Guaranteed Tribal Loans: Options For Borrowers With Poor Credit

Table of Contents

Understanding Guaranteed Tribal Loans

Guaranteed tribal loans are loans offered by lenders affiliated with Native American tribes. Unlike traditional loans from banks or credit unions, these loans sometimes operate under different regulatory frameworks, potentially offering a more accessible avenue for individuals with poor credit. Let's break down the key terms:

- Guaranteed: While the term "guaranteed" might suggest automatic approval, this isn't always the case. It often refers to a higher likelihood of approval compared to traditional lenders, especially for those with bad credit.

- Tribal: These loans are offered by lending institutions associated with Native American tribes, operating on tribal lands and under tribal jurisdiction.

- Lender: This refers to the financial institution providing the loan, whether a bank, credit union, or a tribal lending entity.

- Loan: A sum of money borrowed that needs to be repaid with interest over a specified period.

The regulatory environment surrounding tribal lending is complex and varies significantly depending on the tribe and the specific lender. It's crucial to research the lender's legitimacy and understand the terms carefully before committing to a loan.

- Potential Benefits: Faster approvals, less stringent credit checks, potentially more flexible repayment terms.

- Potential Drawbacks: Higher interest rates than traditional loans, stricter penalties for late payments, the need for rigorous research to find a reputable lender.

Eligibility Criteria for Guaranteed Tribal Loans

Eligibility criteria for guaranteed tribal loans can vary depending on the lender, but generally include:

- Age: Applicants typically need to be 18 years or older.

- Residency: Lenders often require applicants to reside within a specific geographic area or state.

- Income: Proof of income is typically required to demonstrate the ability to repay the loan.

While credit history is considered, guaranteed tribal loans often cater specifically to those with poor credit who might be denied loans by traditional institutions. However, a better credit score may lead to more favorable loan terms.

- Guaranteed tribal loans cater to those with poor credit, but credit history still plays a role in determining loan amounts and interest rates.

- Loan amounts vary based on individual eligibility and the lender's policies.

- Thoroughly understand and agree to all terms and conditions before accepting the loan.

Finding Reputable Guaranteed Tribal Lenders

Finding a trustworthy lender is paramount when considering guaranteed tribal loans. The industry unfortunately attracts predatory lenders and scams, making due diligence crucial.

-

Thorough Research: Check online reviews, compare interest rates and fees from multiple lenders, and verify the lender's licensing and registration.

-

Warning Signs of Predatory Lenders: Excessively high interest rates, hidden fees, aggressive sales tactics, and a lack of transparency about loan terms.

-

Identifying Trustworthy Lenders: Look for lenders with clear and accessible contact information, positive customer reviews, and licenses or affiliations with recognized tribal organizations.

-

Utilize resources like the Better Business Bureau (BBB) and online review sites to check lender legitimacy.

-

Always compare interest rates, fees, and repayment terms across multiple lenders before making a decision.

-

Consult with a financial advisor or credit counselor for guidance if needed.

