: A financial advisor can help you create a personalized plan to manage your windfall effectively.

- Celebrate responsibly: Enjoy your good fortune, but do so responsibly, without jeopardizing your long-term financial goals.

DOGE Poll Results & Cryptocurrency News

The recent DOGE poll generated significant buzz within the cryptocurrency community. Understanding the results and the broader context of cryptocurrency is vital for informed decision-making.

Analyzing the DOGE Poll Data: Understanding Market Trends

The DOGE poll results [insert relevant data and analysis here] show [insert key findings and interpretation]. This data indicates [explain potential implications and market reactions]. The context of this poll is crucial because [provide further context].

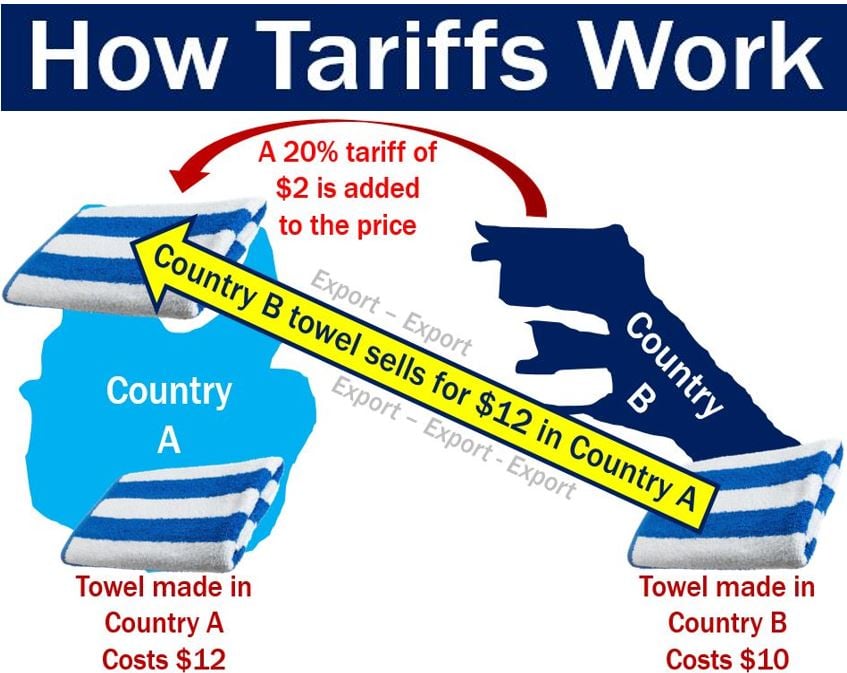

The Volatility of Cryptocurrency: Risks and Rewards

Cryptocurrencies like DOGE are known for their volatility. This inherent risk needs to be understood before investing.

- Discuss market fluctuations: The cryptocurrency market is highly volatile, with prices fluctuating dramatically in short periods.

- Highlight the importance of diversification: Diversifying your investment portfolio across different asset classes reduces overall risk.

- Warn against speculative investments: Investing in cryptocurrencies based solely on speculation is extremely risky.

Conclusion: Your GBR Weekly Roundup Takeaways

This GBR Weekly Roundup covered a range of topics, from practical grocery shopping tips and strategies for managing your budget to the excitement of unexpected financial windfalls and the ever-changing world of cryptocurrency. Remember, responsible financial planning and smart decision-making are crucial, whether you're dealing with a $2000 quarter or planning your weekly grocery shopping budget. Keep checking back for more insightful GBR Weekly Roundups to stay informed about essential financial news and tips! Learn more about improving your grocery shopping budget and managing your finances effectively by subscribing to our newsletter!

Featured Posts

-

El Superalimento Que Supera Al Arandano Beneficios Para La Salud Y El Envejecimiento

May 21, 2025

El Superalimento Que Supera Al Arandano Beneficios Para La Salud Y El Envejecimiento

May 21, 2025 -

Abn Amro Ziet Occasionverkoop Flink Toenemen Groeiend Autobezit Als Drijfveer

May 21, 2025

Abn Amro Ziet Occasionverkoop Flink Toenemen Groeiend Autobezit Als Drijfveer

May 21, 2025 -

The Goldbergs A Complete Guide To The Popular Sitcom

May 21, 2025

The Goldbergs A Complete Guide To The Popular Sitcom

May 21, 2025 -

Abn Amro Heffingen Halveren Voedselexport Naar Vs

May 21, 2025

Abn Amro Heffingen Halveren Voedselexport Naar Vs

May 21, 2025 -

Ofitsiyno Minkulturi Nadaye Status Kritichno Vazhlivikh Telekanalam Ukrayini

May 21, 2025

Ofitsiyno Minkulturi Nadaye Status Kritichno Vazhlivikh Telekanalam Ukrayini

May 21, 2025

Latest Posts

-

Canada Stands Firm Us Tariffs Largely Unchanged Despite Oxford Study

May 21, 2025

Canada Stands Firm Us Tariffs Largely Unchanged Despite Oxford Study

May 21, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Outlook

May 21, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Outlook

May 21, 2025 -

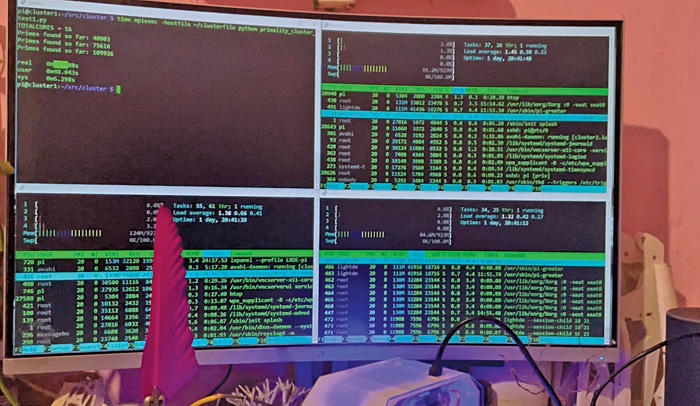

Chinas Space Supercomputer Technological Advancement And Global Implications

May 21, 2025

Chinas Space Supercomputer Technological Advancement And Global Implications

May 21, 2025 -

The Construction Of Chinas Space Based Supercomputer Milestones And Future Outlook

May 21, 2025

The Construction Of Chinas Space Based Supercomputer Milestones And Future Outlook

May 21, 2025 -

Chinas Space Supercomputer An Overview Of The Project And Its Significance

May 21, 2025

Chinas Space Supercomputer An Overview Of The Project And Its Significance

May 21, 2025