Ignoring The Hype: BofA's Reasons Why High Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Focus on Strong Corporate Earnings and Profitability

BofA emphasizes that strong corporate earnings and robust profitability are key indicators that outweigh concerns about high valuations. They argue that these fundamentals support current price levels and offer a strong foundation for future growth. This fundamental analysis forms the bedrock of their bullish case.

- High profit margins driving sustained earnings growth: Many companies are demonstrating impressive profit margins, leading to consistent earnings growth even in the face of economic uncertainty. This sustained performance underscores the underlying strength of the market.

- Resilience of corporate earnings in the face of economic headwinds: Despite potential economic slowdowns or headwinds, corporate earnings have shown remarkable resilience. This suggests a capacity for companies to adapt and maintain profitability even in challenging environments. Analyzing specific company reports reveals this trend.

- Analysis of specific sectors showing strong earnings performance: BofA's analysis likely highlights specific sectors demonstrating exceptional earnings performance. These sectors could include technology, healthcare, or others experiencing robust growth. This sector-specific analysis provides a more nuanced view of market strength.

- Emphasis on long-term earnings potential, not short-term fluctuations: BofA likely advocates for focusing on the long-term earning potential of companies, rather than reacting to short-term market volatility. This long-term perspective is key to understanding their bullish outlook.

The Role of Low Interest Rates and Monetary Policy in Supporting Valuations

BofA's perspective considers the significant influence of low interest rates and accommodative monetary policies on stock valuations. They argue that these factors continue to support market strength and make equities a more attractive investment compared to other asset classes.

- Low interest rates make equities a more attractive investment compared to bonds: With low bond yields, equities become a more appealing option for investors seeking higher returns. This shift in investor preference contributes to higher stock valuations.

- Impact of quantitative easing on liquidity and market valuations: Past quantitative easing programs have injected significant liquidity into the market, contributing to higher valuations. The ongoing effects of these programs continue to influence market dynamics.

- Analysis of the Federal Reserve's policy and its future implications for the market: BofA's analysis likely includes a detailed assessment of the Federal Reserve's monetary policy and its projected impact on interest rates and market valuations. Understanding the Fed's actions is vital to predicting future market movements.

- Discussion on the relationship between inflation and interest rates: BofA likely addresses the complex relationship between inflation and interest rates, explaining how these factors influence market valuations and investor behavior. This detailed examination provides a comprehensive understanding of macroeconomic influences.

Addressing the Concerns of High Price-to-Earnings Ratios (P/E)

While acknowledging high Price-to-Earnings (P/E) ratios, a key valuation metric, BofA likely explains why these ratios don't necessarily indicate an impending market crash. They likely consider other factors like growth prospects and industry dynamics.

- Comparison of current P/E ratios to historical averages and context: BofA's analysis likely puts current P/E ratios in historical context, comparing them to past market cycles and considering the unique circumstances of the present economic environment.

- Differentiation between high P/E ratios in growth sectors vs. value sectors: The analysis likely differentiates between high P/E ratios in high-growth sectors (where higher valuations are expected) and value sectors, which are typically less expensive.

- Discussion of other valuation metrics beyond P/E ratios: BofA likely considers other valuation metrics such as price-to-sales ratios, PEG ratios, and others to provide a more complete picture of market valuation.

- Analysis of the impact of technological innovation on market valuations: Technological advancements can justify higher valuations for companies with strong growth potential in innovative sectors. This analysis highlights the impact of technological disruption on market multiples.

Long-Term Growth Prospects and Technological Innovation

BofA likely highlights the positive impact of long-term growth prospects, particularly in technology and other innovative sectors, as a counterpoint to concerns about high valuations. These secular trends are key to their bullish outlook.

- Identifying key technological advancements driving future market growth: BofA likely identifies key technological advancements, such as artificial intelligence, cloud computing, and biotechnology, as drivers of future market growth.

- Analysis of long-term economic growth projections and their effect on stock prices: BofA's analysis includes projections for long-term economic growth and assesses their impact on stock prices. These projections inform their long-term market outlook.

- Discussion on emerging industries and their potential for high returns: The analysis likely discusses emerging industries with high growth potential, highlighting investment opportunities in these sectors.

- The impact of global technological advancements on market performance: The analysis likely considers the global nature of technological innovation and its impact on market performance, recognizing the interconnectedness of global markets.

Conclusion

Bank of America's analysis suggests that while high stock market valuations are a factor to consider, they are not necessarily a harbinger of an imminent market crash. Strong corporate earnings, accommodative monetary policy, and long-term growth prospects are key factors mitigating the risks associated with elevated valuations. Their bullish stance highlights the importance of considering a range of factors when assessing market conditions. Understanding these factors is vital for effective investment decision-making.

