Ignoring The Recession? Why Stock Investors See A Bright Future

Table of Contents

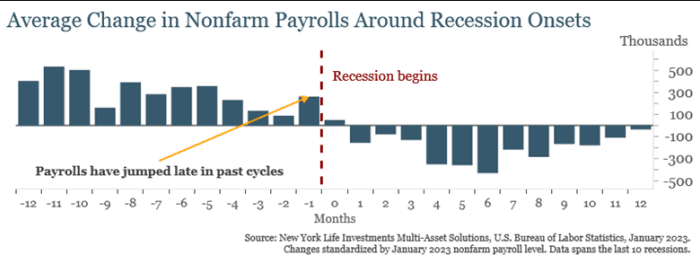

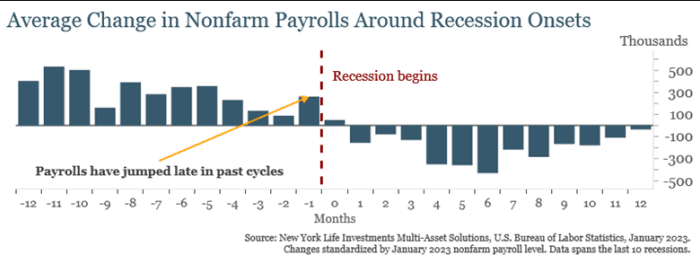

Despite recessionary fears, the stock market has historically shown remarkable resilience. In fact, studies have shown that stocks often begin to recover even before the official end of a recession. This leads to the question: "Ignoring the Recession?" Is it truly possible, and if so, how can savvy stock investors capitalize on economic downturns? This article explores this very question, outlining key strategies and sectors that offer significant investment opportunities, even during an economic downturn. We'll examine recession-proof sectors, the power of long-term investing, the impact of government intervention, and ultimately, how to position yourself for success despite the challenges of a recession.

H2: Recession-Proof Sectors: Identifying Opportunities in a Downturn

Economic downturns don't impact all sectors equally. Smart investors understand that identifying "recession-proof investments" is key to navigating a volatile stock market.

H3: Defensive Stocks: A Safe Haven During Economic Uncertainty

Defensive stocks are often considered a safe haven during economic uncertainty. These are companies that provide essential goods and services, the demand for which remains relatively stable regardless of the economic climate.

- Examples of defensive stocks: Consumer staples (e.g., food producers, household goods manufacturers), healthcare (e.g., pharmaceutical companies, healthcare providers), and utilities (e.g., electricity, gas, water companies).

- Why they perform well: People still need food, healthcare, and utilities regardless of economic conditions. This consistent demand translates into stable earnings and share prices for these companies.

- Dividend Yield: Many defensive stocks offer attractive dividend yields. This means they pay regular dividends to shareholders, providing a steady stream of income even during a recession. A high dividend yield can significantly boost your overall return on investment. The importance of analyzing dividend yield in defensive stock investing can not be overstated.

H3: Cyclical Recovery Stocks: Positioning for the Upswing

While defensive stocks offer stability, cyclical stocks represent opportunities for significant growth during the economic recovery phase following a recession. These companies are particularly sensitive to economic cycles and tend to underperform during downturns but rebound strongly when the economy improves.

- Examples of cyclical stocks: Technology, industrials (manufacturing, construction), and consumer discretionary (e.g., automobiles, travel, retail).

- Identifying Undervalued Cyclical Stocks: Fundamental analysis is crucial here. Look for companies with strong fundamentals (e.g., solid balance sheets, competitive advantages) that are currently undervalued due to market pessimism.

- Economic Recovery: Understanding the timing of the economic recovery is critical when investing in cyclical stocks. While riskier than defensive stocks, their potential for growth is substantially higher.

H2: The Power of Long-Term Investing: Weathering Economic Storms

Ignoring the short-term noise and focusing on a long-term investment strategy is paramount during a recession. Market fluctuations are inevitable, but a well-planned long-term strategy helps mitigate risks and maximize returns over time.

H3: Dollar-Cost Averaging: Mitigating Risk in Volatile Markets

Dollar-cost averaging (DCA) is a powerful technique that involves investing a fixed amount of money at regular intervals regardless of market prices. This strategy mitigates the risk of investing a lump sum at a market peak.

- Benefits of DCA: It reduces the impact of market volatility on your overall returns. By buying more shares when prices are low and fewer when prices are high, you automatically average your purchase price over time.

- Long-term Investing and DCA: DCA is particularly effective as part of a long-term investment strategy, helping you remain disciplined and avoid emotional decision-making.

H3: Ignoring Short-Term Noise: Focusing on the Bigger Picture

Recessions are temporary economic contractions. Panicking and selling your assets during a downturn can lock in losses. Maintaining emotional discipline is crucial for success.

- Long-term Investment Strategy: Focus on your long-term financial goals. Don't let short-term market fluctuations derail your plan.

- Patience in Investing: Investing requires patience and discipline. The market will eventually recover, and those who remain invested will likely reap the rewards. Ignoring short term market fluctuations is a key component of successful long-term investing.

H2: Government Intervention and Economic Stimulus: A Catalyst for Growth

Government intervention often plays a significant role in shaping market outcomes during recessions. Understanding government policies and their impact on specific sectors can provide significant investment opportunities.

H3: Analyzing Government Policies and Their Impact on the Market

Governments frequently use fiscal and monetary policy to mitigate the effects of a recession. This can involve interest rate cuts (monetary policy) or increased government spending on infrastructure and social programs (fiscal policy). Analyzing these policies and predicting their impact is crucial for effective investment strategies.

H3: Identifying Sectors Benefiting from Stimulus Packages

Government stimulus packages often target specific sectors of the economy.

- Stimulus Packages: Look for sectors that stand to benefit from increased government spending. These often include infrastructure investment (construction, engineering), renewable energy, and technological innovation.

Conclusion: Investing Through the Recession: A Path to Long-Term Success

Recessions are a normal part of the economic cycle. While they present challenges, they also create opportunities for strategic investors. By focusing on recession-proof sectors, utilizing long-term strategies like dollar-cost averaging, and understanding the impact of government interventions, investors can position themselves to not only weather the storm but also achieve long-term financial success. Don't let the recession scare you! Learn how to effectively navigate the market and build a diversified portfolio to ignore the recession and achieve your financial goals. To learn more about recession-proof investing strategies and building a diversified portfolio, [link to relevant resources].

Featured Posts

-

Prediksi Skor Dan Susunan Pemain Timnas U 20 Indonesia Vs Yaman

May 06, 2025

Prediksi Skor Dan Susunan Pemain Timnas U 20 Indonesia Vs Yaman

May 06, 2025 -

Free Streaming Guide Gypsy Rose Life After Lockup Season 2 Episode 1

May 06, 2025

Free Streaming Guide Gypsy Rose Life After Lockup Season 2 Episode 1

May 06, 2025 -

Ayo Edebiri Celebrates Ayo Edebiri Day At Her Alma Mater

May 06, 2025

Ayo Edebiri Celebrates Ayo Edebiri Day At Her Alma Mater

May 06, 2025 -

Gypsy Rose Blanchard Life And Earnings After Prison

May 06, 2025

Gypsy Rose Blanchard Life And Earnings After Prison

May 06, 2025 -

Miley Cyrus And Her Fathers Narcissism A Public Struggle

May 06, 2025

Miley Cyrus And Her Fathers Narcissism A Public Struggle

May 06, 2025