HMRC Tax Debt: Savings Accounts And Unpaid Tax Liabilities

Table of Contents

HMRC's Powers to Access Savings for Unpaid Tax

HMRC possesses significant statutory powers to recover unpaid tax. These powers extend to seizing assets, including money held in savings accounts, to settle outstanding tax debts. Understanding these powers is crucial for responsible tax management.

HMRC's Statutory Powers:

HMRC's authority to collect unpaid tax is rooted in various legislation, including the Taxes Management Act 1970 and the various Finance Acts. Before taking action against your savings, HMRC typically follows a process involving:

- Formal Demand: A written demand for payment will be issued, outlining the outstanding tax liability and a deadline for payment.

- Reminder Notices: If the initial demand is ignored, further reminders will be sent.

- Further Investigation: HMRC may investigate your financial situation to determine your ability to pay.

- Enforcement Action: If payment isn't received, HMRC may take enforcement action, potentially involving seizing assets, including savings.

Different Types of Savings Accounts:

The treatment of different savings accounts under HMRC rules varies.

- ISAs (Individual Savings Accounts): Generally, ISAs offer a high level of protection against HMRC seizure. However, this protection isn't absolute and may not apply in all circumstances, particularly if fraudulent activity is involved.

- Individual Savings Accounts (other than ISAs): These accounts are generally vulnerable to seizure by HMRC to settle unpaid tax debts.

- Joint Accounts: HMRC can access funds in joint accounts, even if the other account holder doesn't owe tax. The proportion of the funds seized will depend on the individual's share of ownership and the overall tax debt.

Thresholds and Limits:

HMRC doesn't automatically seize savings. They consider several factors:

- Amount of Debt: The size of the unpaid tax liability is a significant factor.

- Financial Circumstances: HMRC will assess your ability to pay, considering your income, expenses, and overall financial situation. This assessment might involve requesting financial documentation.

- Other Assets: HMRC might consider other assets you own before targeting your savings.

The Role of Enforcement Agents:

If other methods fail, HMRC may engage enforcement agents (formerly bailiffs) to recover the debt. These agents have the power to seize assets, including accessing funds in savings accounts, although this is a last resort.

- Warning Signs: Be aware of official-looking letters and notices. Ignore illegitimate contact.

- Pre-Action Notices: You will typically receive several warnings before enforcement action is taken.

Protecting Your Savings from HMRC Action

Proactive steps can significantly reduce the risk of HMRC seizing your savings.

Open Communication with HMRC:

The most effective way to avoid escalation is open and honest communication with HMRC.

- Contact HMRC Immediately: If you're struggling to pay your taxes, contact HMRC immediately to discuss your situation.

- Negotiate Payment Plans: HMRC may offer payment plans or time-to-pay arrangements to help you manage your debt.

Timely Tax Payments:

The best way to avoid tax debt is to pay your taxes on time.

- Set Up Direct Debits: Automate your tax payments to avoid late payments and penalties.

- Use HMRC Online Services: Manage your tax affairs online for efficient payment.

Seeking Professional Advice:

Navigating complex tax debt issues can be challenging.

- Tax Advisors/Accountants: Professional advice can help negotiate with HMRC and explore solutions to manage your debt effectively.

Debt Management Plans:

Debt management plans (DMPs) can help structure repayments for multiple debts, including tax debt. However, carefully consider the implications before opting for a DMP.

Conclusion: Taking Control of Your HMRC Tax Debt

Understanding HMRC's powers regarding your savings, the importance of open communication, and proactive debt management is crucial. Timely tax payments and seeking professional help when needed can prevent severe financial consequences. Don't let HMRC tax debt control your finances. Take action today! Contact HMRC immediately if you are struggling to pay your taxes, and seek professional advice to manage your tax liabilities effectively.

For further information and support, visit the official HMRC website: [Insert HMRC website link here] and consider seeking advice from a qualified financial advisor.

