Harvard's Tax-Exempt Status: President Condemns Revoking It As Illegal

Table of Contents

Legal Basis for Harvard's Tax-Exempt Status

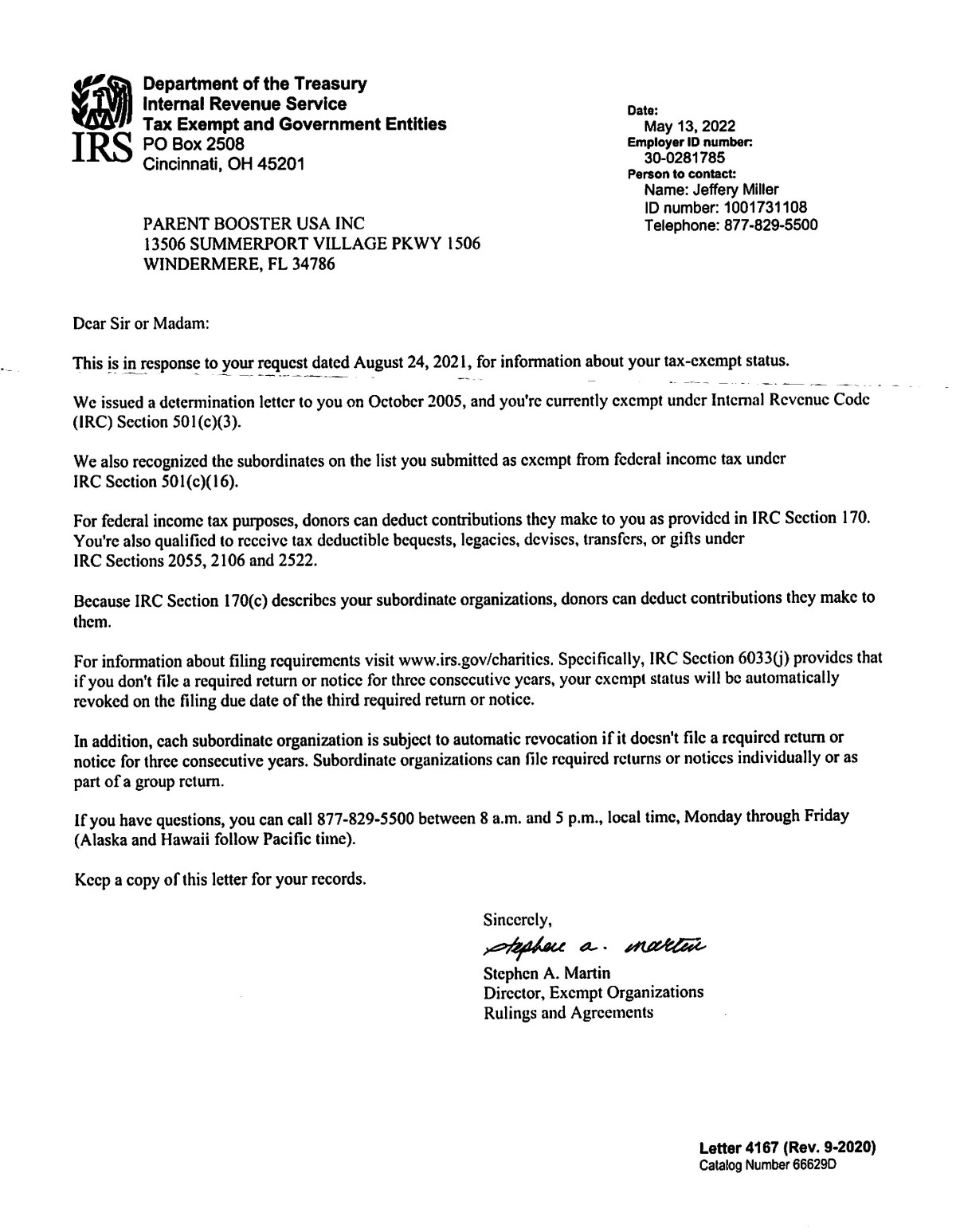

Harvard University, like many other non-profit institutions, operates under Section 501(c)(3) of the Internal Revenue Code. This section of the code governs the tax-exempt status of organizations deemed to be charitable, religious, educational, or for other specified purposes. To maintain this vital tax-exempt status, Harvard must consistently meet several key criteria. These include demonstrating a clear charitable purpose, providing substantial public benefit, and adhering strictly to IRS regulations.

The criteria for maintaining Harvard's tax-exempt status are multifaceted and rigorously enforced. The university must:

- Comply with IRS regulations regarding lobbying activities: Section 501(c)(3) organizations are subject to limitations on their lobbying efforts. Harvard must ensure its lobbying activities remain within permissible bounds.

- Maintain transparency in financial reporting: Regular and transparent financial reporting is crucial for maintaining public trust and demonstrating responsible use of resources. This includes detailed disclosure of endowments, spending, and overall financial health.

