High Stock Market Valuations: A BofA Analyst's Rationale For Calm

Table of Contents

Understanding Current High Stock Market Valuations

What constitutes "high" stock market valuations? This isn't a simple question, as it depends on several key metrics. Price-to-Earnings ratios (P/E), comparing a company's stock price to its earnings per share, are frequently used. High P/E ratios generally suggest investors are willing to pay more for each dollar of earnings, indicating potentially high valuations. Similarly, Price-to-Sales ratios (P/S), comparing stock price to revenue, can also highlight potentially inflated valuations. Other metrics like Price-to-Book (P/B) and PEG ratios also provide valuable insights.

Comparing current valuations to historical averages reveals a complex picture. While some metrics suggest valuations are elevated compared to long-term averages, others paint a more nuanced picture. Periods of rapid technological advancement, like the dot-com boom, have also seen significantly higher valuations, albeit often followed by corrections. The current market landscape is influenced by a unique interplay of factors.

Factors Contributing to High Stock Market Valuations:

- Low Interest Rates: Historically low interest rates have pushed investors towards higher-yielding assets, including stocks. This increased demand has contributed to higher valuations.

- Strong Corporate Earnings Growth: Many companies have reported strong earnings growth, fueling investor optimism and supporting higher stock prices. Future growth projections also play a significant role.

- Technological Advancements: The rapid pace of technological innovation has created a new wave of high-growth companies, commanding high valuations based on future potential.

- Increased Investor Confidence: A general sense of investor confidence, fueled by economic recovery and government stimulus in some regions, has also driven stock prices higher.

Key Drivers of High Stock Market Valuations:

- Low interest rate environment

- Strong corporate profit growth

- Technological disruption and innovation

- Positive investor sentiment

BofA Analyst's Key Arguments for a Calm Approach

The BofA analyst's contrarian view rests on several key pillars. They emphasize a long-term growth perspective, believing sustained economic growth will continue to support corporate profits despite current high valuations. This long-term vision is heavily influenced by the transformative potential of technological innovation. The analyst believes that technological advancements will drive future growth and productivity gains, ultimately justifying current valuations.

Regarding interest rates, the analyst acknowledges the potential for future hikes but anticipates their impact on valuations to be relatively moderate. While acknowledging the possibility of market corrections, they view these as healthy adjustments within a broader upward trend. They believe that these corrections would be opportunities for long-term investors.

BofA Analyst's Main Arguments for a Calm Approach:

- Belief in sustained long-term economic growth

- Emphasis on the transformative power of technological innovation

- Moderate expectation of the impact of future interest rate hikes

- View of market corrections as healthy adjustments within a long-term upward trend

Counterarguments and Risks Associated with High Valuations

While the BofA analyst's perspective is compelling, it's crucial to acknowledge counterarguments and risks associated with high stock market valuations. The potential for a significant market correction remains a serious concern. Overvalued assets are inherently vulnerable to sharp price declines, especially if investor sentiment shifts.

Inflationary pressures pose another significant risk. Rising inflation erodes corporate profits and can lead to higher interest rates, negatively impacting stock valuations. Geopolitical instability and unforeseen global events can also trigger market downturns, adding another layer of uncertainty. High-growth stocks, often characterized by high valuations, are particularly sensitive to rising interest rates, as their future earnings are discounted more heavily when borrowing costs increase.

Potential Risks and Counterarguments:

- Significant risk of market correction

- Negative impact of rising inflation on corporate profits

- Geopolitical risks and market volatility

- Interest rate sensitivity of high-growth stocks

Strategies for Navigating High Stock Market Valuations

Given the current market environment, investors need a well-defined strategy. Diversification remains paramount. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces the overall portfolio's vulnerability to market fluctuations. Value investing, focusing on companies trading below their intrinsic value, can offer opportunities even in a market with high valuations.

Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate long-term investment decisions. Regular portfolio review allows investors to adapt to changing market conditions and rebalance their investments as needed.

Strategies for Managing Portfolios in a High Valuation Market:

- Diversify your investment portfolio

- Consider value investing strategies

- Maintain a long-term investment horizon

- Regularly review and rebalance your portfolio

High Stock Market Valuations – Maintaining Perspective and a Strategic Approach

The BofA analyst's calm approach to high stock market valuations rests on a belief in long-term economic growth fueled by technological innovation. However, it's essential to acknowledge the potential risks, including market corrections, inflation, and geopolitical uncertainty. A balanced perspective, combining optimism with risk awareness, is crucial. Maintaining a long-term investment strategy and a well-diversified portfolio are key to navigating this challenging market. Conduct thorough research, consider professional financial advice tailored to your risk tolerance, and develop a well-informed investment plan to manage effectively within the context of high stock market valuations. [Link to relevant resources on investment strategies].

