How The Stealthy Wealthy Achieve Financial Success: A Practical Guide

Table of Contents

Strategic Investing and Diversification

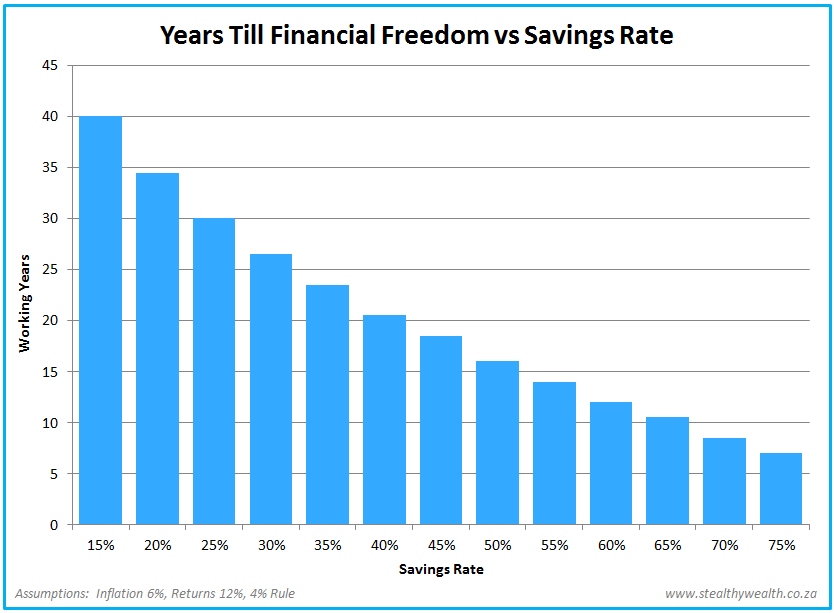

The Stealthy Wealthy don't rely on get-rich-quick schemes. They prioritize long-term, diversified investment strategies, understanding that consistent growth over time is far more reliable than chasing short-term gains. This approach minimizes risk and maximizes the potential for building substantial wealth.

Beyond Stocks and Bonds

While stocks and bonds form a core part of many portfolios, the truly stealthy wealthy understand the importance of diversification beyond these traditional assets. Exploring alternative investments can significantly enhance returns and mitigate risk.

- Real estate investment trusts (REITs): REITs offer a relatively low-risk way to participate in real estate markets, generating passive income streams from rental properties without the direct management hassles. This passive income contributes significantly to building wealth silently.

- Diversification across asset classes: Spreading investments across different asset classes – stocks, bonds, real estate, commodities, and alternative investments – is crucial for mitigating risk. If one sector underperforms, others can cushion the blow.

- Understanding market cycles and long-term growth potential: The Stealthy Wealthy aren't swayed by short-term market fluctuations. They possess a deep understanding of economic cycles and focus on long-term growth potential. This long-term view allows them to weather market storms and capitalize on opportunities.

Professional Financial Guidance

The Stealthy Wealthy don't go it alone. They leverage the expertise of professionals to guide their financial decisions. This is crucial for navigating complex financial markets and optimizing wealth growth.

- Working with financial advisors, wealth managers, and tax professionals: Building a strong team of experts provides access to specialized knowledge and personalized advice. These professionals can provide unbiased, data-driven advice, helping you avoid costly mistakes.

- Developing a personalized financial plan aligned with long-term goals: A well-defined financial plan is the roadmap to financial success. It should incorporate your short-term and long-term goals, risk tolerance, and investment time horizon.

- Regular portfolio reviews and adjustments: Markets are dynamic. Regular portfolio reviews ensure your investment strategy remains aligned with your goals and adapts to changing market conditions.

Mindful Spending and Debt Management

It's not just about earning; it's about managing what you have. The Stealthy Wealthy are masters of financial discipline, understanding that mindful spending and effective debt management are as crucial as smart investing.

The Power of Budgeting

Creating and sticking to a realistic budget is paramount for the stealthy wealthy. This isn’t about deprivation; it’s about conscious spending aligned with financial goals.

- Tracking income and expenses meticulously: Understanding where your money goes is the first step to controlling it. Use budgeting apps or spreadsheets to track every dollar.

- Identifying areas for savings and cost reduction: Regularly review your spending habits and identify areas where you can cut back without sacrificing your quality of life.

- Prioritizing needs over wants: Distinguishing between needs and wants is crucial for effective budgeting. Focus on necessities and delay or eliminate non-essential purchases.

Strategic Debt Reduction

High-interest debt is a significant impediment to wealth accumulation. The Stealthy Wealthy prioritize aggressive debt reduction strategies.

- Developing a debt repayment strategy (e.g., snowball or avalanche method): Choose a method—snowball (paying off smallest debts first) or avalanche (highest-interest debts first)—that works for your psychology and financial situation.

- Negotiating lower interest rates: Don't be afraid to negotiate lower interest rates with your creditors. It can significantly reduce your debt burden over time.

- Avoiding unnecessary debt: Before taking on any debt, carefully assess whether it aligns with your long-term financial goals. Avoid high-interest credit card debt whenever possible.

Continuous Learning and Adaptability

The financial landscape is constantly evolving. The Stealthy Wealthy are lifelong learners, constantly adapting and updating their knowledge and strategies.

Financial Literacy

Understanding investment principles, tax laws, and economic trends is crucial for long-term financial success. The Stealthy Wealthy actively seek to expand their financial knowledge.

- Reading financial books and articles: Stay updated on market trends and investment strategies through reputable financial publications and educational resources.

