HMRC Nudge Letters: EBay, Vinted, And Depop Sellers Beware

Table of Contents

What are HMRC Nudge Letters? Understanding the Warning Signs

HMRC nudge letters are early warnings indicating potential tax compliance issues. They aren't necessarily accusations of wrongdoing but rather prompts to review your tax affairs. These letters can range from gentle reminders about filing your self-assessment tax return to more formal warnings about discrepancies in your reported income.

Types of HMRC Nudge Letters:

- Gentle Reminders: These might simply highlight the upcoming deadline for filing your tax return or remind you of the need to report specific types of income.

- Formal Warnings: These letters indicate that HMRC has identified potential discrepancies between your declared income and their records. They usually request further information or clarification.

Why is HMRC Targeting Online Sellers?

The rise of online marketplaces has created a surge in individual sellers generating taxable income. HMRC is stepping up its efforts to ensure everyone complies with their tax obligations, utilizing data analytics to identify potential non-compliance. This increased scrutiny is not meant to be punitive but rather to ensure fair tax contributions from all.

Identifying a Genuine HMRC Letter:

It's crucial to distinguish genuine HMRC correspondence from scams. Genuine letters will:

- Be printed on official HMRC stationery.

- Contain your unique taxpayer reference number (UTR).

- Have a clear and official tone.

- Not request immediate bank transfers or personal details via email or phone.

Key Phrases in HMRC Nudge Letters:

Look out for phrases such as: "Review of your tax return," "Income tax enquiry," "Further information required," and "Underpayment of tax."

eBay, Vinted & Depop Sellers: Specific Risks and Responsibilities

Each online marketplace presents unique tax implications:

eBay:

Selling on eBay can range from casual selling of unwanted items to running a fully-fledged business. The key is determining whether your selling activity constitutes a business or a hobby. Consistent, high-volume sales often indicate a business, triggering business tax requirements and potentially VAT registration thresholds.

Vinted:

Selling second-hand clothing on Vinted presents specific challenges regarding profit calculation. You need to deduct any costs associated with acquiring and preparing the items for sale (e.g., cleaning, postage). Accurate record-keeping is crucial to correctly calculate your taxable profit.

Depop:

Similar to Vinted, Depop sellers need to track their income and expenses carefully. The line between casual selling and a business venture can be blurred, so honest self-assessment is crucial for tax compliance.

Profit Thresholds and Reporting Requirements:

The income level at which you need to report your profits to HMRC varies. It's essential to understand the current thresholds and ensure you're adhering to all reporting requirements through self-assessment or other appropriate channels.

Record-Keeping Best Practices:

- Keep detailed sales records, including dates, items sold, prices, and buyer information.

- Maintain accurate records of all expenses related to your online selling activities.

- Use spreadsheets or accounting software to streamline record-keeping.

Responding to an HMRC Nudge Letter: A Step-by-Step Guide

Receiving an HMRC nudge letter can be daunting, but prompt action is key:

- Don't ignore the letter: Ignoring it will only exacerbate the situation and potentially lead to more significant penalties.

- Gather necessary documentation: Collect all relevant sales records, bank statements, expense receipts, and any other supporting documents mentioned in the letter.

- Understand your tax obligations: If you're unsure about your tax liabilities, seek professional advice from a qualified accountant.

- Contacting HMRC: Respond promptly to the letter, providing all the requested information clearly and accurately.

- Potential penalties for non-compliance: Ignoring or delaying your response can result in significant financial penalties.

Preventing Future HMRC Nudge Letters: Proactive Tax Compliance

The best way to avoid HMRC nudge letters is to be proactive:

- Accurate record-keeping: Maintain meticulous records of all your sales and expenses.

- Registering as self-employed: If your online selling activity constitutes a business, register as self-employed with HMRC.

- Understanding your tax allowances: Familiarize yourself with any allowances or deductions you're entitled to.

- Utilizing accounting software: Tools such as Xero or FreeAgent can simplify your bookkeeping and tax calculations.

