ICE's Q1 Earnings: NYSE Parent Outperforms On Trading Volume

Table of Contents

Strong Performance Across Key Segments

ICE's Q1 earnings showcased strong performance across its key segments, exceeding analyst predictions and demonstrating the company's resilience in a dynamic market environment.

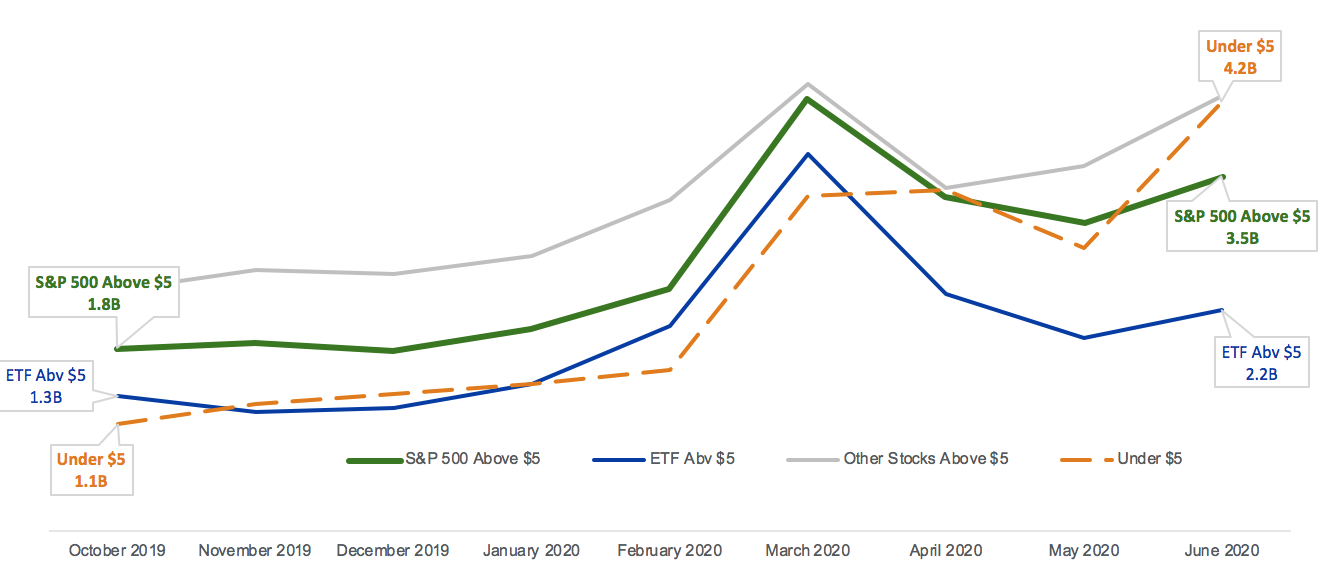

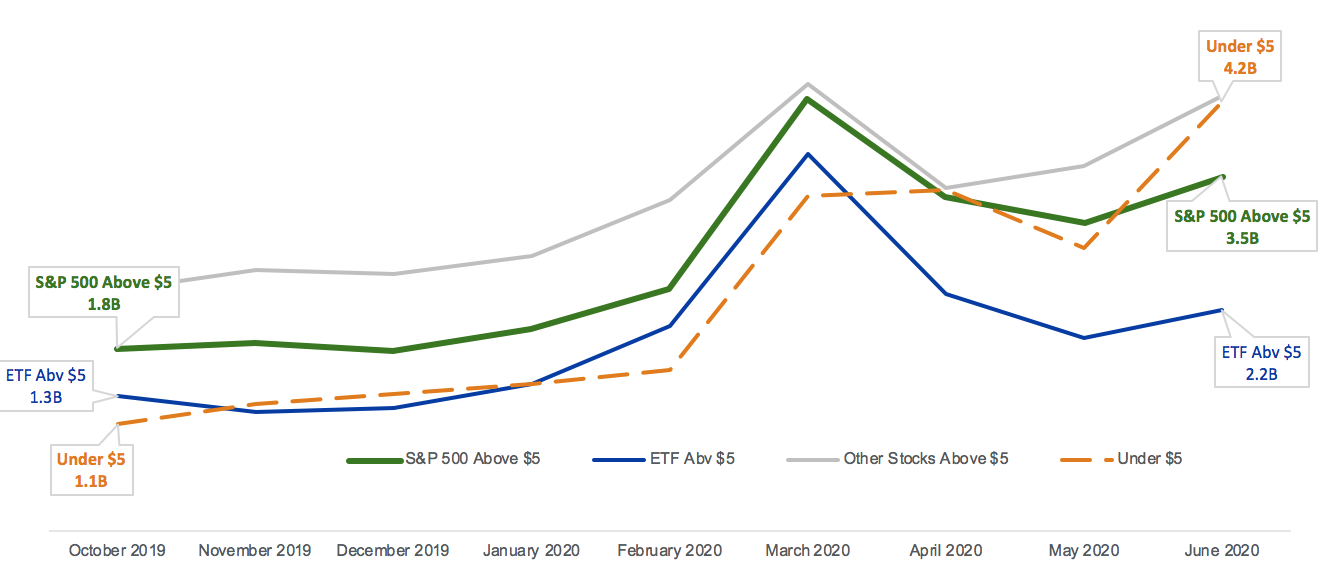

Record Trading Volumes

ICE reported record trading volumes across various asset classes in Q1. This surge in activity was particularly noticeable in:

- Equities: A [quantifiable percentage increase]% increase in daily average trading volume compared to Q1 of the previous year, reaching [specific volume number] shares traded. This reflects increased investor engagement and market volatility.

