How Delinquent Student Loans Affect Your Creditworthiness

Table of Contents

Understanding Delinquent Student Loans and Their Reporting

Definition of Delinquency

A delinquent student loan is one where you've missed payments and are past due. The definition of delinquency varies, typically categorized by the number of days past the due date: 30 days past due, 60 days past due, 90 days past due, and so on. Each level of delinquency carries increasing negative consequences. The severity of the delinquency is directly related to the impact on your credit report.

Reporting to Credit Bureaus

Your loan servicer reports your payment history to the three major credit bureaus: Experian, Equifax, and TransUnion. When a payment becomes delinquent, this information is typically reported after a certain period (often 30 days), negatively impacting your credit score.

- Specific timelines for reporting delinquency: While the exact timeline can vary by loan servicer, it usually takes at least 30 days of delinquency before the information is reported. Consistent delinquency will result in further negative marks on your credit report.

- The impact of different levels of delinquency on credit scores: The longer a loan remains delinquent, the more severe the negative impact on your credit score. A 30-day delinquency is less damaging than a 90-day or 120-day delinquency.

- The role of loan servicers in reporting delinquency: Loan servicers are responsible for tracking payments and reporting delinquency to credit bureaus. It's crucial to maintain open communication with your servicer to address any payment issues promptly. Keyword Optimization: student loan delinquency, credit report, credit score impact, loan servicer reporting.

The Impact on Your Credit Score

Significant Score Reduction

Delinquent student loans can significantly reduce your credit score. The magnitude of the drop depends on several factors, including the severity of the delinquency and your overall credit history. A single missed payment can lower your score, while persistent delinquency can severely damage your credit rating.

Difficulty Obtaining Credit

A low credit score due to delinquent student loans makes it incredibly difficult to obtain new credit. Banks and lenders view individuals with poor credit history as high-risk borrowers. This can impact your ability to secure loans for a car, a house (mortgage), or even a credit card.

Higher Interest Rates

Even if you qualify for new credit with a damaged credit score, you'll likely face significantly higher interest rates. Lenders compensate for the increased risk by charging higher interest, leading to more expensive borrowing in the long run.

- Examples of credit score drops for various delinquency levels: A 30-day delinquency might lower your score by 30-50 points, while a 90-day delinquency could lead to a 100-point drop or more.

- Specific examples of credit applications impacted by poor credit: It might be challenging to get approved for a mortgage, auto loan, or even a credit card with a significantly low credit score.

- Illustrative examples of increased interest rates due to poor credit: Your interest rate on a new loan could be several percentage points higher than someone with a good credit score. Keyword Optimization: credit score damage, interest rate increase, credit application rejection, impact on credit rating.

Steps to Take if You Have Delinquent Student Loans

Contact Your Loan Servicer

The first and most crucial step is to contact your loan servicer immediately. Open communication is key to finding a solution. Explain your situation and explore available options.

Explore Repayment Plans

Several repayment plans can help you manage your student loan debt. These include:

- Income-driven repayment (IDR) plans: Your monthly payment is based on your income and family size.

- Deferment: Temporarily postpones your payments.

- Forbearance: Reduces or suspends your payments for a limited time.

Loan Consolidation

Consolidating your student loans into a single loan can simplify payments and potentially lower your monthly payment. However, it's essential to understand the terms and conditions before consolidating.

Credit Counseling and Debt Management

Credit counseling agencies can provide guidance and support in managing your student loan debt. They can help you create a budget, negotiate with creditors, and develop a debt management plan.

- Contact information for major student loan servicers: This information is readily available online through a simple search.

- Pros and cons of each repayment plan: Research each plan carefully to understand its benefits and drawbacks.

- Steps to consolidate student loans: The process involves applying through a lender or the government.

- Reputable credit counseling agencies: The National Foundation for Credit Counseling (NFCC) is a reputable organization that can refer you to certified credit counselors. Keyword Optimization: student loan repayment, income-driven repayment, loan consolidation, student loan forgiveness, debt management plan, credit counseling services.

Preventing Future Delinquency

Budgeting and Financial Planning

Creating a realistic budget and sticking to it is vital to avoid future delinquency. Track your income and expenses, identify areas where you can cut back, and prioritize your student loan payments.

Automating Payments

Set up automatic payments from your bank account to ensure that payments are made on time every month. This eliminates the risk of missed payments due to oversight.

Monitoring Your Credit Report

Regularly check your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) for accuracy and errors. Early detection of any issues can help you address them promptly.

- Tips for creating a budget: Use budgeting apps or spreadsheets to track your income and expenses.

- How to set up automatic payments: Most loan servicers offer online options to set up automatic payments.

- Where to access free credit reports: You can access your free credit reports annually from AnnualCreditReport.com. Keyword Optimization: student loan management, avoiding delinquency, budgeting for students, credit report monitoring, financial planning tips.