Featured Posts

-

No Murder In Agatha Christies Towards Zero Episode 1 A Critical Look

May 20, 2025

No Murder In Agatha Christies Towards Zero Episode 1 A Critical Look

May 20, 2025 -

Atkinsrealis Droit Inc Avocats Specialises En Droit Commercial Et Civil

May 20, 2025

Atkinsrealis Droit Inc Avocats Specialises En Droit Commercial Et Civil

May 20, 2025 -

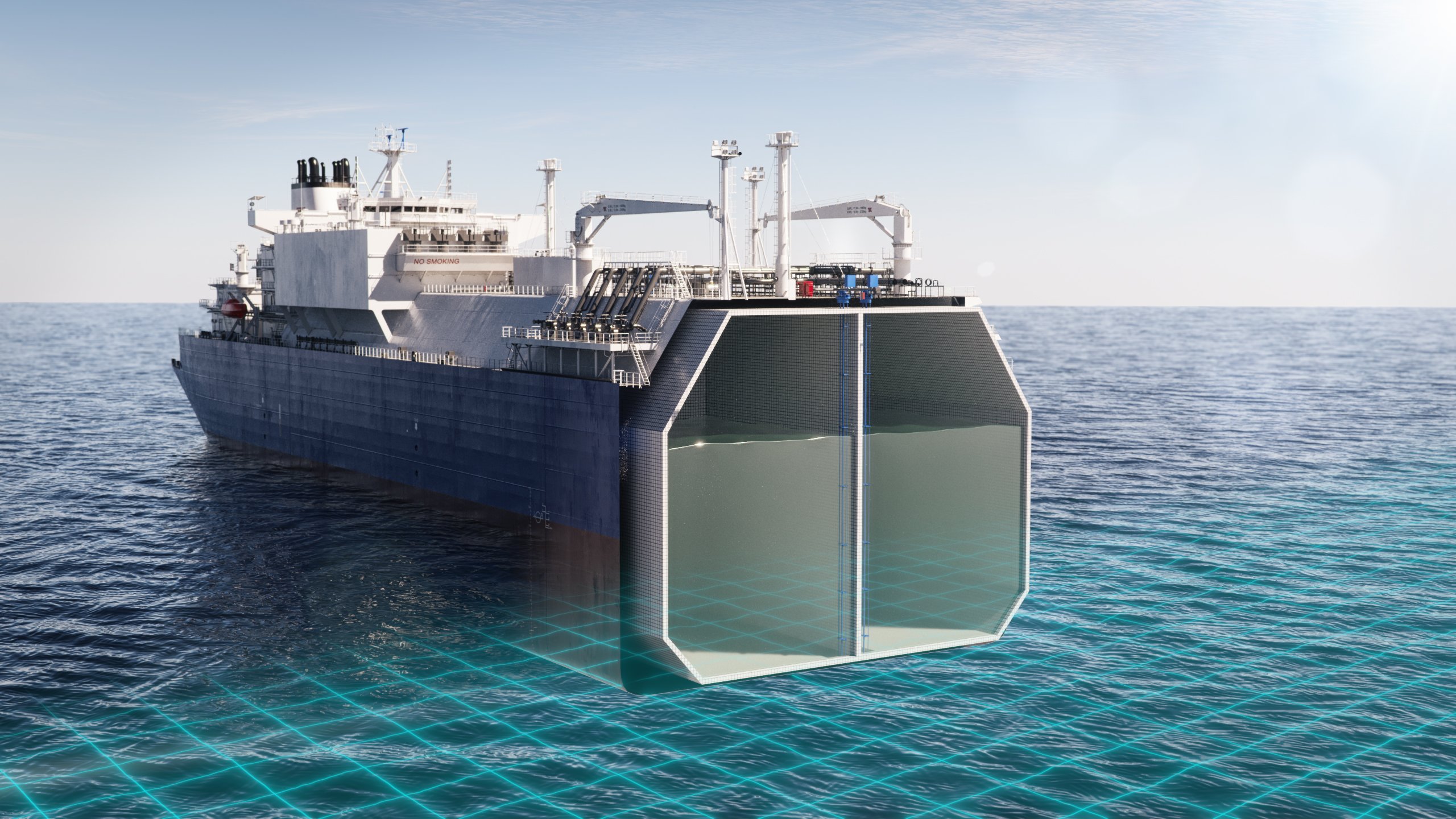

Taiwans Energy Security The Lng Solution Post Nuclear

May 20, 2025

Taiwans Energy Security The Lng Solution Post Nuclear

May 20, 2025 -

Maybank Fuels Economic Growth With 545 Million Investment

May 20, 2025

Maybank Fuels Economic Growth With 545 Million Investment

May 20, 2025 -

Matheus Cunha To Man United Journalist Shares Worrying News

May 20, 2025

Matheus Cunha To Man United Journalist Shares Worrying News

May 20, 2025