High Down Payments In Canada: A Barrier To Homeownership

Table of Contents

H2: The Impact of High Down Payments on Affordability

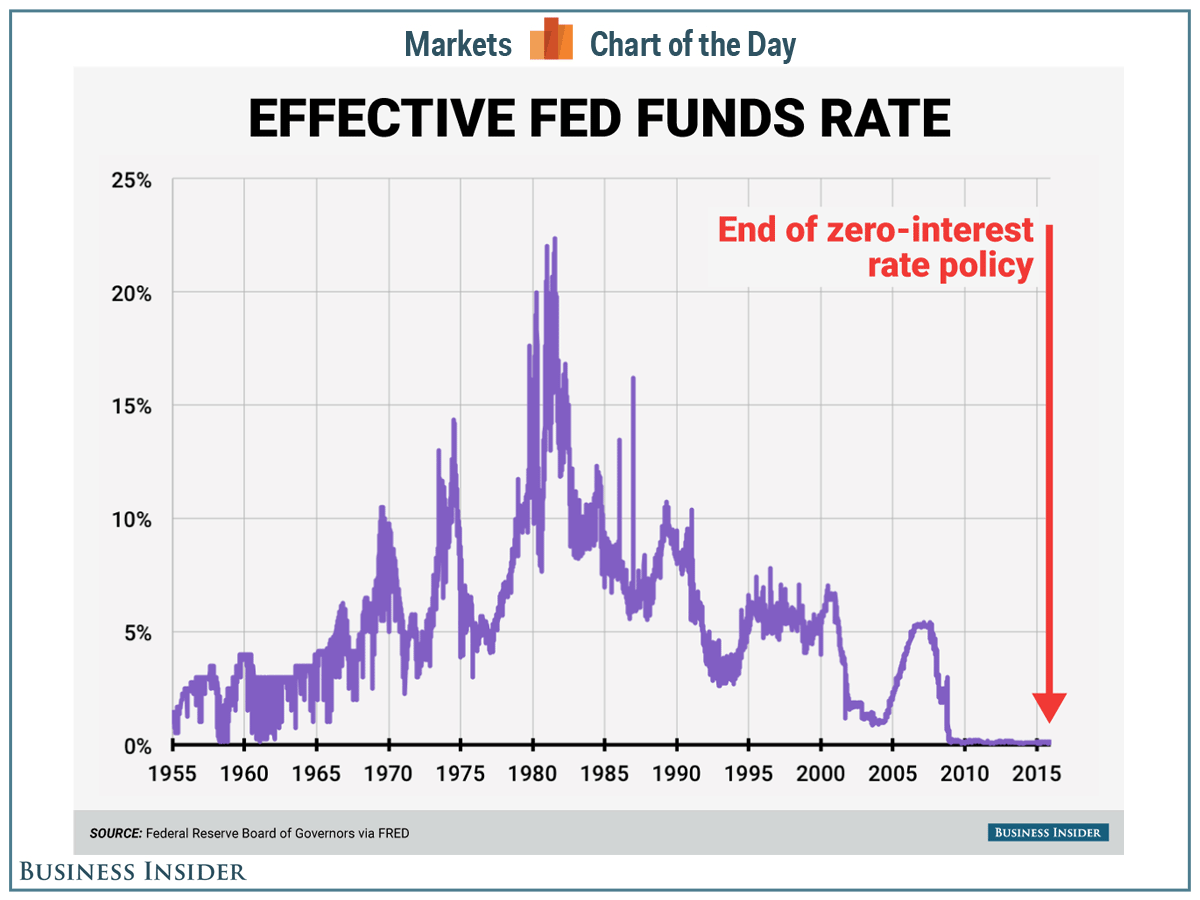

The size of your down payment directly impacts your mortgage and overall affordability. A larger down payment means a smaller loan amount, resulting in lower monthly mortgage payments and less interest paid over the life of the loan. Conversely, a smaller down payment, while requiring less upfront capital, significantly increases your monthly payments and the total interest paid. This is especially true in the current climate of fluctuating interest rates.

-

Compounding Effect of Interest Rates: Higher interest rates exacerbate the financial burden of larger mortgages. A small difference in the down payment percentage can translate to hundreds or even thousands of dollars more in monthly payments over the loan term.

