Impact Of Luxury Goods Recession On Paris' Economy (March 7, 2025)

Table of Contents

Decline in Tourist Spending and its Ripple Effect

A significant decrease in high-spending tourists would trigger a domino effect across Paris' economy. The luxury sector is the engine driving much of Paris's tourism; high-end travelers contribute disproportionately to overall spending. Data from [Insert source citing tourism spending statistics for Paris] shows that luxury tourists account for a substantial percentage (e.g., X%) of total tourism revenue. A reduction in their numbers directly translates into a decline in revenue across numerous sectors.

- Reduced revenue for luxury hotels: High-end hotels, a cornerstone of Paris's luxury tourism landscape, would experience a sharp drop in occupancy rates and average daily rates (ADR). Iconic hotels on the Champs-Élysées and in the Marais district could face significant financial strain.

- Lower occupancy rates in high-end accommodations: This isn't limited to hotels; luxury apartments and private rentals would also feel the pinch, impacting property values and investment returns.

- Decreased demand for luxury services: Concierge services, private chauffeurs, personal shoppers, and high-end dining experiences would see a significant drop in demand, directly affecting employment and revenue within these niche sectors.

- Impact on smaller businesses reliant on tourist spending: Numerous smaller businesses, from boutiques and art galleries to cafes and restaurants, rely heavily on tourist spending. A decline in tourist numbers would disproportionately affect their profitability and survival.

The economic multiplier effect, where initial spending ripples throughout the economy, would be severely dampened, leading to a broader economic slowdown across Paris. The impact of reduced high-end tourism on the overall Paris tourism sector cannot be overstated.

Impact on Luxury Brand Performance and Employment

The performance of major luxury brands based in or operating heavily in Paris would be severely tested during a luxury goods recession. This would translate into tangible financial consequences, impacting not only the brands themselves but also the extensive network of businesses and individuals supporting them.

- Decreased sales and profits for luxury brands: Flagship stores on the Champs-Élysées and other prime locations would see a significant drop in sales, directly impacting profitability and shareholder value.

- Potential store closures or downsizing: To mitigate losses, luxury brands might be forced to close underperforming stores or downsize operations, leading to job losses and a contraction of the retail landscape.

- Layoffs and reduced hiring in the luxury sector: Reduced demand and declining profits would inevitably lead to layoffs and a significant reduction in hiring across various sectors, including manufacturing, retail, and design.

- Impact on ancillary industries like fashion design and craftsmanship: The ripple effect would extend to ancillary industries, impacting designers, artisans, and other professionals whose livelihoods depend on the luxury sector. Luxury manufacturing would also be significantly affected.

The resulting job losses could have severe social and economic repercussions, potentially triggering wider economic instability within Paris.

The Role of Government Intervention and Economic Stimulus

To mitigate the impact of a luxury goods recession, the French government could implement a range of measures to support the affected sectors and stimulate economic activity. Past experiences with economic stimulus packages in other countries and during previous economic downturns provide valuable lessons.

- Government support for luxury brands: Targeted financial assistance, tax breaks, or loan guarantees could help luxury brands navigate the difficult period and avoid drastic measures like widespread layoffs.

- Investment in tourism infrastructure: Upgrades to transportation, communication networks, and other tourism-related infrastructure could enhance Paris's attractiveness to high-spending tourists and boost its competitiveness.

- Incentives to attract high-spending tourists: Targeted marketing campaigns, visa facilitation, and other incentives could attract a higher volume of luxury tourists, offsetting some of the losses.

- Long-term economic diversification strategies: Reducing reliance on a single sector is crucial. The government should invest in diversifying the Paris economy to reduce vulnerability to future shocks.

Effective government intervention and a comprehensive economic stimulus package are crucial to minimizing the damage and fostering a quicker recovery. Strategic fiscal policy will be key in this process.

Long-term Economic Consequences and Recovery Strategies

If the luxury goods recession persists, the long-term consequences could be severe. A prolonged downturn could lead to a decline in foreign investment, reduced employment opportunities, and a decrease in Paris's global standing as a leading luxury destination.