Featured Posts

-

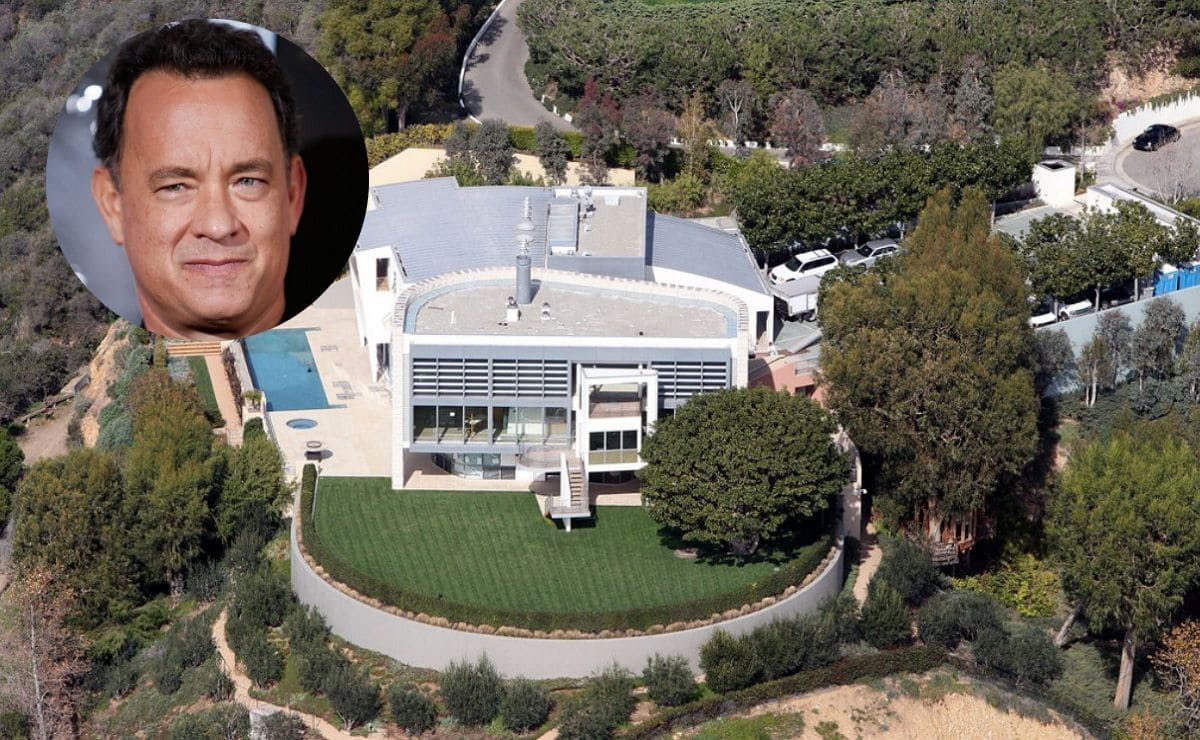

Complete List Celebrities Impacted By The La Palisades Wildfires

May 10, 2025

Complete List Celebrities Impacted By The La Palisades Wildfires

May 10, 2025 -

Caravan Site Controversy Uk City Battles Housing Crisis And Public Anger

May 10, 2025

Caravan Site Controversy Uk City Battles Housing Crisis And Public Anger

May 10, 2025 -

Casey Means And The Maha Movement Analyzing Trumps Nomination

May 10, 2025

Casey Means And The Maha Movement Analyzing Trumps Nomination

May 10, 2025 -

Investigation Into Racially Motivated Stabbing Death

May 10, 2025

Investigation Into Racially Motivated Stabbing Death

May 10, 2025 -

Tarykh Altdkhyn Byn Njwm Krt Alqdm Hqayq Warqam

May 10, 2025

Tarykh Altdkhyn Byn Njwm Krt Alqdm Hqayq Warqam

May 10, 2025

Latest Posts

-

2025 Hurun Global Rich List Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025

2025 Hurun Global Rich List Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025 -

Hurun Report 2025 Elon Musks Billions Reduced Yet Tops Global Rich List

May 10, 2025

Hurun Report 2025 Elon Musks Billions Reduced Yet Tops Global Rich List

May 10, 2025 -

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025 -

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By 100 Billion Still Worlds Richest

May 10, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By 100 Billion Still Worlds Richest

May 10, 2025 -

Understanding Pam Bondis Position On The Lives Of American Citizens

May 10, 2025

Understanding Pam Bondis Position On The Lives Of American Citizens

May 10, 2025