- Seeking professional tax advice: Consult an accountant to ensure you understand your tax obligations and are complying with all regulations.

Conclusion: Avoid HMRC Nudge Letters and Stay Compliant

Ignoring HMRC nudge letters can lead to significant financial penalties and tax investigations. Proactive tax compliance is crucial for eBay, Vinted, and Depop sellers. Ensure your HMRC compliance by maintaining accurate records, understanding your tax obligations, and seeking professional advice when needed. Take control of your tax affairs, avoid an HMRC investigation, and prevent future HMRC nudge letters. Review your tax obligations today and seek professional help if you need it to ensure your HMRC responsibilities are met fully.

Featured Posts

-

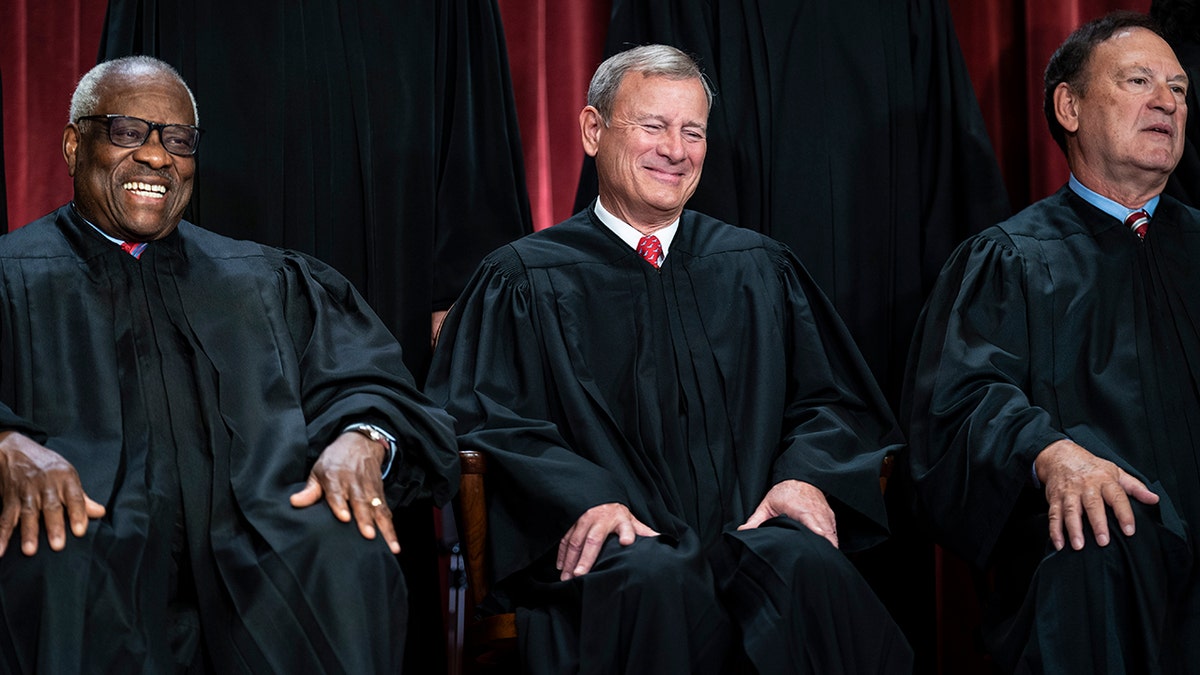

Three Decades On The Bench Reflecting On Alito And Roberts Supreme Court Careers

May 20, 2025

Three Decades On The Bench Reflecting On Alito And Roberts Supreme Court Careers

May 20, 2025 -

Amorims Coup A Major Forward Joins Man Utd

May 20, 2025

Amorims Coup A Major Forward Joins Man Utd

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulkona

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulkona

May 20, 2025 -

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025 -

Wwe Talent Reactions To Hinchcliffes Unsuccessful Segment

May 20, 2025

Wwe Talent Reactions To Hinchcliffes Unsuccessful Segment

May 20, 2025