- Long-term impact on employment: Prolonged job losses could lead to social unrest and long-term economic hardship for affected individuals and families.

- Potential for decreased investment in Paris: Uncertainty about the future could deter investment in Paris, hindering economic growth and development.

- The need for adaptive strategies: Paris needs to adapt to changing consumer preferences and market dynamics. A focus on sustainable luxury could attract a new generation of conscious consumers.

- Focus on sustainable luxury practices: Embracing eco-friendly production methods, ethical sourcing, and sustainable tourism initiatives would not only appeal to a growing segment of consumers but also enhance Paris's global image.

Economic recovery requires a multi-pronged approach, encompassing both short-term relief measures and long-term strategic planning. Developing adaptive strategies and promoting sustainable luxury are critical for securing Paris's future prosperity.

Conclusion: Navigating the Luxury Goods Recession in Paris

The potential for a luxury goods recession poses a significant threat to Paris' economy. The luxury sector is a vital component of its economic health, supporting numerous jobs and generating significant revenue. A decline in tourist spending, reduced luxury brand performance, and potential job losses would have far-reaching consequences. Government intervention, strategic investment, and a focus on sustainable luxury are crucial for navigating this challenge. Proactive measures are essential to mitigate the impact and ensure Paris's continued economic success. We encourage further research and discussion on this topic, inviting you to share your thoughts and perspectives on how Paris can best address the potential luxury goods recession and safeguard its economic future.

Featured Posts

-

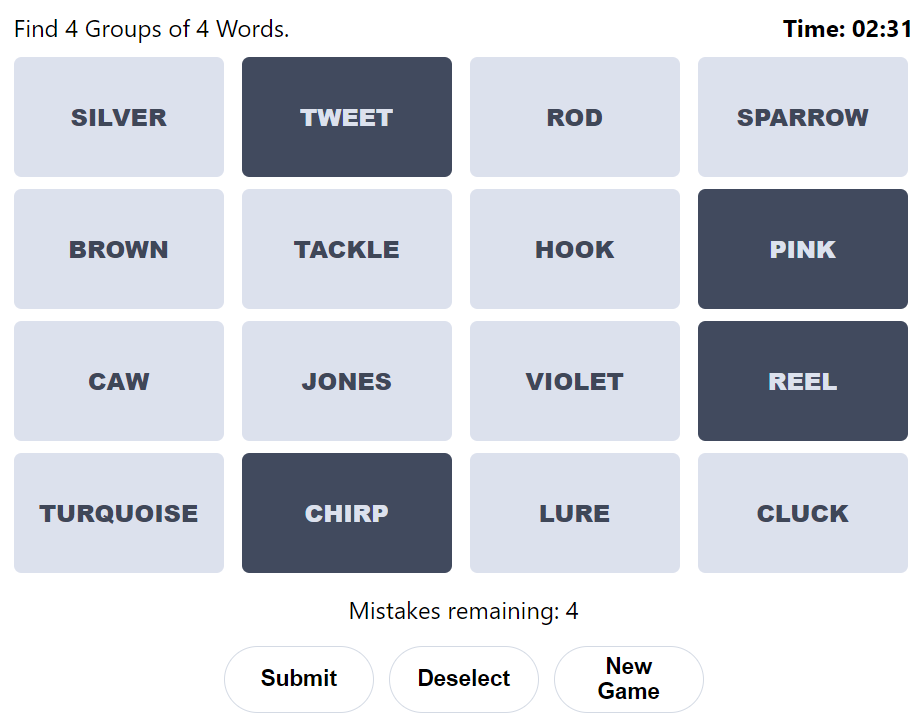

New York Times Connections 646 Answers And Hints March 18 2025

May 24, 2025

New York Times Connections 646 Answers And Hints March 18 2025

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

European Shares Rise On Trumps Tariff Hint Lvmh Slumps

May 24, 2025

European Shares Rise On Trumps Tariff Hint Lvmh Slumps

May 24, 2025 -

Is The Last Rodeo Worth Watching A Critical Review

May 24, 2025

Is The Last Rodeo Worth Watching A Critical Review

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025