Don't let the hype surrounding high stock market valuations deter you. Understand BofA's perspective and develop a well-informed investment strategy based on a thorough analysis of market fundamentals and long-term growth potential. Learn more about mitigating risk and capitalizing on opportunities in today's market by researching BofA's insights on high stock market valuations and other perspectives on market valuation.

Featured Posts

-

Dope Thief Episode 7 Review A Return To Form

Apr 25, 2025

Dope Thief Episode 7 Review A Return To Form

Apr 25, 2025 -

How Jack O Connells Sinners Performance Reconnected Him To His Origins

Apr 25, 2025

How Jack O Connells Sinners Performance Reconnected Him To His Origins

Apr 25, 2025 -

Trump Tariffs And The Demise Of Renaults American Sports Car Project

Apr 25, 2025

Trump Tariffs And The Demise Of Renaults American Sports Car Project

Apr 25, 2025 -

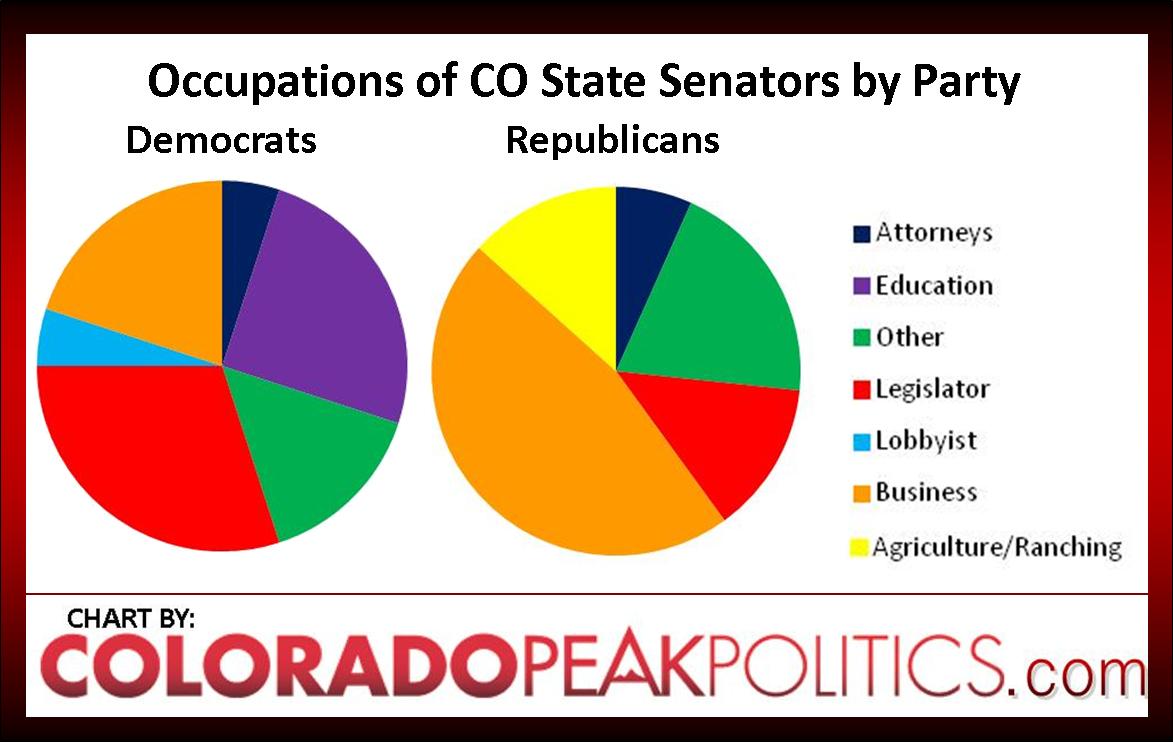

Political Tough Times Examining Party Softness

Apr 25, 2025

Political Tough Times Examining Party Softness

Apr 25, 2025 -

Bayern Munich Extends Bundesliga Lead To 11 Points

Apr 25, 2025

Bayern Munich Extends Bundesliga Lead To 11 Points

Apr 25, 2025

Latest Posts

-

Hjz Rhlat Tyran Alerbyt Ila Kazakhstan Mn Abwzby

Apr 28, 2025

Hjz Rhlat Tyran Alerbyt Ila Kazakhstan Mn Abwzby

Apr 28, 2025 -

Aktshf Kazakhstan Me Tyran Alerbyt Rhlat Mbashrt Mn Abwzby

Apr 28, 2025

Aktshf Kazakhstan Me Tyran Alerbyt Rhlat Mbashrt Mn Abwzby

Apr 28, 2025 -

Abwzby Kazakhstan Tyran Alerbyt Ydyf Khtwt Tyran Jdydt

Apr 28, 2025

Abwzby Kazakhstan Tyran Alerbyt Ydyf Khtwt Tyran Jdydt

Apr 28, 2025 -

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025 -

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025