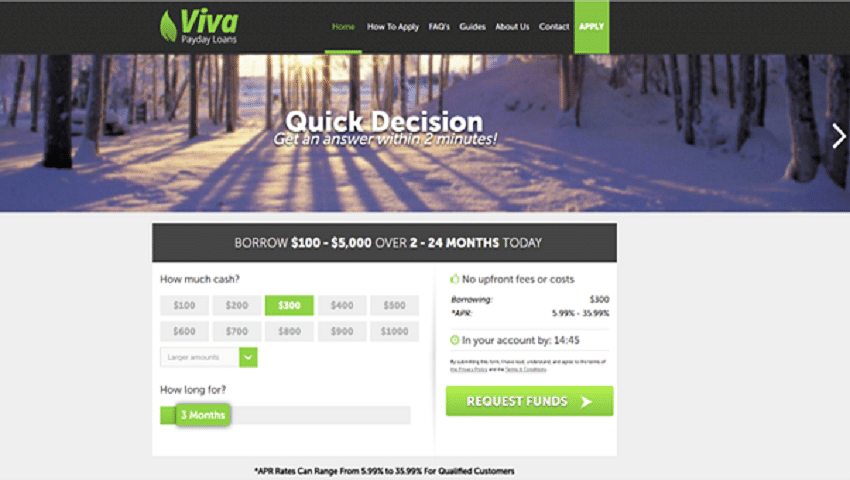

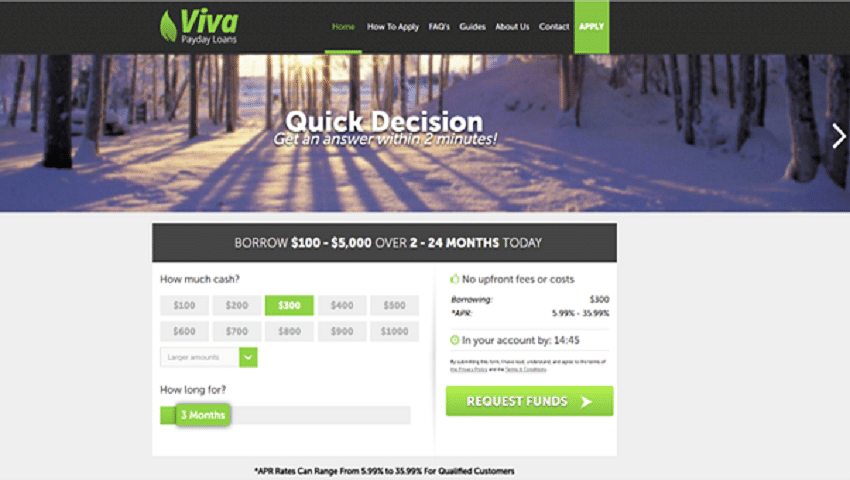

The Application Process for Guaranteed Tribal Loans

The application process typically involves these steps:

- Online Application: Most tribal lenders offer online application forms.

- Document Submission: Provide proof of income (pay stubs, bank statements), identification (driver's license, passport), and proof of address (utility bills).

- Credit Check (often a soft inquiry): While not as stringent as traditional lenders, a credit check is usually performed.

- Loan Approval and Disbursement: Once approved, funds are usually disbursed directly into your bank account.

- Online application processes are generally quick and convenient.

- Be prepared to provide bank statements, tax returns, or other documentation demonstrating your financial situation.

- Maintain prompt and clear communication with the lender throughout the application process.

Responsible Borrowing and Repayment

Borrowing responsibly is crucial when taking out any loan, including guaranteed tribal loans.

-

Budgeting: Create a realistic budget to ensure you can comfortably afford the monthly payments.

-

Repayment Plan: Develop a detailed repayment plan to stay on track and avoid late payments.

-

Consequences of Default: Defaulting on a loan can severely damage your credit score and lead to additional fees and legal action.

-

Utilize free resources for financial literacy and debt management from organizations like the National Foundation for Credit Counseling (NFCC).

-

Loan default can result in significant financial penalties and long-term negative consequences for your credit.

-

Communicate proactively with your lender if you anticipate difficulty making payments. They may offer options like repayment plans or extensions.

Conclusion: Making Informed Decisions About Guaranteed Tribal Loans

Guaranteed tribal loans can be a helpful option for individuals with poor credit who need access to funds. However, it's vital to understand both the advantages and disadvantages. Higher interest rates and the potential for predatory lenders necessitate thorough research and careful comparison shopping. Remember, responsible borrowing involves creating a realistic budget, developing a repayment plan, and choosing a reputable lender.

If you're facing financial hardship and considering guaranteed tribal loans, take the time to understand the process and find a reputable lender to help you navigate your options. Remember to carefully compare offers and choose a lender with transparent terms and a proven track record.

Featured Posts

-

Idojaras Jelentes Csapadek Toebb Hullamban De Kellemes Tavaszias Homerseklet

May 28, 2025

Idojaras Jelentes Csapadek Toebb Hullamban De Kellemes Tavaszias Homerseklet

May 28, 2025 -

The Doomsday Question Will Hugh Jackman Appear In The Avengers

May 28, 2025

The Doomsday Question Will Hugh Jackman Appear In The Avengers

May 28, 2025 -

Ice Cube To Star In And Write Last Friday Movie

May 28, 2025

Ice Cube To Star In And Write Last Friday Movie

May 28, 2025 -

Promo Samsung Galaxy S25 512 Go Avis 5 Etoiles 985 56 E Seulement

May 28, 2025

Promo Samsung Galaxy S25 512 Go Avis 5 Etoiles 985 56 E Seulement

May 28, 2025 -

The Ultimate Guide To Wrexham Activities And Accommodation

May 28, 2025

The Ultimate Guide To Wrexham Activities And Accommodation

May 28, 2025