- Derivatives: A [quantifiable percentage increase]% jump in derivative contracts traded, driven by heightened uncertainty in global markets and increased hedging activity. [Specific examples of derivative products showing significant growth could be mentioned here].

- Fixed Income: [Insert data on Fixed Income trading volume increase and reasons].

This significant increase in trading volume across different asset classes can be attributed to several factors, including:

- Increased market volatility stemming from [mention specific geopolitical events or economic uncertainties].

- Higher investor participation due to [mention specific market trends or investor behavior].

- Successful product launches and enhancements by ICE, attracting new clients and increasing trading activity. [Mention specific product launches or enhancements].

Revenue Growth and Profitability

The surge in trading volume directly translated into substantial revenue growth for ICE during Q1. The company reported a [quantifiable percentage increase]% increase in overall revenue compared to the same period last year, reaching [specific revenue figure].

Key profitability metrics also performed exceptionally well:

- Net income increased by [quantifiable percentage increase]%, reaching [specific net income figure].

- Earnings per share (EPS) grew by [quantifiable percentage increase]%, exceeding analyst expectations by [quantifiable percentage or specific number].

Compared to its competitors in the financial market data and trading space, ICE’s Q1 performance stands out, demonstrating its strong market position and effective strategies. [Include a brief comparison to a key competitor, using publicly available data].

Success of Key Strategic Initiatives

Several key strategic initiatives contributed significantly to ICE's positive Q1 results. These include:

- [Initiative 1: Describe the initiative and its impact on trading volume, revenue, and profitability. Quantify the impact whenever possible.]

- [Initiative 2: Describe the initiative and its impact on trading volume, revenue, and profitability. Quantify the impact whenever possible.]

Analysis of Trading Volume Drivers

The remarkable increase in trading volume during Q1 can be attributed to a confluence of factors:

Market Volatility and Investor Sentiment

Significant market volatility, driven by [mention specific factors like geopolitical tensions, economic data releases, or interest rate changes], fueled increased trading activity. Investors, facing uncertainty, actively engaged in trading to manage risk and capitalize on market fluctuations. This heightened investor sentiment translated directly into higher trading volumes across ICE's platforms.

Product Innovation and Technological Advancements

ICE's ongoing investments in technology and product innovation played a crucial role in driving trading volume growth. Improvements in trading platforms, enhanced user interfaces, and the introduction of new trading tools contributed to increased user engagement and a more efficient trading experience. [Mention specific technological advancements or product innovations, if publicly available].

Expansion into New Markets/Asset Classes

While not explicitly mentioned in the outline, if ICE has expanded into new markets or asset classes, this section should detail those efforts and their impact on Q1 trading volumes. For example:

- [Example: "ICE's recent expansion into the [Asset Class] market contributed significantly to the overall increase in trading volume. The launch of [New Product/Platform] attracted a new segment of clients, resulting in a [Quantifiable percentage]% increase in this specific asset class."]

Future Outlook and Implications for Investors

ICE's strong Q1 performance sets a positive tone for the rest of the year, but several factors will influence its future trajectory.

Management Guidance and Expectations

ICE's management has provided [Insert management's guidance for the rest of the year]. They expect [mention specific expectations for trading volume, revenue growth, and profitability]. This outlook suggests continued strong performance, though potential headwinds should be considered.

Stock Performance and Investor Sentiment

Following the Q1 earnings announcement, ICE's stock price [describe the stock price reaction – increase, decrease, or stability]. Investor sentiment is generally [positive/negative/neutral], reflecting confidence in the company's future prospects, given the strong Q1 results.

Potential Risks and Challenges

Despite the strong Q1 results, ICE faces several potential risks and challenges, including:

- Increased competition from other exchanges and trading platforms.

- Regulatory changes that could impact trading activity or operating costs.

- Economic downturns or market corrections that could affect trading volumes.

Conclusion: ICE's Q1 Earnings: A Strong Showing Driven by Trading Volume

ICE's Q1 earnings demonstrated a remarkable performance, significantly exceeding expectations. The robust trading volume, driven by market volatility, strategic initiatives, and technological advancements, resulted in strong revenue growth and increased profitability. Key performance indicators, including record trading volumes across multiple asset classes and exceeding EPS estimates, highlight the success of ICE's strategies. While future challenges remain, the strong Q1 results indicate a positive outlook for ICE. Stay updated on future ICE earnings announcements and continue to monitor the performance of this leading exchange and its impact on global trading volume. Keep an eye on ICE stock performance and the broader NYSE trading activity for further insights into the financial market's dynamics and ICE's future financial results.

Featured Posts

-

Eurovision 2024 Estonias Italian Parody Shocks And Amuses

May 14, 2025

Eurovision 2024 Estonias Italian Parody Shocks And Amuses

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys New Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys New Docuseries

May 14, 2025 -

Pokemon Go Max Raid Guide Mastering Dynamax Sobble Battles

May 14, 2025

Pokemon Go Max Raid Guide Mastering Dynamax Sobble Battles

May 14, 2025 -

Un Homme Interpelle Au Nord Apres Fraude Sncf Et Exhibition Sexuelle

May 14, 2025

Un Homme Interpelle Au Nord Apres Fraude Sncf Et Exhibition Sexuelle

May 14, 2025 -

Nottingham Forests Awoniyi An Fa Cup Start

May 14, 2025

Nottingham Forests Awoniyi An Fa Cup Start

May 14, 2025