Conclusion:

Delinquent student loans can severely damage your creditworthiness, impacting your ability to obtain credit and leading to higher interest rates. Understanding the definition of delinquency, its reporting to credit bureaus, and its impact on your credit score is crucial. By proactively addressing delinquent loans through communication with your loan servicer, exploring repayment options, and seeking professional guidance, you can take control of your financial future. Don't let delinquent student loans ruin your financial future. Take control of your student loan debt today by exploring available repayment options and seeking help if needed. Start managing your student loan debt effectively and avoid student loan delinquency to improve your credit score.

Featured Posts

-

Warner Bros Pictures Cinema Con 2025 Presentation A Deep Dive

May 17, 2025

Warner Bros Pictures Cinema Con 2025 Presentation A Deep Dive

May 17, 2025 -

Exploring The Life And Career Of Tony Bennett

May 17, 2025

Exploring The Life And Career Of Tony Bennett

May 17, 2025 -

Serious Injury Clouds Angel Reeses Dpoy Celebration

May 17, 2025

Serious Injury Clouds Angel Reeses Dpoy Celebration

May 17, 2025 -

37 Yasindaki Novak Djokovic Yillara Meydan Okuyan Bir Efsane

May 17, 2025

37 Yasindaki Novak Djokovic Yillara Meydan Okuyan Bir Efsane

May 17, 2025 -

Mhrjan Aljzayr Alsynmayy Ykrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Mhrjan Aljzayr Alsynmayy Ykrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Latest Posts

-

Panduan Lengkap Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025

Panduan Lengkap Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025 -

Cara Menggunakan Laporan Keuangan Untuk Pengambilan Keputusan Bisnis Yang Lebih Baik

May 17, 2025

Cara Menggunakan Laporan Keuangan Untuk Pengambilan Keputusan Bisnis Yang Lebih Baik

May 17, 2025 -

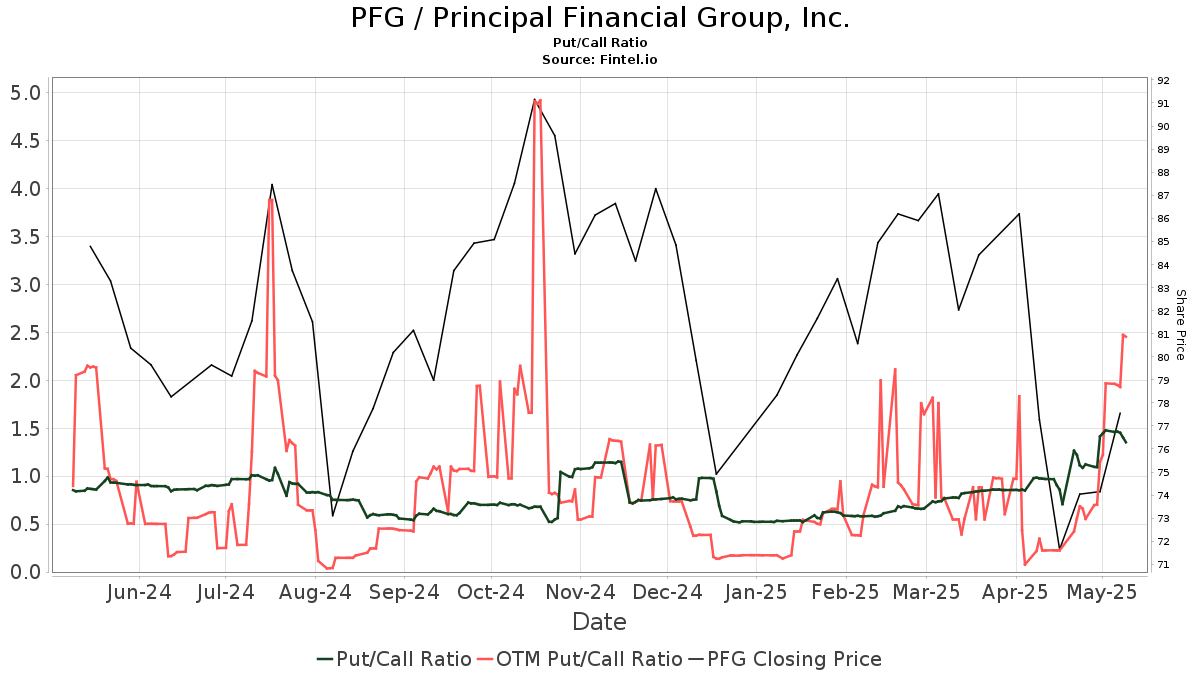

Analyzing Principal Financial Group Pfg What 13 Analysts Say

May 17, 2025

Analyzing Principal Financial Group Pfg What 13 Analysts Say

May 17, 2025 -

Memahami Pentingnya Laporan Keuangan Untuk Kesuksesan Bisnis

May 17, 2025

Memahami Pentingnya Laporan Keuangan Untuk Kesuksesan Bisnis

May 17, 2025 -

Jalen Brunsons Free Agency And The Luka Doncic Trade Saga Assessing The Damage To The Dallas Mavericks

May 17, 2025

Jalen Brunsons Free Agency And The Luka Doncic Trade Saga Assessing The Damage To The Dallas Mavericks

May 17, 2025