-

Illustrative Example 1: Let's compare two scenarios for a $500,000 home:

- 5% Down Payment: A $25,000 down payment leaves a $475,000 mortgage. With a 5% interest rate amortized over 25 years, the monthly payment would be significantly higher than...

- 20% Down Payment: A $100,000 down payment leaves a $400,000 mortgage. The monthly payment at the same 5% interest rate would be substantially lower. This difference in monthly payments can be the deciding factor for many prospective homebuyers.

-

Illustrative Example 2: Saving for a 20% down payment on a $500,000 home requires saving $100,000, which significantly extends the saving timeline compared to a 5% down payment requiring only $25,000. This longer savings period can delay homeownership for years.

H2: The Role of Government Policies and Regulations

The Canadian Mortgage and Housing Corporation (CMHC) plays a crucial role in the housing market by insuring mortgages with down payments less than 20%. This allows lenders to offer mortgages to those who cannot afford a larger down payment. However, the CMHC insurance premiums add to the overall cost of the mortgage.

-

Effectiveness of Current Policies: While CMHC insurance expands access to mortgages, it doesn't fully address the affordability challenge posed by high down payments. The increased cost of insurance coupled with rising interest rates continues to restrict homeownership for many.

-

Proposed Changes and Future Policies: The Canadian government regularly reviews and adjusts housing policies. It's crucial to stay informed about any changes or new initiatives that may impact down payment requirements and affordability programs. [Link to relevant government website].

- Policy Feature 1: [Summary and impact]

- Policy Feature 2: [Summary and impact]

- Policy Feature 3: [Summary and impact]

H2: Alternative Strategies for Saving for a Down Payment

Saving for a substantial down payment requires a dedicated financial strategy. Several options can help accelerate the process.

-

Practical Saving Strategies:

- Develop a detailed budget to track expenses and identify areas for savings.

- Aggressively pay down high-interest debt to free up more funds for savings.

- Maximize high-yield savings accounts and consider investment options with lower risk.

- Utilize the Home Buyers' Plan (HBP) to withdraw funds from your Registered Retirement Savings Plan (RRSP) for a down payment, remembering to repay the withdrawn amount over a set period.

-

Family Assistance: While leveraging family support can significantly reduce the time needed to save, it’s crucial to have clear financial agreements and legal documentation to protect everyone involved.

-

Less Conventional Options: Co-ownership allows you to share the cost of purchasing a property with others, while shared equity mortgages involve an investor contributing a portion of the down payment in exchange for a share of the property's equity.

H2: The Broader Social and Economic Consequences of High Down Payments

The inaccessibility of homeownership due to high down payments has far-reaching consequences.

-

Impact on Social Mobility: Owning a home is a significant contributor to wealth building and intergenerational mobility. High down payments impede this for many, exacerbating existing inequalities.

-

Disproportionate Impact: Younger generations, lower-income families, and new immigrants are disproportionately affected by the high down payment barrier, facing significant challenges in entering the housing market.

-

Long-Term Societal Effects: A housing market inaccessible to a large segment of the population can lead to social unrest, reduced economic growth, and diminished overall well-being.

Conclusion: Overcoming the High Down Payment Challenge in Canada

High down payments represent a major obstacle to homeownership for many Canadians. The impact on affordability is substantial, influenced by government policies, and has broader social and economic implications. However, by implementing strategic saving plans, exploring alternative financing options, and staying informed about government initiatives, aspiring homeowners can navigate this challenge. Don't let high down payments deter your dreams of homeownership. Start planning your financial strategy today by exploring the resources and options discussed in this article and take the first step towards securing your future in the Canadian housing market.

Featured Posts

-

Pakistans Imf Bailout In Jeopardy 1 3 Billion Package Under Review

May 09, 2025

Pakistans Imf Bailout In Jeopardy 1 3 Billion Package Under Review

May 09, 2025 -

Sensex 600 Nifty

May 09, 2025

Sensex 600 Nifty

May 09, 2025 -

Dakota Johnsons Family Supports Her At Materialist Premiere

May 09, 2025

Dakota Johnsons Family Supports Her At Materialist Premiere

May 09, 2025 -

Jeanine Pirro Advises Ignoring The Stock Market In The Coming Weeks

May 09, 2025

Jeanine Pirro Advises Ignoring The Stock Market In The Coming Weeks

May 09, 2025 -

Fed Rate Cuts Why The Us Is Different

May 09, 2025

Fed Rate Cuts Why The Us Is Different

May 09, 2025