- Demonstrate substantial charitable contributions and community impact: Harvard needs to clearly articulate and evidence its contributions to the broader community through research, scholarships, and various outreach programs. This demonstrates the public benefit it provides, a cornerstone of its tax-exempt status.

- Maintain a non-profit organizational structure: The university’s governance and operations must consistently reflect its non-profit nature, ensuring profits are reinvested back into its mission, not distributed to shareholders.

President's Condemnation and Legal Arguments

President [President's Name] has issued a strong statement condemning any attempt to revoke Harvard's tax-exempt status, calling such actions "illegal" and a violation of due process. The President's statement emphasizes that revoking Harvard's tax-exempt status would require clear and compelling evidence of substantial wrongdoing, a threshold that, according to the President, has not been met.

The President's legal arguments center on several key points:

- Potential due process violations: The President argues that any attempt to revoke Harvard's status without proper due process would be a significant violation of legal rights. This would necessitate a fair hearing and opportunity to present a defense.

- Lack of sufficient grounds for revocation: The President contends that the arguments presented for revoking Harvard's tax-exempt status lack the necessary legal foundation and evidentiary support.

- Setting a dangerous precedent: The President argues that revoking Harvard’s tax-exempt status would establish a concerning precedent, potentially jeopardizing the tax-exempt status of other non-profit organizations and potentially chilling charitable giving.

- Specific legal precedents cited: The President's statement likely references relevant case law and legal precedent establishing the high bar for revoking 501(c)(3) status. The mention of potential legal challenges and lawsuits further underscores the seriousness of the situation.

Potential Consequences of Revoking Harvard's Tax-Exempt Status

The consequences of revoking Harvard's tax-exempt status would be far-reaching and severe. The immediate and most obvious impact would be financial:

- Increased financial burden on students: The loss of tax-exempt status would necessitate a dramatic increase in tuition fees to offset the substantial loss of tax revenue. This would disproportionately affect students from lower socioeconomic backgrounds.

- Reduced research funding and educational initiatives: Funding for crucial research projects and educational initiatives would likely face significant cuts due to the increased financial strain. This would compromise Harvard’s ability to maintain its high standard of education and research.

- Impact on the university's ability to fulfill its charitable mission: Losing tax-exempt status would severely hamper Harvard's ability to fulfill its charitable mission by limiting its capacity for grant-making and supporting various community initiatives.

- Erosion of public trust in non-profit organizations: The revocation of Harvard's tax-exempt status could erode public trust in the non-profit sector as a whole, potentially discouraging charitable giving and impacting other organizations.

The Broader Debate on Tax-Exempt Status for Higher Education

The debate surrounding Harvard's tax-exempt status is part of a larger national conversation about the tax-exempt status of universities in general. This conversation centers around key issues:

- The role of endowments in funding higher education: The size of university endowments, particularly at elite institutions like Harvard, is a recurring point of contention. Critics argue that these large endowments should lessen the need for tax-exempt status.

- The affordability crisis in higher education: The rising cost of higher education is a major concern. Critics argue that tax-exempt status for wealthy universities exacerbates the affordability crisis.

- Arguments for greater transparency and accountability for tax-exempt universities: Advocates for greater transparency and accountability contend that universities should be subject to more stringent oversight to ensure responsible use of resources and public funds.

Conclusion

The debate surrounding Harvard's tax-exempt status is complex and far-reaching. President [President's Name]'s strong condemnation, backed by compelling legal arguments, highlights the significant challenges and potential consequences associated with revoking this status. The potential financial burden on students, the detrimental impact on research, and the erosion of public trust in the non-profit sector all underscore the gravity of this situation. The discussion also highlights the need for a nuanced understanding of the legal framework governing tax-exempt organizations and the broader implications for higher education. Further research and informed public discourse are crucial to ensure a fair and just resolution to this critical issue. Stay informed about the developments in this important discussion regarding Harvard's tax-exempt status and the future of higher education.

Featured Posts

-

Singapore Votes High Stakes General Election Looms

May 05, 2025

Singapore Votes High Stakes General Election Looms

May 05, 2025 -

Electric Motor Innovation Breaking Free From Chinas Grip

May 05, 2025

Electric Motor Innovation Breaking Free From Chinas Grip

May 05, 2025 -

Rain Alert Met Department Forecasts Downpour In North Bengal

May 05, 2025

Rain Alert Met Department Forecasts Downpour In North Bengal

May 05, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

May 05, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

May 05, 2025 -

Analyzing The 2025 Tampa Bay Derby Key Horses Odds And Road To Kentucky Derby

May 05, 2025

Analyzing The 2025 Tampa Bay Derby Key Horses Odds And Road To Kentucky Derby

May 05, 2025

Latest Posts

-

Pimblett Raises Concerns About Chandlers Conduct Before Ufc 314 Bout

May 05, 2025

Pimblett Raises Concerns About Chandlers Conduct Before Ufc 314 Bout

May 05, 2025 -

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 05, 2025

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 05, 2025 -

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 05, 2025

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 05, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025 -

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025