- Attending workshops and seminars: Participate in workshops and seminars to learn from experts and network with other financially savvy individuals.

- Staying informed about market changes: Regularly monitor economic news and market trends to anticipate potential opportunities and risks.

Embracing Change

Adapting to economic shifts and market fluctuations is essential for long-term success. The Stealthy Wealthy are not afraid to adjust their strategies as needed.

- Regularly reassessing investment strategies: Periodically review your investment portfolio and adjust it based on your goals, risk tolerance, and market conditions.

- Being open to new opportunities: Stay open to new investment opportunities and emerging trends in the market.

- Not being afraid to take calculated risks: While avoiding reckless behavior, don't be afraid to take calculated risks that align with your long-term financial goals.

Building Multiple Income Streams

The Stealthy Wealthy rarely rely on a single source of income. They actively diversify their income streams, creating a safety net and accelerating wealth accumulation.

Passive Income Strategies

Passive income streams generate income with minimal ongoing effort, providing a foundation for financial security.

- Real estate rentals: Rental properties provide a consistent stream of passive income, and their value often appreciates over time.

- Dividends from stocks: Investing in dividend-paying stocks provides a regular stream of income, supplementing other sources of wealth.

- Affiliate marketing: Promoting products or services online can generate passive income through commissions.

Active Income Diversification

Exploring different avenues for active income can significantly boost earnings and accelerate wealth building.

- Freelancing: Offering your skills or services on a freelance basis provides flexibility and the potential for multiple income streams.

- Starting a side business: Launching a small business can generate significant income and build long-term wealth.

- Investing in a franchise: Acquiring a franchise can leverage an established business model and generate significant income.

Conclusion

The path to becoming "Stealthy Wealthy" isn't about flashy displays but about strategic planning, disciplined spending, continuous learning, and diversification. By adopting the principles outlined in this guide – from strategic investing and mindful spending to continuous learning and building multiple income streams – you can take significant steps toward achieving your own financial success. Start building your own path to becoming "Stealthy Wealthy" today by implementing these strategies. Remember, consistent effort and a long-term perspective are key to unlocking lasting financial freedom. Become stealthy wealthy by making informed financial decisions today!

Featured Posts

-

Gencay Votre Guide Pour Trouver Un Logement Au Forum Du Logement

May 19, 2025

Gencay Votre Guide Pour Trouver Un Logement Au Forum Du Logement

May 19, 2025 -

Upcoming Polish Presidential Vote A Crucial Moment For Europe

May 19, 2025

Upcoming Polish Presidential Vote A Crucial Moment For Europe

May 19, 2025 -

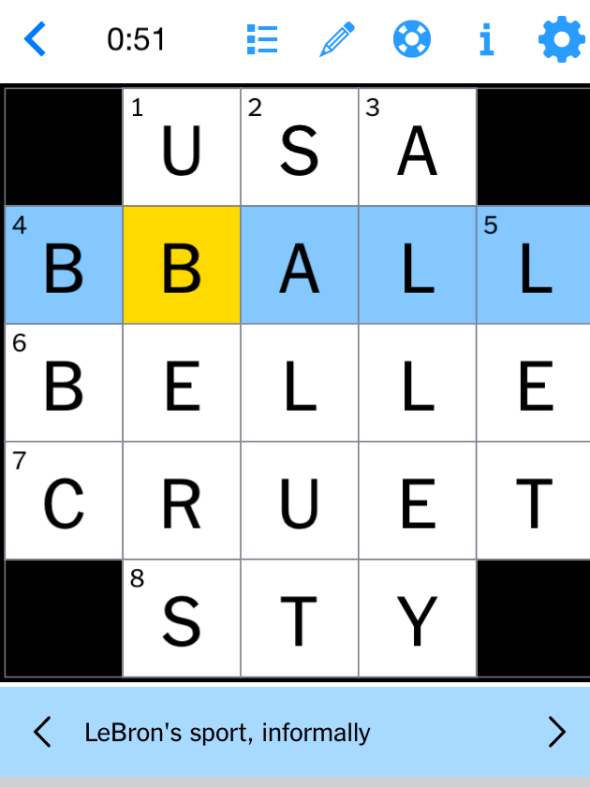

Nyt Mini Crossword March 24 2025 Solutions And Helpful Hints

May 19, 2025

Nyt Mini Crossword March 24 2025 Solutions And Helpful Hints

May 19, 2025 -

Eurovision Song Contest 2025 The Venue And Schedule Revealed

May 19, 2025

Eurovision Song Contest 2025 The Venue And Schedule Revealed

May 19, 2025 -

Assessing The Economic Impact Of A Major Rave

May 19, 2025

Assessing The Economic Impact Of A Major Rave

May 19, 2025

Latest Posts

-

Continuing Tariff Uncertainty An Fp Video Analysis Of Domestic And International Impacts

May 19, 2025

Continuing Tariff Uncertainty An Fp Video Analysis Of Domestic And International Impacts

May 19, 2025 -

Amazon And Its Workers Union Battle Over Quebec Warehouse Closures Before Labour Tribunal

May 19, 2025

Amazon And Its Workers Union Battle Over Quebec Warehouse Closures Before Labour Tribunal

May 19, 2025 -

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 19, 2025

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 19, 2025 -

Amazon Faces Union Challenge In Quebec Over Warehouse Closure Decisions

May 19, 2025

Amazon Faces Union Challenge In Quebec Over Warehouse Closure Decisions

May 19, 2025 -

Is Canada Post Insolvent A Report Calls For Delivery Service Reform

May 19, 2025

Is Canada Post Insolvent A Report Calls For Delivery Service Reform

May 19, 2025